Latin America is increasingly becoming an epicenter of the global coronavirus (COVID-19) disease 2019 pandemic. The shock on the region’s economies is worsening, in turn depressing energy consumption.

COVID-19 hits Latin American economies that are already weakened, with already dampened energy demand growth expectations. Mexico’s economy stagnated in 2019 amid policy uncertainty, Brazil is shaking off years in the doldrums, Argentina is trying to refinance its massive debt, and Chile recently endured nationwide social protests.

South America’s industrial sector is energy intensive and highly dependent on mainland China. Mainland China—one of the markets hit hard by COVID-19—accounts for 30% of Brazilian exports, represents Argentina’s second-largest trading partner, and is the main offtaker for Chile’s prominent mining industry. Demand from the three countries’ industrial base—representing more than 40% of both gas and power total demand—is highly elastic to GDP. This situation is exacerbating the energy consumption impact of the economic slowdown.

Meanwhile in Mexico, gas and power demand are tightly linked to industrial activity, which in turn is battered by cuts in oil production and by the unprecedented economic downturn in the United States. Furthermore, the worst of the direct impacts of COVID-19 on Mexico’s economy are likely yet to come.

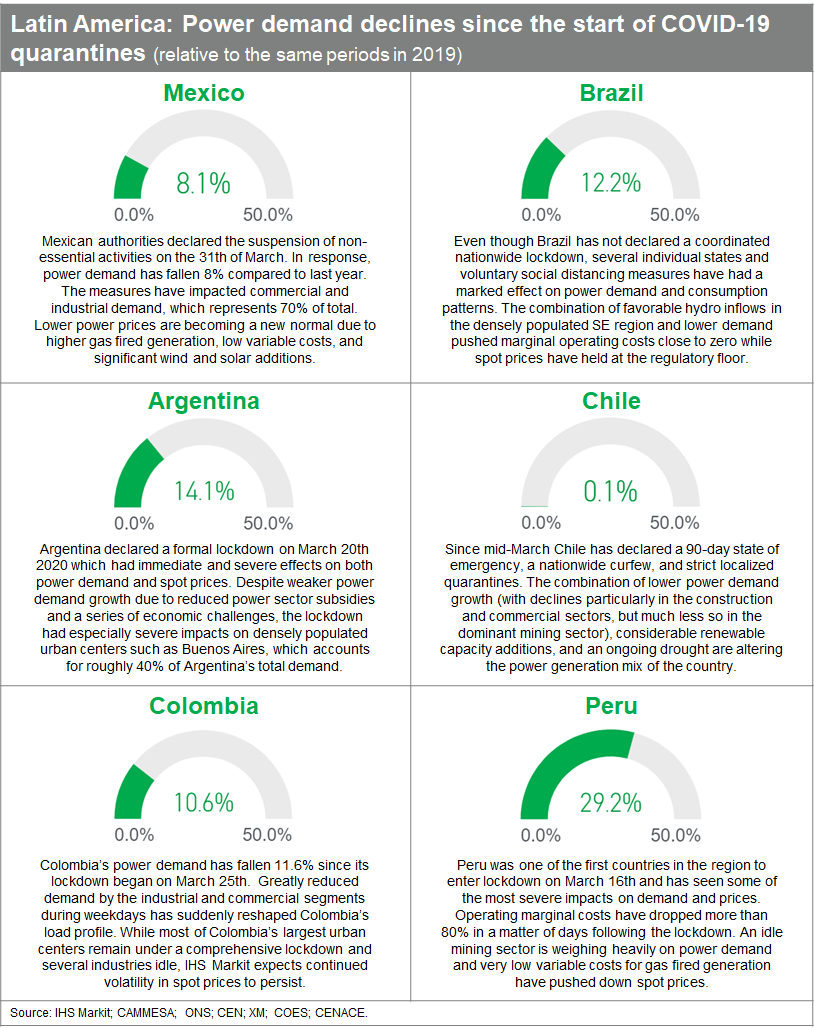

Already, power consumption from the six largest economies of Latin America has dropped almost 12% since each country started its quarantines, compared to the same periods of last year (see figure below).

IHS Markit identified and is monitoring factors that particularly impact Latin America’s gas and power needs, including:

Ongoing fallout in the economies of mainland China and the United States, the main outside trading partners of Latin American countries

The capacity of Latin American governments to stay in front of the COVID-19 spread, for example in Brazil and Mexico

Government responses towards low oil and gas prices in Brazil, Mexico and Argentina (such as new support to private investment versus greater state involvement), which also disrupt trade balances (for example Mexico’s dependence on US gas)

The governments’ balancing acts between improving the economic situation of their populations and implementing retrenchment policies to address debt, especially in Argentina

The governments’ abilities to pass new reforms to foment investment, especially in Brazil

Possible freezes in power and gas tariffs to end consumers, such as in Argentina

Changes in the global prices for oil and gas, affecting government coffers like in Mexico, Brazil and Argentina

A sustained slump in the price of mined minerals, affecting heavily Chile and Peru for example

Social unrest reducing business confidence and private sector investments

Figure 1: Latin America: Power demand declines since the start of COVID-19 quarantines (relative to the same periods in 2019).

Learn more about our Latin America gas and power research.

To learn more about the data behind this article and what IHS Markit has to offer, visit https://ihsmarkit.com/index.html.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.