Technology is among the many sectors in the US seeing buying behaviors evolve due to COVID-19. Companies and consumers across the country are adapting to working from home, as shelter-in-place has become the new norm. Tech media consumption has shifted accordingly for three key categories: traditional IT support, work-from-home (WFH) hardware and skills software.

By examining Quantcast’s first-party data before and after the COVID-19 outbreak, we took a deeper look into how online behaviors have changed for sites in each category.

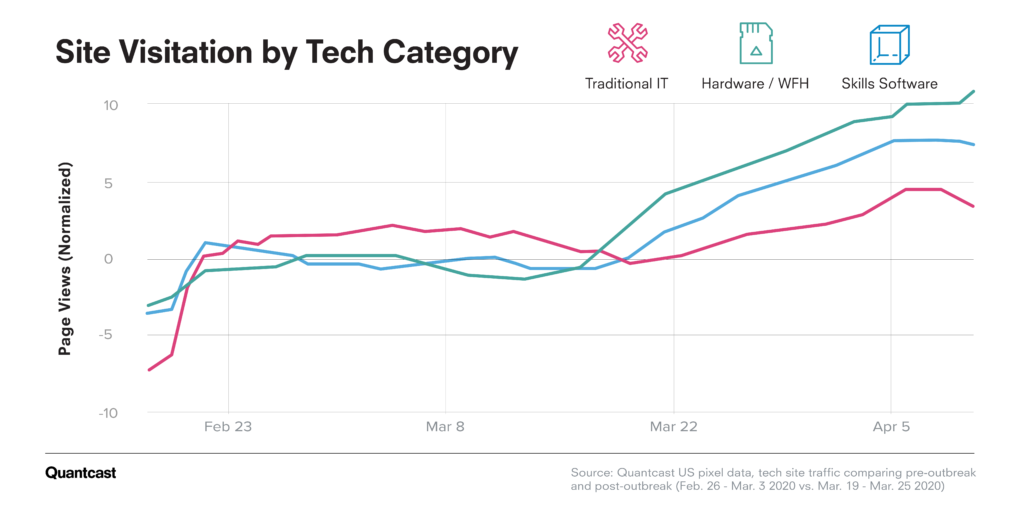

Traditional IT entities were the first to spike above normal levels back in late February while WFH hardware and skills software remained stagnant. However, as the COVID-19 outbreak forced everyone inside with shelter-in-place orders in mid-March, we see site traffic for the non-traditional tech verticals surging.

WFH hardware entities were the first to blow past their baseline levels beginning on March 17th. A few days later on March 20th, skills software sites then blew past their baseline visitation levels, and the new trend continues.

As white collar workers have been forced to work from home, so have parents, educators, and artists who are flocking to creativity suites, driving up demand for creative tech outlets.

Tech audiences have shifted since COVID-19, but differently for each category

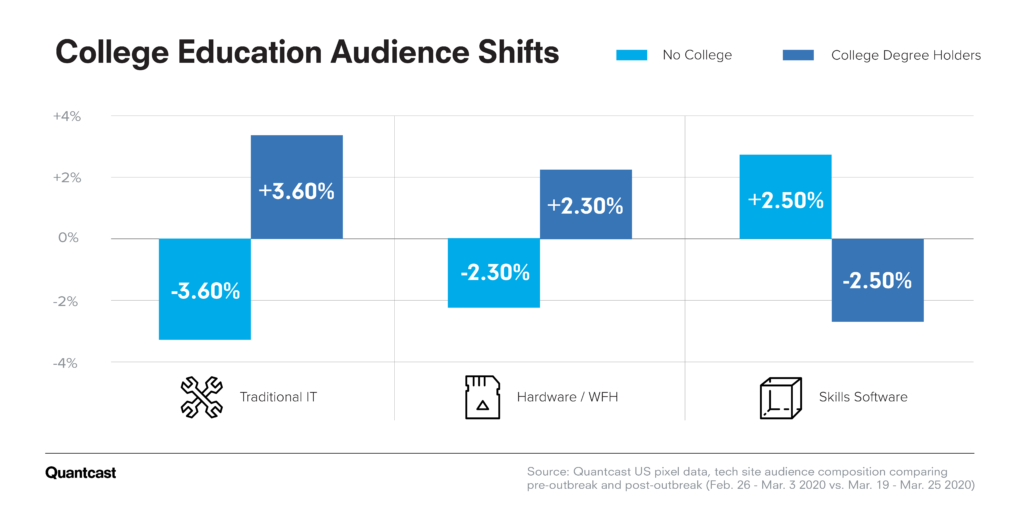

While you might expect college degree holders to have increased their audience composition across all tech clusters, we’re seeing an increase of non-college-educated consumers flocking to skills and creativity digital domains. With the job market more disrupted than ever, those lacking college degrees are looking to pepper their resumes with skills ranging from photo editing to coding and everything in between.

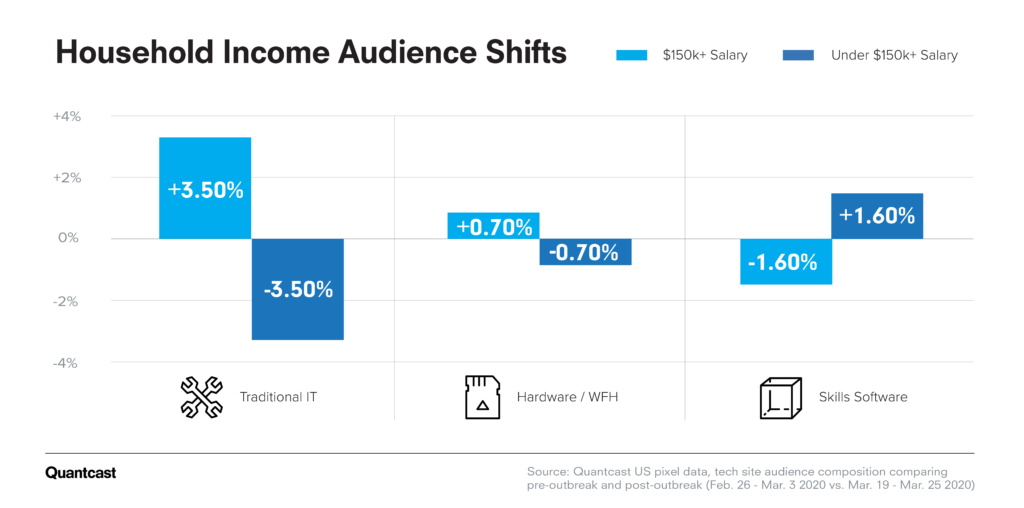

Further proving that the skills software tech category is welcoming new audiences, the high net worth audience is actually shrinking their composition. Instead, creative digital properties are welcoming a less affluent and less educated audience hungry for career building skills and creative outlets during COVID-19.

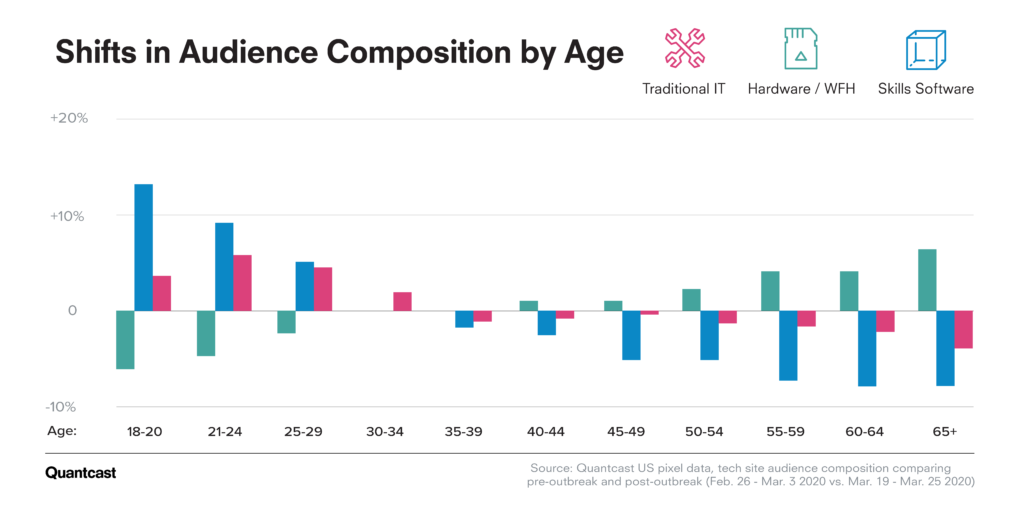

Teenagers have increased their audience composition within the traditional IT and skills software categories at tremendous rates, engaging in tech site visitation at previously unseen levels, since COVID-19. Conversely, Gen X and Boomer consumers are shying away from traditional IT and skills software and instead have upped their WFH hardware site visitation. This implies that the older half of the working world have suddenly found themselves needing to adapt to the new normal and transition decades of in-office work towards WFH set-ups.

Gen Z consumers did not increase their WFH hardware activity, reflecting the fact that the younger generation is already a “digital native” to telecommuting and the tools required.

To learn more about the data behind this article and what Quantcast has to offer, visit https://www.quantcast.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.