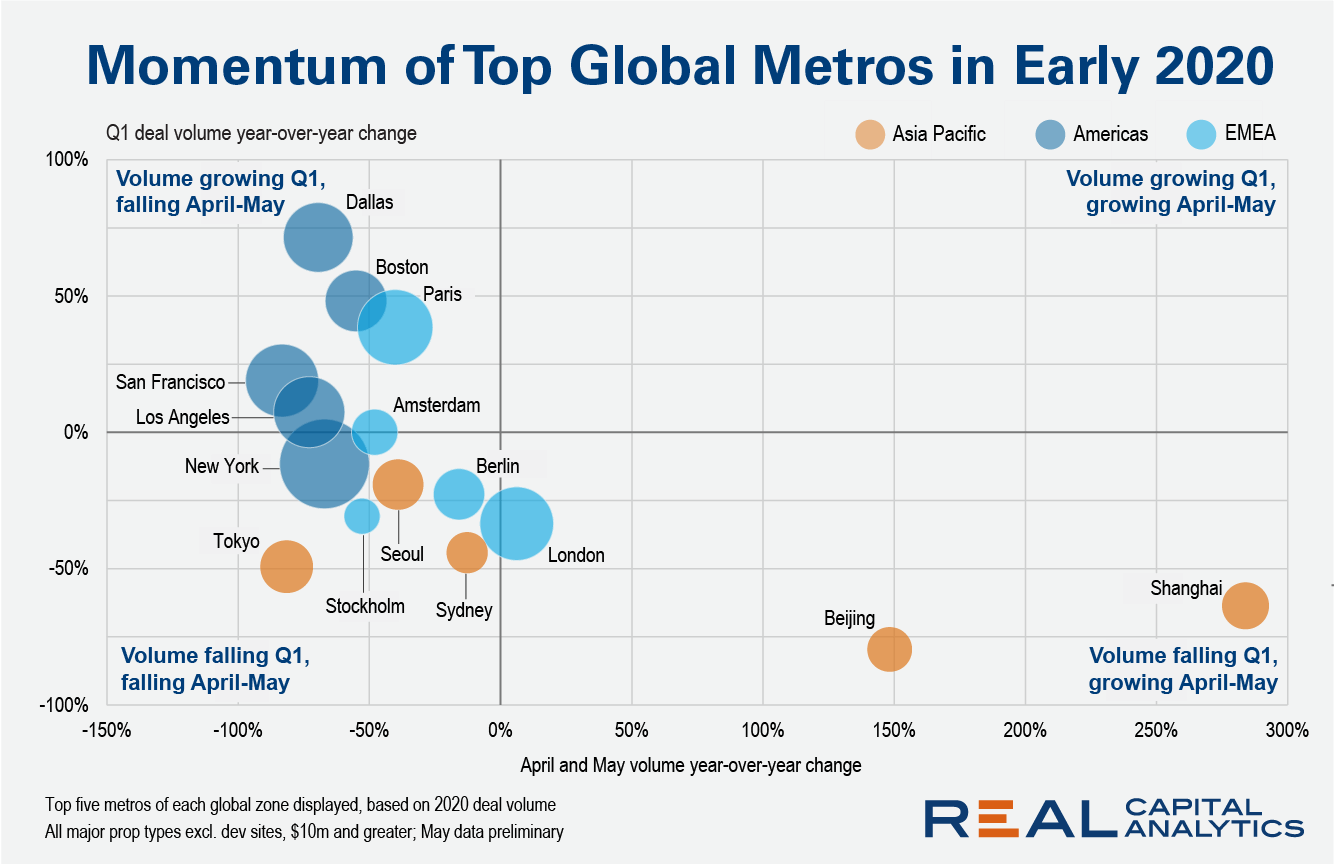

Despite the slowdown in real estate markets accelerating across most of the world into the second quarter of the year, acquisition trends in two key global cities, both in China, have turned positive.

Global volumes started to wane around March this year, but the weakness in Asia Pacific had already been apparent for some time, as all of the region’s top 10 metros suffered double-digit declines in the first quarter. In contrast, more than half of the key metros in Europe and the U.S. recorded an increase in transaction activity, as economic shutdowns and travel restrictions were implemented later in the quarter.

Fast forward a couple of months, and Asia Pacific’s slide has been echoed across most of the top metros in the U.S. and Europe. For April and May deal activity, London was the only metro outside of Asia Pacific that managed to keep pace with last year, and even then, volume was mainly propped up by Blackstone’s multibillion-pound student housing acquisition. In the U.S., volumes across all the top 10 metros fell by more than 50%. (Deal volume data for May is preliminary.)

Back in Asia Pacific, nascent signs of a recovery are beginning to take root. Shanghai and Beijing have both rebounded in the second quarter so far, after precipitous drops in investment in the first quarter. It should be noted that Q1 2020 declines looked particularly stark in comparison with a record $10 billion spent across both metros in Q1 2019.

The completion of two large office deals in each city has injected some much-needed confidence into their outlook. The most prominent deal was GIC’s billion-dollar purchase of LG’s headquarters in Beijing, the largest individual property purchase across the globe in the quarter so far. In the coming months, volumes should continue to be supported by domestic firms selling assets to pare their debt loads.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.