Inflation poses a challenge for the financing of commercial real estate. As inflationary pressure pushes up interest rates, the cost to finance commercial real estate investments can increase as well. U.S. commercial mortgages originated in 2021 had an average 3.7% coupon rate for 7/10-year fixed rate products. Into March of this year, this rate had climbed to 4.3%, an extra 60 basis points. Increases in other rate instruments could foretell further commercial rate increases if traditional relationships hold moving forward.

Australia’s construction sector has faced many headwinds due to Covid, with constrained supply pipelines causing delays in shipments of necessary materials, lockdowns hampering progress on much construction activity, and, more recently, significantly rising costs. However, over the last two years, there has still been significant investment in building new assets, thereby increasing the amount of stock and the size of the investment market.

Liquidity fell in some of Europe’s leading real estate markets in 2021 despite acquisition volume on the continent reaching a new annual record, the latest update of RCA’s _Capital Liquidity Scores_ shows. A shift in investors’ sector preference is behind the weaker outturn, and also explains the leap in liquidity in other markets. In Central Paris, liquidity fell by 3% to a four-year low at the end of 2021, and liquidity in Frankfurt dropped to its lowest level since 2014. In Milan, liquidity dropped by 7% year-over-year to its lowest score since 2015.

U.S. commercial property price growth continued apace in February as all four major property types posted double-digit annual price growth. The US National All-Property Index rose 19.4% from a year ago and 0.8% from January, the latest _RCA CPPI: US_ report shows. Industrial prices climbed 28.5% from a year prior, the fastest annual rate among the major property sectors in February and a record for any property type since the inception of the RCA CPPI. In June 2021 industrial price growth surpassed its previous high, seen prior to the Global Financial Crisis, and growth has accelerated every month since.

France stood out among Europe’s largest property markets in 2021, posting a lower level of commercial real estate deal activity than during the pandemic-disrupted 2020. Of the top 10 European markets in 2021, only the Netherlands also registered a decline. Weakness in France’s office market was the culprit. Offices account for around 60% of the amount spent on French property since 2007 and the uncertainty affecting the sector has had an outsized effect on the market as a whole. Other more in-demand European sectors — namely apartment and industrial — have not compensated.

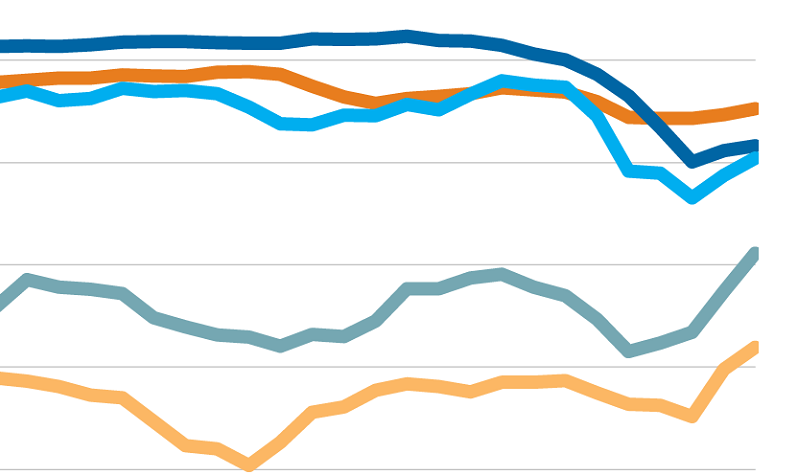

Global commercial property market liquidity continued to grow at the end of 2021, as buyers returned to the market in numbers after almost two years of a pandemic that had stymied investment activity. Liquidity was up year-over-year in 94 of 155 markets and up on a quarterly basis in 77 of 155, the latest _RCA Capital Liquidity Scores_ report shows. For 17 markets, liquidity was at a record high at the close of last year.

There is a first time for everything, and such was the motto of some investors in the U.S. as they made their first purchases outside of their traditional geographic footprint in 2021. A list of the top markets for new entrants provides some insight as to where investors headed and what factors lured them there. For some first-time market participants, the decision to expand their geographic horizons had less to do with geography and more to do with access to a specific asset class.

Interest in the multifamily commercial property sector has skyrocketed during the Covid era. Global investment volume in 2021 was almost double 2019’s level, with record spending in the U.S., U.K., Germany and Canada. Japan was one of only two major residential markets to buck this trend, tumbling year-on-year. Based on deal volume alone, it would seem that interest in the Japanese sector is receding. However, other indicators tracked by Real Capital Analytics and MSCI point in a different direction.

Industrial construction and property prices in Canada are at record high levels, an observation we noted at the recent MSCI/REALPAC 2022 Canada Real Estate Investment Forum. If property markets simply mean reverted, at some point one would expect prices to decline. Instead, both price growth and investment in new industrial construction continued at a strong pace in 2021. This combination lends weight to the argument that there is a fundamental shift in the nature of demand for industrial space in Canada.

Investors have been looking to alternative asset classes such as life sciences properties as demand trends for traditional investments like offices and retail face uncertainty. Location may not matter as much moving forward for those traditional asset classes; for life sciences assets though, investors are focusing on specific markets. Location may matter for life sciences assets for now, but not forever. The life sciences sector is heavily dependent on knowledgeable workers trained in arcane matters of biology.

Singapore’s commercial real estate investment market has enjoyed a strong rebound in 2021 after sliding to its second lowest annual tally for deal volume in 2020. Including pending deals slated to close before the end of the year, 2021 investment is just shy of the 2017-19 yearly average and marks the second best annual total on record. The bounceback is notable for a couple of reasons. For one, Singapore’s resurgence hasn’t been overwhelmingly driven by the industrial and apartment sectors, as in other leading economies.

People tend to fight the last war. This truism applies to many aspects of life where people assess problems by interpreting them in light of previous bad experiences. The Covid-19 crisis and the resulting recovery in investment activity into 2021 makes a great case for never following this simple behavior. The Covid-19 crisis led to a flurry of fund announcements where investors planned to use the distressed investment playbook that worked so well after the Global Financial Crisis (GFC).

The majority of global property markets registered improving capital liquidity at the end of the third quarter, the latest _RCA Capital Liquidity Scores_ report shows, an indication that the recovery from the Covid-19 pandemic is gaining momentum. Liquidity increased from a year prior in 90 of the 155 markets covered by the analysis, up from 55 at midyear and 29 in the first quarter. However, on average, liquidity is not yet back at pre-pandemic levels.

Commercial property investment in Japan improved slightly in the third quarter of 2021, with deal volume reaching 862 billion yen ($7.6 billion), 9% higher than the same period last year. Office transactions in Tokyo constituted about half of total deal activity in the quarter. According to Real Capital Analytics data, third quarter volumes for the apartment, industrial and retail sectors each sat at a little over 100 billion yen. Office investment volume totaled well over triple this amount at 465 billion yen.

Investors around the world are fretting over recent spikes in inflation. The OECD reported that in the G20 countries alone, the pace of inflation jumped higher than the pre-pandemic pace to an average 4.6% rate through September of 2021. Worried about the implications for their portfolios, institutional investors are turning to commercial real estate as a hedge. Real estate can outperform inflation, but not always. Inflation can distort investment decisions. Rather than focusing on the fundamentals of a project, inflation can lead investors to underwrite above-average income growth.

Global commercial real estate price growth accelerated in the third quarter of 2021, with the Asia Pacific region leading price gains, the latest _RCA CPPI Global Cities_ report shows. The RCA CPPI Global Cities Composite Index climbed 7.3% in the third quarter from a year ago, up from the 6.1% year-over-year pace seen the prior quarter and the 2.5% rate seen in the third quarter of 2020 amid the pandemic’s challenges.

With the acceleration of flexible working induced by the pandemic, investors in Asia Pacific have been watching closely to see if office prices would suffer. The pandemic did slow the increases in pricing recorded in some of the gateway cities in the region in the middle of 2020, but, in 2021 pricing in most markets has resumed an upward trajectory. For five of the eight cities shown in the chart, prices have now reached levels higher than those just before the pandemic.

The headline rate of U.S. property price growth accelerated further in September, propelled by faster rates of growth from all four major property types, the latest _RCA CPPI: US_ report shows. The RCA CPPI National All-Property Index rose 16.1% from a year ago and 2.2% from August. The office sector index accelerated to a record 16.9% year-over-year rate in September, overtaking apartment and on par with the industrial sector. Suburban office prices powered the gain, climbing 20.2% year-over-year. CBD office prices fell 1.2%.

Germany’s office transaction market has picked up momentum through the spring and summer, with deal activity for the first eight months of the year now on par with the average for the five years before the pandemic. The second quarter of 2021 was the ninth best quarter on record for office transaction volume. Investors spent €8.4 billion ($9.7 billion) in the quarter and another €3.8 billion over the normally quiet summer months of July and August.

Student housing investment volume in the U.S. reached $1.7 billion in the second quarter of 2021. While this level represents a high-triple-digit rate of increase compared with the same period a year ago, it is still 12% below the average level for a second quarter between 2017 and 2019. Sales of student housing assets had ground to a halt in Q2 2020 amid Covid-19 disruption to the commercial real estate market and as universities and students across the U.S. pivoted to remote learning.