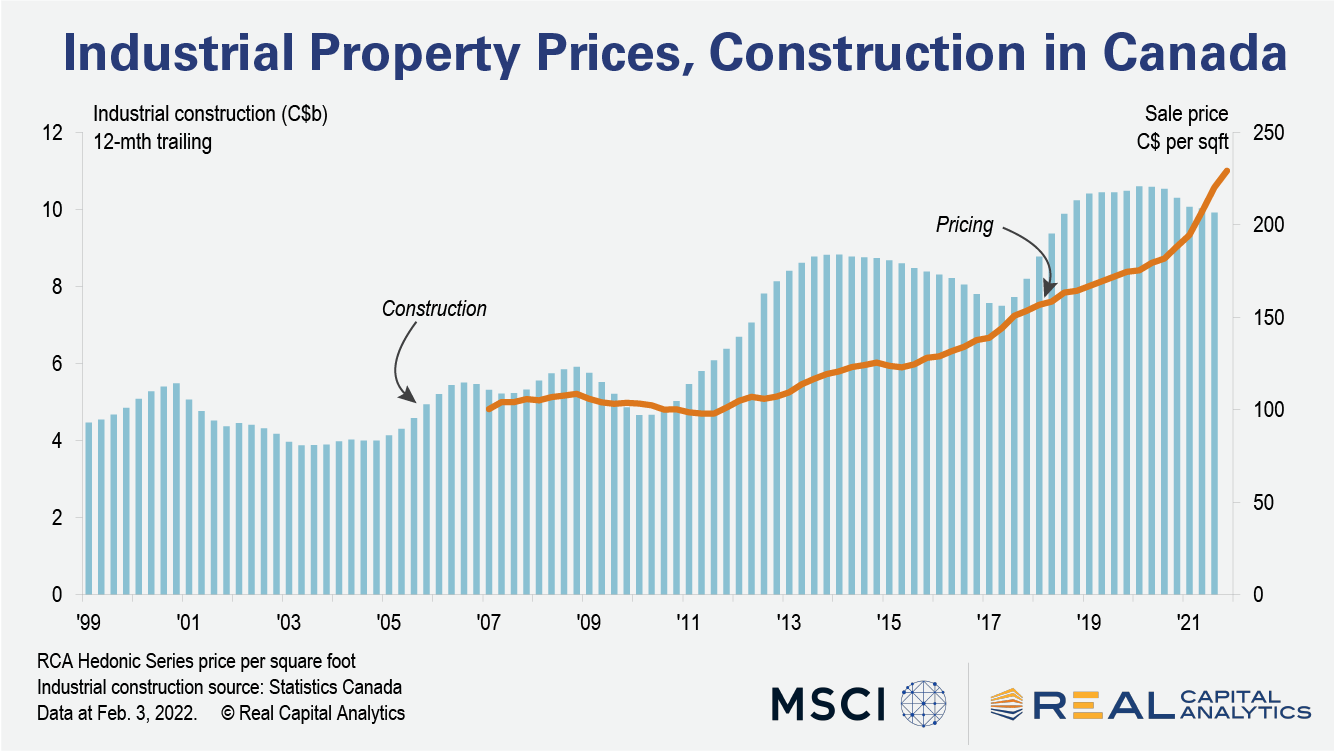

Industrial construction and property prices in Canada are at record high levels, an observation we noted at the recent MSCI/REALPAC 2022 Canada Real Estate Investment Forum. If property markets simply mean reverted, at some point one would expect prices to decline. Instead, both price growth and investment in new industrial construction continued at a strong pace in 2021. This combination lends weight to the argument that there is a fundamental shift in the nature of demand for industrial space in Canada.

When markets price assets of any sort higher than book values, or replacement costs, or both, it provides an incentive to investors to bring more assets to market. This simple notion was put forth by James Tobin in a seminal paper that underlies much investment theory across all asset classes. When applied to real estate investment and development, this type of analysis becomes problematic due to the challenges of measuring replacement costs.

Sure, every developer will have a sense of what it would cost to build a particular project at a particular point in time. And of course, every investment committee in the commercial real estate world is pitched assets priced at a discount to replacement cost. None of these types of examples are rolled up into a statistically valid index of replacement costs, however. In the absence of hard figures, some thought experiments can help to explain why prices have not yet mean reverted in Canada.

Industrial properties are effectively boxes where the manufacturing, storage, and shipment of goods happens. A fixed amount of space is out there and when that fixed amount intersects with the demand from all industrial space users, a market rent comes to light after building owners and tenants negotiate their needs.

The investment market then values that rent (or more appropriately the NOI) at some cap rate to get a sale price-per-square-foot measure. If that sale price is higher than the cost to develop new assets, developers will get itchy to bring new projects to market. Again, we cannot see the cost figure that they know instinctively, but developers certainly have been scratching an itch, with the value of new industrial construction projects trending close to C$10 billion ($7.9 billion) per year of late, Statistics Canada reports.

New projects to market in turn though should interact with the market for space where building owners and tenants negotiate to set market rents. If the demand for space by tenants has not changed and more space is introduced, all other things equal, rents and NOI figures should go down. Instead, the same-store NOI figures for industrial properties that come out of MSCI’s performance management data set showed an 8.2% year-over-year pace of growth in Q4 2021, a pace 630 bps higher than the average set since 2001.

This disconnect comes about because of a fundamental shift in tenant behavior. For any given level of consumer activity, there is now more demand for logistics space. The team at Prologis looked at this issue in 2020 and found that e-commerce sales generate three times more demand for logistics space than do sales in stores. Property income and prices are growing so quickly simply because e-commerce activity as a share of total retail sales continues to grow faster than supply can catch up with demand.

Statistics Canada reported that e-commerce activity has increased from about 2% of all retail sales in 2016 up to 7% by November of 2021. Online sales grew 5.8 times faster than that of retail sales in total in the years before the pandemic struck.

E-commerce will hit a saturation point, eventually, and growth will be no more than that of retail sales overall. Will that saturation point be 20 years from now? Will it be next Tuesday at 3pm? We just do not know. The pandemic generated some unusual trends in 2020 and 2021 for e-commerce sales however, so figures published over the coming year will provide perspective on how much longer the supply chain changes in Canada will boost prices.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.