Investors around the world are fretting over recent spikes in inflation. The OECD reported that in the G20 countries alone, the pace of inflation jumped higher than the pre-pandemic pace to an average 4.6% rate through September of 2021. Worried about the implications for their portfolios, institutional investors are turning to commercial real estate as a hedge. Real estate can outperform inflation, but not always.

Inflation can distort investment decisions. Rather than focusing on the fundamentals of a project, inflation can lead investors to underwrite above-average income growth. It might work for a while, but over the longer term, the accompanying increase in interest rates can reduce financing options and push up cap rates thus hurting valuations.

Analysis of inflation trends and real estate performance is tricky due to issues of timing. Detailed data collection in the property markets really only began in the 1980s with the explosion of computer technologies. The collection of building-level information allowed for far more detailed indices than had been available earlier via impressionistic surveys. Nonetheless, this type of information that the industry relies upon today was not collected in the 1970s when inflation was a significant global concern.

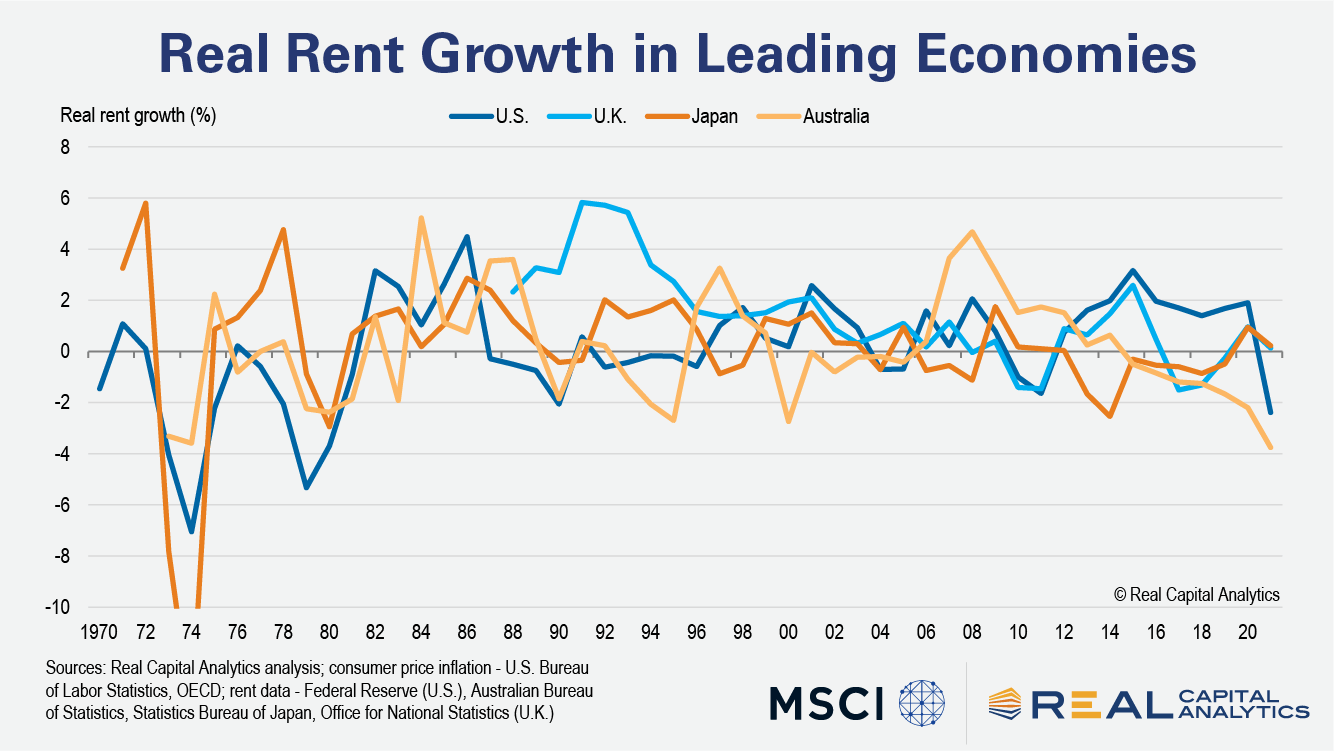

Within the consumer price indices generated by government statistics agencies globally however, there are records of the rental prices paid in the residential markets over time. These organizations had much greater access to computer technology than the private markets for years and have detailed records of prices going back almost a century in some cases.

These price metrics are not a perfect measure of current conditions and graph C3 of this article from the Reserve Bank of Australia highlights the fact that in the short-term, private market information on rent trends does capture turning points in the market better. Nonetheless, these measures can provide a long-term view of income performance across numerous countries.

The chart shows trends in the U.S., the U.K., Japan and Australia. These four countries have seen residential rent growth, on average, outperform inflation by 40 bps over the last 25 years. Japan underperformed over this time frame while the U.S. outperformed. There are numerous differences between the U.S. and Japan, but the simplest explanation for the outperformance of the U.S. is that far fewer housing units are built relative to the population size than in Japan.

Investors are currently hungry for long duration assets with an inflation hedge. There are times when real estate has provided such a hedge, other times, not so much. Investors should not assume that all real estate is protected from inflation, if the market cycles of tenant demand and new supply are working against one’s investments, inflation is not likely to help paper over any mistakes in underwriting.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.