Australia’s construction sector has faced many headwinds due to Covid, with constrained supply pipelines causing delays in shipments of necessary materials, lockdowns hampering progress on much construction activity, and, more recently, significantly rising costs. However, over the last two years, there has still been significant investment in building new assets, thereby increasing the amount of stock and the size of the investment market.

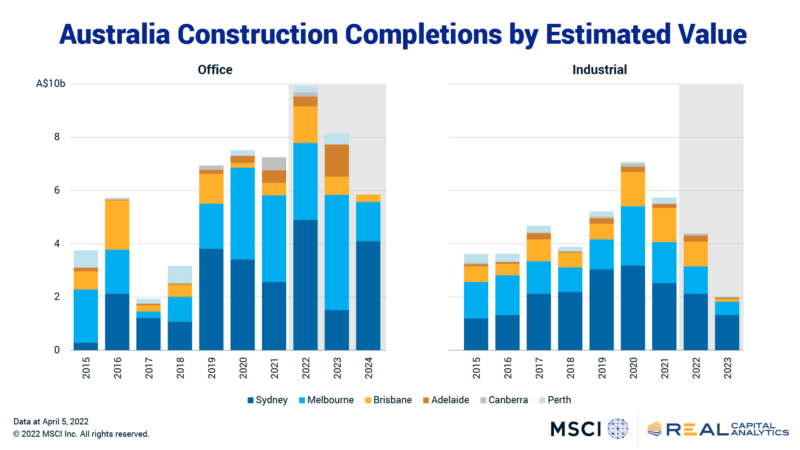

The office sector had been undergoing a mini supply boom pre-Covid, and over the last two years several of these developments have been completed. During 2017 to 2019, Australia saw just under A$14 billion ($10.4 billion) worth of office assets enter the market and during 2020 and 2021 this increased to A$15 billion, Real Capital Analytics data shows. Office properties with an estimated value of A$10 billion are set to complete in 2022, taking the 2020 to 2022 total to more than A$25 billion across over 200 new office buildings.

The majority of new office supply is located in Sydney and Melbourne at around 80% of total completions between 2020 and 2022. These two major financial hubs traditionally form the bulk of the office supply pipeline. The timing of all this new product coming to market could be seen as unfortunate, given that many occupiers are re-examining their office footprint due to the rapid workplace evolution brought on by the pandemic.

In the retail sector, acquisition volume reached the second strongest annual level in 2021, bettered only by 2015. The pandemic sparked an increase in retail acquisition activity, which can be partially attributed to the significant value declines seen in the sector. Yet, investors seem reluctant to embark on new projects when it comes to retail.

The industrial sector in recent years faced the opposite situation to the retail sector where its supply pipeline has been booming. However, in an odd quirk of fate, it is precisely because of the retail sector that this has occurred.

The online retail penetration rate has been increasing in the country for several years, according to Australia Post and the advent of Covid meant people relied more heavily on online shopping as non-essential retail services were closed in widespread lockdowns. More online shopping means more distribution warehouses are required. From 2015 to 2019, A$24.4 billion worth of industrial assets were added to the market, just ahead of the office sector.

The huge ramp-up in industrial construction resulted from shifts in retailing trends pre-Covid, but we can also see the impact the pandemic had on the development pipeline. The number of industrial assets completed and the total value of projects reached records in 2020, with 2021 the next strongest year for both metrics. There is also just over A$7.5 billion worth of assets expected to complete in 2022 and 2023.

Still, the headwinds in the construction industry persist. The issue of rising costs was brought into the spotlight with the collapse of one high-profile builder earlier this year which, according to media reports, has left many large developments in the balance.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.