2021 was a curious year for the travel app sector. Travel was hit hard in the previous 12 months, with recreational and business travel virtually halted all over the world. 2021 saw travel rebound back towards pre-pandemic levels, thanks to a combination of vaccine rollouts, natural immunity and governmental plans for safe reopenings despite new variants causing intermittent lockdowns and travel restrictions.

Down, Up, Down – A ‘Spikey’ Year for Travel App Downloads

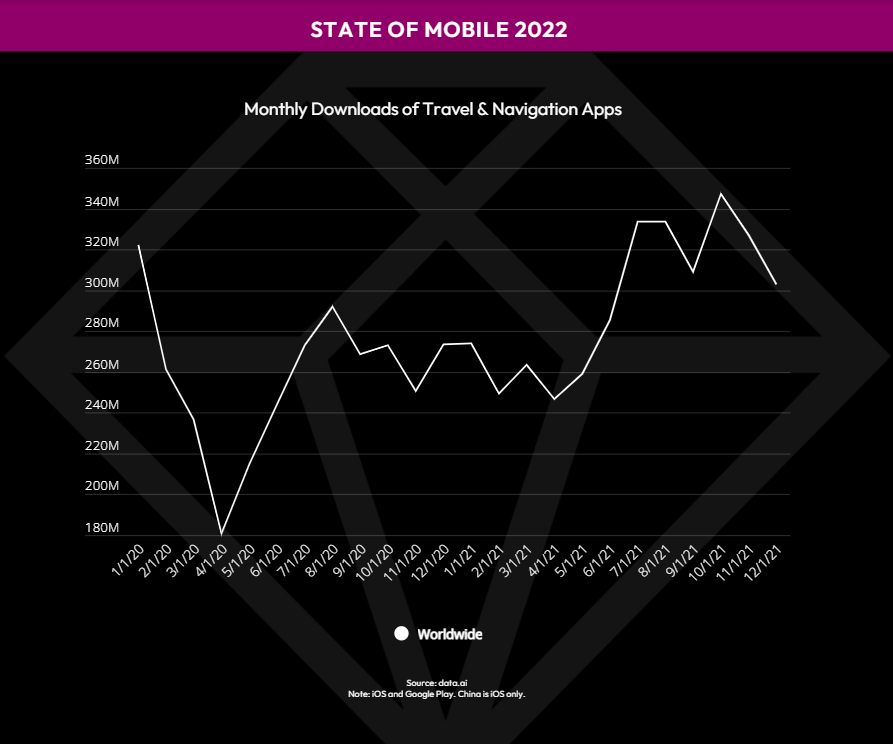

The shape of the app download line chart reflects this stop/start dynamic emerging from new COVID-19variants in 2021. We can see a sharp fall in download activity for the first four months of the year as the worst of the Delta variant hit.

Global monthly downloads of Travel & Navigation apps slipped from 322 million in January of 2020 to 181 million in April 2021. There followed an upturn starting the summer of 2021 until late into the year, with monthly downloads peaking at 347 million in October 2021. But then the graph headed downwards as fears around the Omnicron variant appeared to slam the brakes on once again.

Still, let’s put this in perspective. Overall worldwide downloads of travel apps for the second half of 2021 hit 1.95 billion. That is not far off the pre-pandemic total of 2.08 billion in H2 2019.

US and India Experienced the Biggest Fluctuations in Travel Demand

Needless to say, there was regional variation in download activity — due to local Covid-19 travel policies. Many countries’ downloads remained flat, while others fluctuated dramatically. The US experienced a marked rise in installs across 2021, with monthly downloads almost doubling from 23 million in February 2021 to 40 million in July 2021 – the highest monthly downloads in the US since August 2019.

India’s market was wildly up and down too. Its consumers downloaded over 50 million travel apps in January 2021, but by May 2021 the rate was down to about 29 million. As of November 2021 it was back up to just under 45 million downloads.

Map Products Navigate Their Way to the Top – but Ridesharing Apps Made a Comeback

The travel app market’s top products are quite diverse in nature, though it’s possible to put most of them into three categories: maps, booking and ride sharing. In 2021, the world’s most downloaded product was Google Maps, with fellow navigation products Waze at #3 and Google Earth at #4.

Uber scored at #2. In fact, 2021 was a comeback year for the app; it placed in the top 3 for download in 10 countries in the study. However, we should be mindful that many of these downloads may have been for reasons of (food) delivery rather than rides. The company’s own financials show its ride hailing (mobility) business rose 37% in 2021, while delivery business increased by 60%.

Overall, demand for rideshare apps returned to mostly normal levels, and even peaked higher in some regions. In the US, Uber riders spent nearly 212 million sessions in the app in December 2021. Meanwhile riders spent three sessions for every one driver session on Lyft in the US.

Driver supply showed signs of post-pandemic recovery too. In the UK, the supply of available drivers was nearly equal with demand from riders in 2021.

Gojek/Goto consolidates and APAC and prepares for a harder push

Other apps that enjoyed an impressive 12 months include Gojek, the Indonesia-based ‘super app’ that offers ride sharing alongside deliveries, shopping and around a dozen other services.

Gojek ended the year as the #1 travel app in Indonesia and Singapore, #2 in Vietnam and #3 in Thailand. The company had an eventful 2021. Local MNO Telkomsel invested $300 million in Gojek in May 2021 and, shortly after, Gojek merged with e-commerce platform Tokopedia. The $18 billion deal saw the creation of a new holding company called GoTo. In March 2022, Goto announced plans for an IPO and further expansion.

Has llegado! Didi Mobility’s LATAM bet pays off

Another performance worth noting came from Didi Mobility. The CN-HQ’d app dominated the download chart across LATAM, scoring at #1 in Mexico and Argentina, and #2 in Colombia, Chile and Peru. This success was a number of years in the making. Didi signaled its intention to target the region when it acquired Brazilian ridesharing company 99 in 2018.

This was not the only 2018 acquisition to pay off impressively in 2021. There was also Google’s purchase of Bengaluru-based Sigmoid Labs. Sigmoid’s Where Is My Train app was already a hit with commuters 4 years ago when Google swooped. But in 2021, our data placed it as the world’s #1 breakout travel app (defined in terms of YoY volume growth).

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.