People tend to fight the last war. This truism applies to many aspects of life where people assess problems by interpreting them in light of previous bad experiences. The Covid-19 crisis and the resulting recovery in investment activity into 2021 makes a great case for never following this simple behavior.

The Covid-19 crisis led to a flurry of fund announcements where investors planned to use the distressed investment playbook that worked so well after the Global Financial Crisis (GFC). These fund managers raised money on a mistaken belief that this downturn would be the same as the last. To date, distressed asset sales have been minimal as the nature of the crisis was uniquely different from previous downturns.

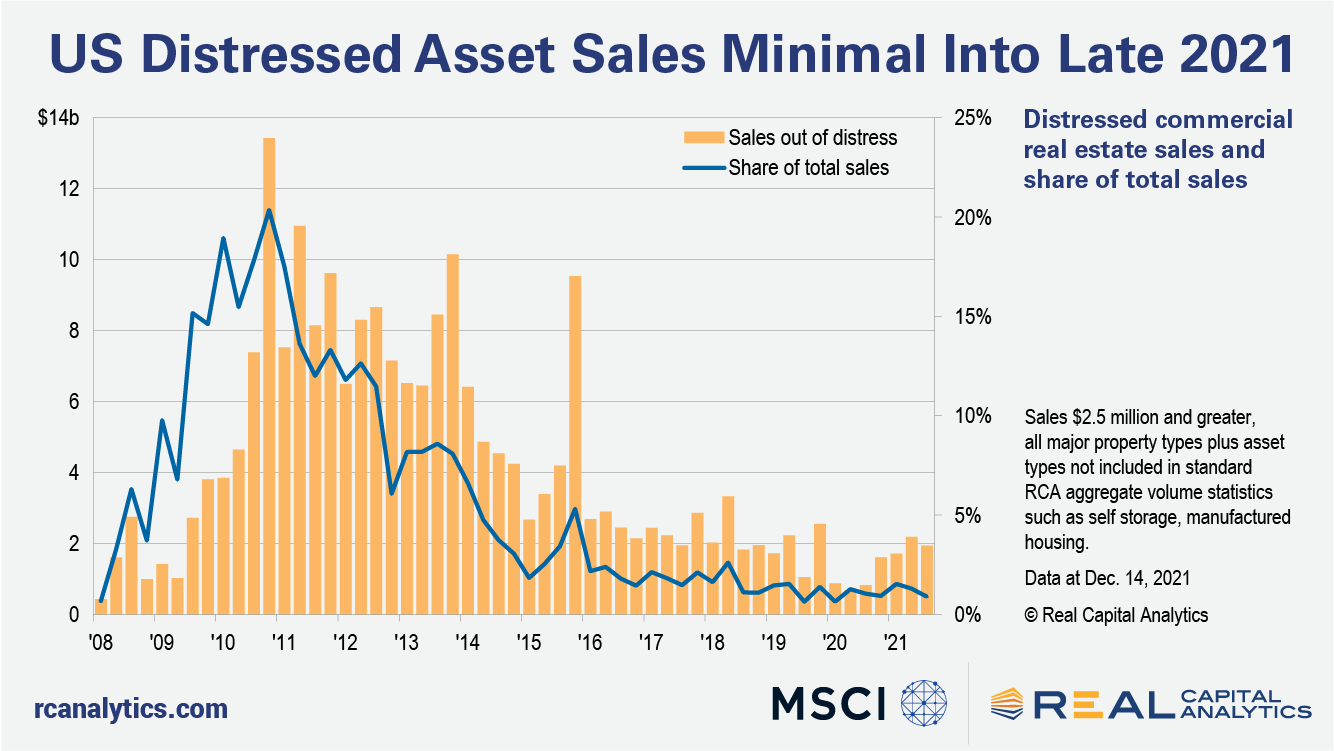

Distressed asset sales are still few and far between late into 2021, representing a smaller share of the market than at this point after the onset of the GFC. That crisis started in December of 2007 and six quarters into the downturn distressed asset sales were behind 7% of the market, on the way to a 20% share of total. In Q3 2021, roughly the same lag after the start of the GFC, such sales represented less than 1% of total sales.

This crisis hit differently than the GFC as it was a shock to the real economy and not a shock to the financial market. Institutional memory on the part of U.S. political leaders and financial market regulators led to a fast response in the form of the CARES Act. This action put a floor under the worst fears for the financial markets and ensured a continued flow of capital to the debt markets. Ongoing debt prevented the kind of distressed sales seen in the aftermath of the GFC where cash flowing assets simply could not be refinanced even at healthy LTV ratios.

Do not think though that all is well and that property will move forward with no problems. Fundamental challenges exist for many properties with changes in the structure of work, consumer behavior, the flow of goods, and the desire to travel calling the income performance of many assets into question.

Those questions, though, are more long-term phenomena that will drag out over many years. A well-functioning debt market this time around has ensured that those assets which are better positioned to survive economic changes need not go through the dramatic foreclosures seen more than a decade ago.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.