Do not be fooled into thinking that U.S. commercial property prices have already fallen at high double-digit rates. Until market participants can comfortably start visiting properties, clients, and other service providers – and we enter the price discovery phase of the downturn – prices cannot move. However, the spread between buyer and owner expectations on pricing has widened sharply.

There is a bottle of whiskey locked in a cabinet at my neighborhood liquor store. They want $700 for this bottle of Yamazaki but I do not want to pay that much, and it has sat there for some time. The fact that the bottle remains there does not mean that the price is going to fall: the owner should eventually get that price. What it shows though is that at this price, the liquidity for that bottle, so to speak, is low. The same issue plagues the commercial property market today.

Transaction volume was the first loser of this economic crisis, with U.S. investment activity down some 70% year-over-year in April. Liquidity is falling, in part because people cannot get out and about, and in part because buyers and owners are becoming more cautious. That caution will lead potential buyers to reduce what they are willing to pay and will leave owners hesitant to sell at any price.

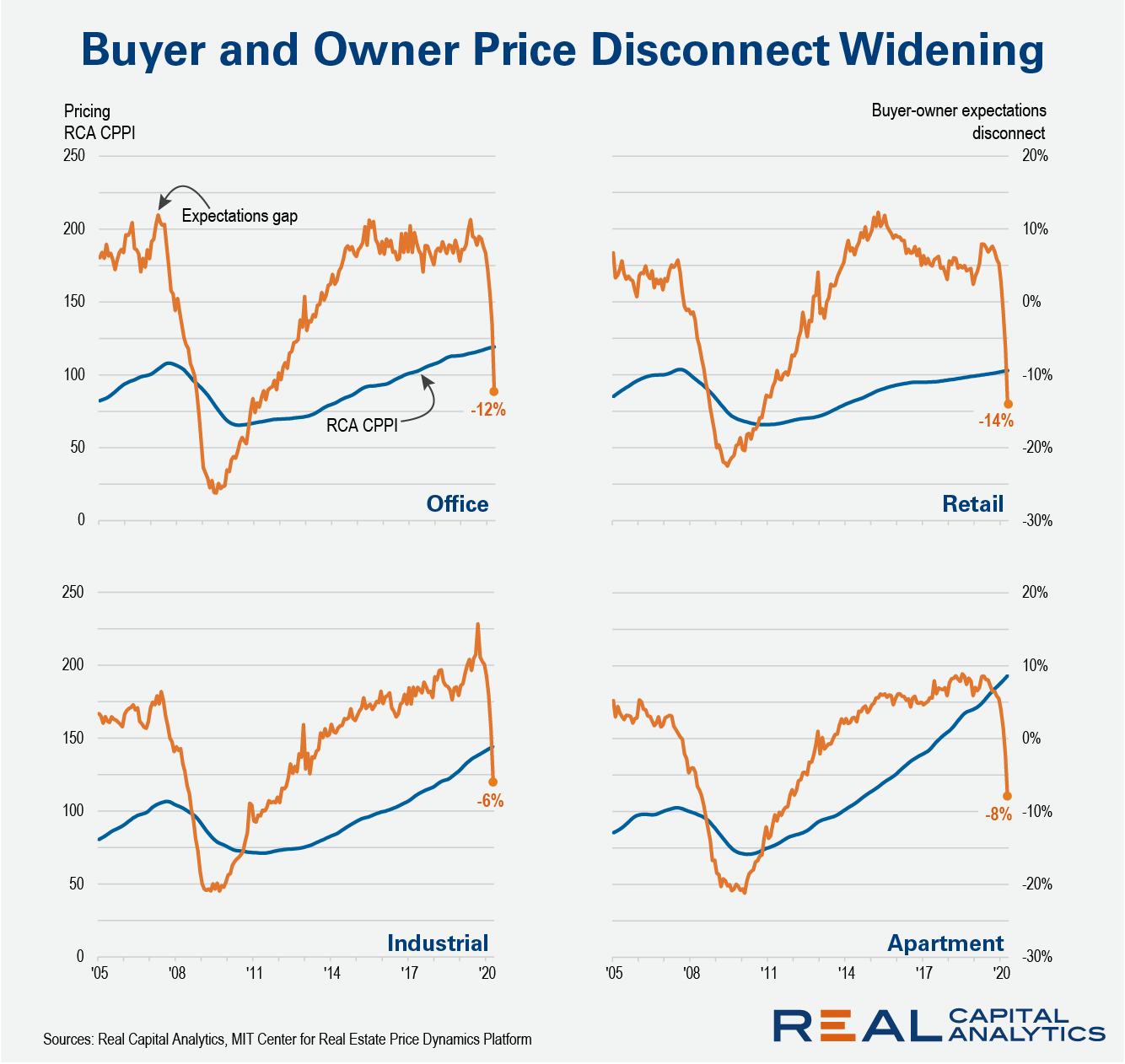

Measuring the disconnect between buyer and seller expectations is tricky, but possible. The team at the MIT Center for Real Estate Price Dynamics Platform did some work to measure this disconnect and their work shows a growing gap in price expectations, particularly for the retail and office sectors. (The mathematics in their analysis is tricky, but these folks in Boston are wicked smaaht.)

The way to understand their analysis as a layperson is to think about the supply and demand curves of microeconomics. That type of interaction works in the commercial real estate market as well. Reduce the buyer demand for an asset while keeping the supply steady, and price mechanisms will adjust keep supply and demand in balance.

If the supply and demand for commercial real estate assets were balanced, deal volume would not be so low and be back at normal levels. Dorinth van Dijk on the Price Dynamics Platform team ran some analysis for RCA looking at what type of price adjustments would be necessary today to keep deal volume constant given historical trends in the supply and demand for real estate investments.

Deal volume was high in the period between 2015 to 2019 because buyers had been underwriting an expectation of higher values than owners. Whether through cheaper debt, lower cap rate expectations, or forecasting stronger rent growth, these buyers jumped into these assets at price levels that were simply too good for the current owners to pass up.

By contrast, volume has cratered into 2020 as potential buyers are not as enthralled with the investment opportunity today. The gap in expectations between buyers and sellers is such that if we wanted to see a more normal level of deal volume, owners would need to cut office prices by 12% for the market to clear. By contrast, the apartment sector would need to see only an 8% correction in prices to restore deal volume to normal levels, and industrial only a 6% adjustment.

Again though, just because buyer expectations have changed does not mean that owners will cut their prices. As long as the owner of the liquor store up the street is in good standing with the bank and cash is flowing, it is wishful thinking that I will get that bottle of Yamazaki for the price of a bottle of Evan Williams. In the same way, expecting that suddenly you will be able to buy office buildings at a 23% discount to the prices from last year just because the prices of office REITs have fallen that much is wishful thinking.

To be clear, I do think that prices will decline. The U.S. economy is in a recession and there will be shocks to property income that will eventually lead sellers to realize losses. The key issue though, is that this decline has not happened yet. As long as the lending market does not seize up like in the Global Financial Crisis, where credit was unavailable at any price, owners can delay potential losses.

To learn more about the data behind this article and what Real Capital Analytics has to offer, visit https://www.rcanalytics.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.