As many Americans have spent weeks at home during the COVID-19 pandemic, apparel retail has been among the hardest hit industries, while ecommerce has been thriving. Where does this leave online sellers of secondhand fashion? Like the merchandise on their sites, the answer is a mixed bag. In recent months, year-over-year sales were down more often than not among fashion resale platforms, but some have seen spending increase.

Stadium Goods, which caters to the pre-owned athletic sneaker market and also sells apparel, has seen the most growth during the pandemic, with average weekly sales from Mar 16 through May 24 growing over 50 percent year-over-year. The marketplace also supports consignment, with product lines ranging from vintage Air Jordans to the latest Yeezys, varying in price from just over $100 to several thousands of dollars for rare pairs, like the Back-to-the-Future-inspired “Marty McFly.”

ThredUP and Poshmark, two resale sites geared primarily toward women’s fashion, have also seen sales increase 22 percent and 5 percent, respectively. In uncertain economic times, these secondhand marketplaces help provide both secondary income for sellers and affordable apparel for savvy shoppers.

Little movement in average spending among online luxury consignors

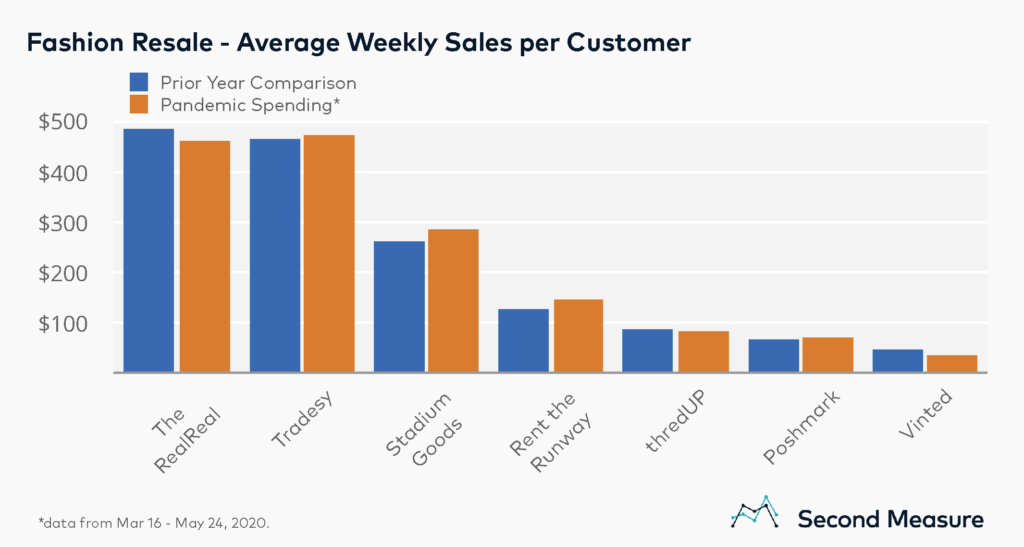

Overall, pandemic customers are spending similarly to the comparable weeks in 2019, with average weekly sales per customer changing between -5 percent and +15 percent year-over-year on most resale platforms. The exception being Vinted, where sales per customer have fallen to under $35, a 26 percent decrease over the same weeks in 2019. Already the secondhand site with the lowest weekly sales per customer before COVID-19, the Vinted marketplace is host to deep discounts on both designer labels and fast-fashion brands.

Meanwhile, retailers that cater to luxury fashion, like the RealReal and Tradesy, continue to attract big spenders, with the average shopper spending upwards of $450 both this year and last. These folks who have been all dressed up with no place to go in recent months may finally be getting to show off their latest purchases, since most states are well underway with phased reopenings.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.