A rising brand, a grocery turnaround, and the retailers that could benefit from Fred’s closing.

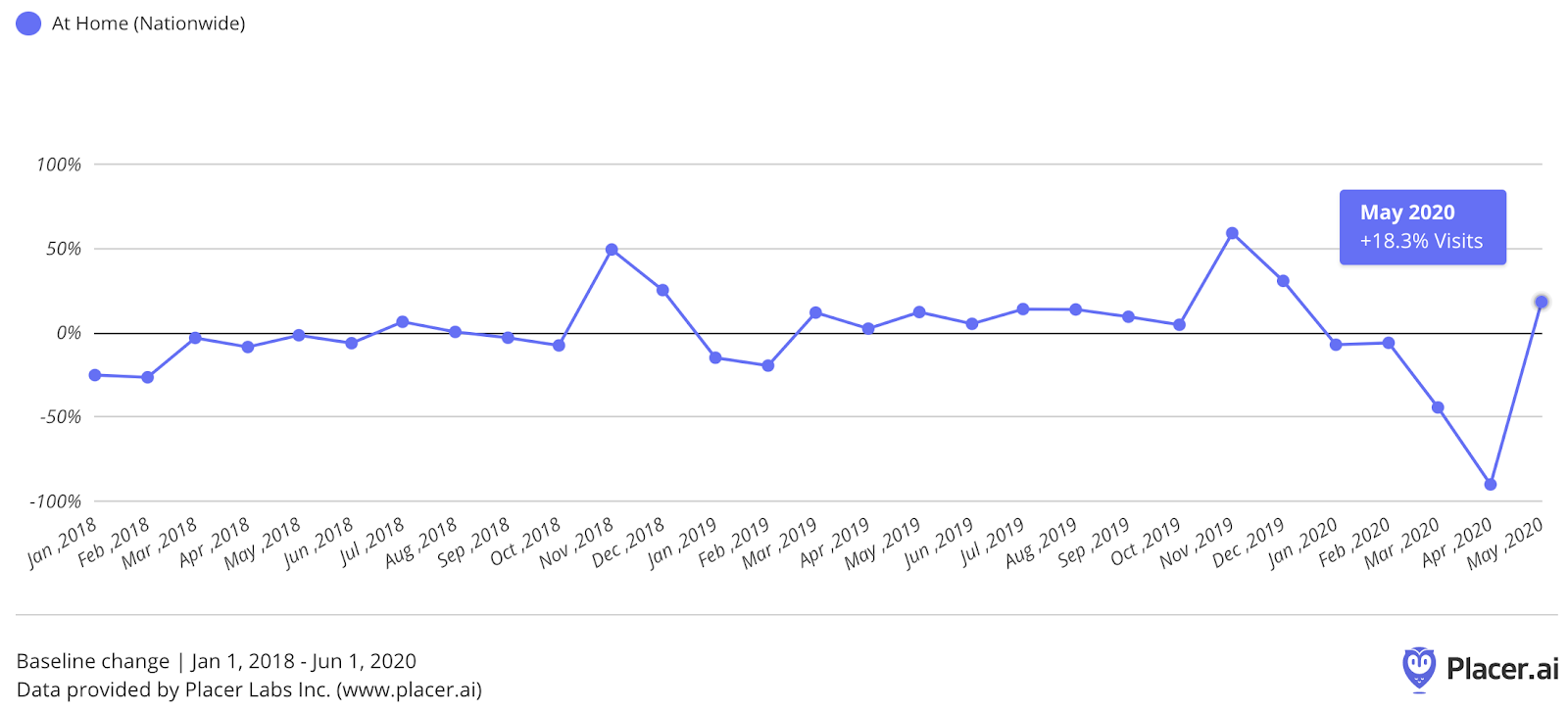

At Home Surging

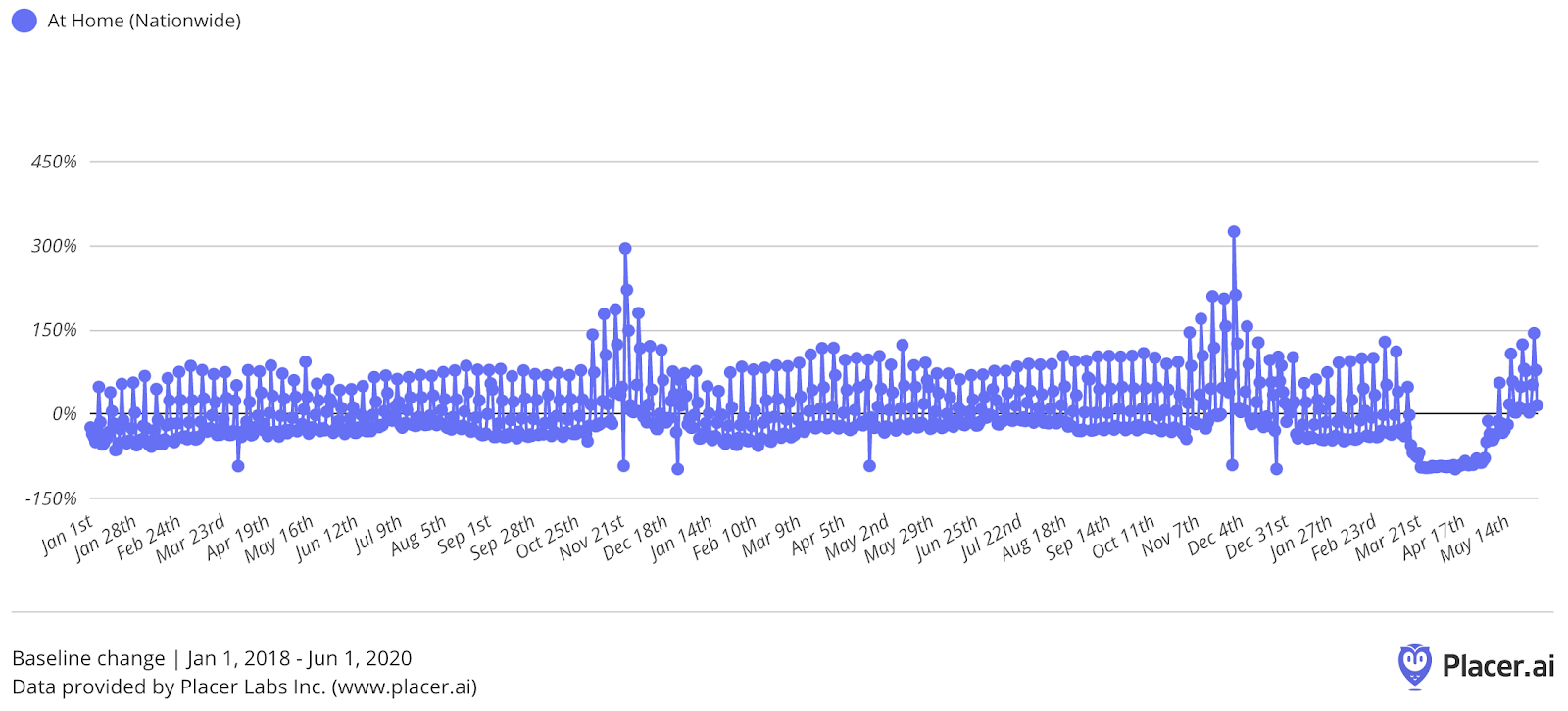

At Home is in the midst of a significant expansion, and the results are looking incredibly strong. In-store activity kicked off strong in 2020 with visits in January and February that were up 7.7% and 13.5% year over year. The pandemic then drove a major drop in March with visits plummeting to a 56.4% year-over-year decline and bottoming out in April. However, May has been surprisingly strong with visits actually showing a 5.9% increase over the same month a year prior and hitting the highest point since 2018 apart from the normal November/December seasonal surge.

While a skeptic would note that the growth of stores certainly contributes, there is a lot of reason to be excited about the brand. Analyzing daily traffic over the same period shows a sharp rise in visits later in May 2020. In fact, visits on Saturday, May 30th were up dramatically on the equivalent Saturday a year prior. Should the pace continue, and it appears to be doing just that based on early June numbers, the brand’s 2020 could be exceptional.

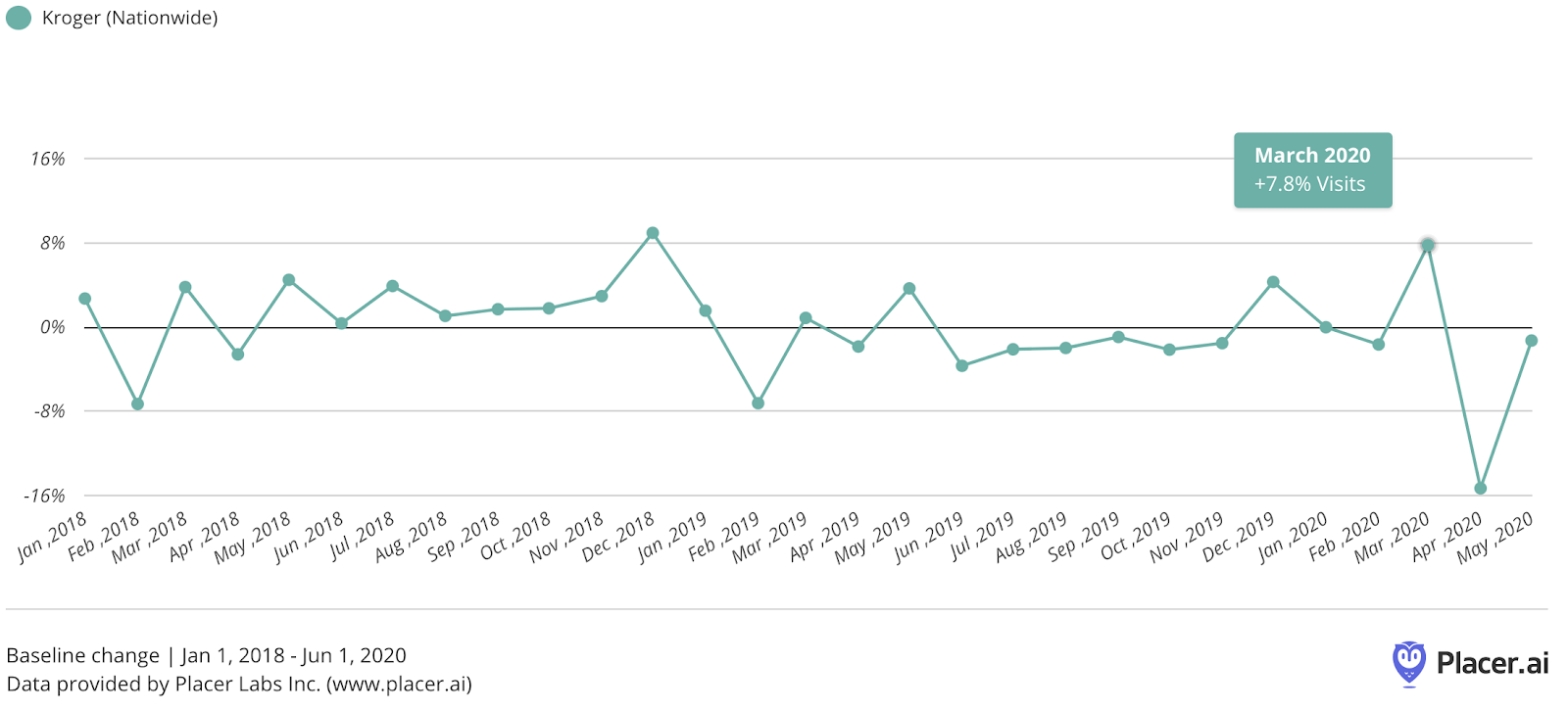

Kroger’s Rebound

The Kroger brand had not been enjoying its greatest period pre-pandemic with mixed results throughout 2019. January 2020 continued this trend with a 1.5% year-over-year decline before things changed dramatically. February visits rose 6.0% and March visits grew by 6.9% before seeing an inevitable decline in April. The increase was driven heavily by the renewed strength that traditional grocers have experienced amid the pandemic.

And the recovery is showing signs that this trend could last for Kroger. Visits are quickly returning to pre-pandemic levels, something that could give this chain a much needed long term boost.

Fred’s – Closure Beneficiaries

With Fred’s on its way to a full closure of all stores, a remaining question is who might benefit from this process. Considering the chain’s geographic distribution, the closure is unsurprisingly likely to shift more customers into the Walmart universe. Over 96% of Fred’s visitors, also visited a Walmart since 2018 and over 42% visited a Sam’s Club.

These numbers are significantly higher than key competitors Target and Costco who have overlaps of 49.8% and 6.1% respectively. Additionally, Dollar General and Dollar Tree look to be in store for boosts considering 72.9% and 60.3% of Fred’s visitors also visited stores for those brands during the same period.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.