Panic buying fuels explosive sales

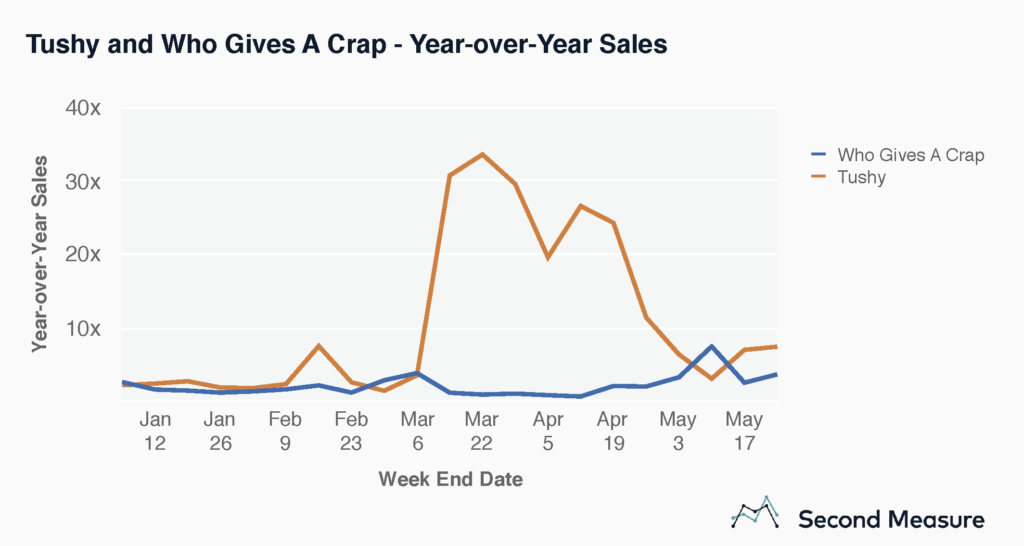

Earlier this year, the dawn of COVID-19 triggered mass stockpiling of toilet paper, causing widespread shortages. Second Measure’s data shows that one company in particular has benefited from this: Tushy, which sells bidets and bamboo toilet paper. Both Tushy’s sales and customer counts increased six-fold the week of March 9th, when the frenzy really began. At its peak, weekly sales were up more than thirty-fold, with almost all growth coming from new customers.

As the stockpiling of toilet paper driven by panic buying soared, consumers turned to companies like Tushy and Who Gives A Crap—which sells bamboo and recycled toilet paper as well as tissues—to overcome the shortage. The demand was so high that Who Gives A Crap ran out of inventory. On March 13, the company announced on Twitter that they were officially sold out in the U.S., UK, and Australia. While many U.S. consumers were desperate for toilet paper, others turned to more sustainable bathroom alternatives, like bidets.

Nationwide toilet paper shortage blew bidet sales out of the water

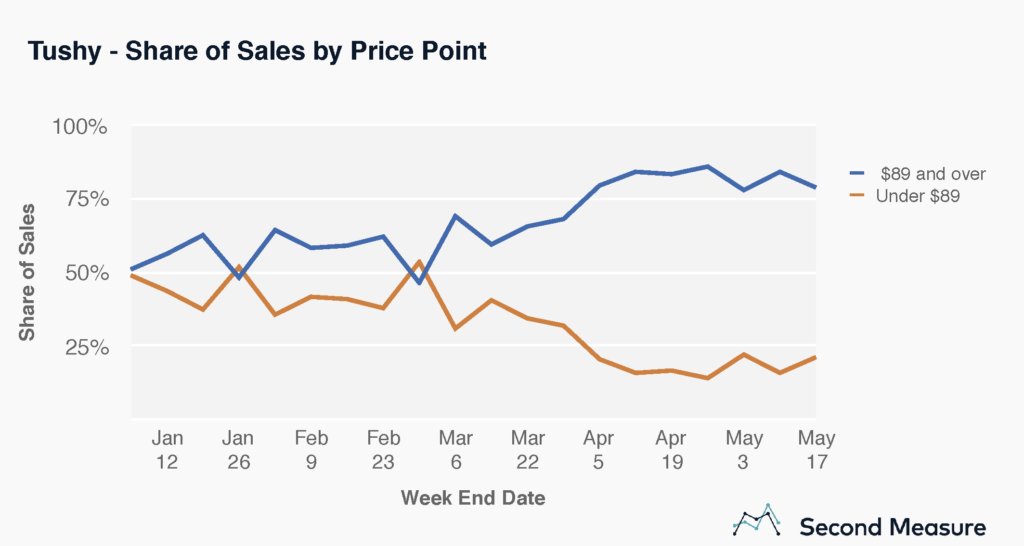

A closer look at assumed bidet sales (i.e., transactions above $89, the cost of Tushy’s entry-level bidet) revealed a nearly 50-50 split in share of sales between bidets and bamboo toilet paper the final week of February, before diverging drastically in the following weeks.

During the week of March 9th, bamboo toilet paper and other small ticket items accounted for ~40% of Tushy’s sales, but the company’s continued success has been due to the steady stream of presumed bidet sales, which accounted for ~80% of total weekly sales by the end of April.

Crap customers prove to be most valuable

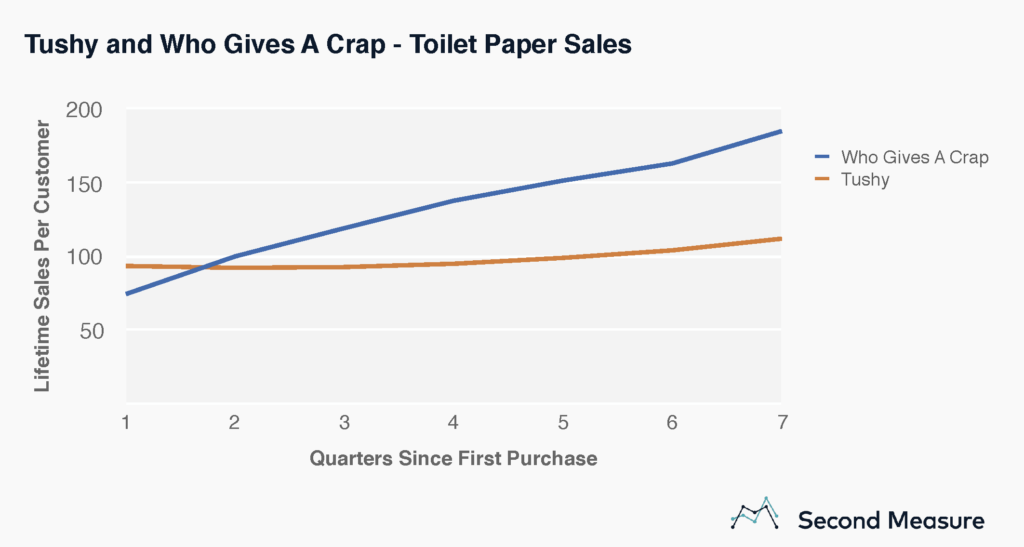

Though Tushy’s sales far outperformed that of Who Gives A Crap in terms of year-over-year growth, the latter’s customers have higher lifetime sales. Our analysis of both companies’ lifetime sales per customer revealed that Who Gives A Crap’s lifetime sales for customers is higher and surpasses Tushy’s after the first quarter.

Among customers acquired in the last two years, shoppers at Who Gives A Crap spent $74 on average in the quarter following their first purchase, compared to $93 at Tushy. However, by the one-year mark since their first purchase, customers at Who Gives A Crap spent $138 on average, compared to $95 at Tushy.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.