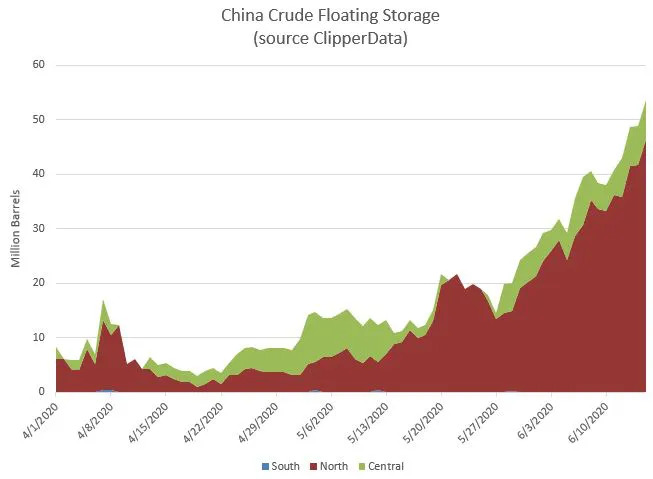

Vessels laden with crude waiting offshore China for more than seven days – which we classify as floating storage – has climbed above 50 million barrels for the first time. As the chart below illustrates, this volume is far beyond what is typical – the average over the first four months of this year was just under 10 million bbls:

This increase is less related to China running out of onshore storage – Ursa Space Systems sees storage utilization running at ~65% of total capacity. Instead, the issue is more related to terminal congestion at ports in Northern China. Waterborne imports reached a record 10.65 million barrels per day last month, and are pacing above that so far in June.

While it may have been Middle Eastern crude that led to record imports into China last month – with Saudi leading the charge at well over 2 million barrels per day – Brazilian crude is the leading source of barrels currently waiting offshore at close to 6mn bbls, while there is over 5mn bbls of Russian Urals onboard a VLCC, three Aframaxes and one Suezmax off Qingdao. Saudi crude accounts for 4mn bbls of the total floating storage, while there are over 4mn bbls of Iraqi crude, 3mn bbls of which are from Northern Iraq (Kurdistan region).

To learn more about the data behind this article and what ClipperData has to offer, visit https://clipperdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.