Data Synopsis:

Dig Deeper:

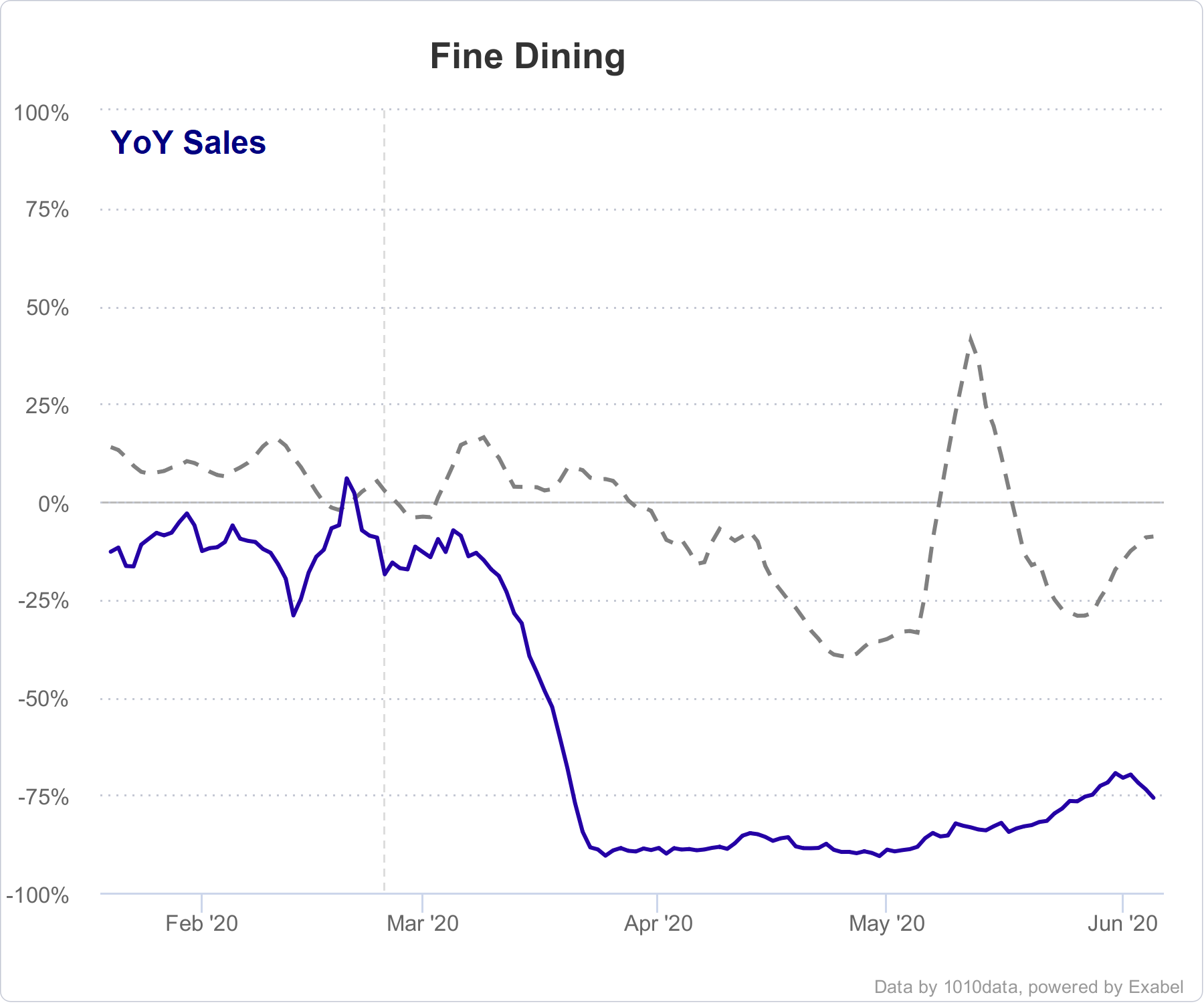

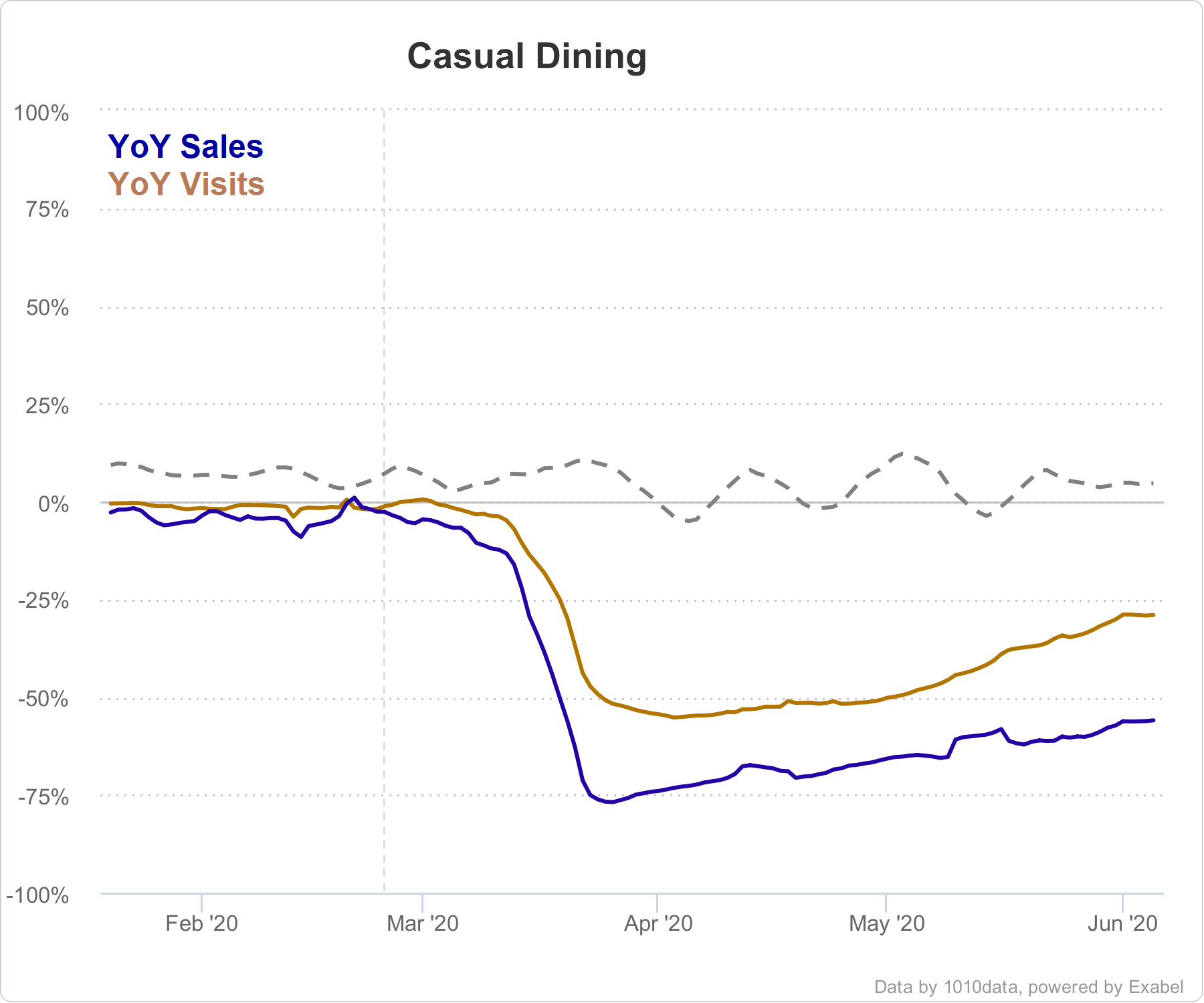

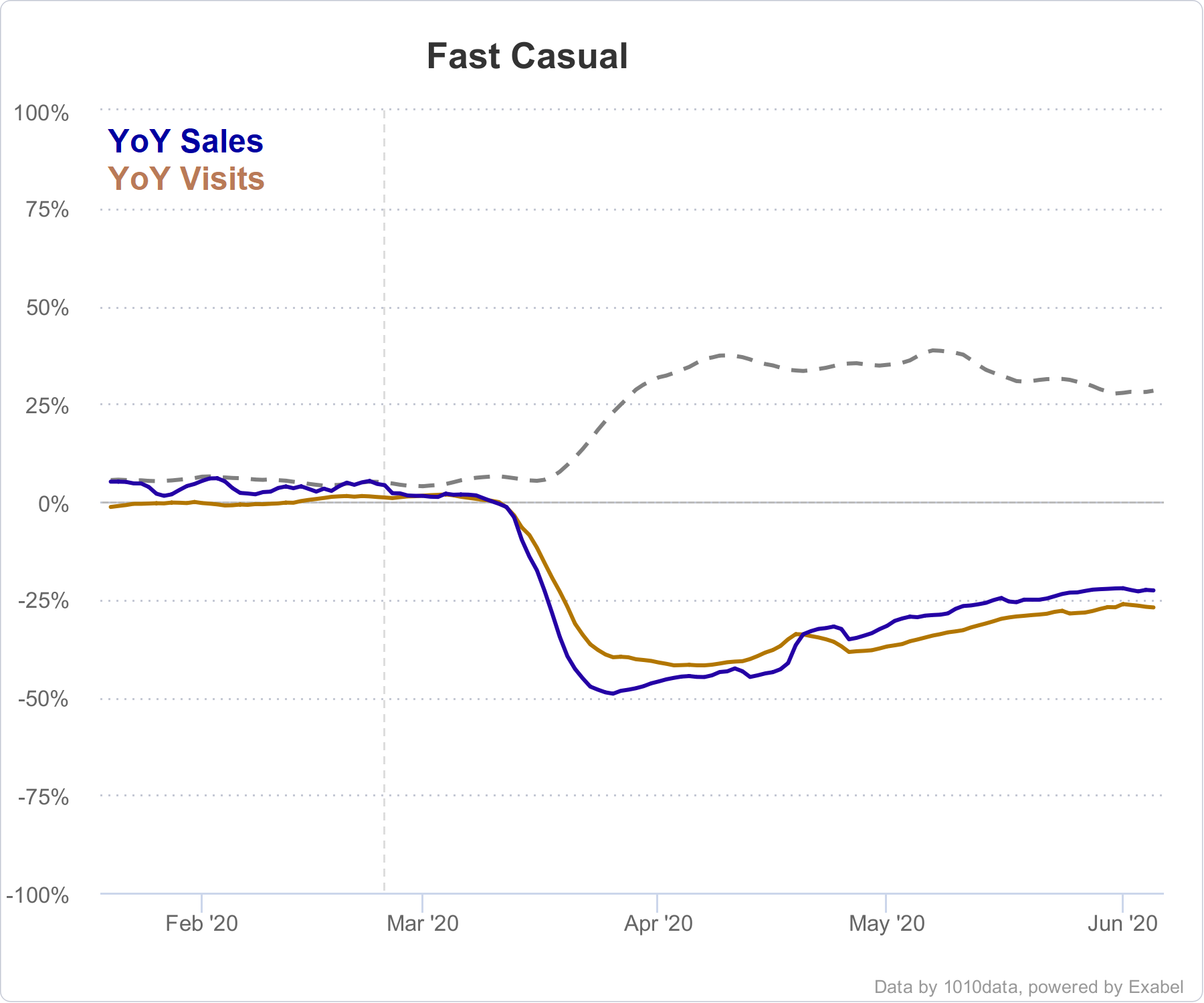

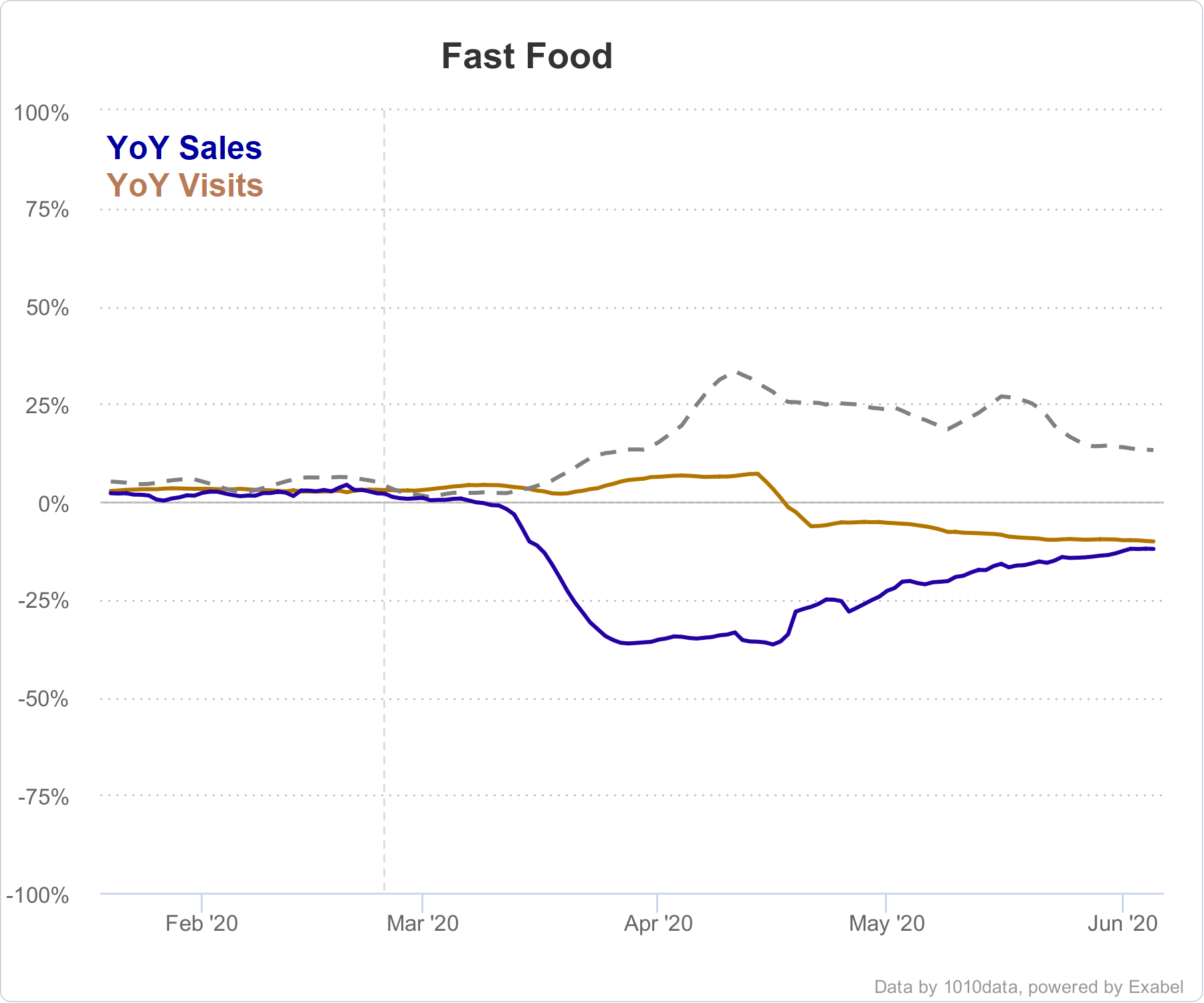

As a result of COVID-19, by mid-March restaurants in most parts of the United States began suspending operations. According to transaction data from 1010data, year-over-year sales in fine-dining, casual-dining and fast-casual establishments quickly plummeted 91%, 77% and 49%, respectively. Fast-food sales were down only 36% as operators were equipped with drive-thrus and relied on delivery and pick-up orders.

With the pandemic subsiding and governments allowing a return to business, we are witnessing a diverging recovery. As of early June, with the re-opening of most states and the adjustment to pick-up orders and delivery, fast-food and fast-casual restaurants have seen sales recover to 88% and 78% of last year’s levels, respectively.

Casual-dining and fine-dining sales, however, have not recovered as quickly. With higher price points and a reliance on alcohol sales as well as the inclusion of tipping, fine-dining and casual-dining sales are still down 76% and 56%, respectively. One other contributor to the disparity is the record unemployment rate. With 13.3% of the labor force on the sideline as June 5th, demand for discretionary spending is the first to suffer.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.