The number of coronavirus cases in Latin America continues to rise, with more than 1.4 million people infected in Brazil and Mexico. The lockdowns and quarantines of recent months have weighed heavily on clean product demand in these countries – something starkly reflected in their import volumes.

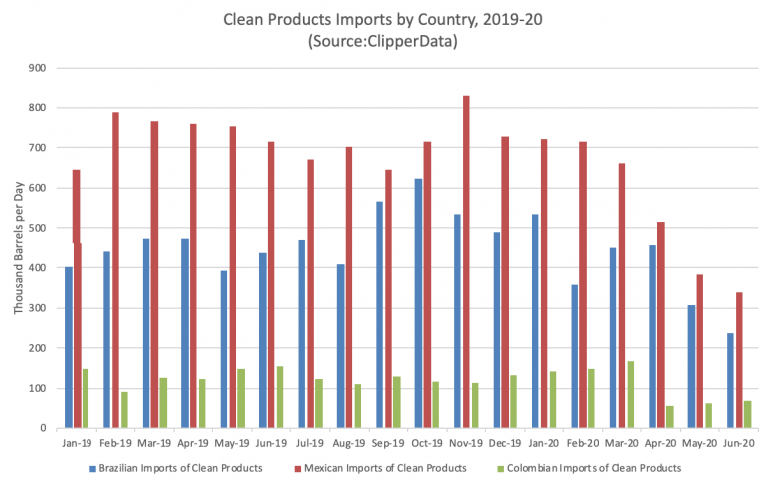

As we close out June, Mexican clean product imports this month are at their lowest monthly pace since 2014, halving from year-ago levels. Brazilian clean imports have followed a similar trajectory, also halving versus June 2019’s pace, while Colombia is seeing imports ticking slightly higher, but from a very low base:

Despite the virus ravaging the region’s populations and economies, industries are restarting, and life is slowly returning to normal. Nonetheless, this rebound in activity is yet to spur on clean product import demand. The drawing down of high product inventories and the rebounding of refining activity has meant a delay in import demand, at least for now.

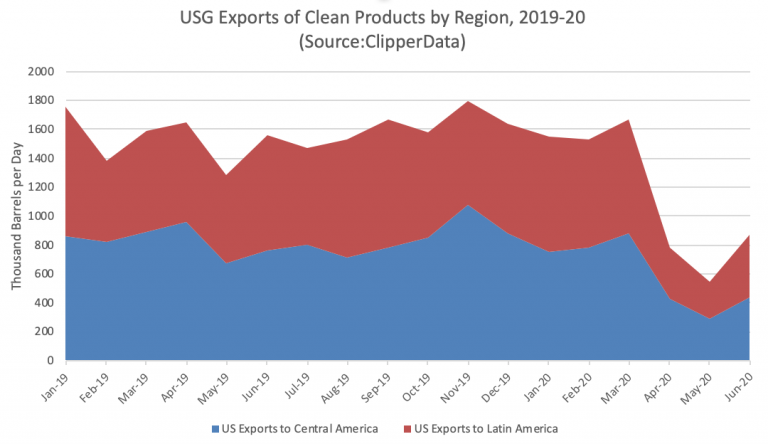

But US Gulf clean product exports are showing signs of rebounding Latin American demand. Exports have plummeted since April, though are slowly rebounding in June and are set to be higher in July. Nevertheless, it will take a good amount of time before they return to pre-COVID19 levels.

Despite Latin America’s gradual return to normalcy, congestion levels in major cities in the region remain way below 2019 levels, according to data gathered by Tomtom. Regardless of what indicator you look at – be it imports, economic indicators, or congestion – there are some signs of a rebound, just not to pre-pandemic levels.

To learn more about the data behind this article and what ClipperData has to offer, visit https://clipperdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.