New York is reopening and the success here could provide critical insights into the nature of the wider retail recovery. New York City was among the hardest-hit cities and the state was one of the hardest-hit states, and if a rebound can successfully happen here, there is tremendous room for optimism throughout the country.

So has the recovery shown thus far.

Overall

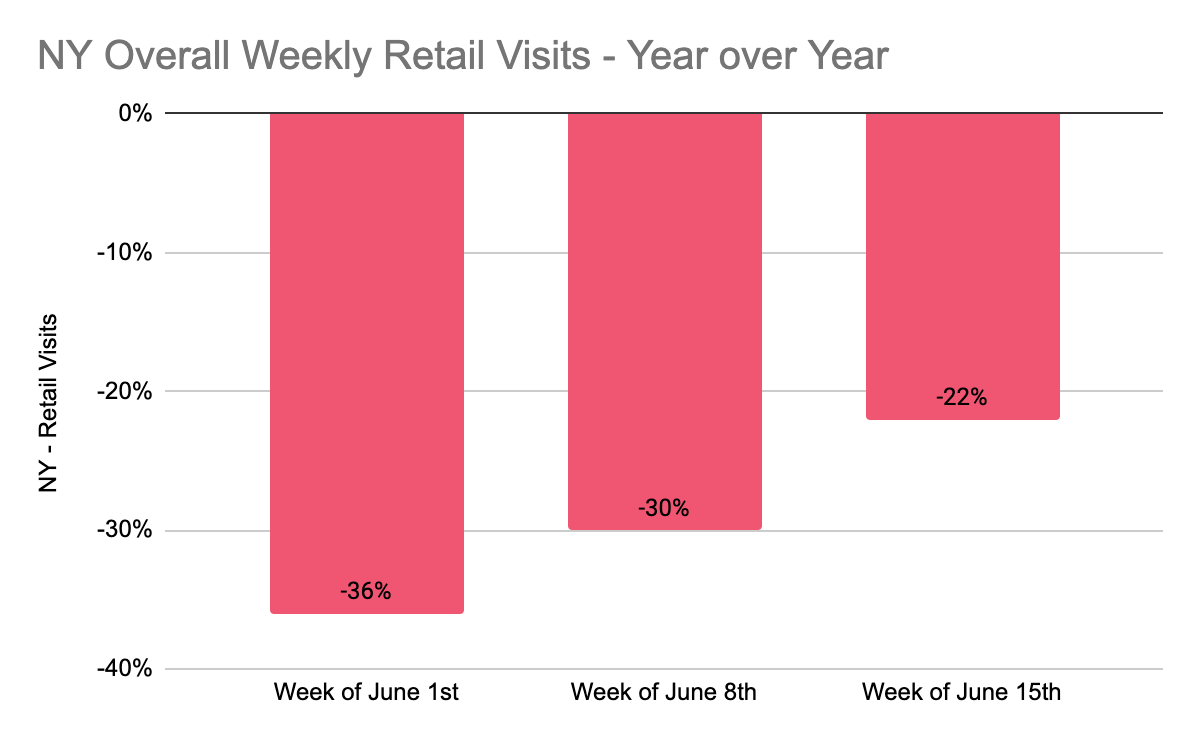

As of the week of June 15th, overall retail visits in NY were still down 22% year over year. However, this showed a marked improvement on previous weeks and was the strongest for retail visits since the week of March 9th, when visits were up 5% year over year.

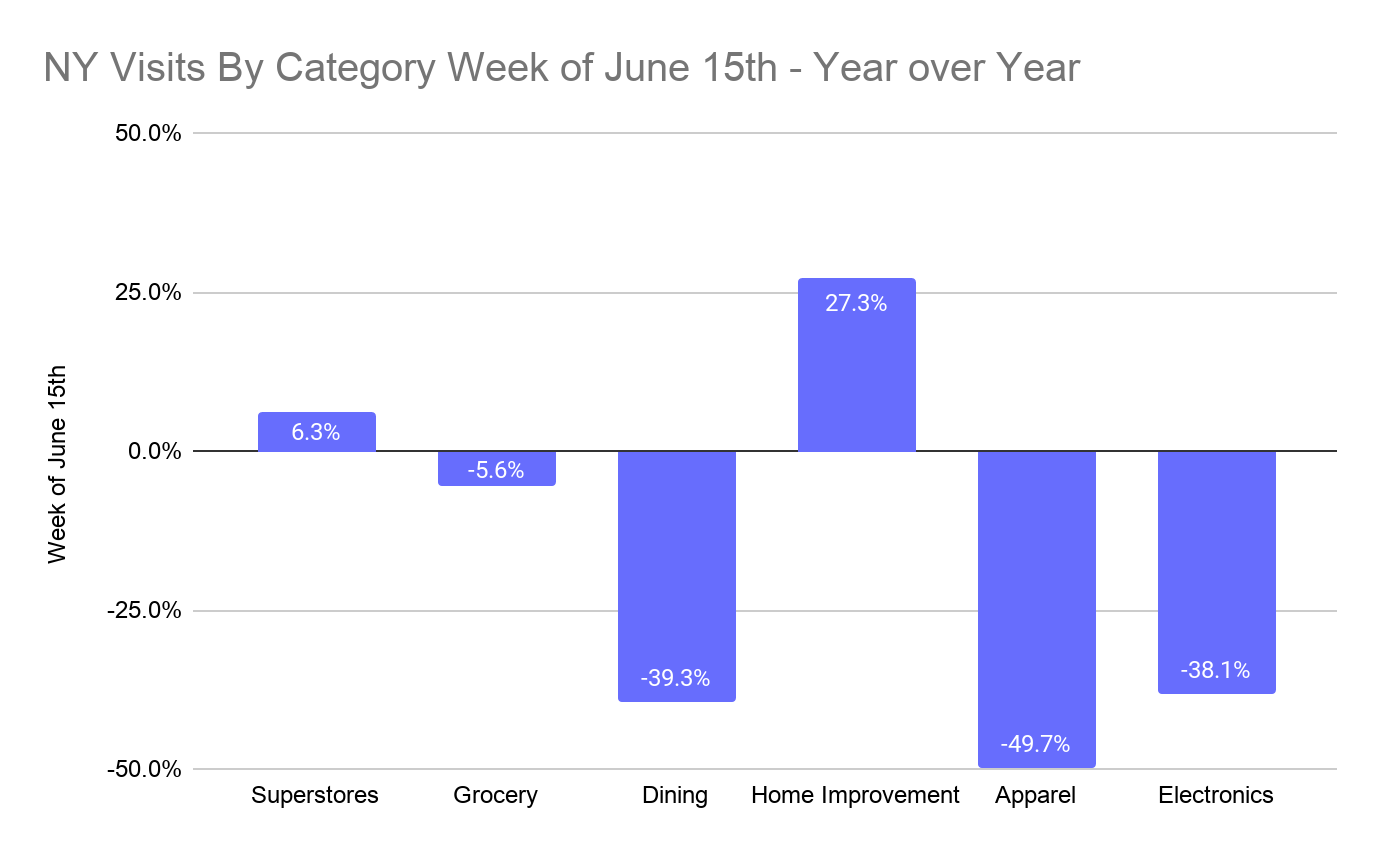

But while the impact of the recovery is clearly being felt, it is not benefitting all sectors equally. While the home improvement category, led by brands like Home Depot and Lowe’s, is up 27.3% year over year, apparel visits were still down 49.7% compared to the equivalent week in 2019. And lingering issues such as closed malls are going to continue to influence the visit distribution across subsectors.

Diving Deeper – Mass Merchandise

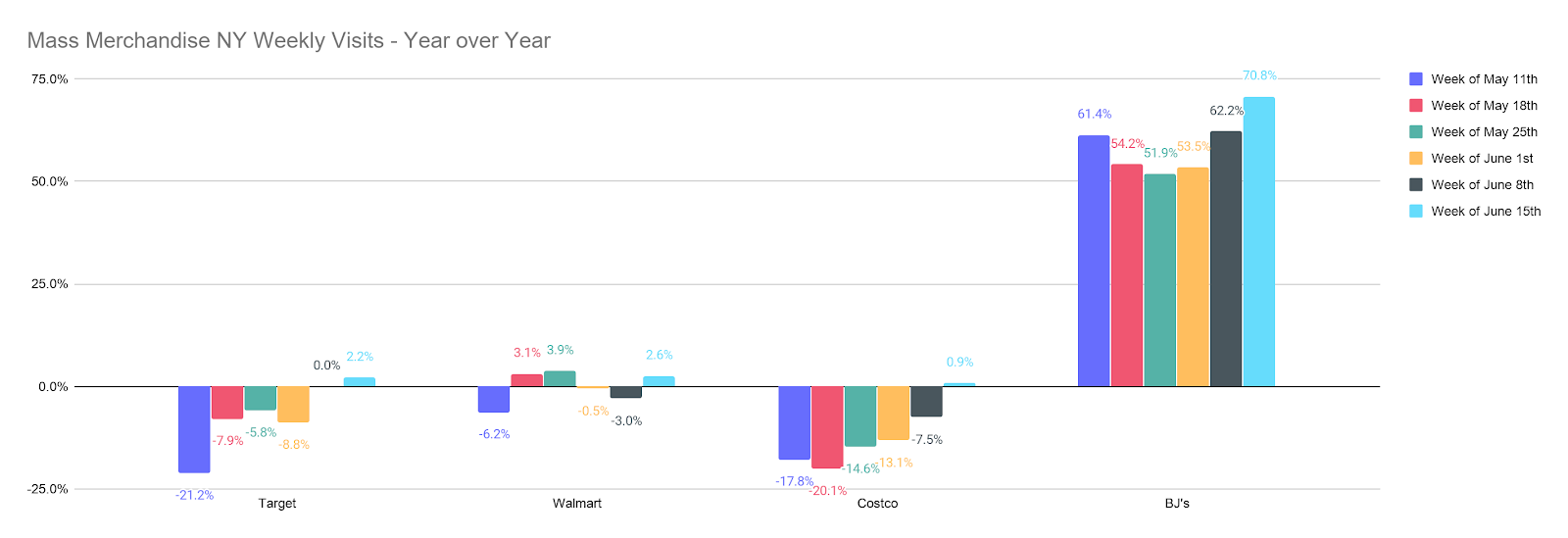

One of the key sectors to watch is mass merchandise as it plays a central role in the lives of so many New Yorkers. While the industry was deemed essential and thus allowed to remain open, it too saw visits take a significant hit. Brands like Target and Costco saw visits drop more than 20% year over year the week of May 18th, yet both also returned to growth the week of June 15th. Visits to Target and Costco locations in NY were up 2.2% and 0.9% respectively for those brands.

Walmart, comparatively, saw a more mixed performance with several weeks showing year-over-year growth throughout May and early June. The combination of grocery and wider shopping was incredibly compelling, as it enabled shoppers to accomplish much more with a single visit while prioritizing value – something of unique importance considering the mix of the pandemic and economic uncertainty. Yet, no brand may have had a more interesting pandemic than BJ’s Wholesale Club. The player which had been struggling earlier in 2020 saw a unique surge during the COVID crisis that has sustained well into May and June. Visits the week of June 15th, for example, were 70.8% higher than the equivalent week in 2019.

Diving Deeper – Apparel’s Return?

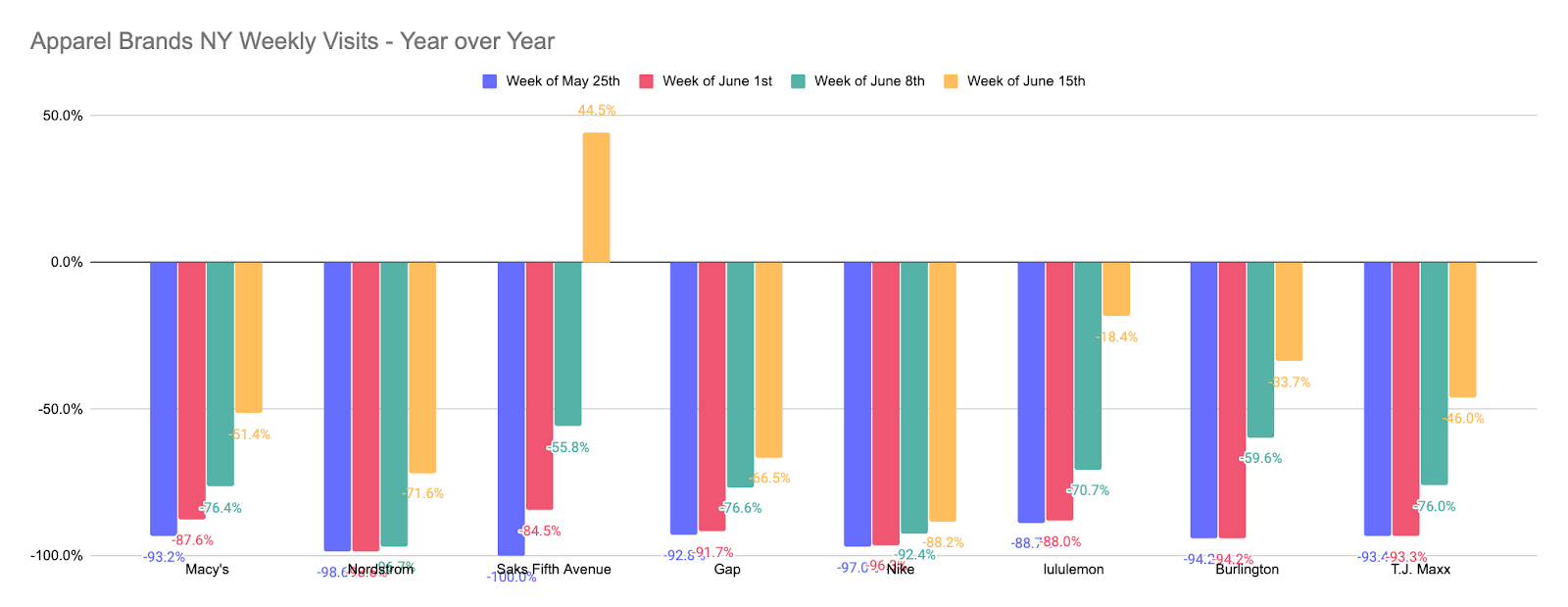

As mentioned above, few sectors have been hit harder than the wider apparel space. The combination of being non-essential combined with the closure of malls had a huge impact on visits to apparel retailers in New York. Yet, here too, a recovery looks to be en route.

Following weeks of little to no traffic, June marked a turning point with the week of June 15th signaling a significant change. Visits to Macy’s locations were down just 51.4%, to Gap locations just 66.5% and to Lululemon locations just 18.4%. And all this with only some stores able to open, though much of the success was related to curbside pickup offerings.

But the most interesting sign of the resiliency of consumer demand may be the surge that Saks Fifth Avenue locations saw the week of June 15th, with visits rising 44.5% year over year. Does this mean the brand’s troubles are over? Of course not. Does it mean that consumers are still very much interested in shopping when the opportunity presents itself and that pent up demand could have a positive short-term influence? All indications seem to point to yes.

Shopping Centers – The Battle Moving Forward

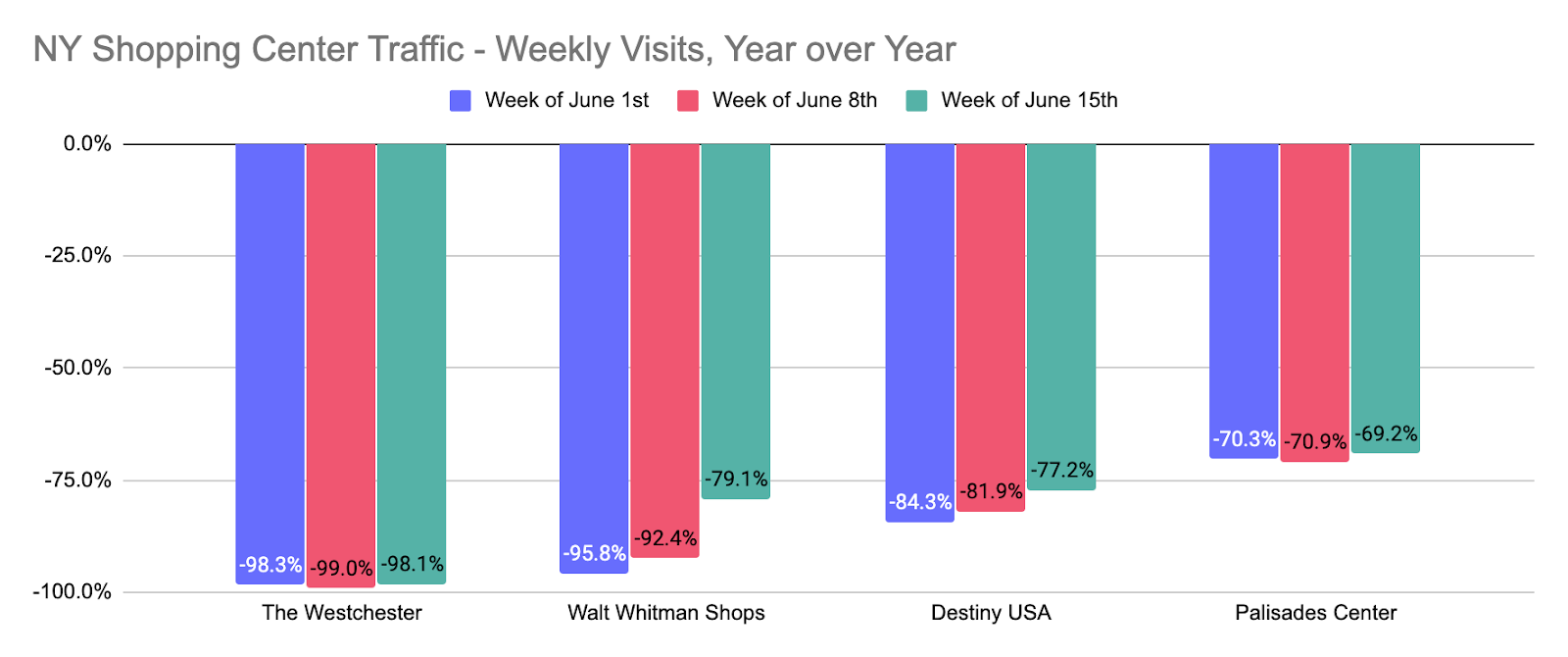

One of the key indicators to track for the potential of a fuller recovery is the performance of shopping centers. Though indoor malls are still largely closed, alongside theatres and gyms, even here positive signs are emerging.

While obviously nowhere near normal, with the opening up of curbside pickup and visits to stores with an external entrance, some centers were already seeing rising traffic. Critically and obviously, the power of these centers is essential to unlocking the potential of a wide range of retailers. So even their limited success with only a small number of channels available to them is still a very positive sign.

Conclusion

New York is a critical marker for the retail sector to understand its progress towards a recovery. And there are many positive signs that indicate a rebound is en route and ‘normalcy’ could be within reach. However, the unique nature of this pandemic has shown just how susceptible even the strongest retailers are to its effects. So while there are many positive signs, the idea that another lockdown could appear is certainly not beyond the realm of possibility.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.