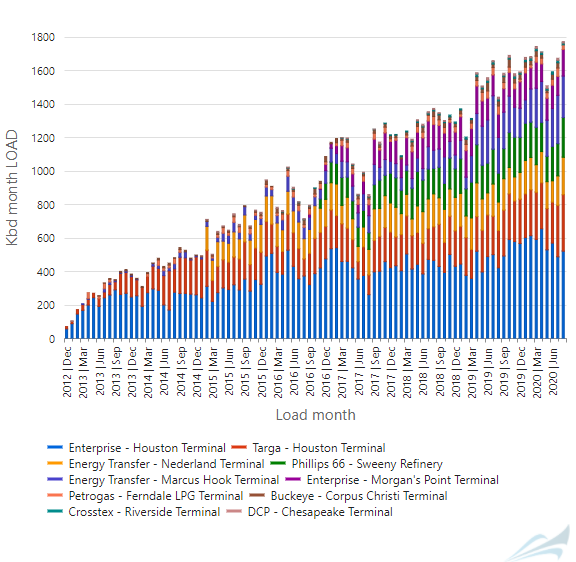

Naphtha’s price surge in May and June has made LPG more cost effective for petrochemical crackers that are able to switch feedstocks. LPG prices moved only slightly higher during the naphtha rally, and especially so in producing regions such as the US. As a result, a favorable arb developed for US suppliers, and loadings are up to 1.78 million barrels per day this month to the highest on our records, making them 12% higher than July and 24% above year-ago levels.

OPEC announced on March 8 that it would increase oil production to counter higher output from Russia and US shale, and most energy prices collapsed until forming a bottom in mid-April following the OPEC+ production curtailment deal. Naphtha fell more than most LPG markets, prompting many flexible petrochemical crackers in Asia and Europe to switch to naphtha. The spread between propane in Houston and East Asia fell from more than $300 per metric ton in January to nearly $60/Mt in early June, but that has reversed and is approaching $100/Mt.

Increased demand for LPG is coming at a time when US terminals are getting ready to expand again. Enterprise’s Houston terminal expansion went into service in October, and its exports continued rising through April, when they reached 653,000 bpd.

To learn more about the data behind this article and what ClipperData has to offer, visit https://clipperdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.