In this Placer Bytes, we dive into the insane momentum driving dollar stores and a similar power being revealed for Best Buy.

Dollar Stores on the Rise

The wider “dollar” space appeared among the most likely to see a longer-term boost from the pandemic. The sector is dominated by players with a wide range of goods and lower costs, positioning them well in a time where mission-oriented shopping and economic uncertainty reign. Yet, even an optimistic reading of the tea leaves would still have fallen short of the unique power the space has seen in recent months.

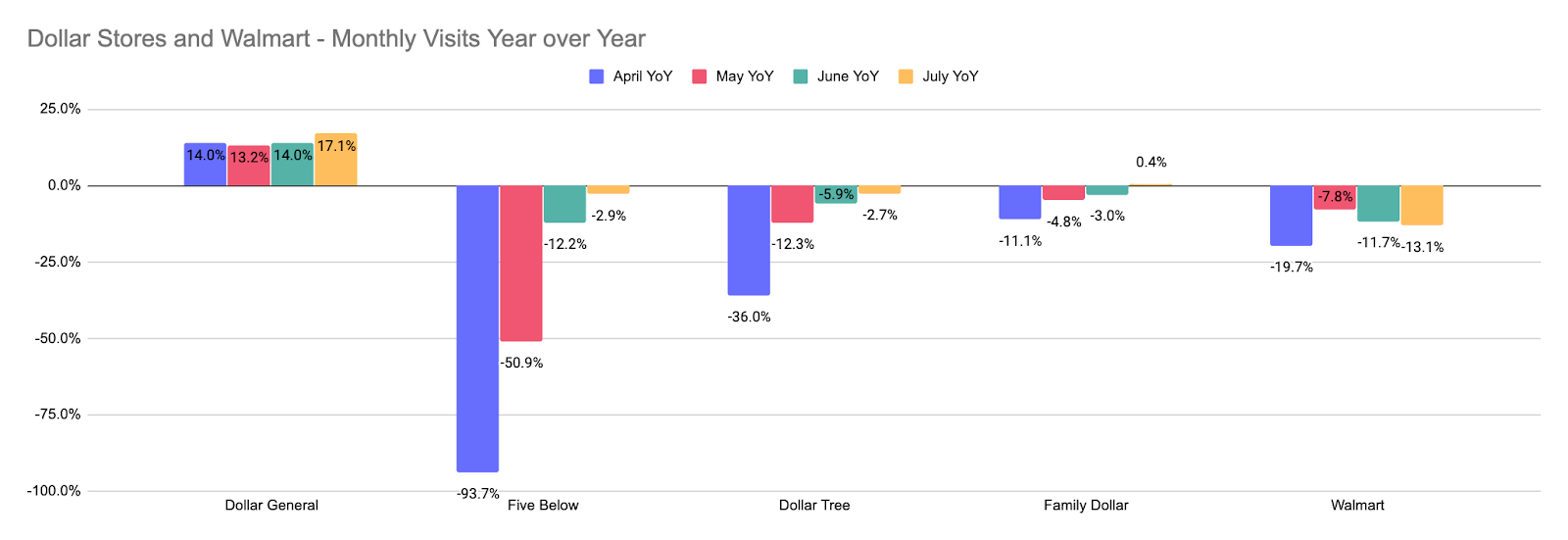

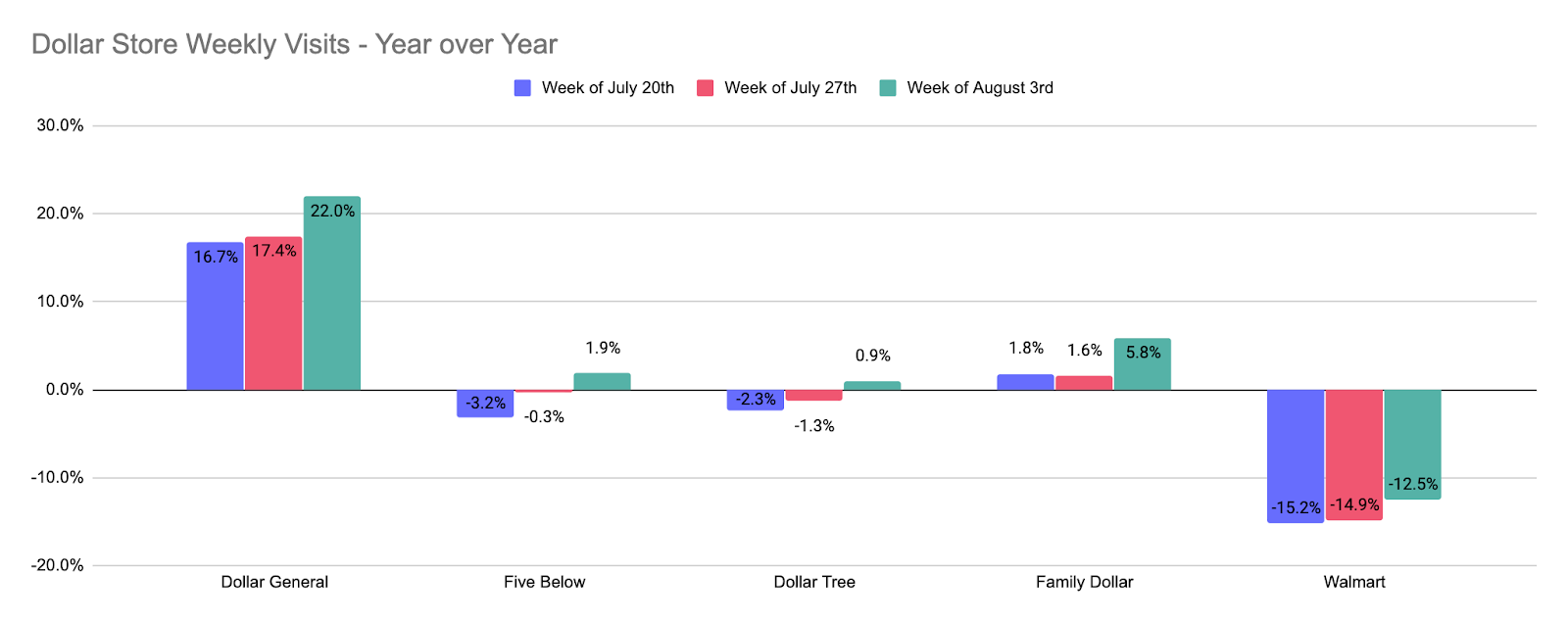

While Walmart visits were still down 13.1% year over year in July, Five Below and Dollar Tree were down just 2.9% and 2.7% respectively. And while Family Dollar was up 0.4%, the true king of the space appears to be Dollar General. The rising retail giant saw visits grow 17.1% year over year in July, after 14.0% and 13.2% growth in June and May respectively.

While these brands are all seeing movement in the right direction, each of the dollar store players had already returned to year-over-year growth by the week beginning August 3rd. With a high likelihood that the current period of economic uncertainty could extend deep into 2020 and even 2021, the ability to provide value should remain a very significant asset.

The Best Buy

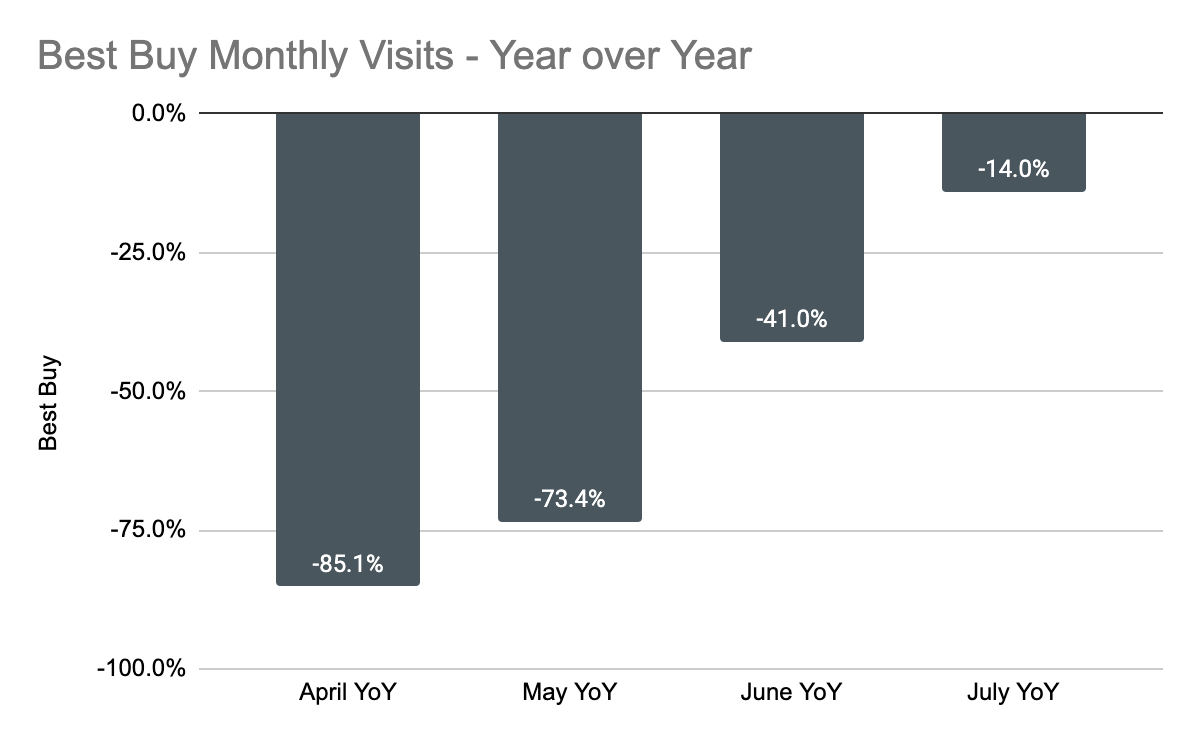

It’s difficult to exaggerate just how impressive Best Buy’s visit rates have been. While it did reopen to appointment-only traffic earlier in the pandemic, visits had risen to just 41.0% down year over year by June and only 14.0% down by July. And considering the wider economic uncertainty, the resurgence of COVID cases in key states, and a range of other obstacles had weekly visits just remained in that range, the result would have been very promising.

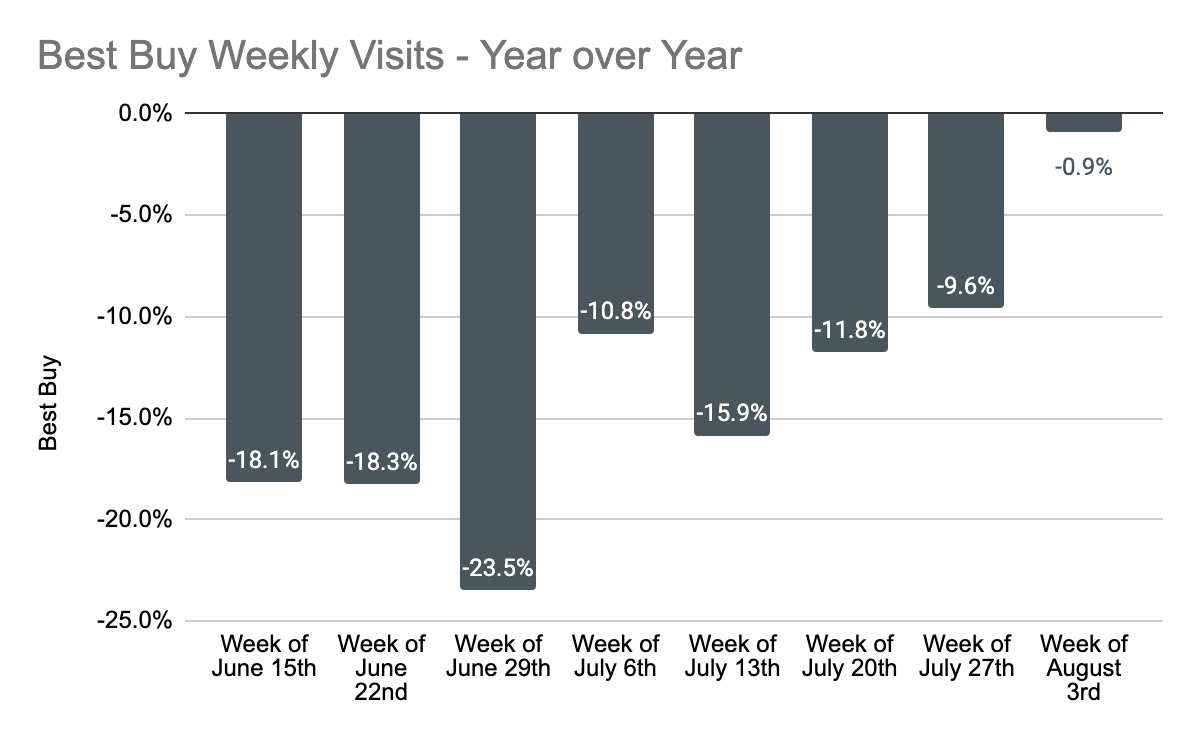

Visits managed to move even closer to 2019 rates with traffic the week of August 3rd down just 0.9% year over year. It is possible that Best Buy found a space where the uncertain back-to-school season actually benefits them. Remote work, remote learning and beyond put an added emphasis on high-quality tech, and the lack of summer camps for kids may have increased the need for distractions, and therefore an additional emphasis on Best Buy’s product offering.

Whatever the cause, it is becoming increasingly clear that Best Buy’s position is uniquely strong. Additionally, the brand doesn’t seem to be governed by the same rules impacting other brands that normally benefit heavily from back-to-school. Should it prove capable of reaching growth amid the madness, it is possible Best Buy could be among the few to have the strength to buck negative trends later in the year as well.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.