Credit Benchmark have released the August Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The August CCIs have seen significant further credit deterioration for UK, EU and US Industrial companies.

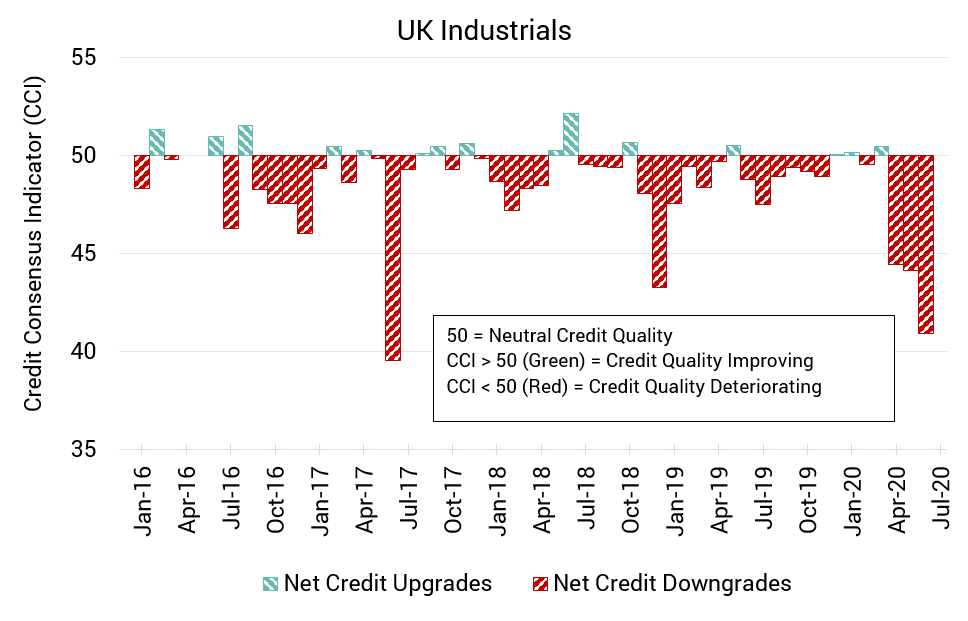

UK Industrials: CCI Shows Deeper Drop This Month

Credit quality continues to worsen month-on-month for UK Industrial companies, with a third consecutive month of decline.

The CCI jumped down several points to register at 40.9 this month, down from 44.2 last month.

The deterioration coincides with the recent announcement that the UK entered its first recession since 2009 amidst a 20.4% fall in output and plummeting productivity and consumer spending levels.

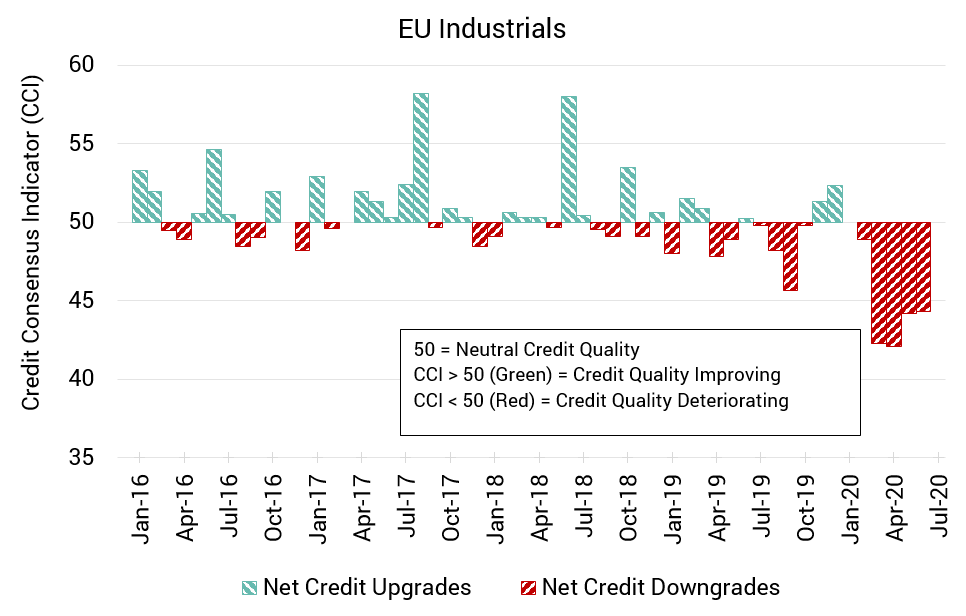

EU Industrials: Credit Trend Remains in the Red

EU Industrial companies continue their strongly negative credit run, with a fifth consecutive month of net downgrades and little sign of improvement.

The CCI for this month is 44.3, following on from last month’s CCI of 44.2.

The region has shown less dramatic decline than for US and UK companies, with Germany leading the group’s recovery. Weak international trade with the US and UK remains a barrier to healthier trade volumes.

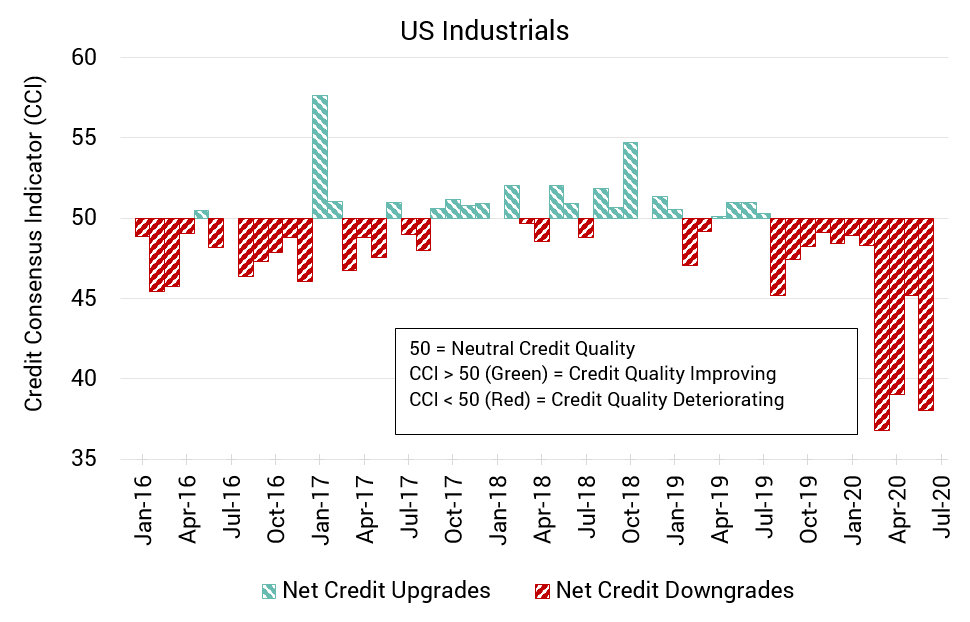

US Industrials: CCI Plunges Once More

The mild easing of downgrades observed for US Industrial companies last month has reverted to parallel previous lows.

The CCI has dropped back down to 38, after last month’s less severe 45.2.

Industrial production in the US rose by 3% in July; a strong sign of progress after serious declines in March and April. However weak global growth and the threat of a resurgence of COVID-19 are continuing to weigh negatively on the credit outlook.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.