In this Placer Bytes, we’ll dive into Costco’s return, Nike’s offline future, and what the loss of Pier 1 will mean for the home goods sector.

Return of the King

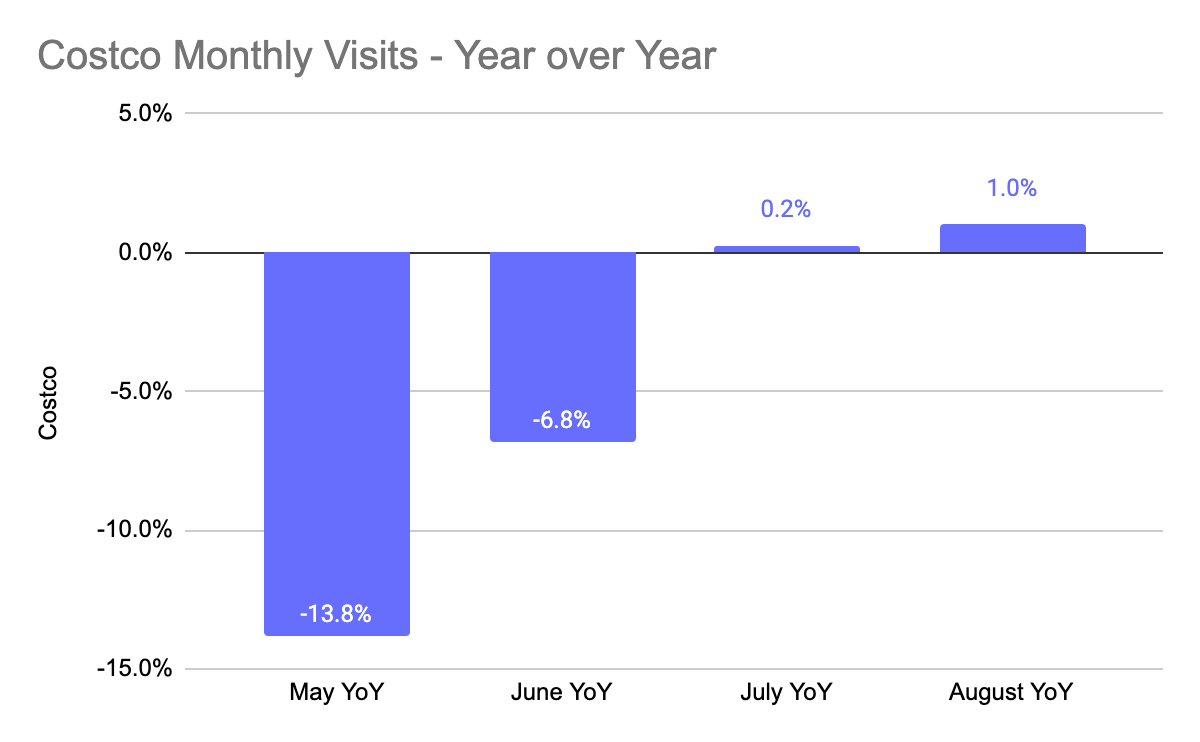

Costco is amazing at what they do. While competitors like Sam’s Club and BJ’s Wholesale surged, there were questions about Costco visits remaining down year over year. Yet, the moment the economy truly began to open up, Costco’s visits returned. By July 2020, visits were back to a slight year-over-year bump, and August continued the recovery with visits up 1.0% year over year.

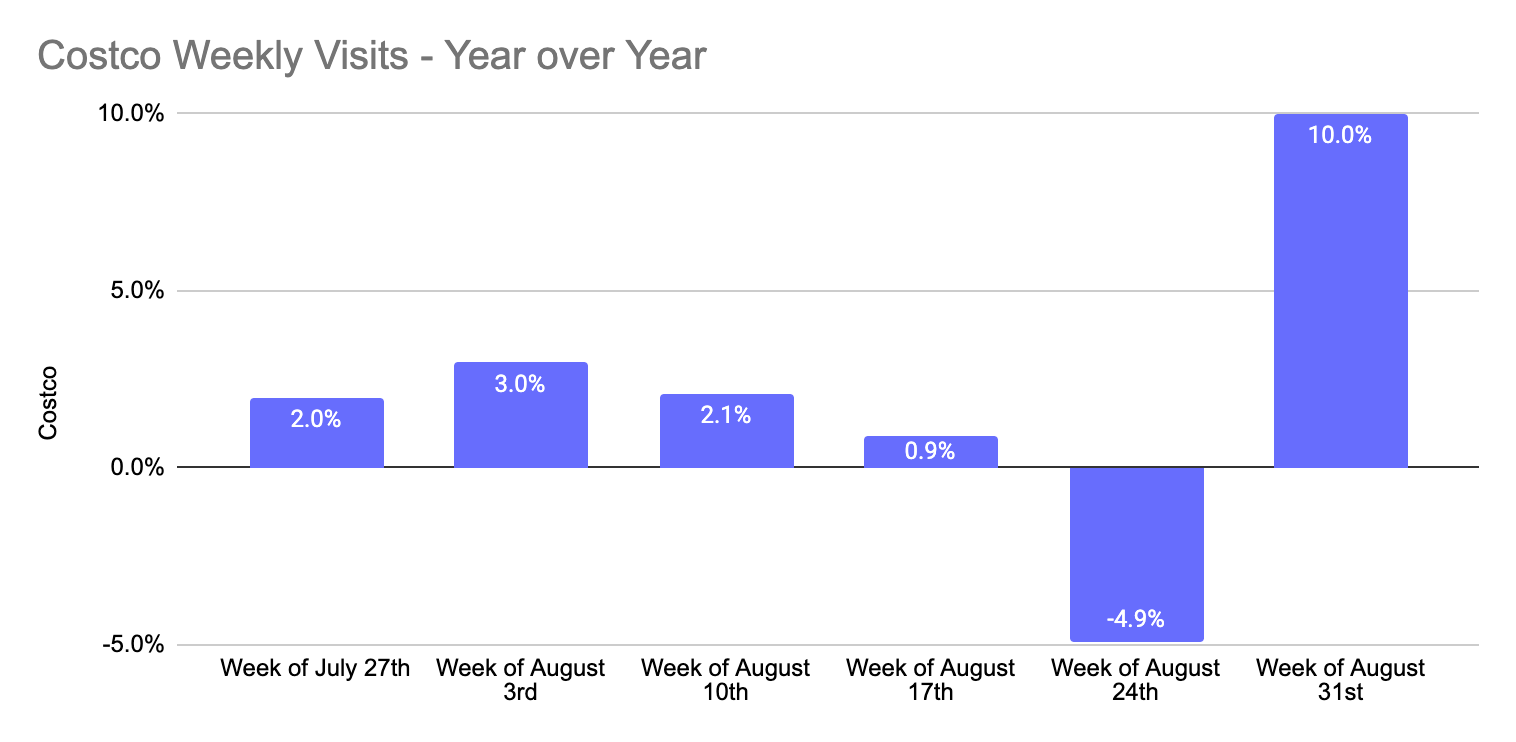

And impressively, the pace has only picked up with a peak the week beginning August 31st of 10.0% visit growth year over year. Simply put, while the grocery sector as a whole is performing well and key wholesale competitors are indeed rising, Costco continues to reassert its unique level of retail dominance.

Nike’s Just Doing It

In the last month, it was reported that Nike would be shutting down nine wholesale accounts following a late June announcement of an offline retail expansion. What’s driving this growth in a period when many are questioning the long term viability of brick and mortar? Success.

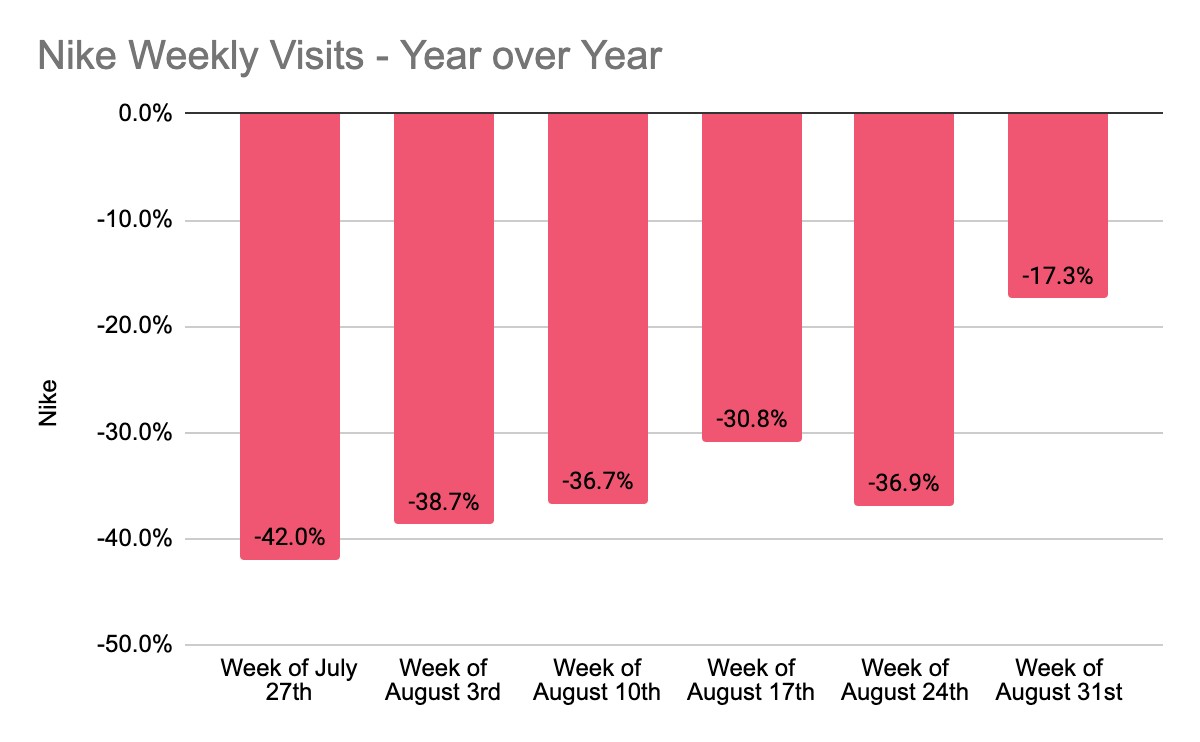

Visits to Nike locations were down just 17.3% the week beginning August 31st. This was far better than the visits that were down an average of 37.6% year over year in June, July, and August. But Nike wasn’t just recovering, they were outperforming the rest of the apparel industry. The wider apparel sector was down 23.0% that same week even though it includes brands like T.J.Maxx, Ross, Kohl’s, and others ideally suited to this period. And even the wider retail sector including high performing spaces like home improvement and grocery was down 13.5%, putting Nike just off that pace.

Nike’s offline explosion is centered around a clear vision on an owned future, and this is something that could become even more significant if other key departments and wholesale players continue to shut down stores.

Pier 1 for the Holidays?

We’ve spent a good deal of time trying to understand who may benefit from Pier 1 closing and the question has become all the more pressing considering how much visits have increased to the brand in recent weeks and months.

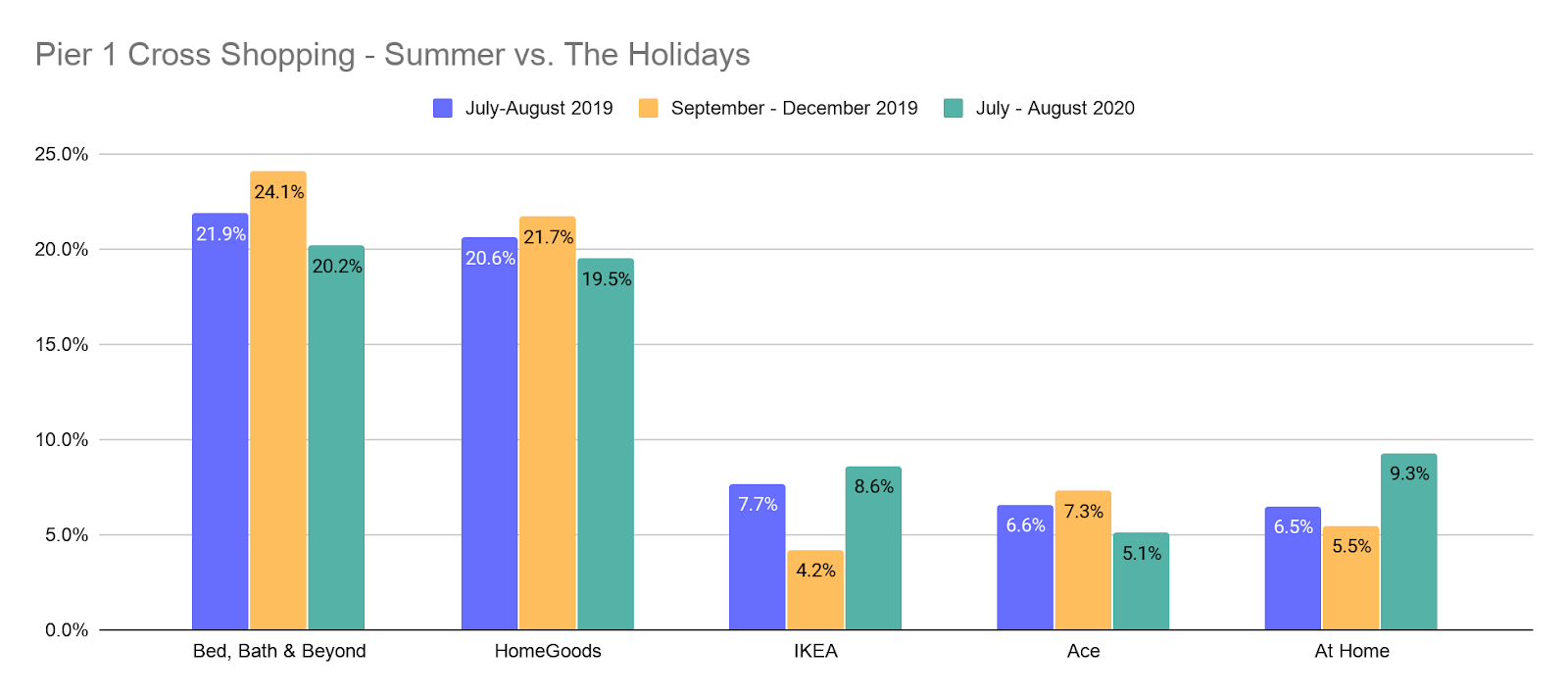

And while there is much to be gleaned from the changes in cross-shopping patterns between July and August 2019 to the same months in 2020, there are potentially bigger clues in the holiday season performance. Looking at five key home goods brands shows that three had bigger overlaps in cross-shopping in the holiday period than during the summer. And interestingly enough, all three have seen less cross-shopping in 2020 than they did in 2019. This points to a potential boon for these brands in the holiday season. Why? Cross shopping may have dipped in the last year but one of the core reasons could be the shift to mission-driven shopping. If visitors went to visit Pier 1 because of liquidation sales, this change may have meant that this was the only visit they’d be making on that shopping trip.

So, who could benefit? While it seems like IKEA shopping patterns don’t align well, Bed Bath & Beyond, and HomeGoods could see a bump as a result of the store closures. The biggest question centers around At Home. The brand has seen traffic surge of late and this could be something that lasts deeper into the holiday season this year – especially if they can effectively fill part of the Pier 1 vacuum.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.