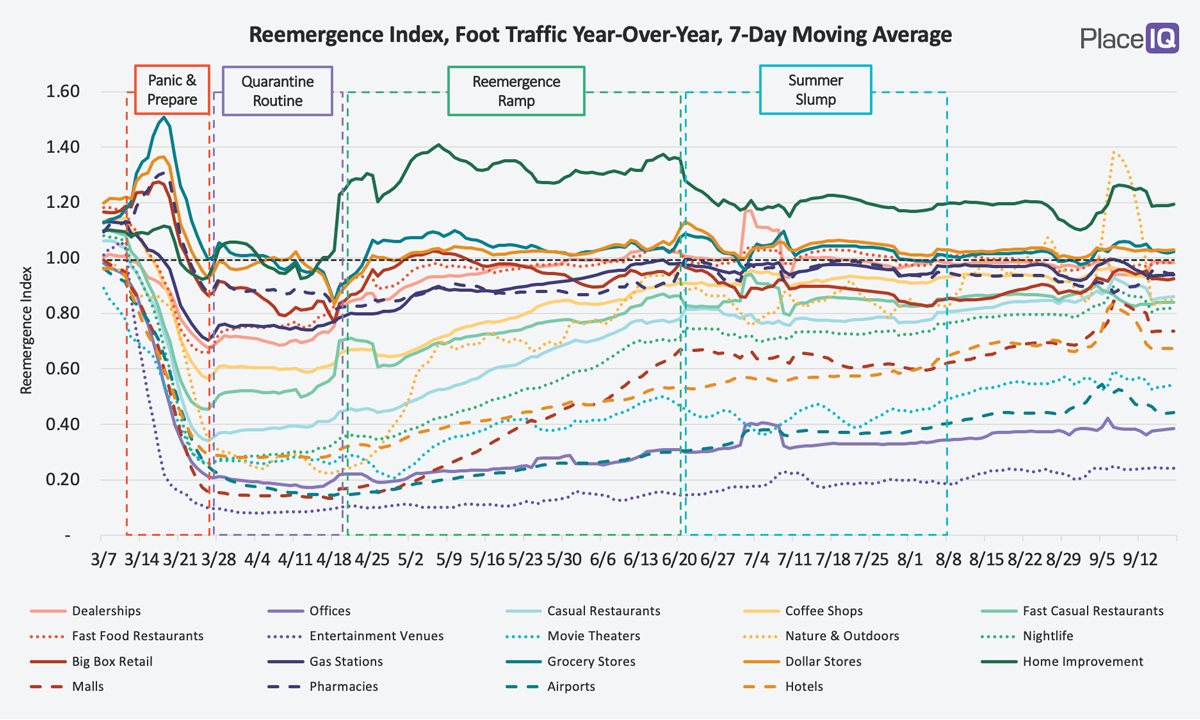

With this week, Summer is officially over. And so too our Summer Slump comes to an end, with traffic ever-so-slightly up from its August levels.

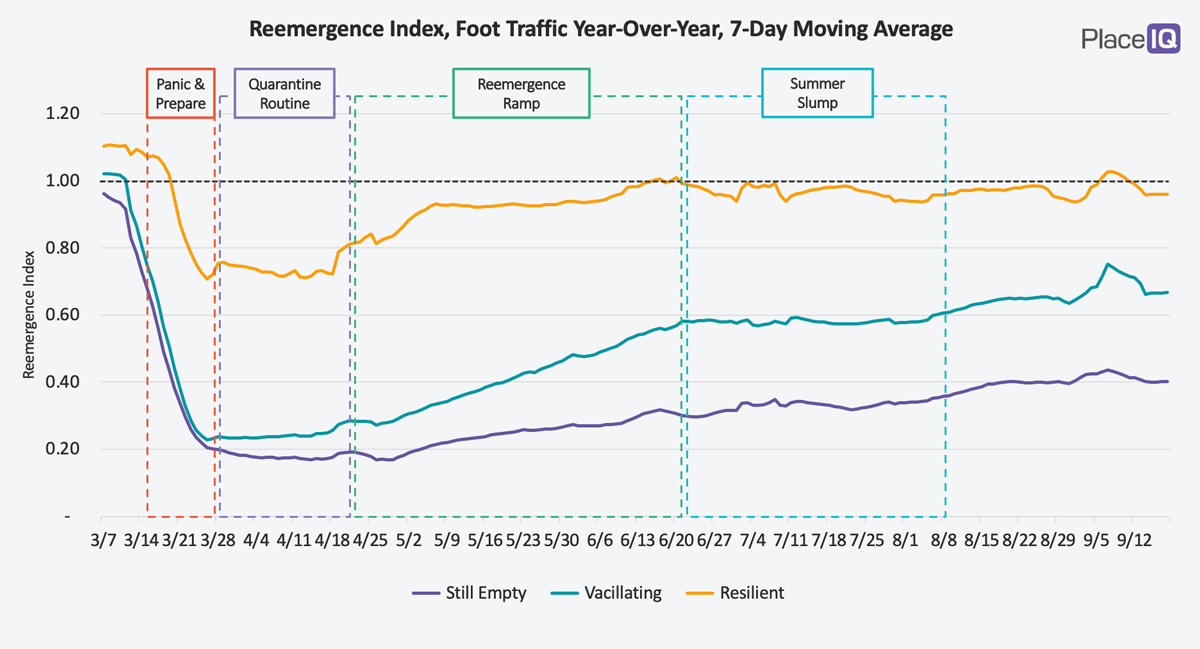

Clustering the chart into our Still Empty, Vacillating, and Resilient categories, we can see the slight upward trend more clearly:

Now, there’s something to note about that Labor Day spike: it’s not what it seems. Our Reemergence Index works by comparing weekday traffic year-over-year. We compare the 14th Friday in 2020 to the 14th Friday in 2019.

This works very well, with one exception: this method causes false spikes or drops when holidays misalign by day of week – like July 4th. Labor Day is held on the first Monday of September, but last year it was the 2nd and this year it was the 7th, leaving them a week apart in our graph. As a result we see a major spike for the whole weekend. For single day holidays we might average this spike out, but with Labor Day the whole weekend is affected so such a quick fix isn’t an option. We know not to read too much into that Labor Day spike.

And yet, every problem is an opportunity… In order to manage the Labor Day offset, we started comparing holiday periods in 2019 and 2020 and wound up with some interesting insights. That’s what we’re going to break down today.

Examining the Holiday Halflife

Holidays have been interesting during this COVID era. Easter was the instigator that ushered us out of our strictest quarantine. We were caught off guard by the approaching Holiday and the usual week-long shopping spike was compressed into just 3 days, wherein we rushed around for a way to create some semblance of the holiday at home. Following Easter, we began to venture out more to still open businesses and venues. For example, fast food traffic and nature and outdoor activities picked up dramatically as we searched for a break from home meals and gyms, respectively.

If Easter functioned as a thawing event — a moment that pushed us out beyond our comfort zone — did we see other holidays performing similar functions?

Not really. Easter was special because it came after 3 weeks of hard quarantine, but the ensuing holidays are being celebrated differently.

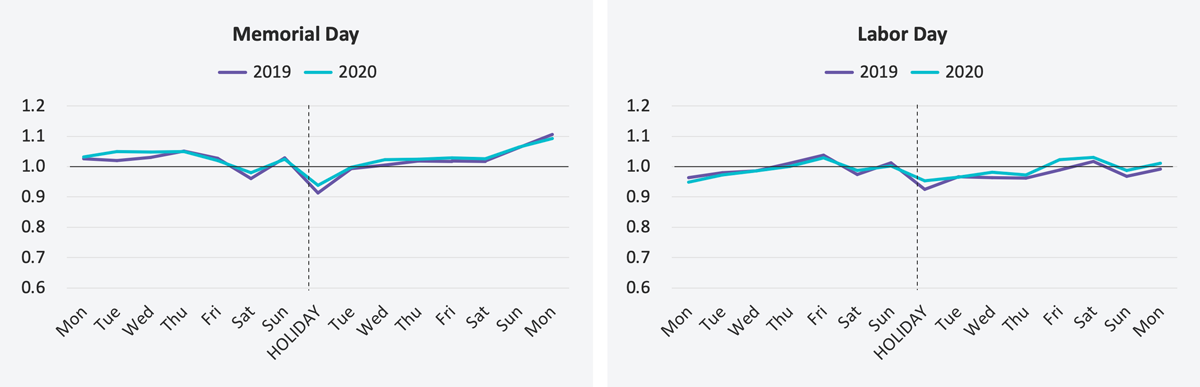

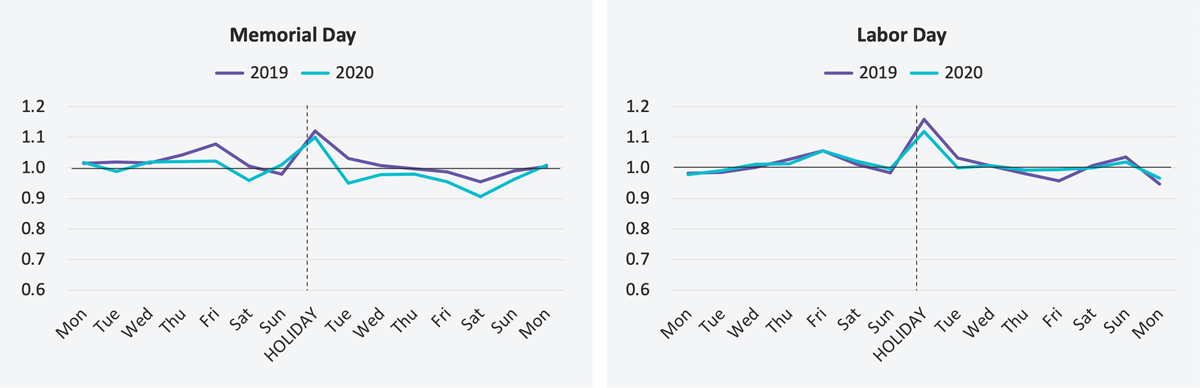

To explore this we looked at Memorial Day and Labor Day, two very similar three-day-weekend events. For each day in the week preceding and following the holiday, we indexed it against its past four weekdays of traffic (so, a holiday Monday is compared to the average traffic for the past 4 Mondays). We don’t use a year-over-year index here because we want to see if and how these holidays disrupt consumers’ usual activities.

For example, here is how Memorial Day and Labor Day influence traffic to fast food restaurants:

Holiday Half-life: Fast Food Restaurants

Long Weekend Holiday Foot Traffic Patterns, Compared to the Weekday Avg for the Previous 4 Weeks

There’s two big takeaways here. First, Memorial Day and Labor Day do not drive extra traffic to fast food restaurants. On the holiday itself, both reduce traffic nearly 10% for a usual Monday. The second thing to note here is that these 2020 and 2019 patterns are nearly indistinguishable! Despite a global pandemic, we see exactly the same impact on fast fooding dining from both holidays. This surprised us, but confirmed we have a benchmark. This comparison yields similar results for a category not usually affected by these holidays, which is good! If we find differences between this year and last, we can be more sure of this signal.

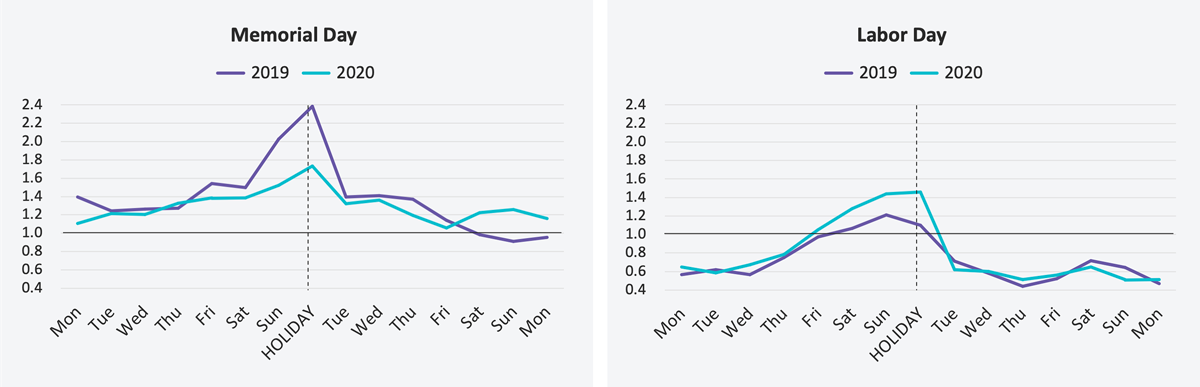

Perhaps the biggest difference we found is how Memorial Day and Labor Day affected hotel traffic:

Holiday Half-life: Hotels

Long Weekend Holiday Foot Traffic Patterns, Compared to the Weekday Avg for the Previous 4 Weeks

Both holidays generated a significantly bigger and longer bump to hotels in 2020. Memorial Day’s pattern is particularly interesting: for the holiday weekend itself (Sat-Mon) the lines almost match. But before and after that period, 2020 generated significantly more traffic compared to its preceding averages. This indicates that hotel usage, and vacations, extended ahead and beyond the holiday weekend itself. With more flexibility due to work-from-home and distance learning (in the case of Labor Day), people treated these holidays as weeklong affairs in 2020.

The picture gets more complex when we look at Nature and Outdoor activities:

Holiday Half-life: Nature & Outdoors

Long Weekend Holiday Foot Traffic Patterns, Compared to the Weekday Avg for the Previous 4 Weeks

Here, we can see how Memorial Day truly kicks off Summer each year. In 2019 we have standard behavior, with Memorial Day spiking traffic over 2x. In 2020 this spike was subdued but held for a longer duration. While Memorial Day’s 2019 spike dropped back to norm by the following Saturday, in 2020 we see this uptick holding around +20% into the next week.

By Labor Day we see a pattern that looks a lot like our hotel pattern. Traffic in 2020 spikes relative to the preceding weeks earlier and higher than in 2019. Though the following week is nearly the same.

Holiday Half-life: Grocery Stores

Long Weekend Holiday Foot Traffic Patterns, Compared to the Weekday Avg for the Previous 4 Weeks

For grocery stores, big box, and even liquor stores the trend is the same. There’s a pop in traffic generated by the holiday for various festivities, but 2019 and 2020 generate the same burst off their relative baselines.

While the upside here for retailers or restaurants isn’t dramatic, it’s comforting to know that the boosts each industry receives from these smaller holidays is nearly directly inline with what you’d proportionately expect during a normal year. This stands in stark contrast to our compressed 2020 Easter, boding well for the upcoming holiday season.

However, the major opportunity lies in the travel sector: consumers are consistently extending 3-day-weekends into week-long affairs. Thanks to flexible work-from-home ‘commutes’ and changing vacation preferences, consumers are stretching these weekends out. We recommend businesses positioned to take advantage of these longer stays to prepare appropriately for this new trend. Encourage larger booking windows and run promotions that go beyond the headline holiday weekend.

To learn more about the data behind this article and what PlaceIQ has to offer, visit https://www.placeiq.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.