In early May, we noted the unique potential of the off-price apparel sector to buck the trend of the wider space and drive significant returns. And now, deep into the recovery, we are seeing that the return is even more impressive than expected, especially considering the ups and downs being driven by COVID resurgences across the country.

Overall Rebound

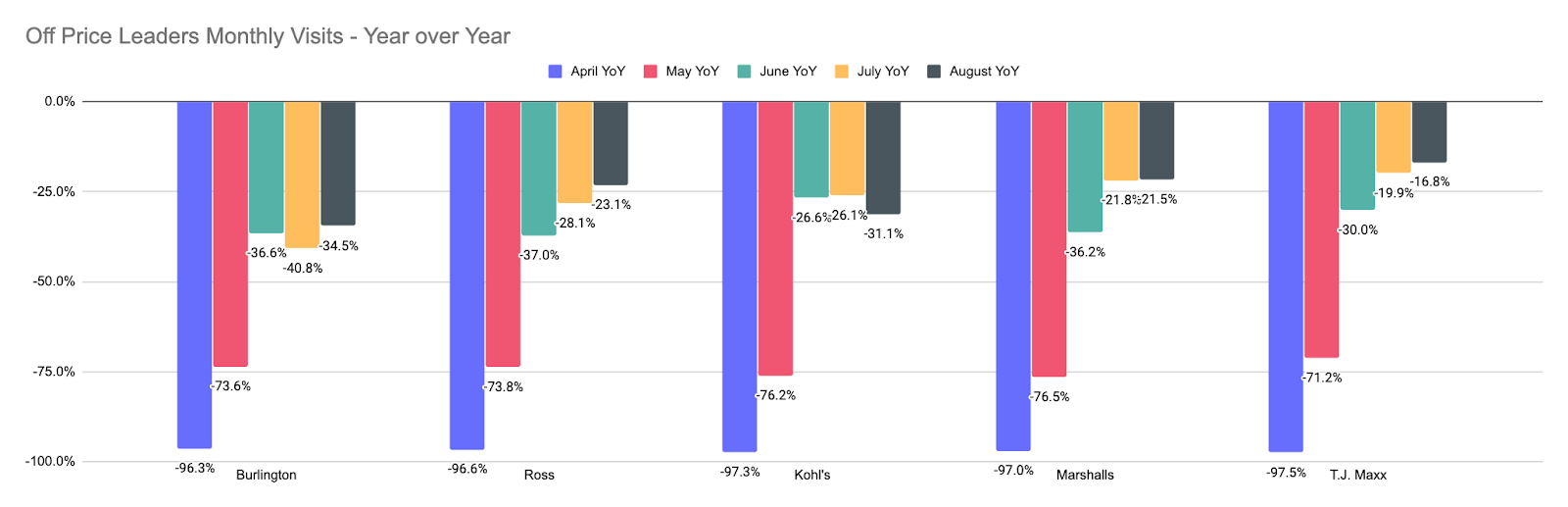

Looking at monthly visits for five of the top off-price and value oriented apparel retailers shows strong relative numbers across the board. And this includes August visits that are being compared to the normal surges seen during the Back to School season. Essentially, where we might have expected to see visit gaps exacerbated by a normal seasonal peak, we still see strong steps towards 2019 levels.

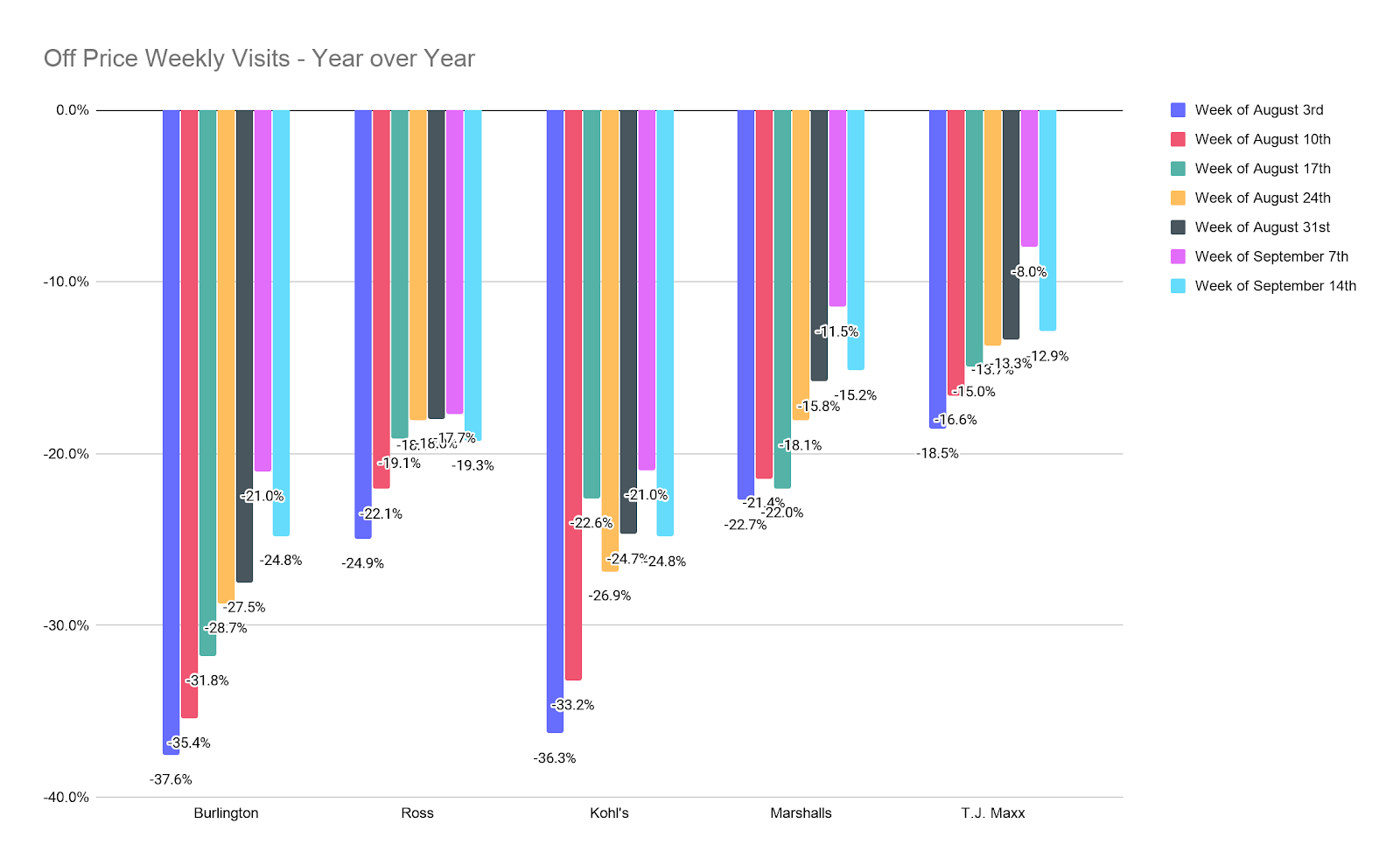

Weekly Visits Show a Consistent Pace

Impressively, the situation looks even better when analyzing weekly visit data. T.J. Maxx and Marshalls saw visits push closest to 2019 numbers with the former seeing offline traffic come within 8.0% of 2019 levels the week of September 7th. But even Kohl’s and Burlington were seeing huge jumps from visits that were down over 35% each the week of August 3rd, to down just 25% year over year each the week of September 14th.

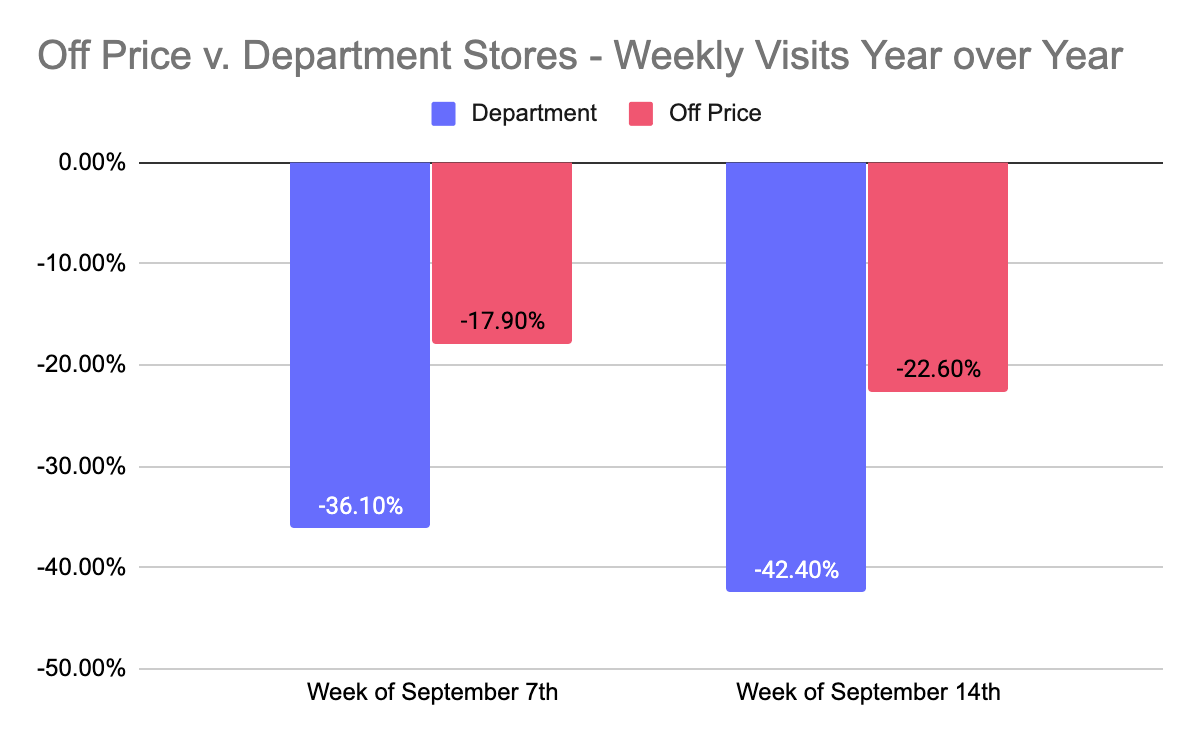

And the numbers from the wider apparel sector put the performance into even greater focus. While a group of leading department stores were down an average of 36.1% and 42.4% the weeks of September 7th and 14th, these off-price leaders were down just 17.9% and 22.6% on average. Importantly, the stronger numbers the week of the 7th are related heavily to a later Labor Day in 2020 allowing these brands to compete with a quieter week than normal.

Reasons for More Optimism

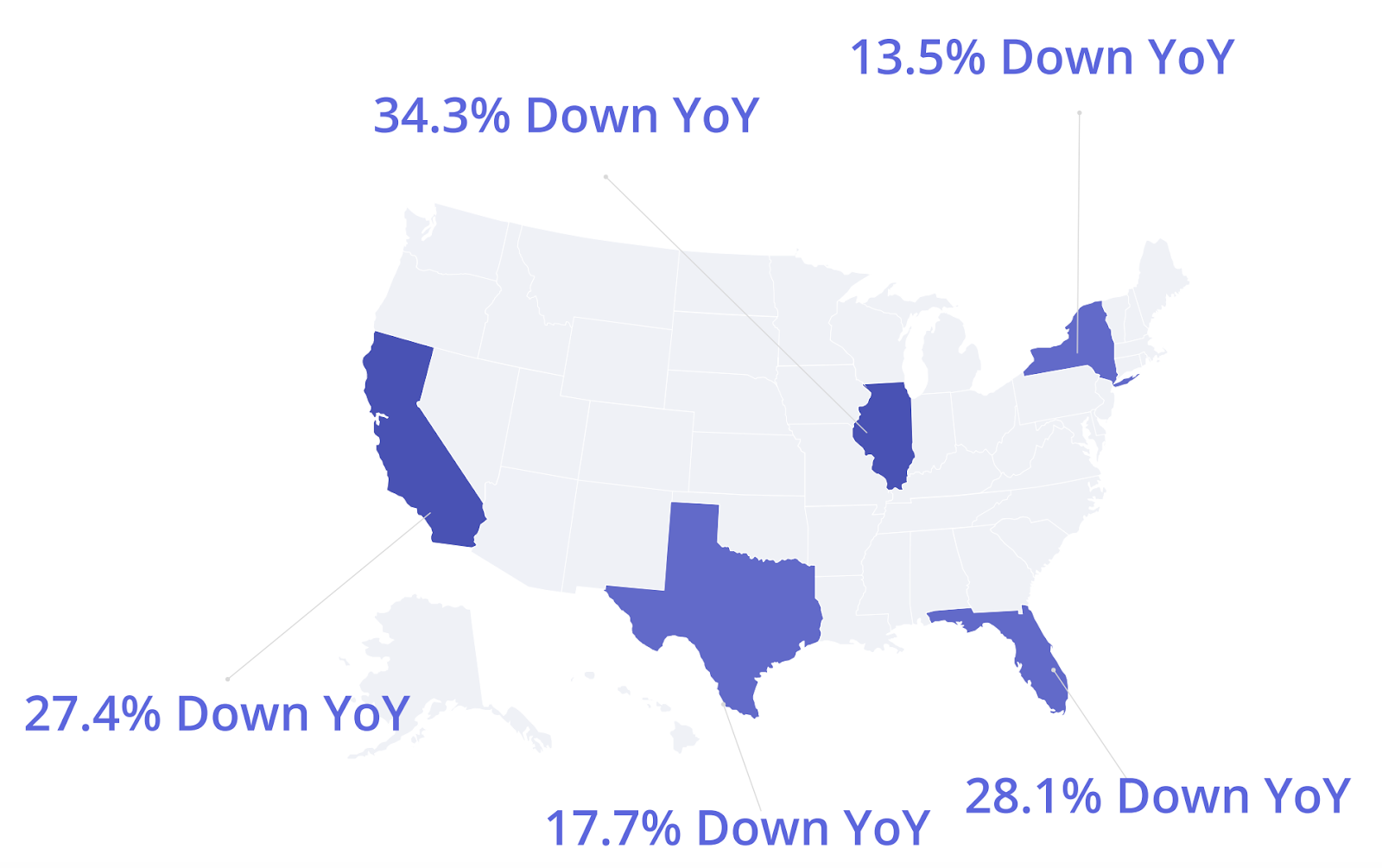

But, the biggest cause for excitement may come from breaking the performance of these brands down by region. For Kohl’s, California, Texas and Illinois are the three states with the largest number of locations amounting to over 20% of the brands overall footprint. And looking at visits the week of September 14th, two of these states were doing far worse than the nationwide average. Visits to California and Illinois locations were down 27.4% and 34.3% respectively, pulling the wider nationwide recovery number down. On the other hand, visits in New York and Texas were down just 13.5% and 17.7% respectively that same week.

The clear takeaway is that even with these brands performing well, if key states can continue to recover, the upside is exceptionally high. And this is because off-price retail isn’t just well positioned for the recovery period, but for the longer term we’re heading into.

Even when the pandemic finally comes to a close, an extended period of economic uncertainty is almost inevitable, and the ability to provide a value-oriented apparel option will be in high demand. This positions the sector well for potentially years to come, something that is all the more impressive considering they still haven’t figured out how to effectively leverage digital yet. If brands in the space can put more of these pieces together, the result could be tremendous.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.