Source: https://www.advan.us/blog.php

Are you back in the office? It’s a question many of us find ourselves asking our friends and peers. The answer is, it depends. Each has their own comfort level, and it also depends largely on their role and their employer.

Morgan Stanley announced in May that it would start bringing traders back to the floor in June. Most recently, JP Morgan made a similar announcement - those in sales and trading roles returned on September 21.

Yet, despite some of the headlines, the return to work has been slow and very selective.

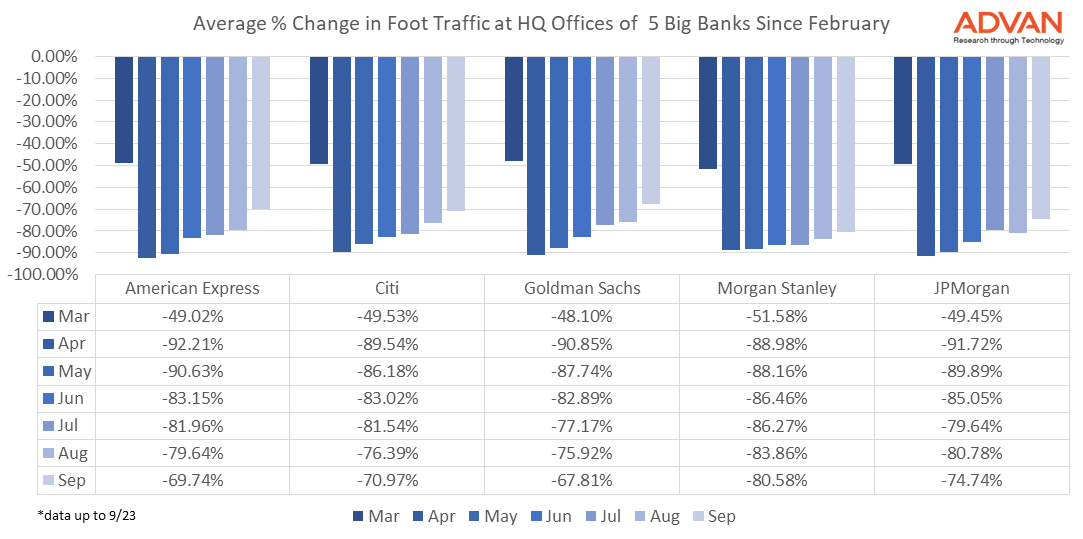

Looking at foot traffic for 5 of the largest banks, we see very similar patterns. The chart above shows the percentage change in average traffic by month, compared to February 2020. For all of the banks we analyzed, foot traffic in April was down by over 90%.

Numbers have been creeping back up, but very slowly. Goldman Sachs employees seem to have been most keen to return, but foot traffic in September was still 68% lower than in February, suggesting that about 32% of its employees are back at their desks. This compares to 30% for Amex, 29% for Citi and just 20% for Morgan Stanley.

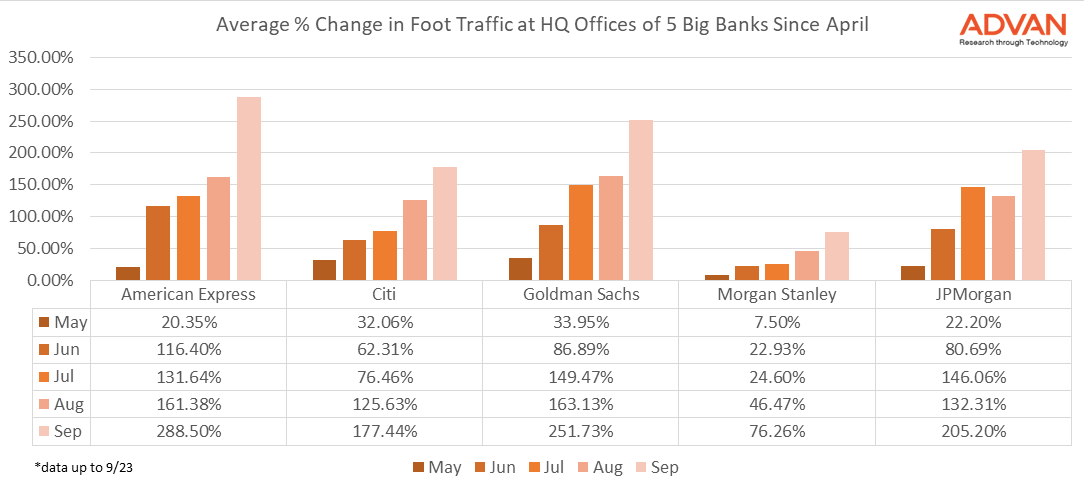

An alternative way to visualize the trends is by looking at the speed of return: comparing employees to April – the nadir for foot traffic.

In terms of return speed, American Express’ headquarters was up almost 300% in September compared to April. At the other end of the scale, Morgan Stanley was up just 76% this month from April’s low. Given the attention that Morgan Stanley received as one of the earliest banks to send its traders back to the floor, the data suggests that beyond those in trading roles, very few employees are back at MS headquarters.

To learn more about the data behind this article and what Advan has to offer, visit https://advanresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.