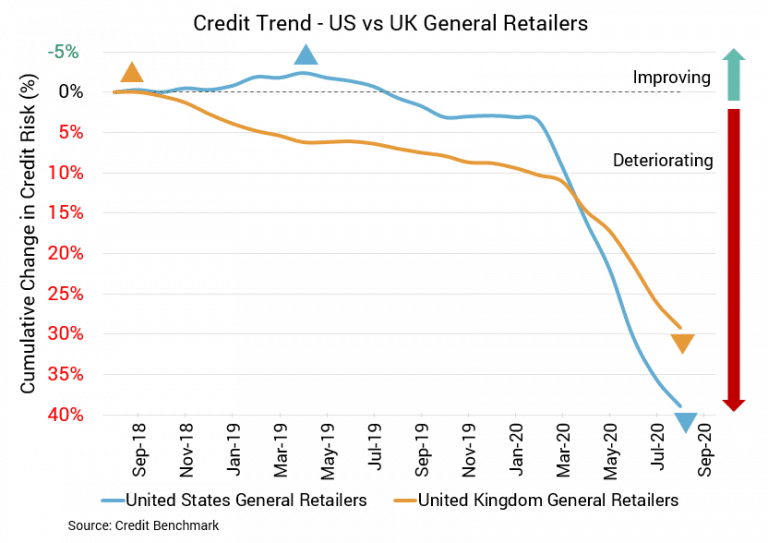

Retail sales may be rising, even if the pace in August was lower than anticipated, but retailers themselves continue to struggle. The number of store closings in the US has remained higher than openings most weeks, bankruptcies are at a notable high and there’s potential for more in the months ahead, including many well-known brands. The plight of UK retailers was similar in September. The situation looked better in October, but the British Retail Consortium warned the relief may not last. The hits to each country have been staggering. There are calls for more stimulus in the UK. In both the US and UK, retail sales will be limited until more restrictions can be lifted and the economies of each country improve.

UK Retail Sector Default Risk Remains Significantly Higher

US General Retail Firms

The downwards trajectory of credit quality for the US retail sector over the last year has been relentless. Each month brings a new drop in credit quality and an increase in default risk. Compared to the last update, credit quality has dropped by approximately 2%. It’s down about 7% from two months prior, about 14% from three months prior, and about 34% from six months prior. Year over-year, credit quality has fallen by around 38%. Average probability of default is now approximately 58 bps, compared to about 57 bps in the prior update. It was about 55 bps two months prior, about 51 bps three months prior, and about 43 bps six months prior. At the same point last year, it was around 42 bps. The current overall CBC rating for this aggregate is bb+, with about 78% of firms at a CBC rating of bbb or lower.

UK General Retail Firms

The UK retail sector has followed a similar trajectory. With the most recent update, credit quality has dipped by approximately 2%. It has fallen by about 6% from two months prior, about 10% from three months prior, and about 17% from six months prior. Credit quality has dropped by around 21% year-over-year. Average probability of default is now approximately 83 bps. It was about 81 bps in the prior update, and about 78 bps two months prior, about 75 bps three months prior, and about 71 bps six months prior. It was about 69 bps at the same point last year. The overall CBC rating for this aggregate is still bb, with about 92% firms at a CBC rating of bbb or lower.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.