There is no doubt that malls took a serious hit during the spread of COVID. However, as we’ve seen in previous reports analyzing the different recoveries of indoor and outdoor centers, the pace of recovery can be highly tied to format. So, we decided to dive into an intrigued subset of the outdoor center, outlet malls, to see how they’re recovering and stacking up against other competition.

Overall Sector Strength

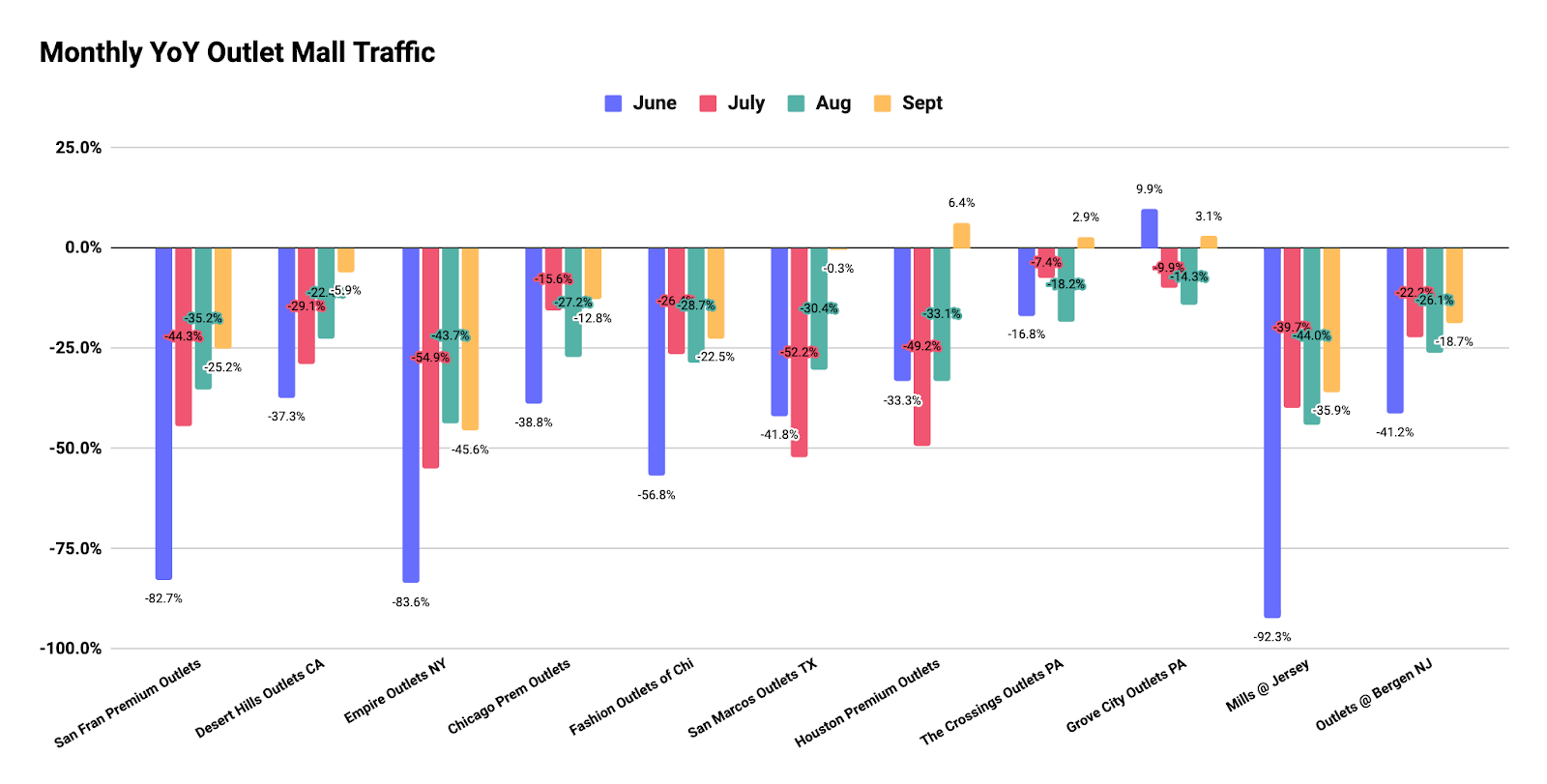

When looking at eleven outlet malls across the country in states such as New York, Texas, California and Illinois, we see a positive trend across the board. Each center’s traffic improved dramatically since the spring, shrinking the gap with 2019 traffic levels. While the group saw an average visit decline of 26.9% in August year over year, by September, that gap was down to just 12.8%.

And we see this trend continuing when looking at weekly data. When analyzing the week beginning September 28th we see traffic closest to 2019 levels for almost every mall measured. The average weekly year-over-year traffic for the collective group was down just 9.3% year over year, 3.3% closer to ‘normalcy’ than the week prior where visits were 12.6% down.

Lingering Regional Effects

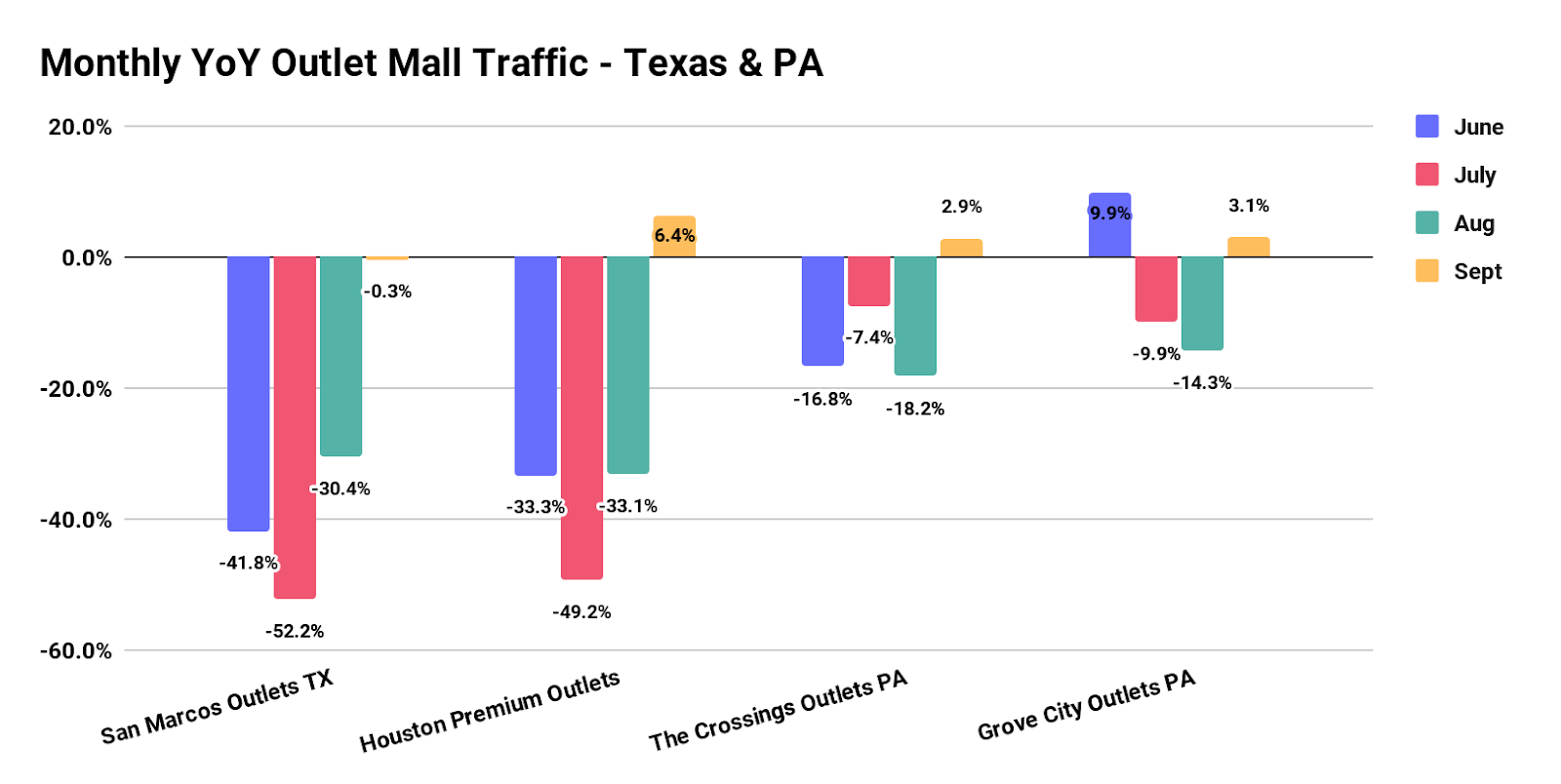

And, as we’ve seen before there are different levels of recovery based on state and/or region. Among the malls measured, Grove City Premium Outlets and The Crossings Outlets in Pennsylvania have seen the strongest traffic trends. Visits for Grove City were an impressive 9.9% above 2019 levels for June. And, while the traffic gap did increase for both July and August likely owing to a uniquely strong back to school season in 2019, traffic shot back up to 3.1% up for September. Similarly, visits for the Crossing Premium Outlets was 2.9% above, year over year for September.

Yet it’s important to note that Pennsylvania has not seen a significant resurgence in cases like we have seen in Texas or California. When we analyzed two outlet centers in Texas, we saw recovery, but not at the same pace as what took place in Pennsylvania. The average year-over-year monthly decline for the two centers analyzed in Texas from June through September was 27.9%. Though, critically, both saw very strong September visits rates with San Marcos Outlets down just 0.3% year over year and Houston Premium Outlets up 6.4%.

While geographic location certainly affects the rate of recovery, the overall sector is still showing a positive trend back to pre-COVID levels.

How do they Stack up against Indoor and Outdoor malls?

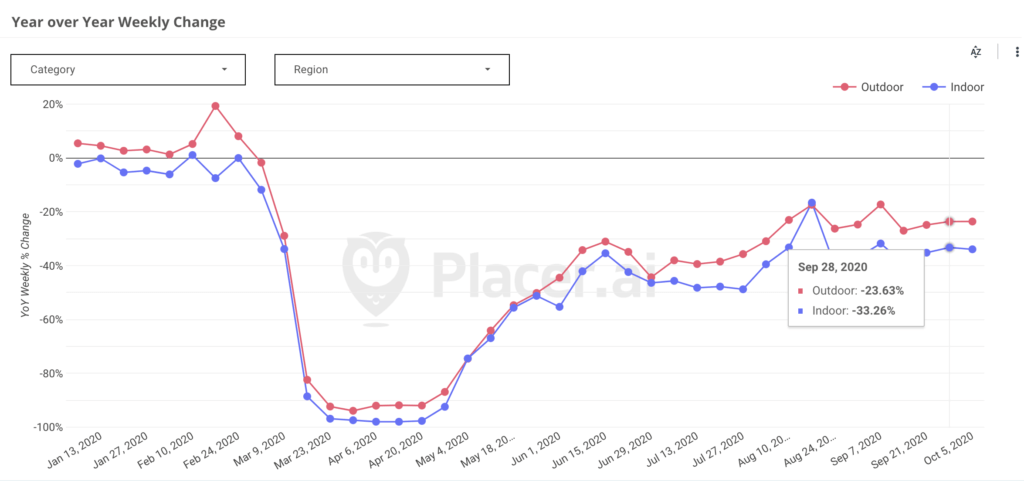

So, how do they compare to a traditional indoor mall, or other types of open air centers? When looking at year-over-year weekly data for September 28th, we see visits for outdoor malls down 23.6% and indoor centers down 33.2% year over year. While this is fairly impressive given the current environment, it falls below numbers for outlet centers. The average for the outlet malls for that same week was down 9.3%.

But the big question is why? Outlet malls benefit from a few factors that are likely playing a key role in enabling them to recover faster. Firstly, they generally have a clear value orientation with many retailers leveraging these locations for off price deals. This is a huge advantage in a wider environment of economic uncertainty creating a clear and immediate pull. Secondly, a lot of them are outside. The ability to provide a ‘mall-esque’ experience in an open air environment where social distancing is less of a clear concern is uniquely appealing when consumers clearly miss that shopping option. Finally, they are well suited to mission driven shopping patterns where visitors want to accomplish more with each visit.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.