Credit Benchmark have released the November Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The November CCIs show yet another month of credit deterioration for UK, EU and US Industrial companies, though each region showed notable improvement in the severity of the trend.

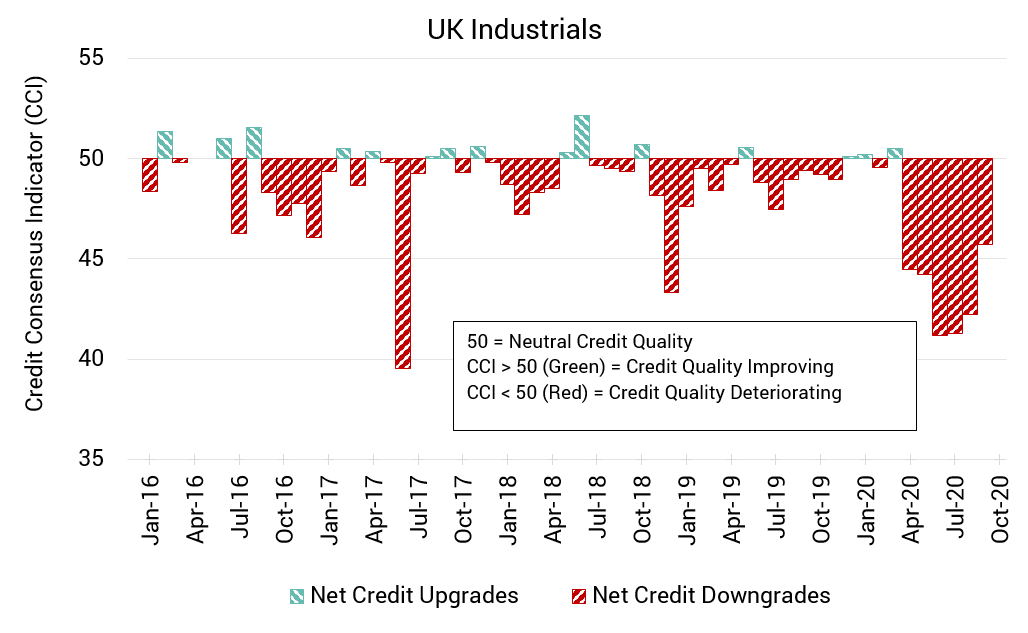

UK Industrials: CCI Jumps in the Right Direction

UK Industrial companies have entered a sixth consecutive month of net credit deterioration but the severity has lessened, and the overall position is the best it has been since March – before COVID had begun to majorly impact the global economy.

The CCI for this month sits at 45.7; an improvement from last month’s CCI of 42.2.

Recent promising developments in the race for a COVID vaccine may see UK credit quality continue to improve, but the spectre of Brexit still hangs over international trade and foreign investment.

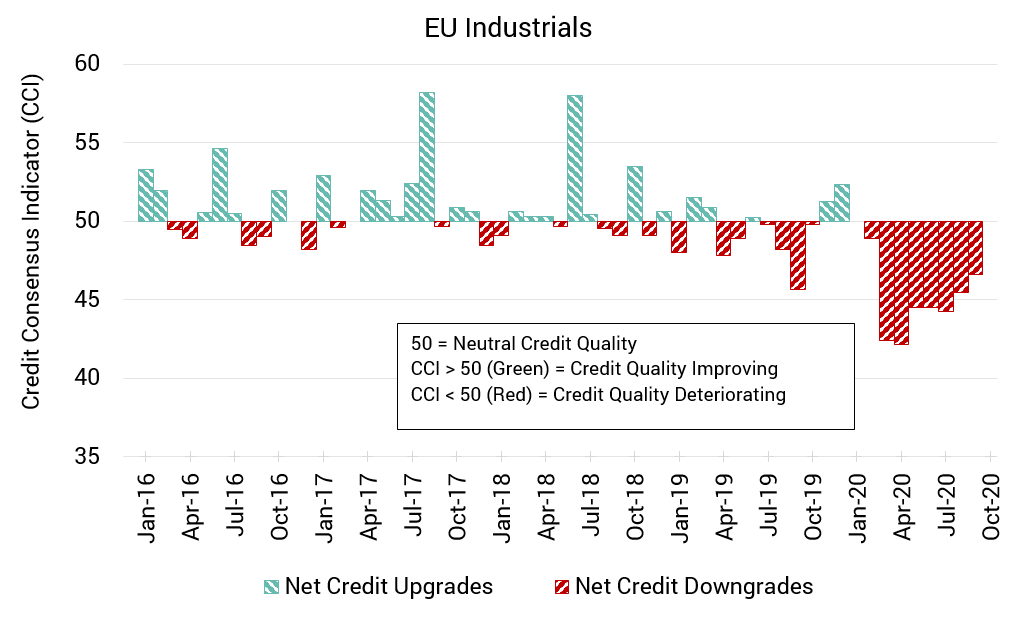

EU Industrials: Downgrades Gradually Lessen

EU Industrial companies have not seen a month of net credit improvement since last December – but unlike their UK and US peers, deterioration has been milder and more consistent.

This month’s CCI is 46.6, an improvement from last month’s CCI of 45.5. The recent trend of net deterioration is gradually lessening.

Eurozone manufacturing saw a fourth consecutive increase in factory output last month, with Germany the stand-out performer for the region. But with a second wave of COVID consumer demand will probably struggle to support current output levels.

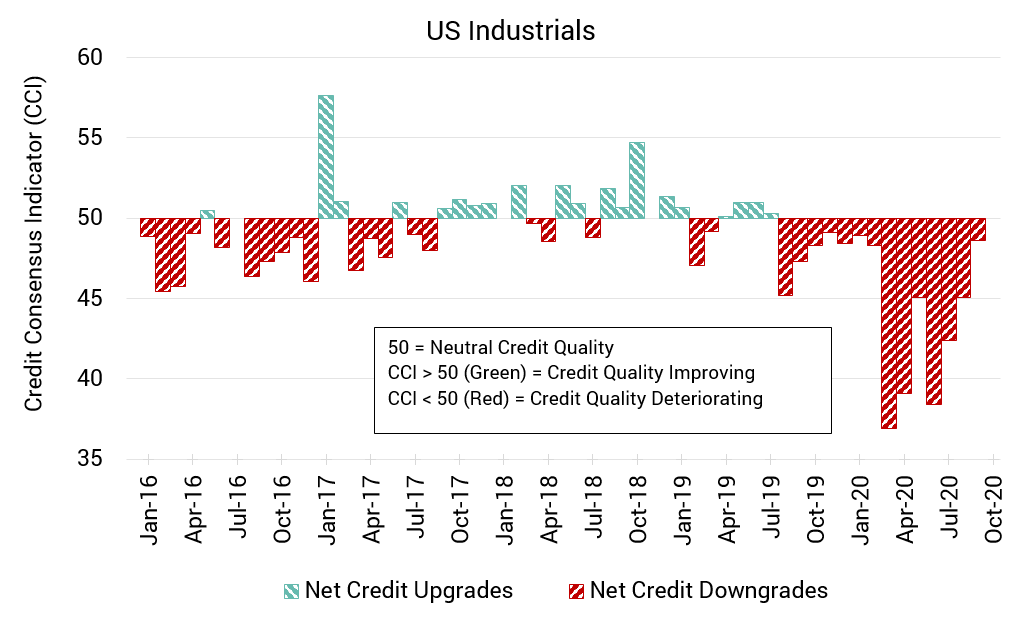

US Industrials: Credit Quality Moves Closer to Equilibrium

US Industrial companies have seen the biggest improvement in their collective credit quality this month vs. their UK and EU peers.

This month, the CCI sits at 48.6, a significant improvement from the deep drops observed in recent months. Last month’s CCI was 45.1.

As the US struggles to recover after months of dampened economic activity, not all manufacturers are emerging as equals. The Federal Reserve reported that while business-to-consumer sales are booming in areas like recreational vehicles, boats, appliances and trucks, the business-to-business sector remains stalled.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.