The outlook for the US retail sector is now less bleak than in earlier months. After disappointing sales data in September, data released in October was more upbeat, even amid ongoing concerns about the economy. The economic situation is similar in the UK, with sales data released in September and October showing gains despite ongoing weaknesses in the economy, but credit quality for the UK retail sector continues to deteriorate. COVID-19 cases are flaring up in both countries.

Is This a Turning Point or a Temporary Reprieve?

US General Retail Firms

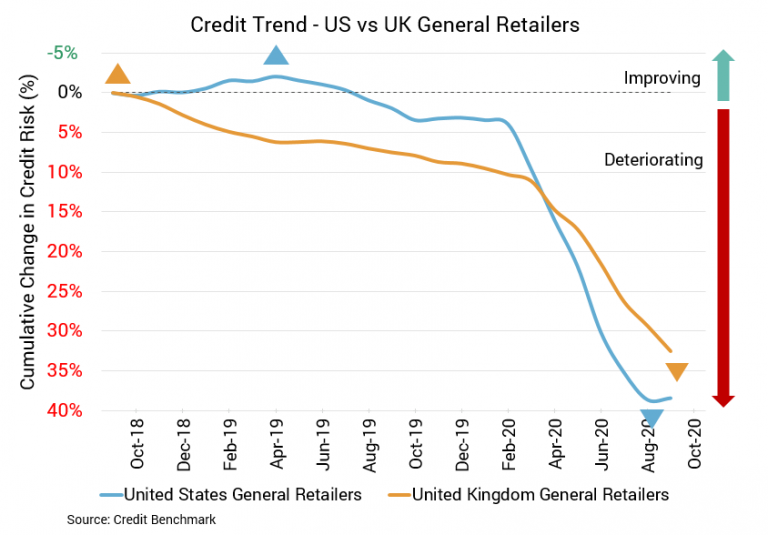

After a long and persistent downward trend, the deterioration in credit quality for the US retail sector has halted. Credit quality for US general retail firms is unchanged from the prior update, yet it’s still down about 26% from six months prior and about 36% from the same point last year. Likewise, default risk has stabilized, but average probability of default for the sector remains significantly higher than it was six months prior or at the same point last year. Average probability of default is now about 57 basis points, compared to about 45 basis points six months prior and about 42 basis points at the same point last year. The decline in credit quality is evident in this aggregate’s overall Credit Benchmark Consensus (CBC) rating of bb. Approximately 77% of firms have a CBC rating of bbb or lower.

UK General Retail Firms

Unlike the US retail sector, UK retail sector credit quality continues to decline. Credit quality for UK general retail firms is down about 2% from the prior update, about 19% from six months prior, and about 23% from the same point last year. The ongoing decline in credit quality is apparent in the sector’s average probability of default, which is currently about 84 basis points. That’s significantly higher than what we’re seeing in the US. It’s also up from 82 basis points in the prior month, about 71 basis points six months prior, and about 69 basis points at the same point last year. An overwhelming majority of firms in this aggregate – about 92% – have a CBC rating of bbb or lower, and its overall CBC rating is bb+.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.