ATTOM Data Solutions’ newly released Q3 2020 U.S. Residential Property Mortgage Origination Report shows that 3.25 million mortgages secured by residential property were originated in Q3 2020 in the U.S. The report noted that figure was up 17 percent from Q2 2020 and 45 percent from Q3 2019, to the highest level in 13 years.

According to ATTOM’s most recent residential property mortgage origination analysis, home mortgages originated in Q3 2020 represented an estimated $974.1 billion in total dollar volume, up 20 percent from Q2 2020 and 52 percent from Q3 2019, to the highest point since 2005.

The Q3 report noted those increases resulted partially from the jump in purchase mortgages, which rose faster on a quarterly basis than the number of refinance loans for the first time in more than a year. The report also noted that lenders issued roughly 1.05 million home-purchase mortgages in Q3 2020, up 28 percent from Q2 2020 and 25 percent from Q3 2019. The dollar amount of purchase loans also increased to $336.3 billion in Q3 2020, a 35 percent increase from Q2 2020 and a 36 percent increase from Q3 2019.

ATTOM’s Q3 2020 mortgage origination analysis also revealed that lenders originated 1,050,624 purchase mortgages in Q3 2020, up 28.1 percent from Q2 2020 and up 25.4 percent from Q3 2019, to the highest level since the third quarter of 2006.

The report stated that residential purchase mortgage originations increased from Q2 to Q3 2020 in 94.98 percent of the metro areas analyzed with a population greater than 200,000 and at least 1,000 total loans. Purchase mortgage originations increased by at least 25 percent in 53.5 of the metros analyzed, with the largest quarterly increases in Springfield, IL (up 233.5 percent); Savannah, GA (up 158 percent); Barnstable Town, MA (up 132.7 percent); Scranton, PA (up 85.6 percent) and Bridgeport, CT (up 77.5 percent).

The Q3 analysis noted the metros with at least 1 million people and the biggest quarterly increases in purchase originations were Boston, MA (up 75.3 percent); Hartford, CT (up 52.6 percent); San Jose, CA (up 49.8 percent); Los Angeles, CA (up 43.3 percent) and St. Louis, MO (up 42.2 percent).

Countering the national trend, residential purchase mortgage lending decreased from Q2 to Q3 2020 in just 5.1 percent of the metros analyzed, with the largest decreases in Sioux Falls, SD (down 60.1 percent); Myrtle Beach, SC (down 17.5 percent); Cedar Rapids, IA (down 16.6 percent); Ann Arbor, MI (down 14.5 percent) and Baltimore, MD (down 7 percent). The report noted that aside from Baltimore, one other metro with at least 1 million people had a quarterly decrease in purchase originations – Pittsburgh, PA (down 3.6 percent).

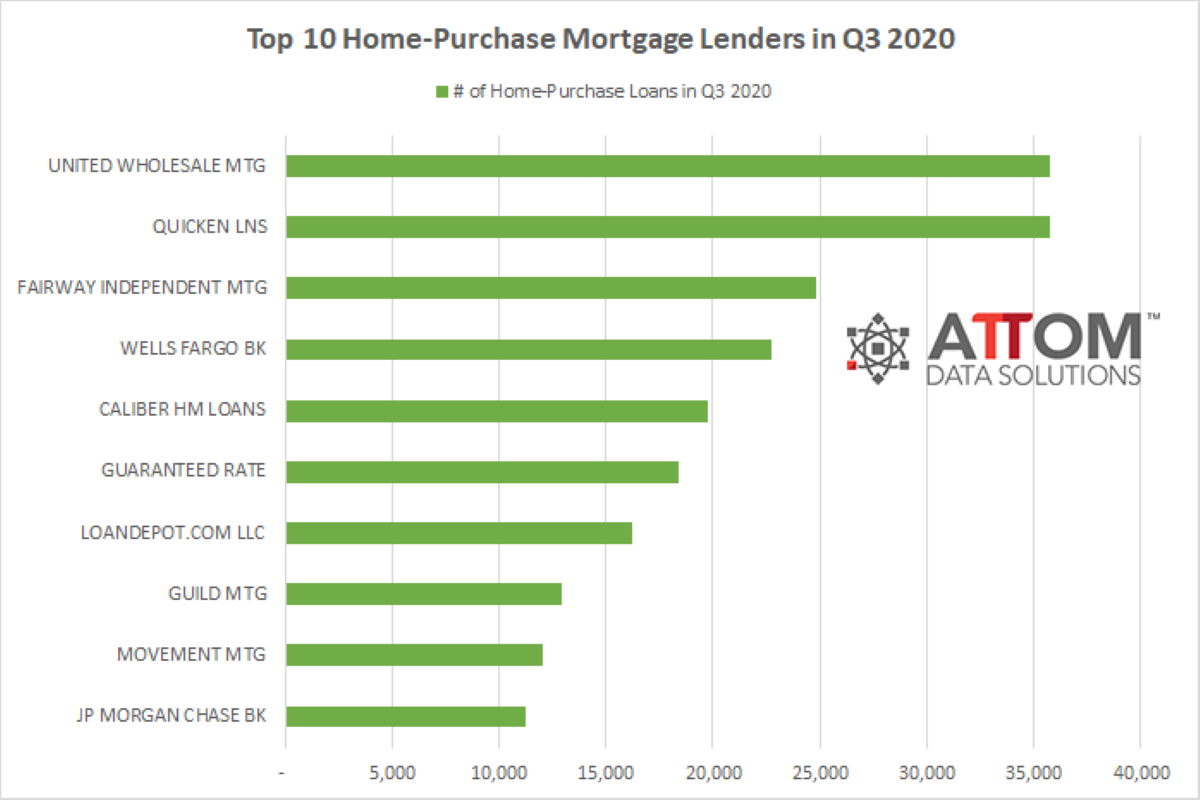

In this post, we take a deep dive into the data behind ATTOM’s Q3 2020 U.S. Residential Property Mortgage Origination Report to uncover the top 10 home-purchase mortgage lenders in Q3 2020 by loan volume. Those lenders include: UNITED WHOLESALE MTG (35,732 home-purchase loans); QUICKEN LNS (35,711 home-purchase loans); FAIRWAY INDEPENDENT MTG (24,858 home-purchase loans); WELLS FARGO BK (22,734 home-purchase loans); CALIBER HM LOANS (19,746 home-purchase loans); GUARANTEED RATE (18,392 home-purchase loans); LOANDEPOT.COM LLC (16,206 home-purchase loans); GUILD MTG (12,934 home-purchase loans); MOVEMENT MTG (12,028 home-purchase loans); and JP MORGAN CHASE BK (11,233 home-purchase loans).

ATTOM’s Q3 2020 mortgage origination analysis also stated that refinance activity continued to represent the majority of home loans and kept growing, but at a smaller quarterly pace than purchase lending. The number of refinancing loans increased only 16 percent from Q2 to Q3 2020, to 1.96 million, and the amount refinanced increased 15 percent, to $587.6 billion.

The report noted that as a result, the amount of money lent to buyers taking out new mortgages in Q3 2020 represented 34.5 percent of all lending, up from 30.6 percent in Q2 2020; the portion refinanced by owners rolling over old mortgages dipped from 63.1 percent in Q2 2020 to 60.3 percent in Q3 2020.

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.