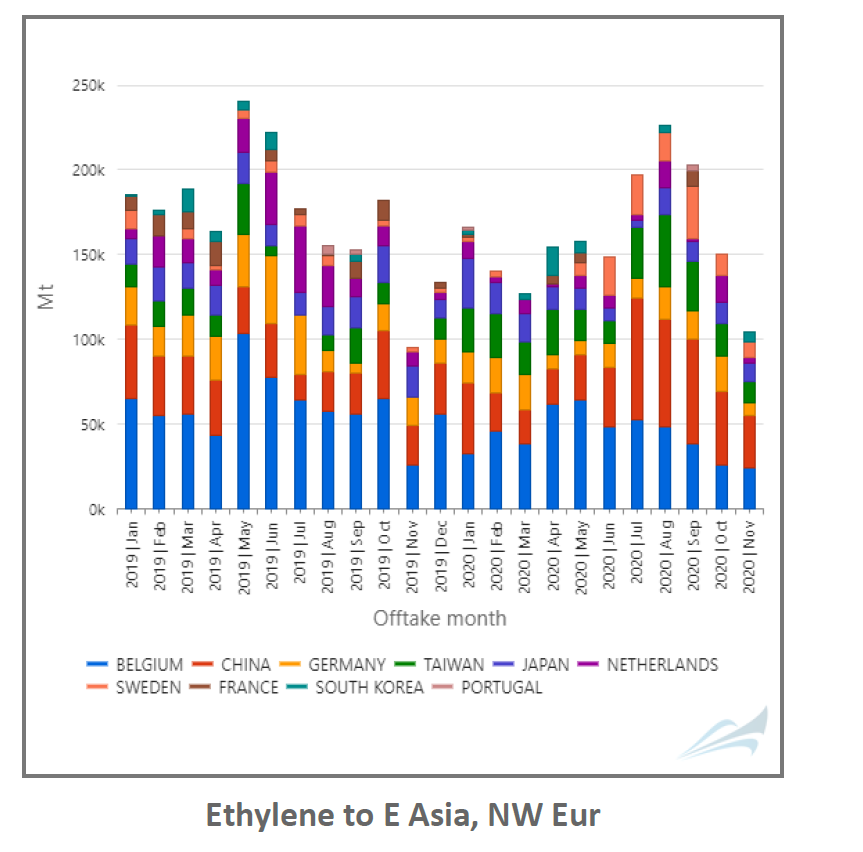

Steadily rising prices of ethylene between mid-April and mid-September caused many buyers to turn to alternative sources, but a recent pullback in the market has rekindled interest.

Ethylene offtake this month is currently around 172,825 metric tons, and compares to 253,399 Mt in October. Ethylene prices on the US Gulf Coast rallied more than 225% between a low in April near 8c/pound and a peak in September at more than 26c/lb. At that time, buyers reacted through a combination of reducing purchases, working off existing stockpiles or possibly turning to more locally produced ethylene with feedstocks such as naphtha.

Gulf Coast ethylene prices have fallen since early September to nearly 19c/lb, which is helping to spark global demand again. Belgium’s discharges are running at a pace of 1,339 Mt/d this month, compared to 829 Mt/d in October, thanks mostly to Ineos’ Antwerp terminal and Total’s Antwerp refinery.

China imported 31,259 Mt of ethylene so far this month, compared to 43,301 Mt in October. Chinese imports may be bolstered by the drop in ethylene prices, along with the possibility of a near-term price increase, after the outage of LG Chem’s 1.6mn Mt/yr cracker in Yeosu, South Korea on November 5. The cracker is expected to remain shut until January. Two of the Chinese cargoes that discharged this month were loaded aboard MGCs at Enterprise in Morgan’s Point, while single SGC discharges were made from vessels loaded in Ruwais and Singapore.

To learn more about the data behind this article and what ClipperData has to offer, visit https://clipperdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.