As the last housing market indicator in 2020, the S&P CoreLogic Case-Shiller Index finishes the year on a high note during this trying year. Home purchase activity remained consistently elevated through the end of the year, with some expected seasonal slowdown turning up as winter months approached. Still, the slowdown appears to be smaller than in a typical year. Overall, total home sales in 2020 are expected to register a slight boost from the 2019 total and clock in the strongest year since 2006. Looking forward, mortgage application data and pending sales suggest there will be higher activity in the beginning months of 2021. Additionally, as coronavirus vaccines become broadly available, economic activity is likely to pick up pace and home sales gains should speed up, too.

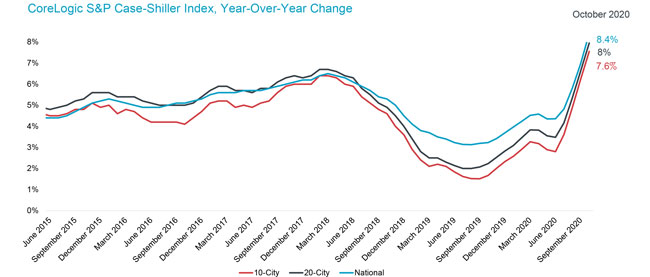

The national Case-Shiller Index jumped 8.41% in October, posting a new high and growing at the fastest pace since March 2014. The index is now 25% above the peak reached during pre-Great Recession. The month-to-month index jumped 1.37% from September — the fastest increase since spring 2013.

The 10- and 20-city composite indexes were also up considerably, up 7.55% and 7.95% year over year, respectively. Both indices continue to surge at the fastest pace in over six years (Figure 1). Compared to a year ago, the two indices have accelerated considerably when they were reporting only about 2% to 2.5% growth rate. Also, the 10-city price index has maintained the growth momentum, much like the 20-city index, illustrating that robust, underlying housing fundamentals are strong across a variety of U.S. metropolitan areas.

Figure 1: Home Price Growth Reaches New Highs in October 2020

Phoenix, topping the list as the metro with the strongest home price acceleration for the 16th consecutive month, experienced a 12.7% jump in home prices this October. Seattle remained in second place, with an annual increase of 11.7%, followed closely by San Diego, which was up 11.6%. All metro areas had home prices leap at least 6% in October. Even Chicago (up 6.3%) and New York (up 6%), while ranking on the bottom of the 20-city list, had their home price growth accelerate by more than six-fold over the last year.

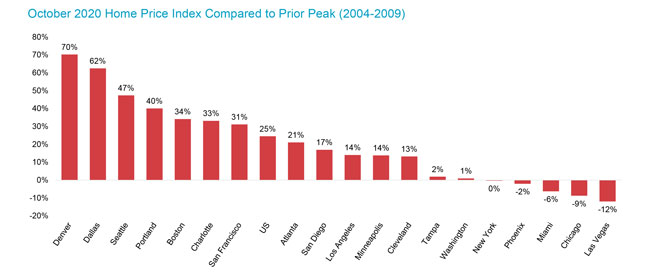

Figure 2: U.S. Home Prices are 25% Above Their Prior Peak

Nationally, October home prices were 25% higher than the previous peak, though seven of the 20 reported that their new peaks were more than 30% above the previous peaks reached between 2004 and 2009. While home prices continue to reach new historical highs, some metro areas have still not recovered their pre-Great Recession peaks. Four metro areas are still lagging, with Las Vegas being the slowest to catch up to its previous high. Phoenix, which has been growing at the fastest pace for the past 16 consecutive months, has still not reached its previous peak, and remains about 2% below that level (Figure 2).

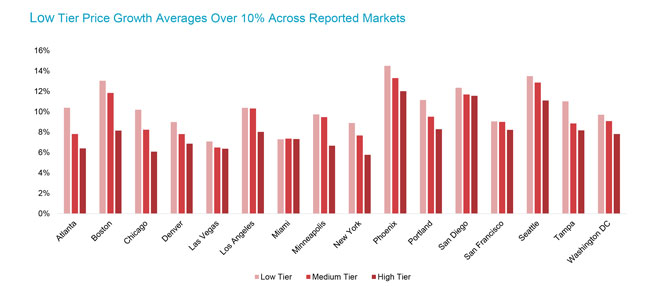

Figure 3: Low-Tier Home Price Growth Reaches 15% in Some Markets

Lastly, homes in the lower one-third of the price distribution continue to experience the highest demand from buyers, leading to the average annual growth rate of 10.5% across the 16 cities (Figure 3). In October, Phoenix had a 15% jump in lower-tier home prices. Even in Las Vegas and Miami, low-tier home prices were increasing at 7% annually — about a 3-percentage-point acceleration since the onset of the pandemic. The average growth among medium-tier priced homes was 9.5%, and highest-tier prices were up 8.1% on average. Compared to April 2020, high-tier prices had highest acceleration of almost 5 percentage points.

Looking ahead, 2021 will present a new set of challenges both for the economy and the housing market. While distribution of coronavirus vaccinations is underway, there may still be some bumps along the way to economic recovery. Fortunately, some critical economic stimulus support appears to also be underway soon, hopefully buffering the impacts of recent shutdowns. Depending on the path of the pandemic over the next few months, policy makers may opt to extend foreclosure moratoriums, in addition to recent extension of rent eviction moratoriums, which will help struggling homeowners and renters. Taken together, recent stimulus actions are likely to help housing market demand and ensure continued home price growth.

To learn more about the data behind this article and what CoreLogic has to offer, visit https://www.corelogic.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.