In this Placer Bytes, we dive into the Q4 performances of Bed Bath & Beyond and Walgreens to see how they ended their 2020 campaigns.

Bed Bath & Beyond’s Rocky End

Last year, we marked Bed Bath & Beyond as one of the brands we expected to emerge as a winner in 2020. And it certainly appeared to be on that path, posting same-store sales gain for the first time since 2016. But what about Q4?

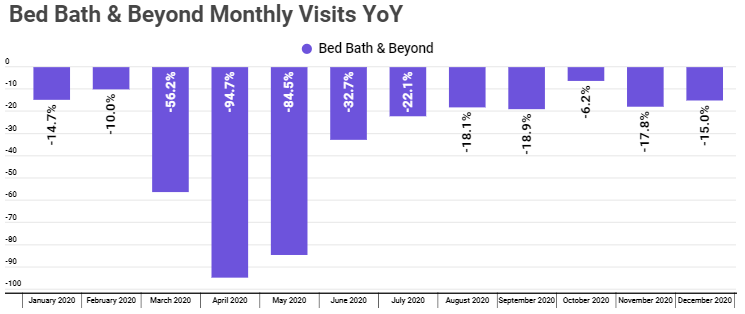

Bed Bath & Beyond had 2019 visit levels in its sights by October, with visits down just 6.2% year over year. Yet, the combination of a resurgence of COVID cases and the high bar set by the 2019 holiday season caused the visit gap to increase to 17.8% and 15.0% in November and December respectively. But, even with this step back the quarter still marked the best for the brand in 2020 with visits down a monthly average of 13.0% year over year. This was better than the Q3 mark of 19.7%, and only slightly off the pace of pre-pandemic January and February when monthly visits were down an average of 12.3%

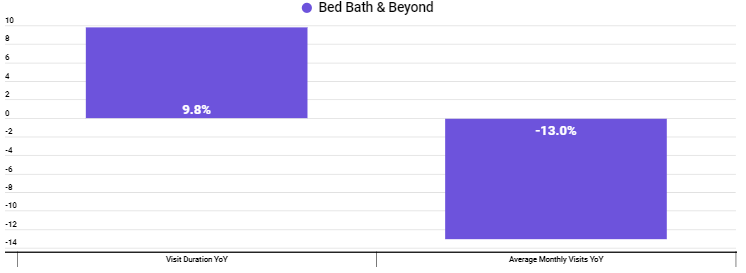

And there are also signs that the magnitude of visits may have offset the loss of visits. Even though the average monthly visit gap was 13.0% year over year in October, November and December, the average visit duration was up 9.8% during that same period, indicating a high potential for larger basket sizes and a likelihood of high conversion rates. A final positive note was that visits the week beginning December 21st were down just 7.4% year over year, the best weekly visit gap since October. All signs that point to a holiday season that may have performed far better than expected, and strong momentum heading into 2021.

Bed Bath & Beyond Visit Duration

Can Walgreens Close the Gap with CVS?

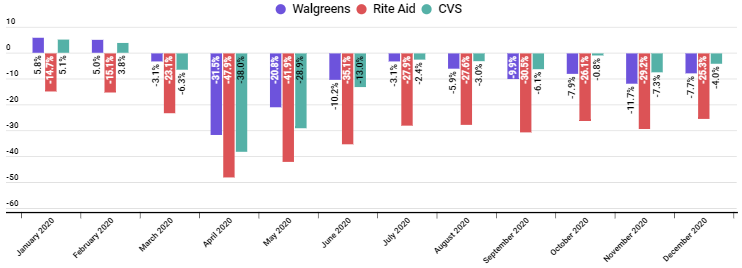

Beyond the obvious challenges levied by a year defined by COVID, Walgreens also happened to be operating against CVS, another Placer.ai 2020 winner. And while Walgreens actually began the year with an edge , January and February visits were up 5.4% on average, while CVS visits were up just 4.5% those months, the pandemic flipped that situation.

In Q3 and Q4, Walgreens saw average monthly visits down 6.3% and 9.1% respectively, while CVS saw visits down 3.8% and 4.0% those same months. And while the slight edge for CVS is a challenge, both brands far outpaced Rite Aid, which saw average monthly visits gaps of 28.7% and 26.9% in Q3 and Q4 respectively. Critically, regional distribution matters a lot here with suburban focused chains seeing less of a hit than those oriented towards cities.

Pharmacy Leaders - Year over Year

But, visits for Walgreens and Rite Aid were trending up into the end of 2020. Walgreens saw visits down just 3.7% the week of December 21st, the best mark since August, while Rite Aid’s weekly visit gap of 21.3% was its best since March. Yet, here too, CVS set the standard with visits up 0.1% the week of December 21st. And, with both Walgreens and CVS likely benefitting from the ability to provide vaccines and an increased focus on health and wellness, the battle between the two could be one of the most interesting to watch in 2021.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.