Where other retail segments struggled to come close to their 2019 visit rate, home improvement leaders surged to impressive year-over-year growth. Yet, some brands were able to leverage the powerful surge in customer demand better than others.

In our latest Home Improvement 2020 Deep Dive whitepaper, we dove into the major shifts that shaped the industry during the pandemic and investigated which brands succeeded to adapt and profit. Below is a taste of what we found.

More Than Just Mission-Driven

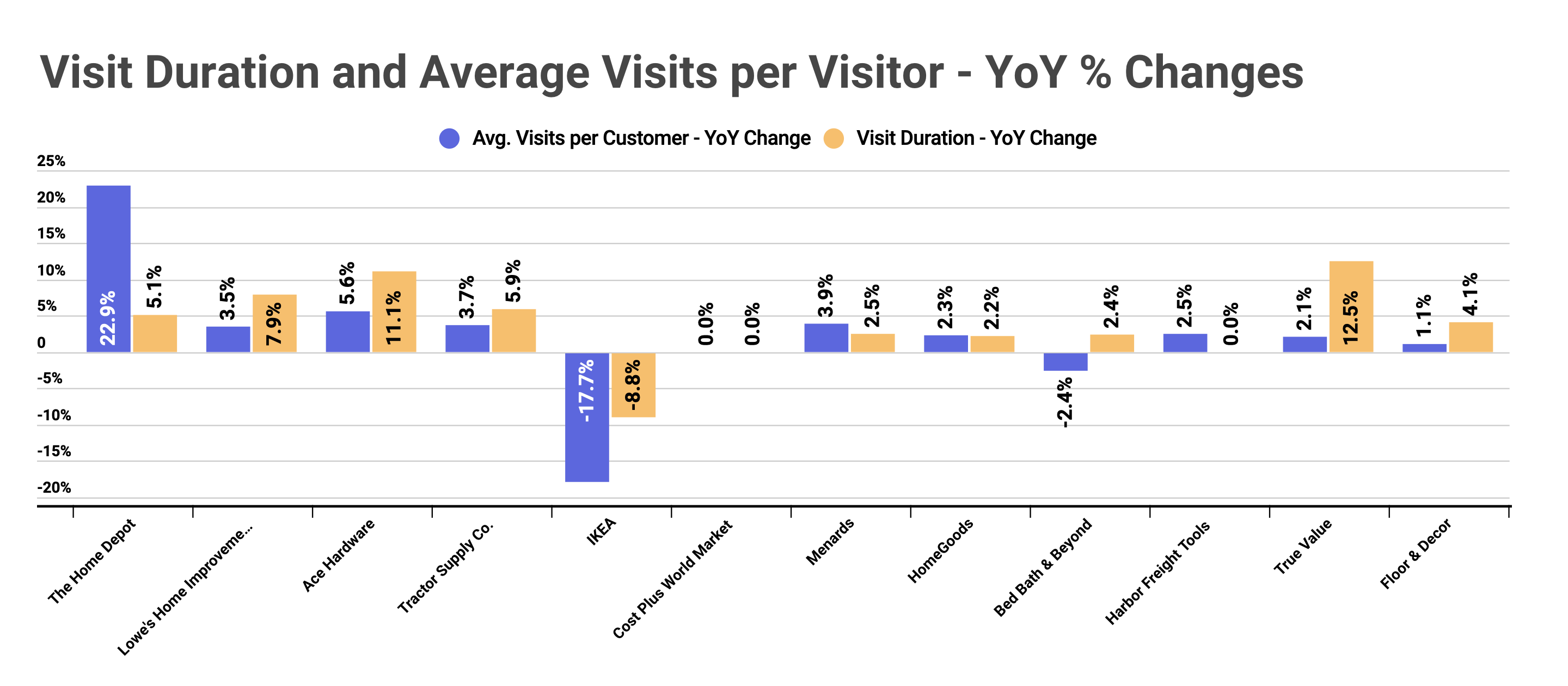

While many retail sectors experienced a pandemic-driven consumer shift toward mission-driven shopping – a decline in visit frequency on one side along with an increase in visit duration on the other – the home improvement sector’s 2020 experience was unique.

Data reveals that shoppers visiting home improvement chains not only spent more time in stores but also that the average visits per visitor metric had increased dramatically. Out of twelve home improvement brands analyzed, ten experienced a 2.2% to 12.5% year-over-year increase in visit duration. Nine of the brands also saw a rise of 1.1% to 22.9% in the average visits per customer on a year-over-year basis. While waiting periods may have influenced visit durations slightly, this trend’s extended nature shows the likelihood of more significant visits with larger basket sizes.

Loyalty Can Be Gained

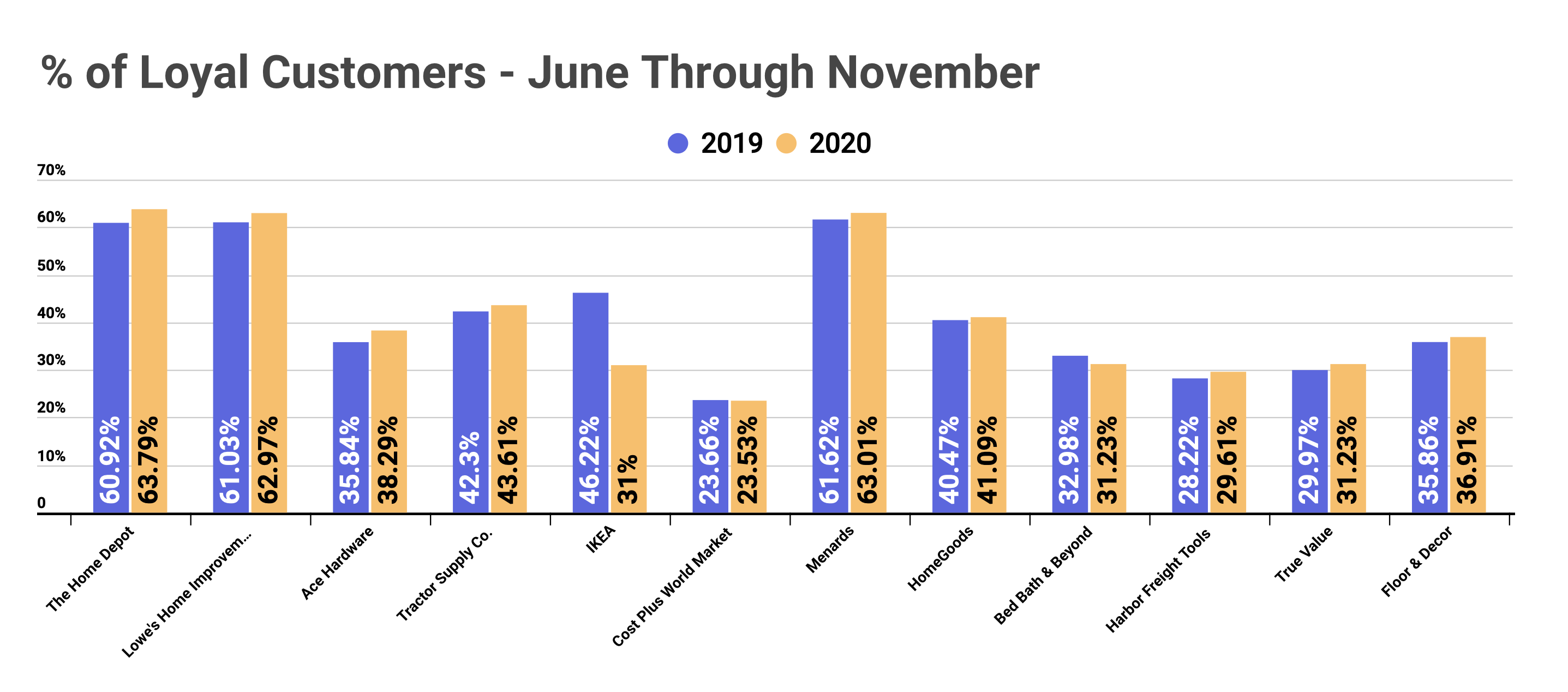

In times of economic instability and changing consumer habits, loyalty and customer retention become more crucial than ever. Consequently, many leading home improvement chains launched or promoted special loyalty programs to attract and retain regular customers during the pandemic.

These loyalty programs had a significant impact on many brands. Comparing data from June through November of 2020 to the same months in the prior year shows that customer loyalty rates increased across the brands analyzed. Most saw a 1%-2% increase in the percentage of loyal customers who visited the same chain at least twice over that period, an impressive achievement during a global pandemic.

Home Depot and Ace Hardware even exceeded that average with a 3% increase in the percentage of loyal customers, respectively. In contrast, Bed Bath & Beyond and IKEA underperformed with declines of 1% and 15% in loyal customer rates, respectively. Though the former was likely affected by store closures.

Going the Extra Mile?

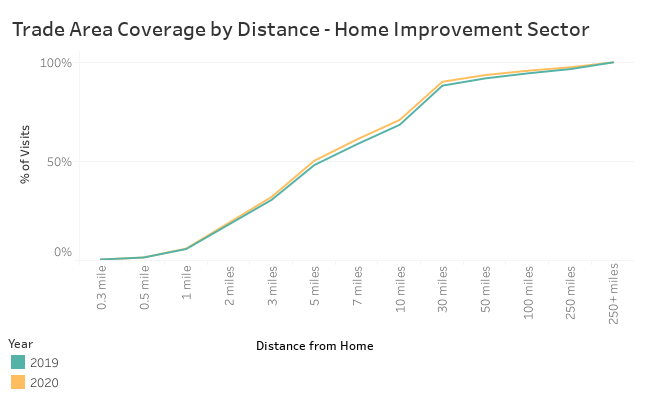

Shoppers’ traveling distance to home improvement stores was another significant pandemic-driven change experienced by the sector in 2020.

Location data shows that more shoppers prioritized proximity to home when choosing where to go in 2020. As much as 71% of home improvement store visits in 2020 came from within a 10-mile store radius, an increase from 68% in 2019. This pandemic-driven trend reflects shoppers’ increasing preference for familiarity and avoidance of travel-related risk and inconvenience. It also emphasizes the significance of the loss of ‘normal’ commutes that would take visitors to other areas.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.