Source: https://www.creditbenchmark.com/the-covid-year-review-of-credit-and-solvency-trends-in-2020/

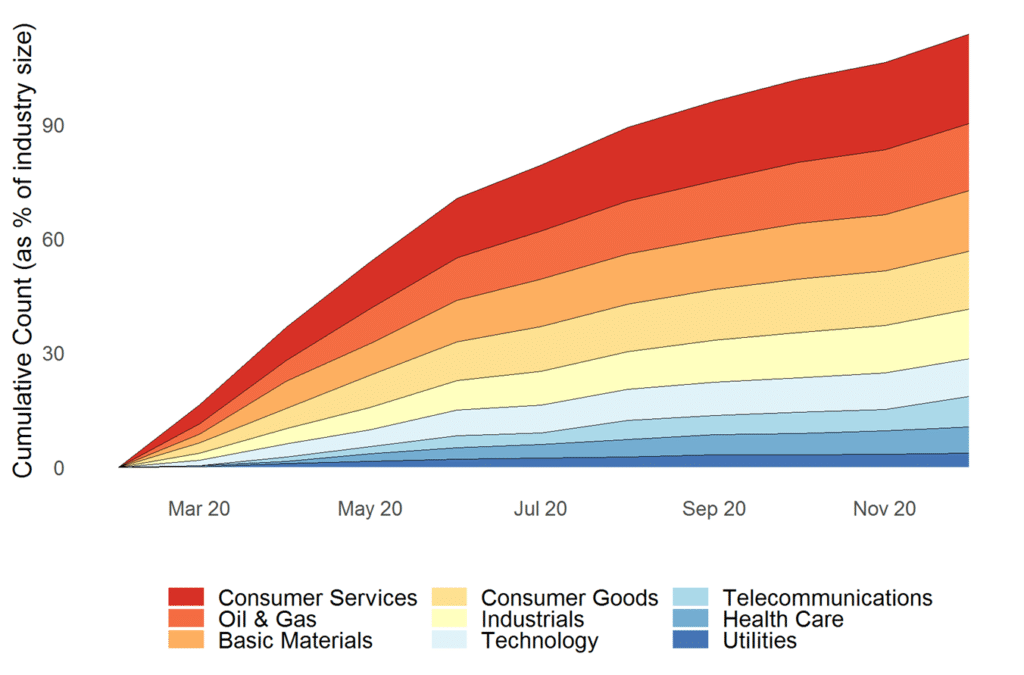

Figure 1.1 shows the cumulative increase in Fallen Angels, with each layer showing the cumulative % total of the respective industry universe, by December from a March start date corresponding to the onset of the pandemic.

The 2020 pandemic brought various forms of disruption, hardship and human tragedy. Governments and businesses around the world had to rely on trial and error to find the best response.

There have been some high-profile corporate winners – companies that support home working, online delivery and logistics providers, packaging firms, some pharmaceuticals. But Covid has highlighted economic and social inequalities, and added “health poverty” to the lexicon.

There have also been many losers, with almost entire industries being downgraded to junk. But default rates have been low, due to massive government support programs, and a wave of mergers and acquisitions as larger firms with strong balance sheets swallow their struggling competitors. Good news for investment banks, who along with insurance companies have weathered the crisis well.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.