As a result of the pandemic, there has been a significant shift happening in major cities with many, if not most, seeing an exodus of residents. This has led some to speculate that the impact on city-oriented retail could be especially severe.

Yet, a deeper look presents a very different conclusion. Not only is city retail not facing a long-term challenge, but a potential refresh that could create a far better and more diverse urban retail ecosystem.

Net Losses Equal Opportunity?

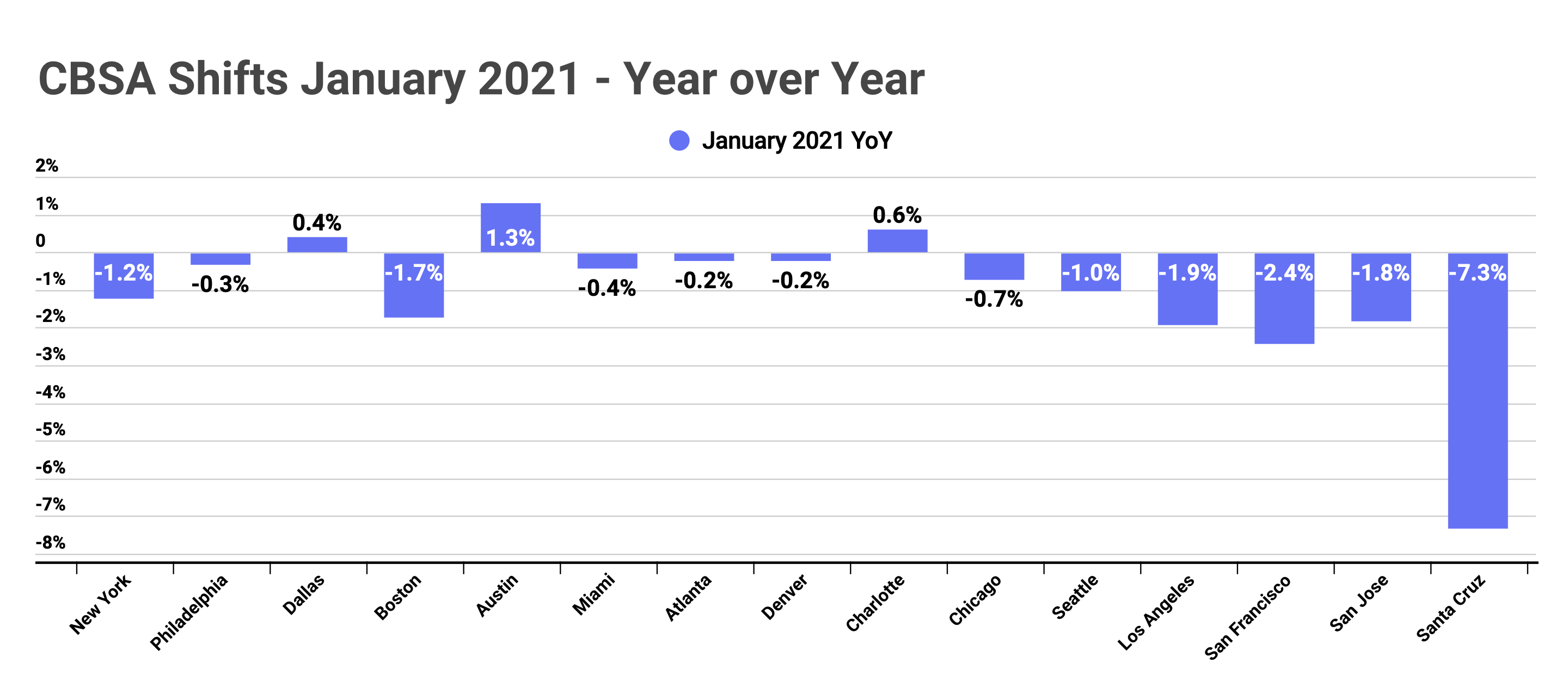

Looking at net change in populations across some of the larger CBSAs in the country shows a clear pattern of decline. In January 2021, the New York CBSA saw a year-over-year difference of -1.2%, while San Francisco, Los Angeles, and Boston saw declines of 2.4%, 1.9%, and 1.7% respectively. While these drops are not massive, they are heavily offset by new residents making their way to fill gaps in these areas. And there are powerful indications that what is truly taking place is less about an exodus than a revival.

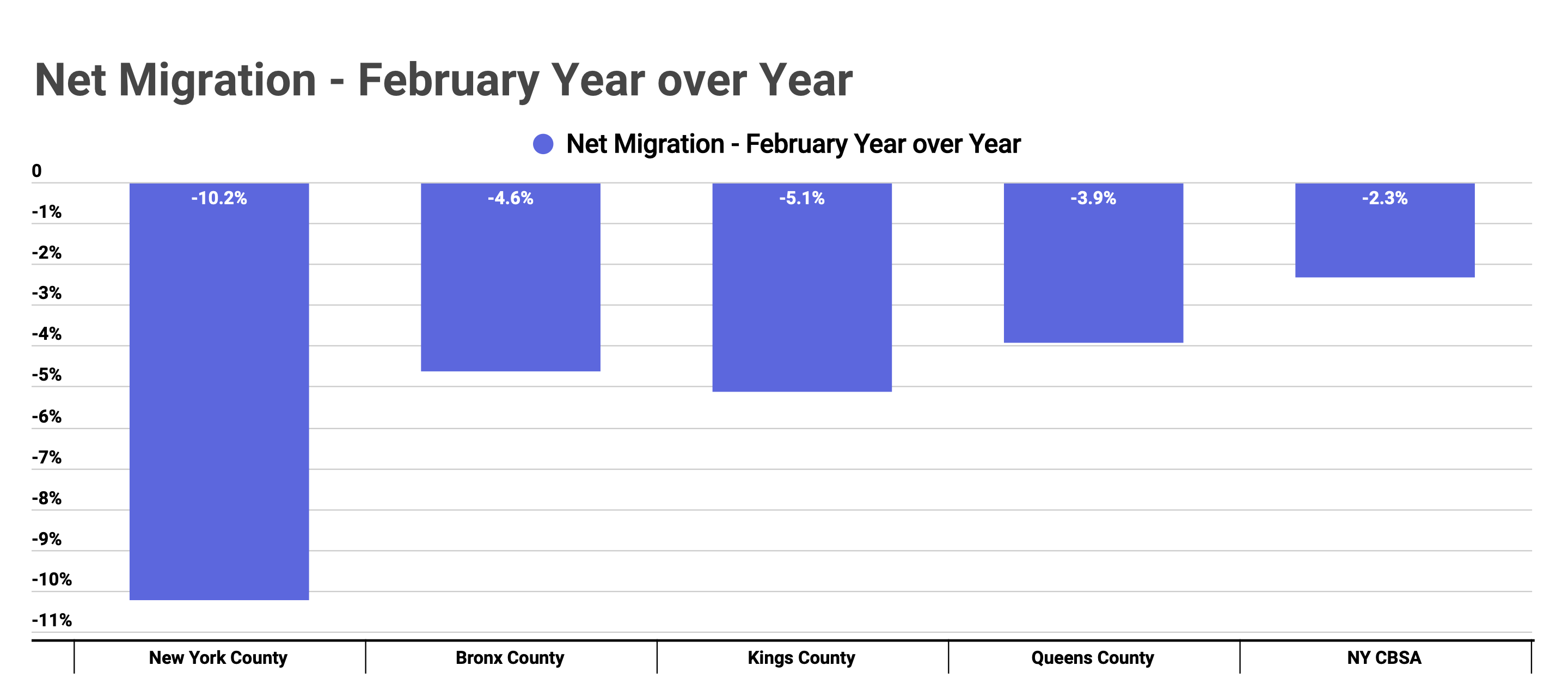

Looking at New York City specifically shows that the counties covering Manhattan, Brooklyn, and Queens were all seeing net losses in February 2021, with New York County seeing the most significant 10.2% year over year decline. Diving deeper into this county analysis reveals that the most likely cause of movement is a shift to the suburbs – a trend that is heavily indicated by the data in major cities across the country. This is a positive result for cities as it means that they are likely maintaining their center of gravity, even if people are moving out. And those moving out are likely the ones seeking more space for growing families or more value for their housing dollars. This presents a powerful opportunity for suburban retail and malls as they look to address the needs of this new population – one which likely has more spending capacity than they did before.

Yet, there is another facet to this move that could have even bigger implications for retail. According to UrbanDigs, median rent dropped by 20% in January 2021 year over year even as signed leases grew by 22% year over year. This leads to a very clear sign that those that are coming to the city are younger and taking advantage of this newfound affordability.

What This Means for City Retail

Considering this younger, Gen-Z-oriented audience has shown a clear preference for in-store shopping and a more authentic and direct brand relationship, the result could likely be a rise in flagship stores for a more diverse set of brands. Essentially, there are many reasons to expect that a wider array of retailers will look to focus on more owned retail locations in major cities. Critically, the focus with these locations will be as oriented to experience and a long-term brand relationship as it will be to driving in-store sales. Why?

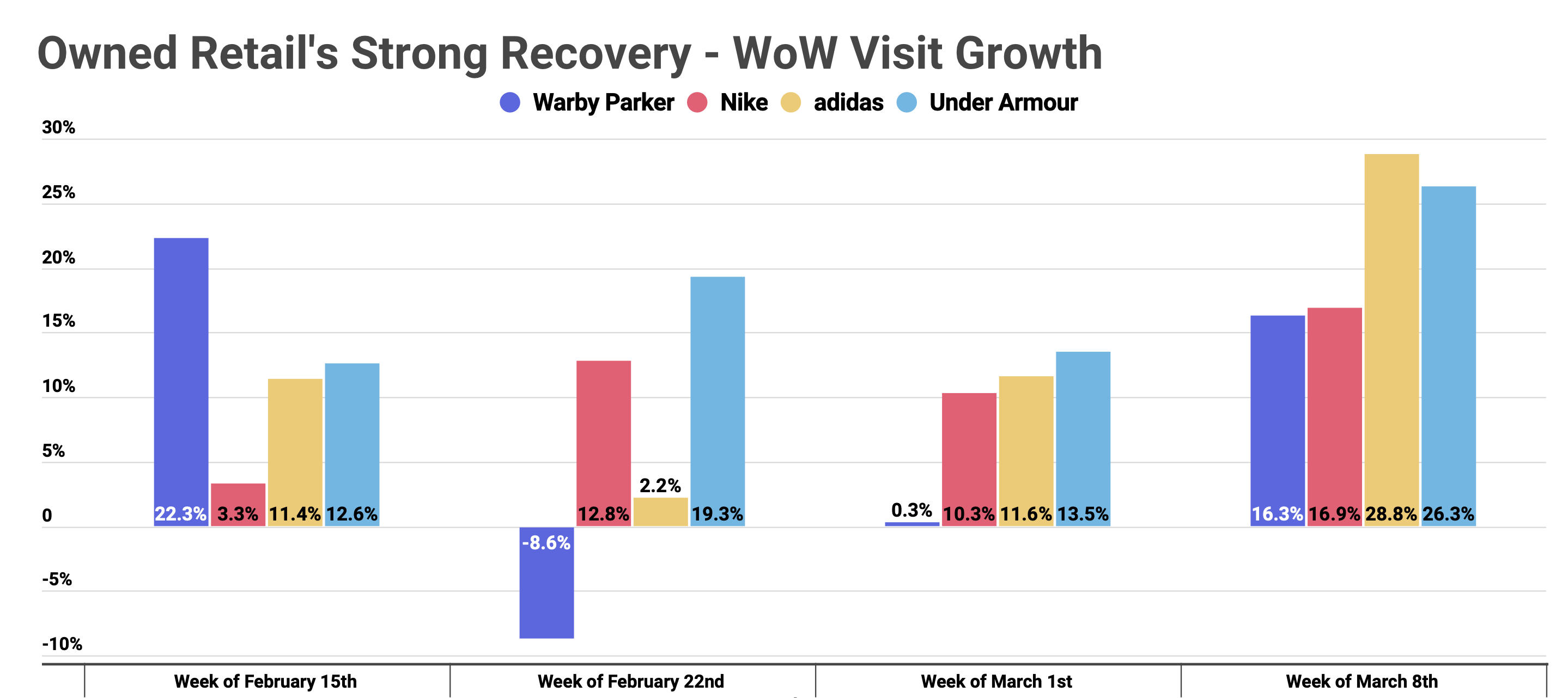

First, DTC and product-oriented brands are already on the rise offline because they are identifying the value of owning the customer relationship. Visit trends for these brands have been very positive, and even looking at recent data shows that some of the fastest recovering retailers are those that have emphasized their own brand and own products.

Second, these brands are recognizing that there are many values driven by an owned location beyond just selling products. Locations can actually cut operational costs by improving last-mile delivery efficiency, creating a point for returns, and enabling digital offerings like BOPIS.

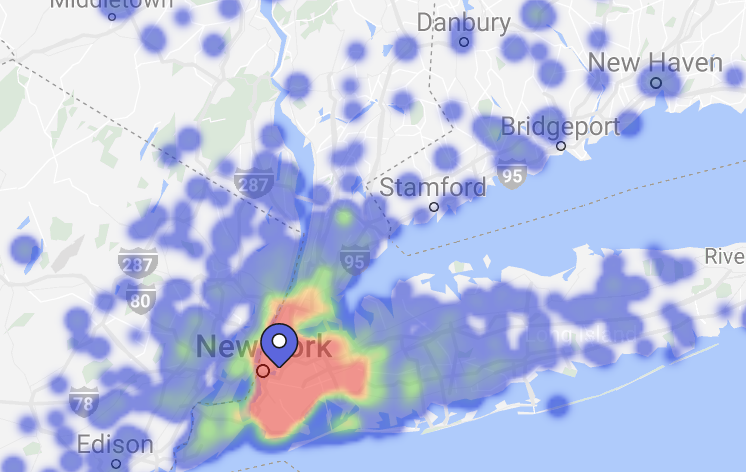

Locations also provide the chance to drive awareness in a very significant way. Looking at a single Everlane location in NYC shows the massive reach a major city offers. The branch saw just under 600,000 full visits in 2019 and that doesn’t account for all the passersby or quick check-ins. This visibility alone is an enormous boost, especially when you consider how much more likely an in-store visitor is to convert into a customer compared with online visits.

Finally, the flagship actually boosts the value of a brand’s online offering. The ICSC’s Halo Effect report found that offline shopping and retail visits can drive significant gains to online channels over an extended period of time. Essentially, the location solidifies a relationship that then leads to more purchases in the long run. Even just from a practical perspective, knowing the fit or sizing of a given brand can help a consumer feel far more confident in making an online purchase. Let alone, the value of removing the need to purchase multiple sizes and therefore incurring high return costs.

Rise of the Flagship & Why This is Good

Combine declining rents, the need to reach a new audience, and the focus many landowners are placing on brands that are a ‘draw’, and the situation becomes especially exciting. Online-only brands or those with a smaller owned offline footprint have the chance to get in at a good price with the potential to achieve several aims at once. Even better, the sharp focus of these brands means that the wider retail landscape could become more diverse as a larger mix of retailers takes up smaller pieces of the overall city retail pie.

And this is good for everyone. More diversity equals less direct competition, and more opportunities to identify ideal location fits, while ultimately better serving the customer with what they want. Even more, it should make city retail more exciting and targeted allowing it to perform better and become more sustainable.

How will this trend play out in the long term?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.