In this Placer Bytes, we break down the latest performances of two home furnishings leaders – Bed Bath & Beyond, and Conn’s, and analyze Amazon’s latest grocery push.

Bed Bath & Beyond’s Continued Rebound

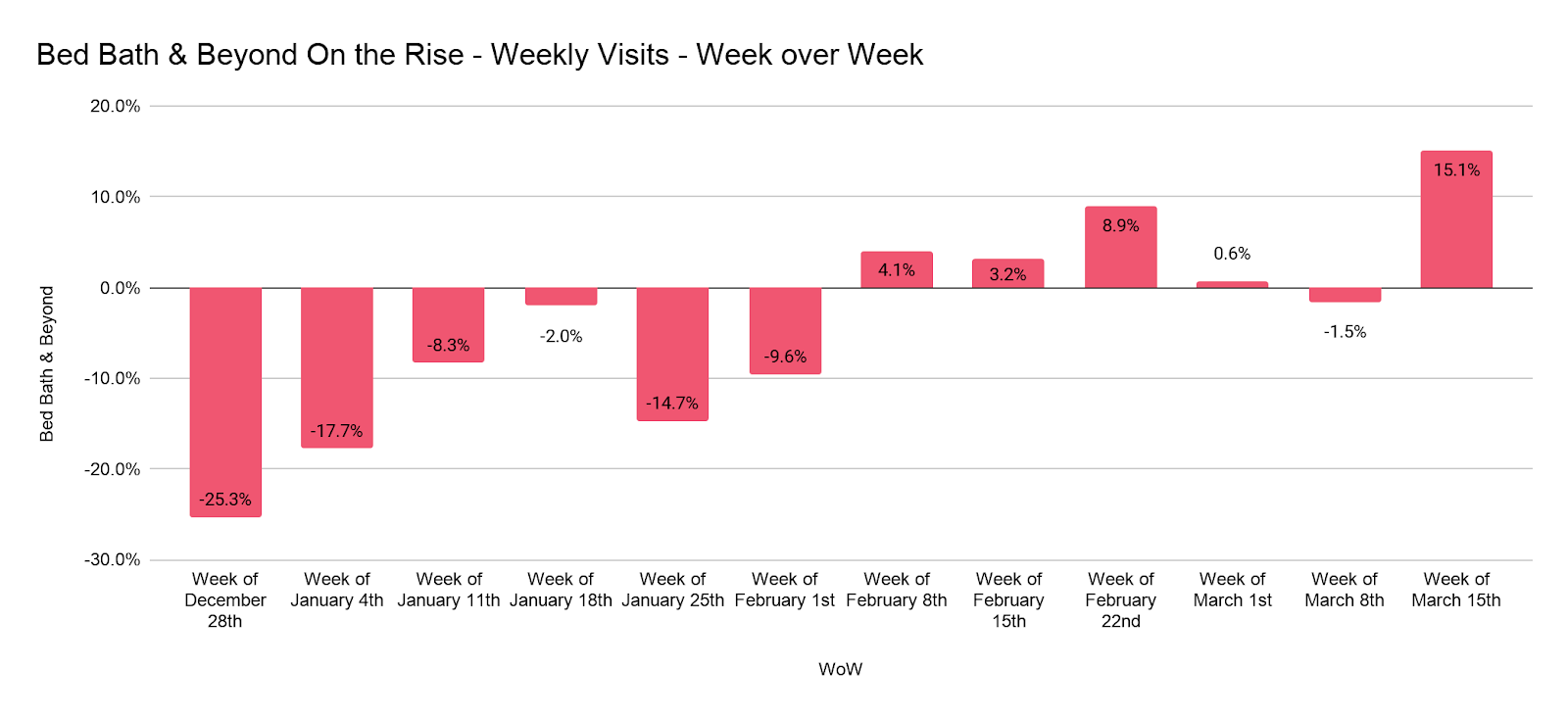

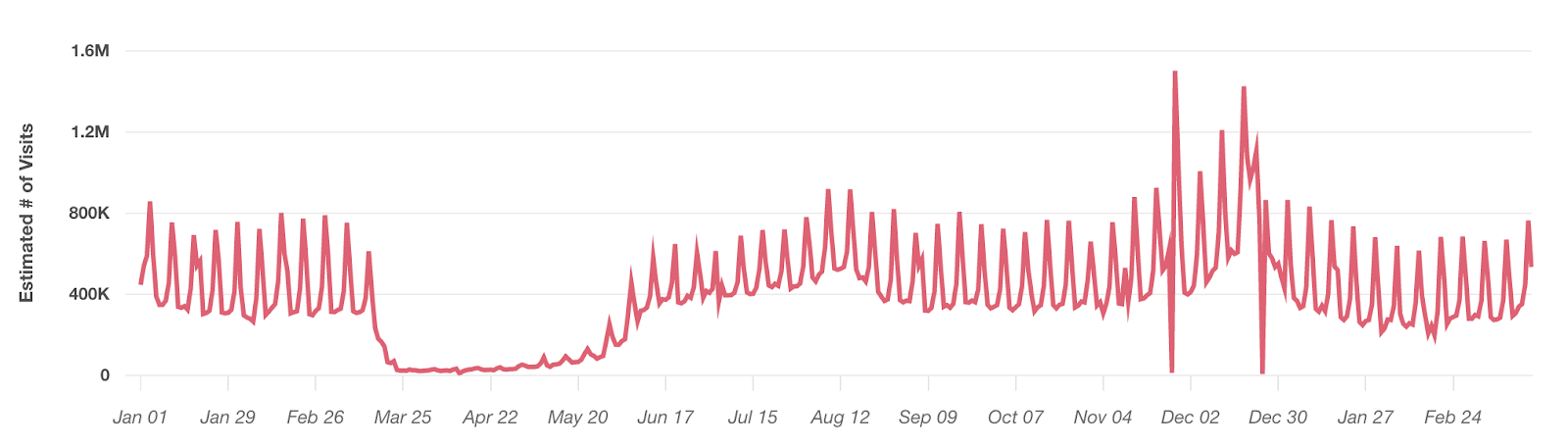

There were fairly widespread concerns just a few years ago that Bed Bath & Beyond’s long-term prospects were anything but rosy. But, the brand saw a strong year that was only expected by a handful of observers. And it looks like that strength could continue into 2021. After seeing visits decline steadily week over week following a peak in mid-December, visits began to steadily rise again after a wave of inclement weather that hit across the US in late January and early February. By the week beginning March 15th, visits had risen 15.1% week over week.

And this was a significant jump driven by an especially strong Saturday that was in line with Saturday traffic from pre-pandemic weeks in 2021. The result is a brand that could see a bright period in the coming months as home furnishings continues to outperform as a category.

Conn’s – The Perfect Combination?

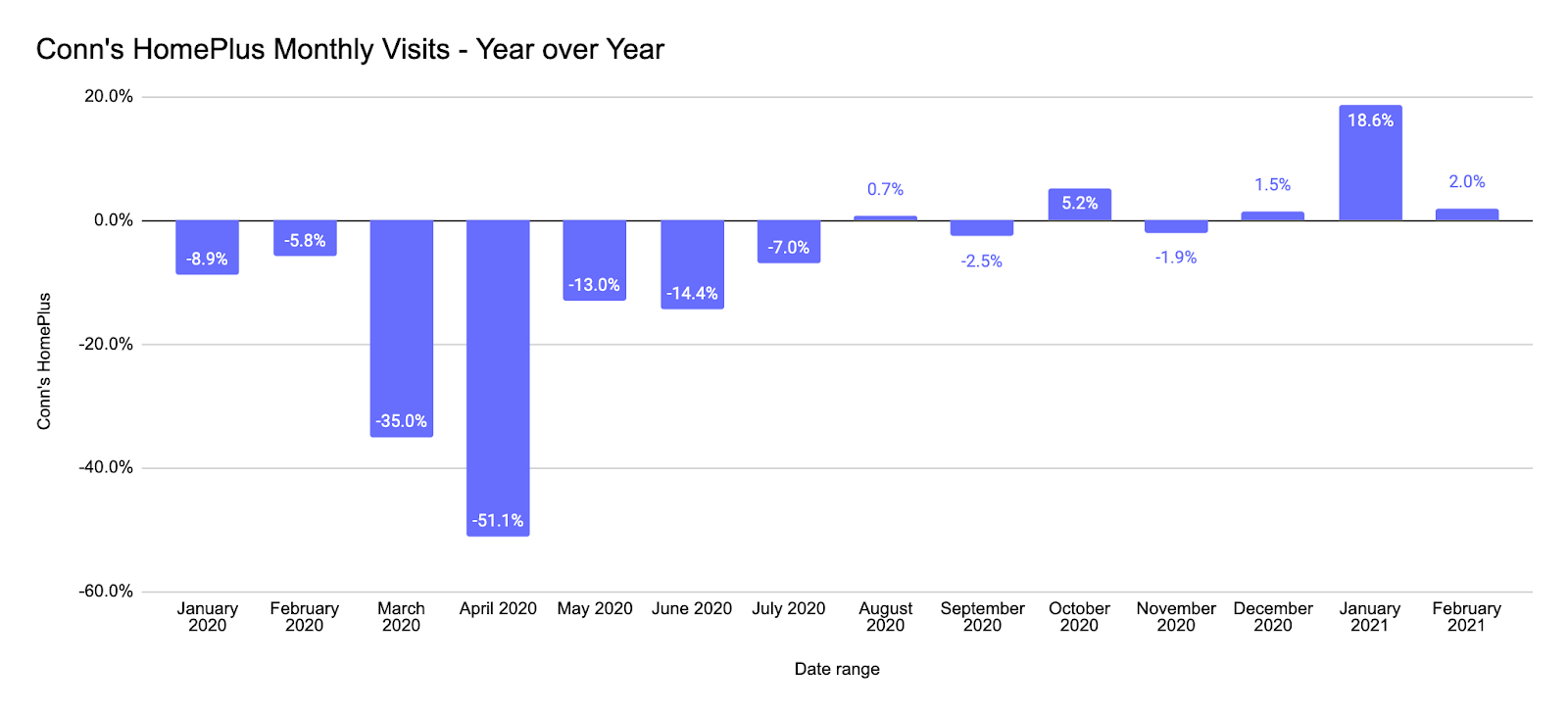

Another brand that has benefitted from the home goods wave is Conn’s Home Plus, who has seen an added lift from its focus on electronics as well. The brand had a rougher start in 2020 with visits down 8.9% and 5.8% year over year in January and February respectively. Yet, the pandemic seems to have driven a reset that has propelled the brand forward. Visits rose consistently closer to ‘normal’ levels during the recovery and the brand has seen year-over-year visit growth four of the last five months, including visit jumps of 1.5%, 18.6%, and 2.0% in December, January, and February respectively.

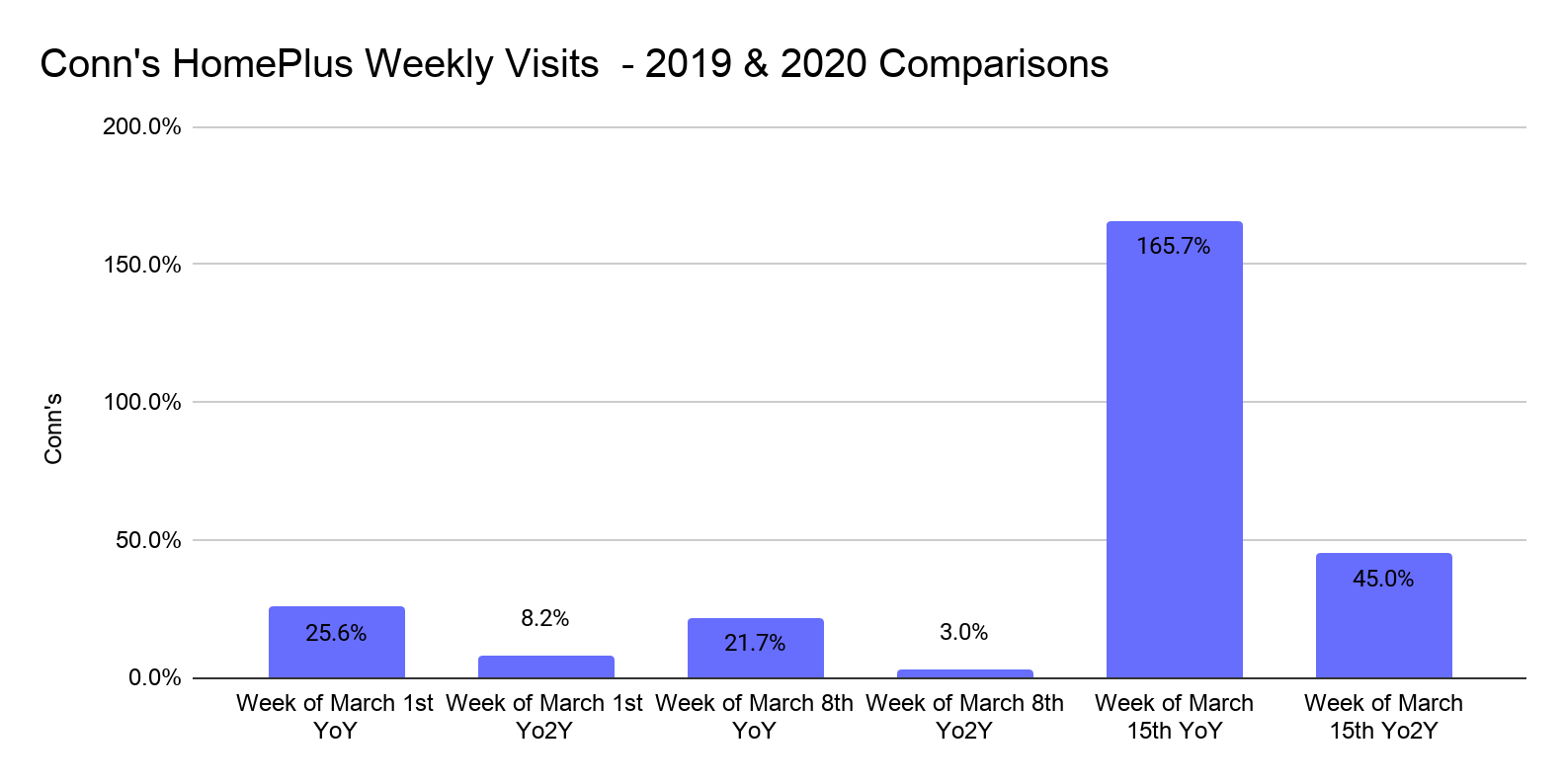

And the pace seems to be increasing with weekly visits up significantly year over year in early March. Even when looking to account for the challenges of 2020, the brand’s visit comparisons with 2019 were also very strong. Visits the weeks beginning March 1st, 8th and 15th were up 8.2%, 3.0%, and 45.0% when compared to the equivalent weeks in 2019.

Is Amazon Fresh the Next Big Move?

When analyzing the launches of Amazon Fresh locations there is a clear notion that the brand is focused on competing against traditional grocery chains. Whereas Amazon’s first foray into grocery was focused on a more niche and high-end brand like Whole Foods, the recent launches indicate that the company sees a wider and complementary market opportunity in becoming a more traditional player.

Looking at five locations in California, Ralphs is the number one competitor with an average cross-shopping rate of 75.3% among those customers for the period from January 1st, 2021 through February 25th. Interestingly, Trader Joe’s was the clear number two, followed by Vons, Whole Foods, and Sprouts.

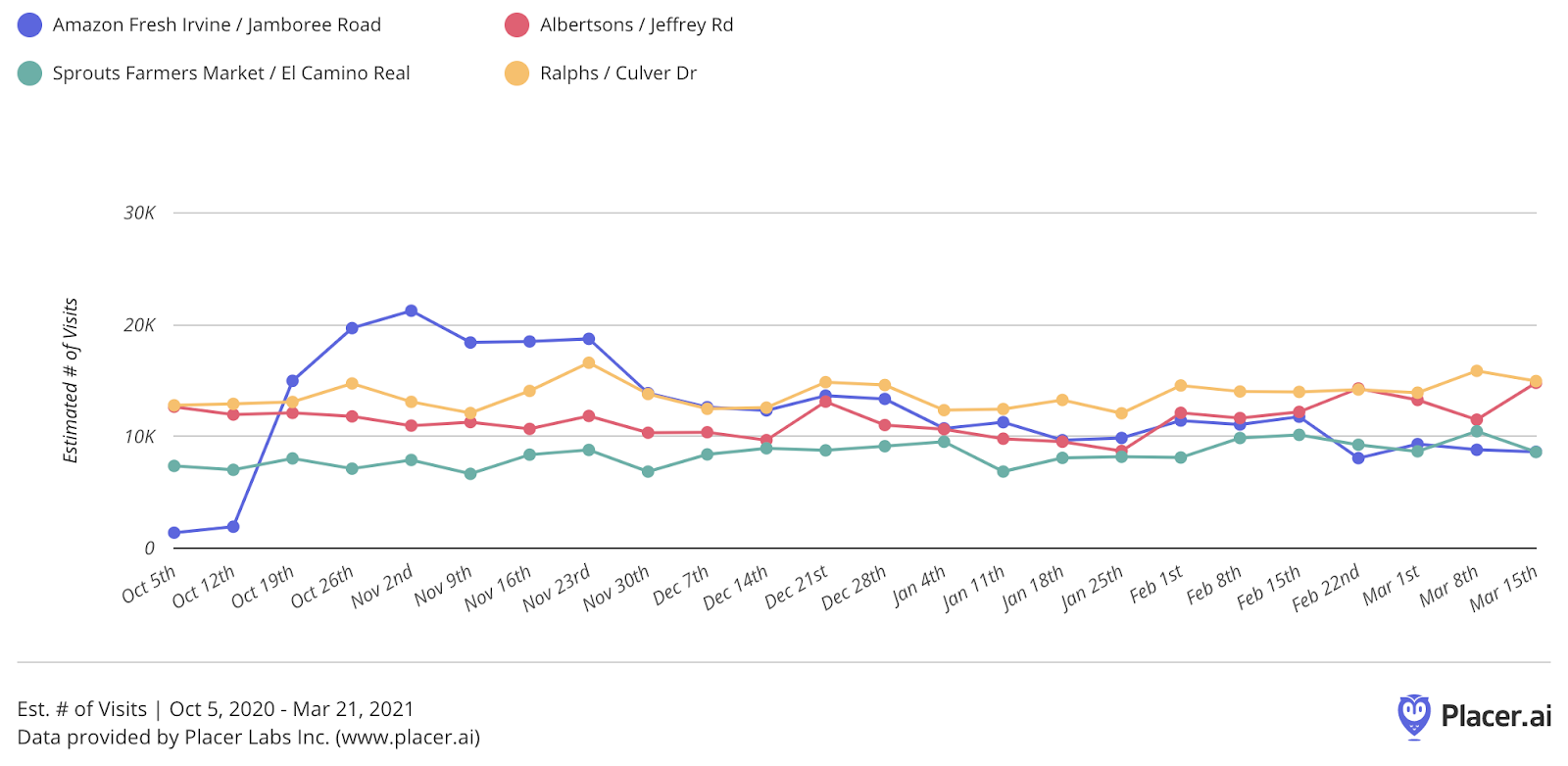

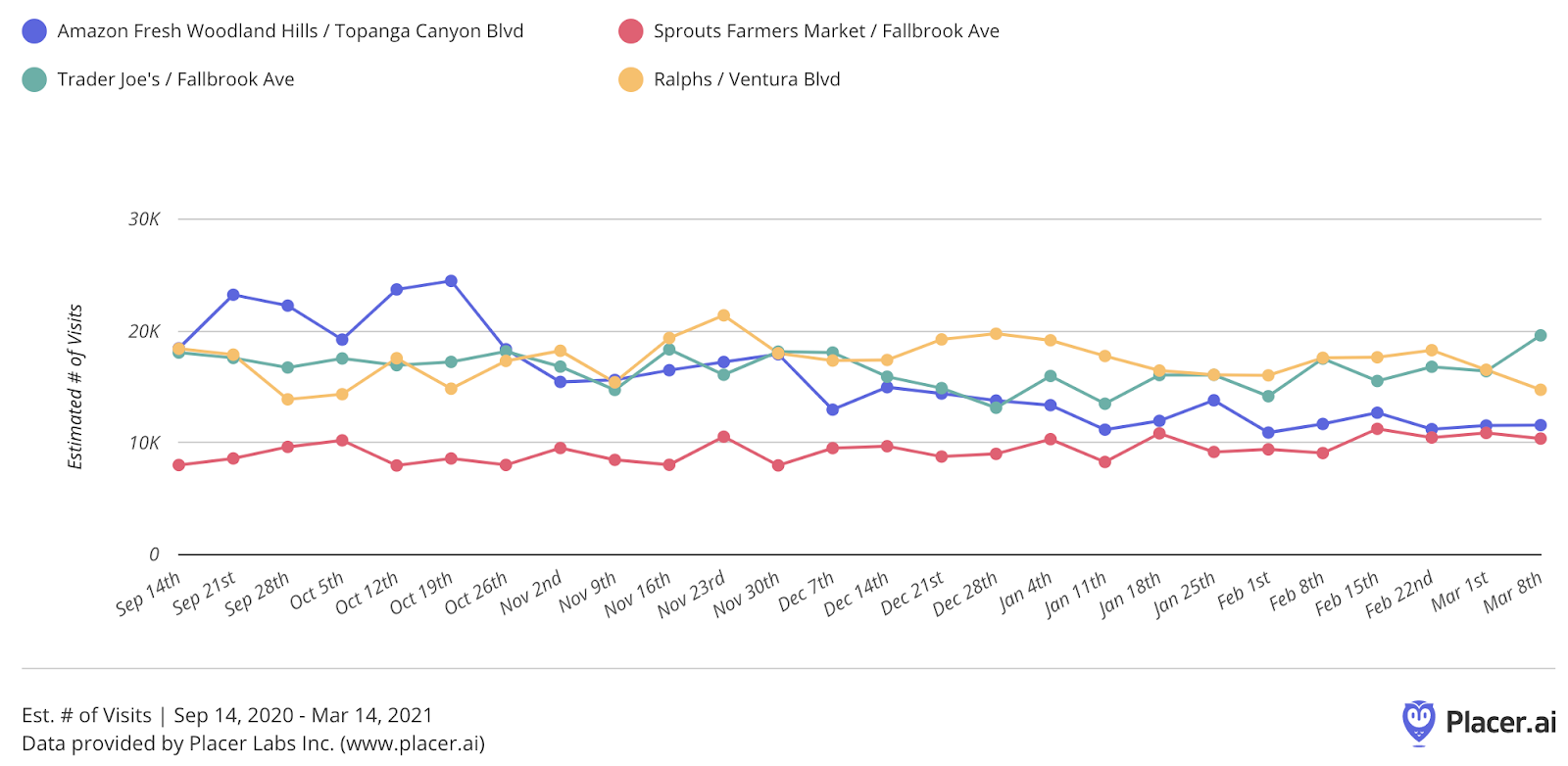

When considering the contextual performance of a few locations that have been around relatively longer, a similar pattern emerges around these launches. The locations drive an initial surge of visits that puts them far above competitors before the visit trends level out and the locations become part of the wider grocery mix. While they are not the top performers in either of these areas, they are still showing strong numbers that are on par with other top-tier California supermarket chains. The real question that will only be answered over time is whether these locations will be seen as the ‘main’ grocery option for a significant audience, or whether they will be perceived as a piece of a wider mix.

Will Bed Bath & Beyond, and Conn’s continue to thrive? Will Amazon’s latest foray into grocery prove to be its most successful?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.