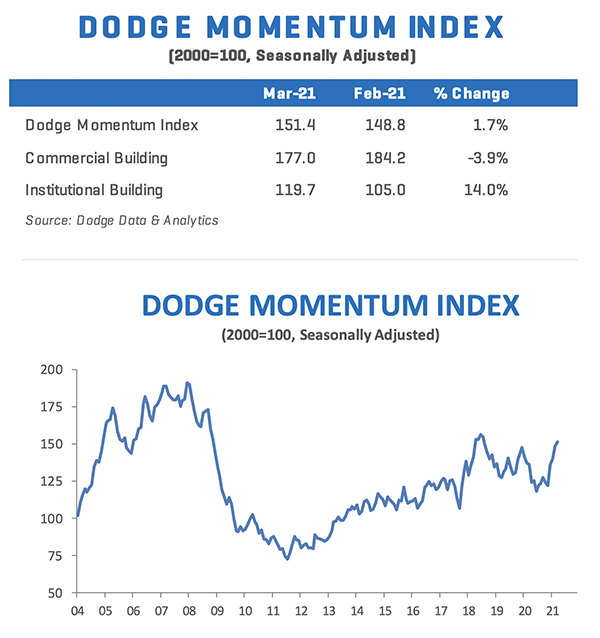

The Dodge Momentum Index moved 1.7% higher in March to 151.4 (2000=100) from the revised February reading of 148.8. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. According to the March data, the Index hit its highest level since the summer of 2018 as a result of an increase in institutional projects that entered the planning stage, and which came on the heels of a similar gain for the sector in February.

Overall, the Momentum Index for March 2021 was up 11% in total versus March 2020. While healthcare and lab projects continue to dominate institutional planning, March saw a more broad-based selection of project types including education and recreation buildings. Institutional building construction rose 14.0% from February, while year-over-year comparisons showed a 10% increase for the sector. Commercial construction, however, dipped 3.9% for the month due to a slight pullback in warehouse activity that other commercial projects could not make up for, though the sector showed a 12% increase from March 2020 in year-over-year comparisons.

There were 16 projects with a value of $100 million or more that entered planning within March. The leading commercial projects were a $400 million Facebook Data Center in Springfield NE and a $350 million warehouse project in Shreveport LA. The leading institutional projects were the $200 million Warhorse Casino in Lincoln NE and the $163 million Inland Valley Medical Center in Wildomar CA.

Based on this data, March may signify that the public side of building construction is beginning to stabilize following the COVID-19 led pressure on state and local budgets and suggests a pickup in construction starts may occur as 2021 progresses.

MARCH 2021 DODGE MOMENTUM INDEX

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.