With 2020 behind us and signs of recovery abound, we checked back in on the travel industry to see how it’s been rebounding thus far and what 2021 could have in store for hotels and airports.

Year-Over-Year Comparison

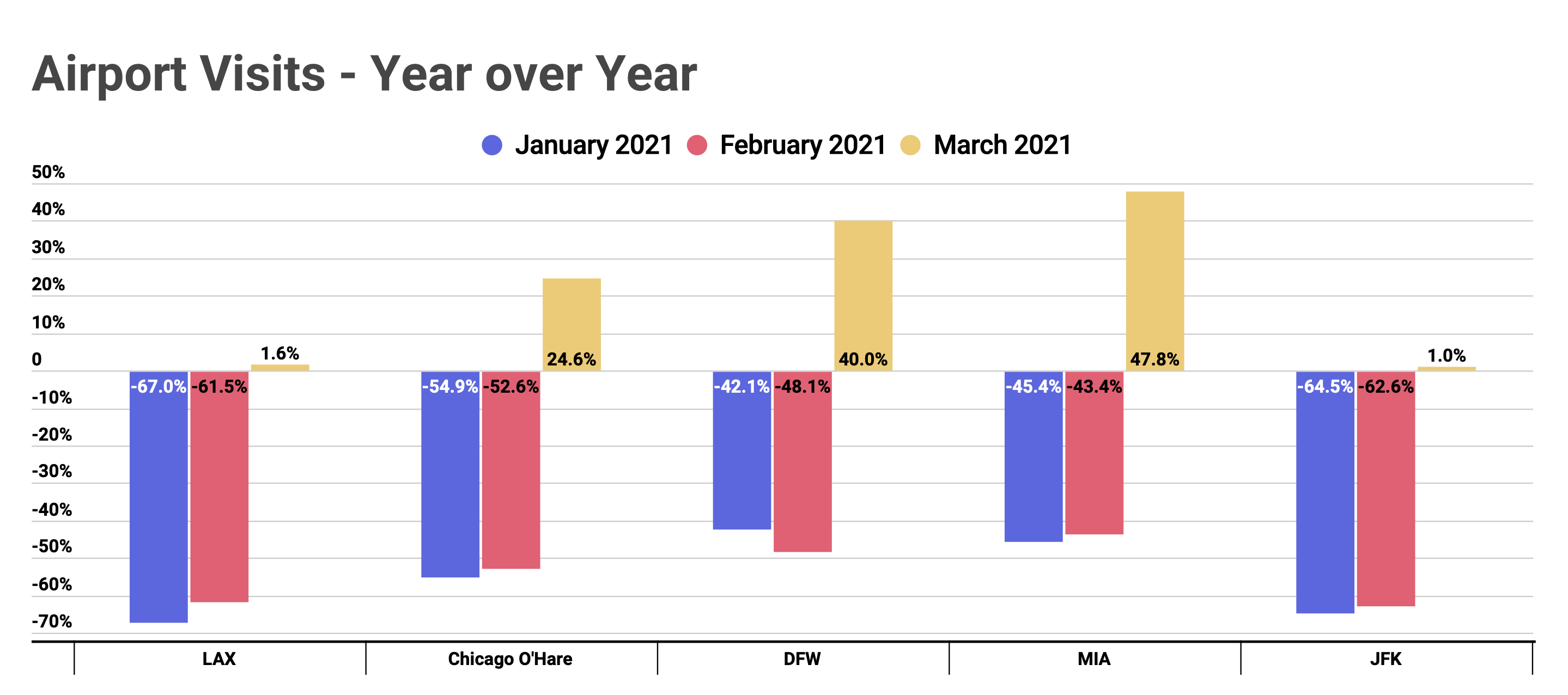

Last time we checked in, visits to airports were rebounding at the end of the year following the holidays, and that progress continued into 2021. Almost every airport showed year-over-year growth from the end of 2020 into the new year. Only DFW airport in Dallas showed an increase in the year-over-year gap between January and February – likely because of the unprecedented weather the state experienced at the beginning of the new year.

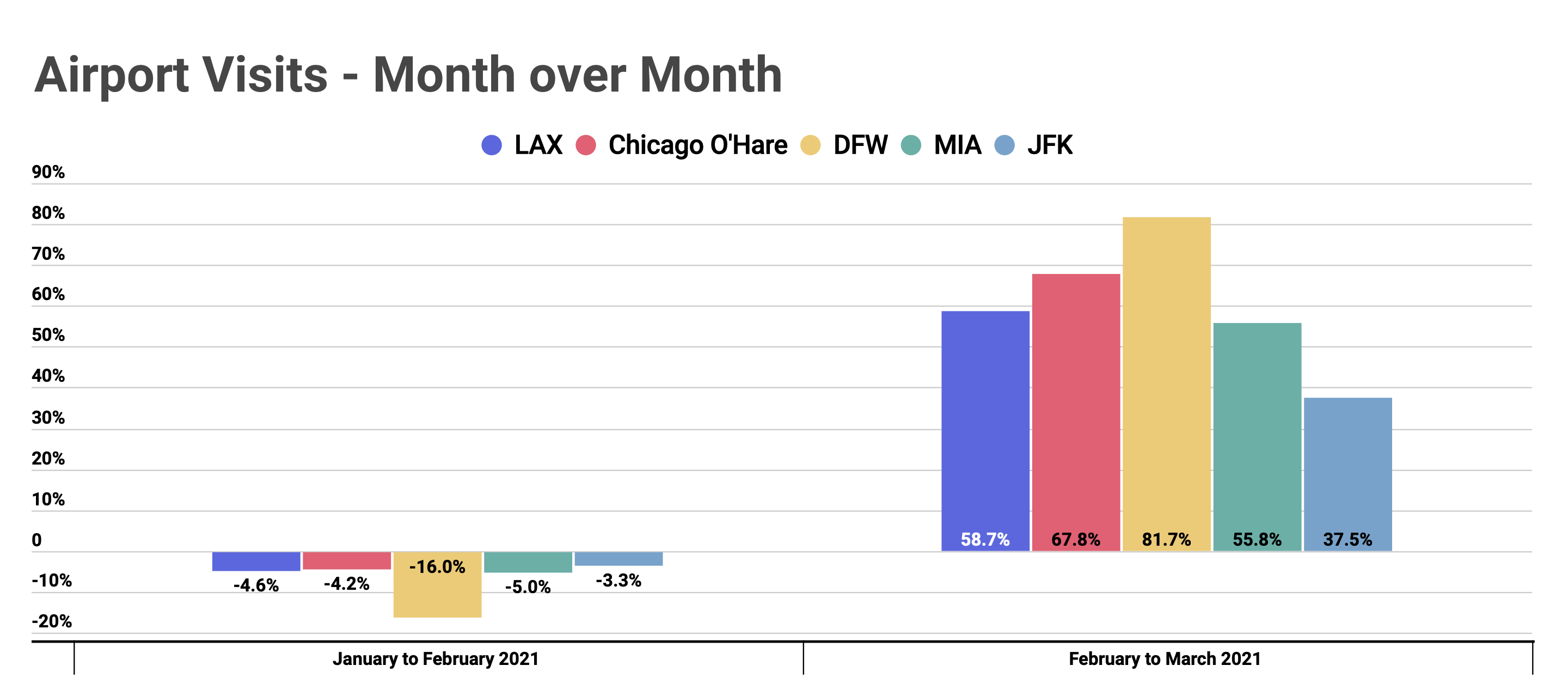

And while March data is obviously skewed because of the pandemic-driven restrictions from 2020, airport traffic also showed impressive month-over-month growth in the new year. Visits from January to February 2021 showed only a minor dip – a relative success considering the weather issues in February and the fewer number of overall days. And then visits grew exponentially from February to March, with all airports hitting new heights. DFW showed the highest month-over-month growth with 81.7%, followed by O’Hare and LAX with 67.8% and 58.7% growth respectively.

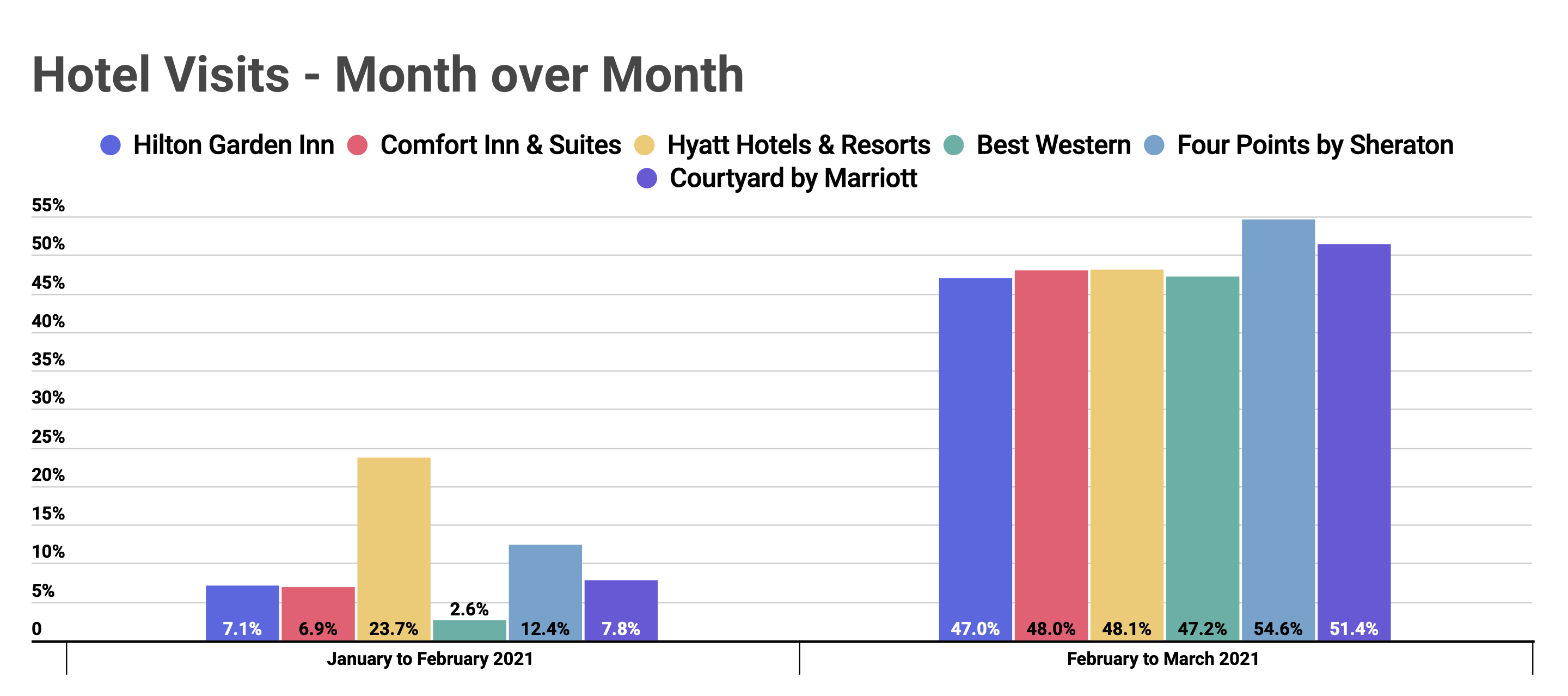

And, month-over-month for hotels showed just how strong consumer demand is becoming. Traffic was already up between January and February for all hotels analyzed even though February was affected by severe weather and had fewer overall days. And, visits grew even stronger into the spring with traffic soaring in March month over month.

The sudden and dramatic increases in traffic may seem obvious with the country lifting almost all travel restrictions now. The final weeks of March only prove that narrative further with traffic for both airports and hotels showing tremendous year-over-year growth for the end of the month.

A More Effective Comparison

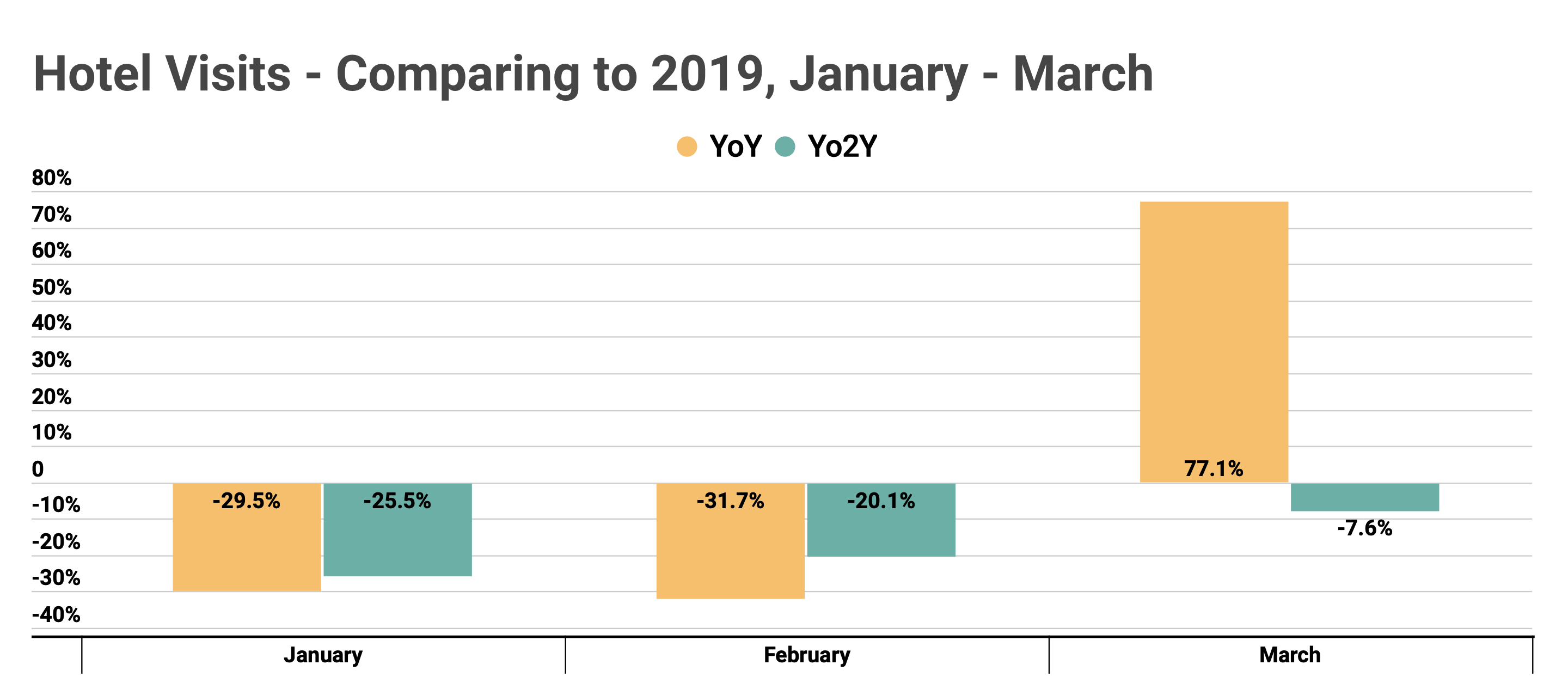

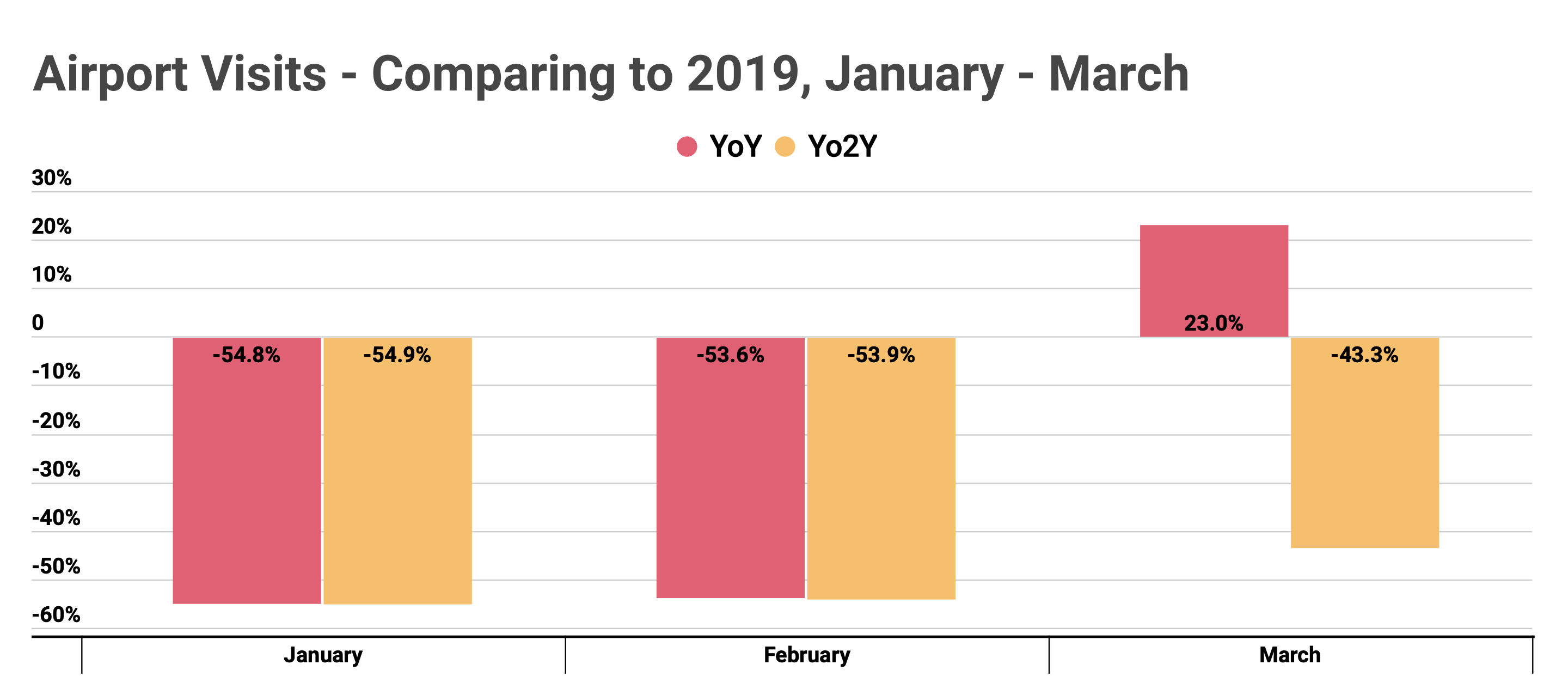

Given the unconventional circumstances the travel industry faced, we also took a closer look at a more effective comparison, by comparing 2021 numbers to the equivalent periods in 2019.

When looking at the hotel industry, the year-over-year visits gap was 29.5% and 31.7% down in January and February respectively, and 77.1% up in March. Yet, the March numbers are skewed by the pandemic’s initial wave of closures. Looking at 2021 numbers from January, February and March compared to 2019 provides a much more accurate picture of the progress taking place. While visits were down 25.5% and 20.1% in January and February compared to the same months in 2019, by March that gap had shrunk to just 7.6%. This indicates a very powerful recovery that could bring this sector back to a degree of normalcy by Q2.

When doing the same comparison for the airports, we see a similar pattern. Year-over-year growth was down 54.8% and 53.6% respectively in January and February, but of course traffic shot up in March to 23.0% up. When comparing this to January and February 2019 numbers, we see numbers that are almost identical, and March is where the significant step forward takes place.

So, while the effects of COVID are certainly lingering and will continue to have an impact on the overall industry, the declines are not nearly as bad as people may have thought.

Will the travel industry continue to rebound? If so, how strong will the growth be throughout 2021?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.