In this Placer Bytes, we dive into Disney’s theme park recovery and analyze whether to jump back on the Whole Foods or Trader Joe’s bandwagon.

Disney

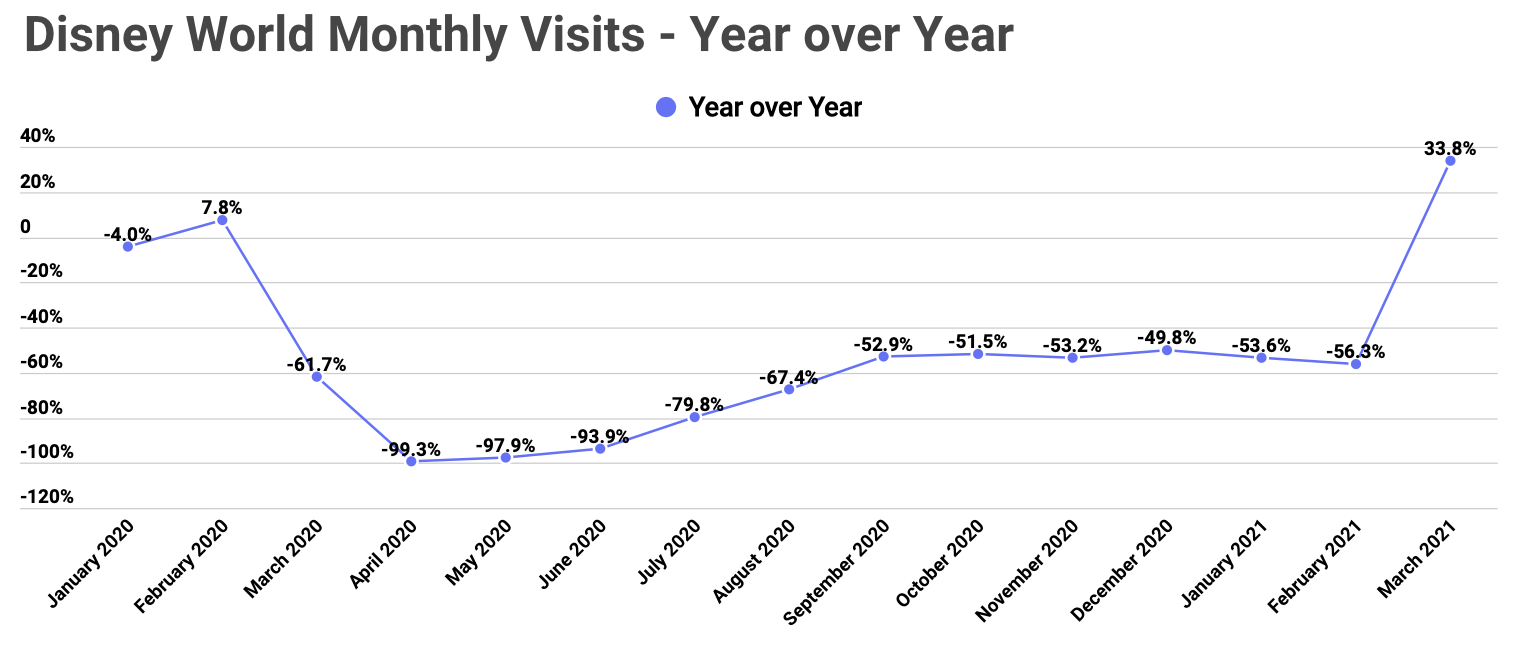

Disney World is back on the upswing after seeing visits in January and February down just 49.8% and 53.6% year over year, respectively. This is about the level the theme park had been at since the late summer. While visits were actually up 33.8% in March, the number is misleading because it is being compared to a month in 2020 that already saw COVID-related closures.

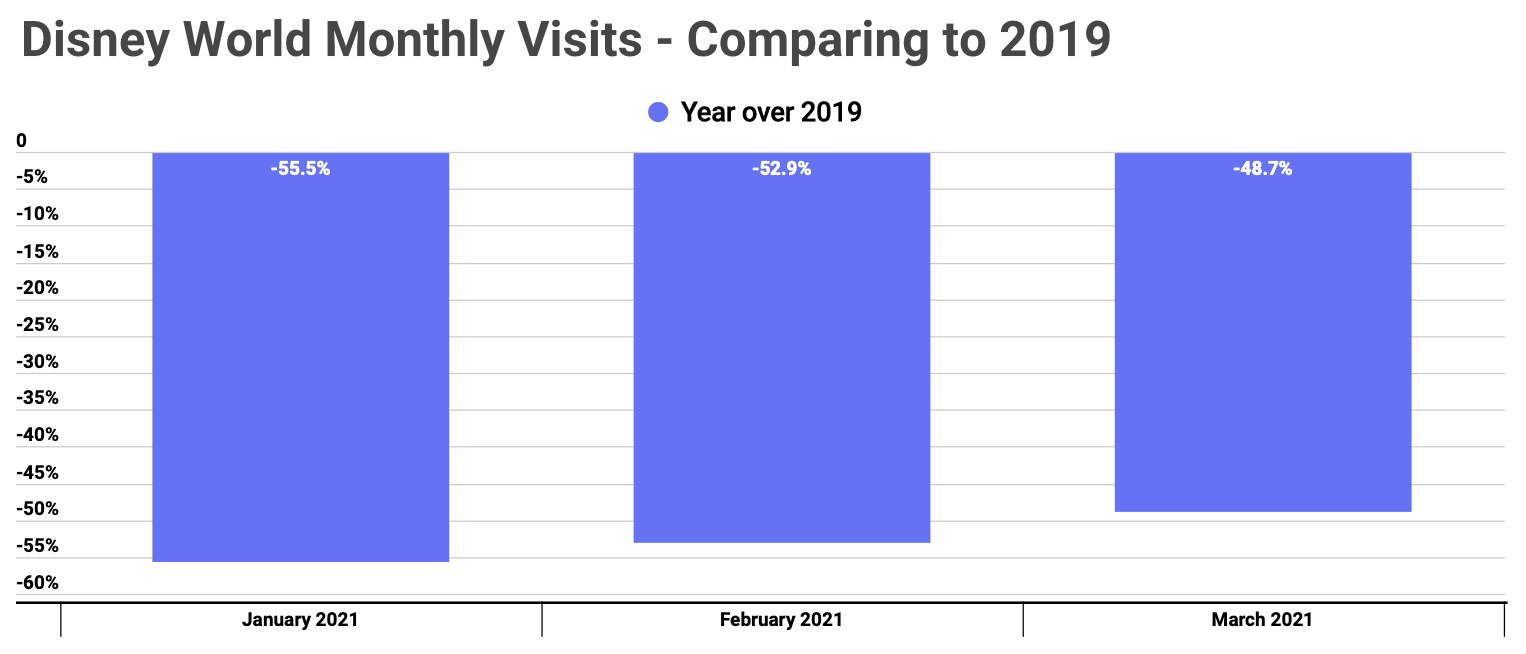

A better metric for measuring progress is comparing March 2021 visits to the same month in 2019 – the last true comparison that accounts for both COVID and seasonality. And there is clear growth here as well as visits improved throughout Q1 with the visit gap shrinking from 55.5% in January to 52.9% in February and just 48.7% in March when compared to the equivalent months in 2019. Even better, visits do appear to be continuing to trend back towards normalcy.

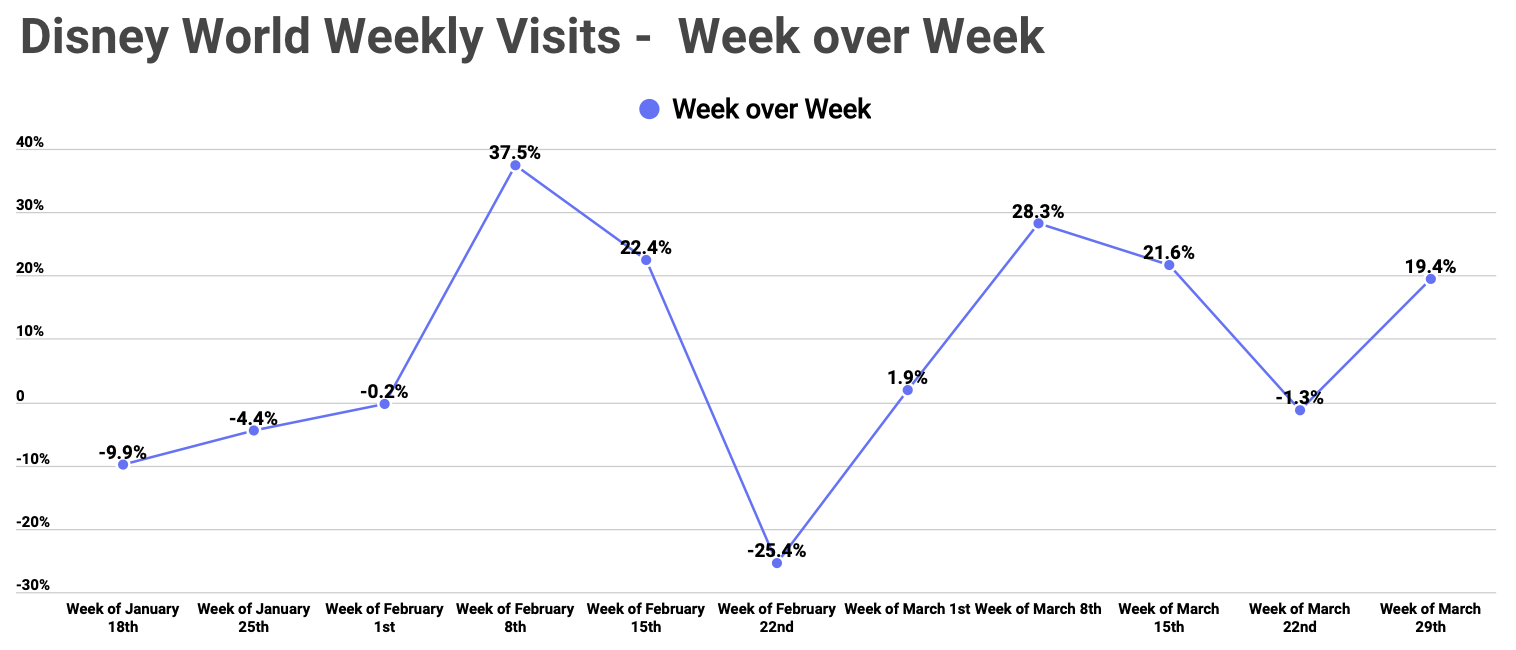

Looking at weekly visit growth week over week, shows a clear trend of improvement with visits growing consistently since the start of February. Including a 19.4% increase the week of March 29th showing that the increases were growing heading into April, a very strong sign in the months leading up to a critical summer period.

Grocery Comebacks

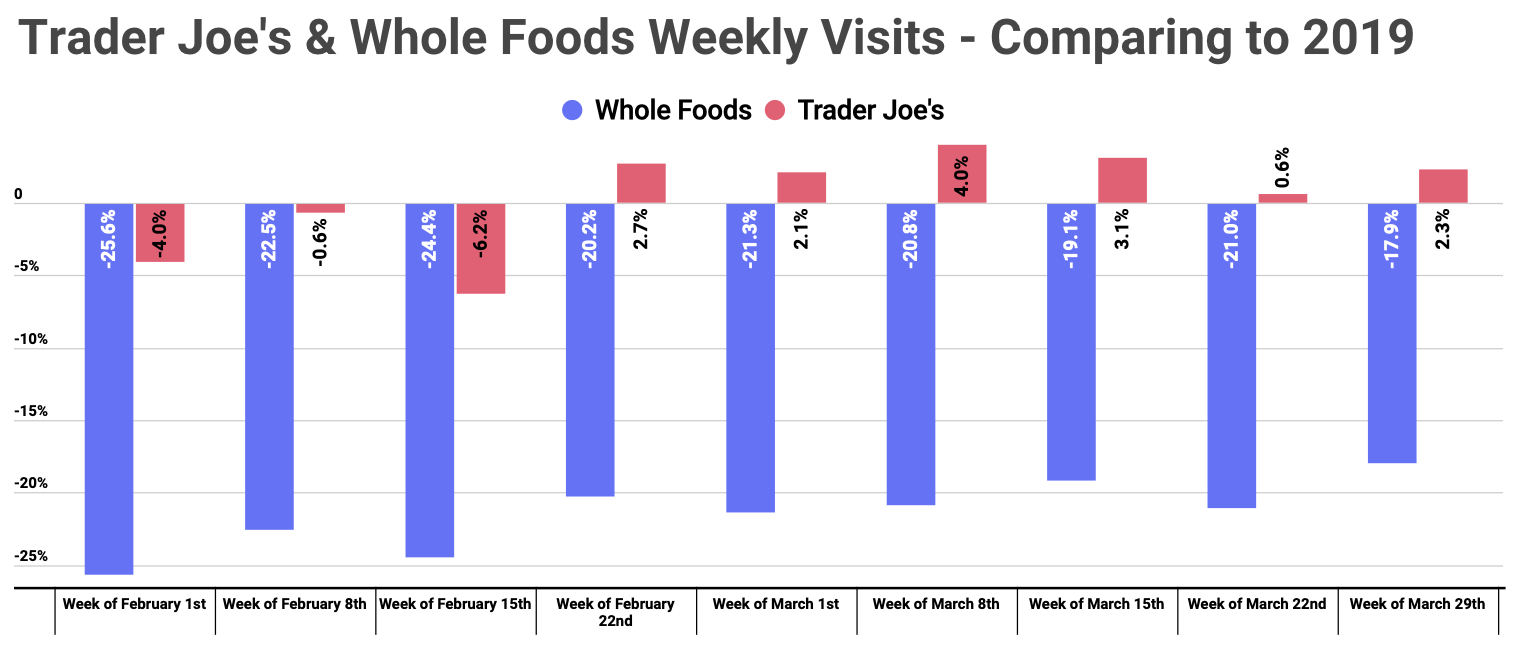

While a lot of attention has been given to overperforming grocery brands, there are several especially interesting cases among those who struggled. Whole Foods lagged behind the growth of other grocery leaders largely due to a misalignment of the brand’s strengths and the unique environment created by the pandemic. Trader Joe’s struggled significantly early in the pandemic but rebounded impressively as the recovery picked up steam.

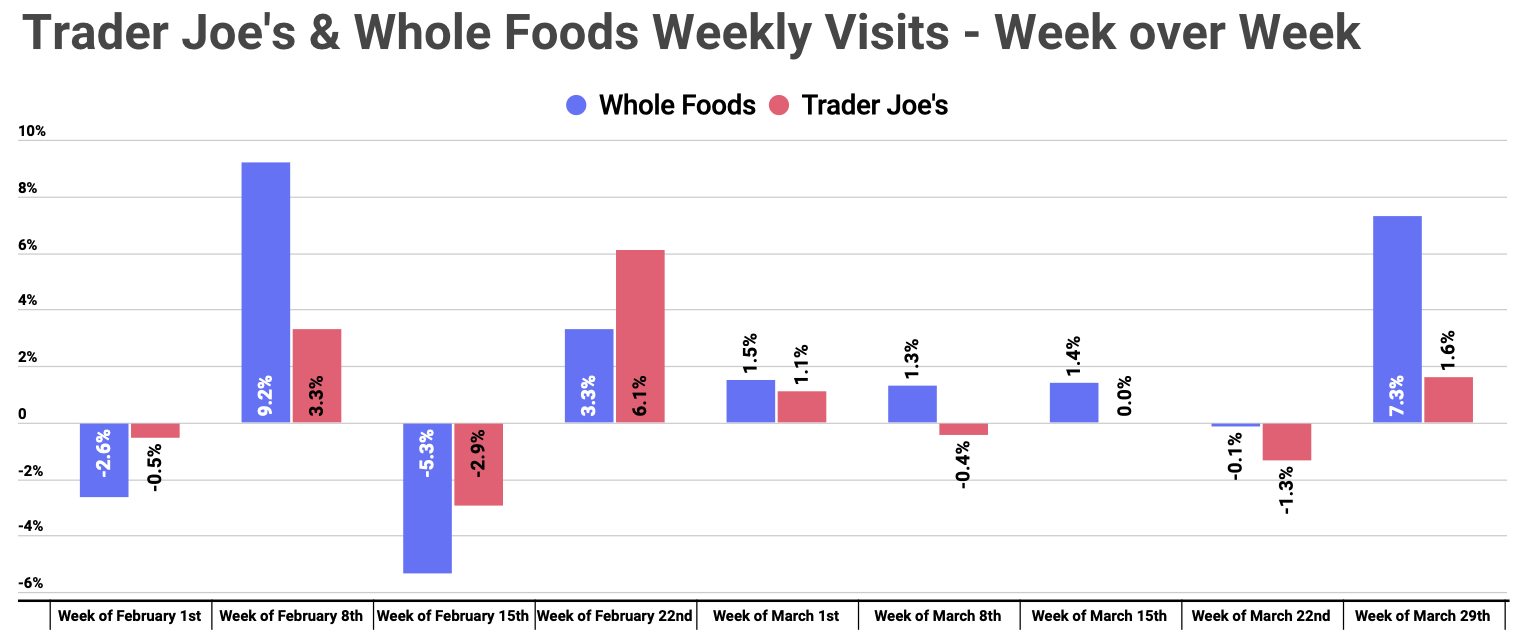

Looking at weekly visits from both compared to 2019 shows that in each case, their respective recoveries are picking up pace. Trader Joe’s has seen comparable visit growth over the equivalent weeks in 2019 every week since the week beginning February 22nd. On the other hand, Whole Foods has seen its visit gap consistently shrink with visits going from down 25.6% the week beginning February 1st to down just 17.9% the week beginning March 29th.

And while Trader Joe’s seems to have found its rhythm again, Whole Foods is also seeing consistent week-over-week visit increases, culminating in a 7.3% week-over-week jump the week of March 29th.

Will Disney visits continue to rise ahead of the summer? Will Whole Foods and Trader Joe’s continue their return to strength in the spring?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.