Admittedly, the athleisure and athletic wear space was one where we expected to see a rapid and significant recovery. Yet, the magnitude and speed of the recovery deserve extra note because many of the brands that headline the sector are facing significant challenges that make the success all the more impressive.

While sweatpants as work clothes may have picked up pace, the locations of many of these brands are mall or city based, making the wider recovery context more challenging. Yet, they recovered.

Where the Sector Stands

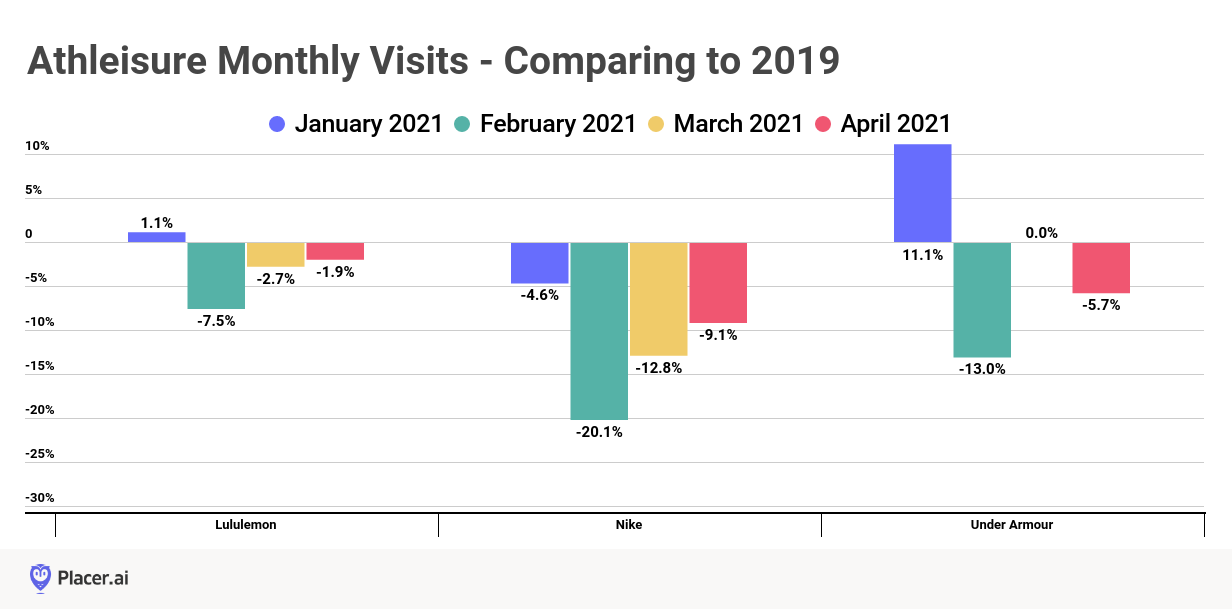

Comparing monthly visits in 2021 to the last normal retail period in 2019, shows that visits are trending in a very positive direction. In spite of significant growth in online shopping, visits to the brands measured are drawing impressively close to 2019 levels. Visits to Nike in April were down just 9.1% and to Under Armour down just 5.7%. Lululemon had an even tighter visit gap with April visits down just 1.9% compared to the equivalent month in 2019.

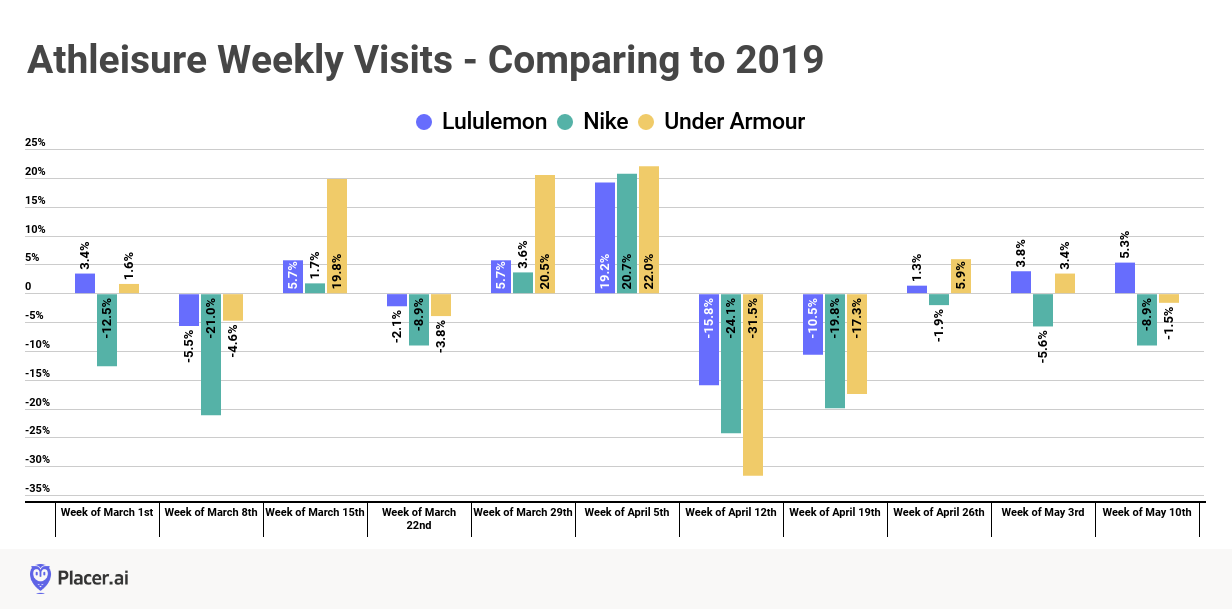

And the pace appears to be picking up. The weeks of April 26th, May 3rd and May 10th, Lululemon saw visit growth of 1.3%, 3.8% and 5.3% respectively compared to the equivalent weeks in 2019. Nike and Under Armour also saw relative strength with those weeks either showing limited declines or even growth.

Stars Aligning for Greater Growth?

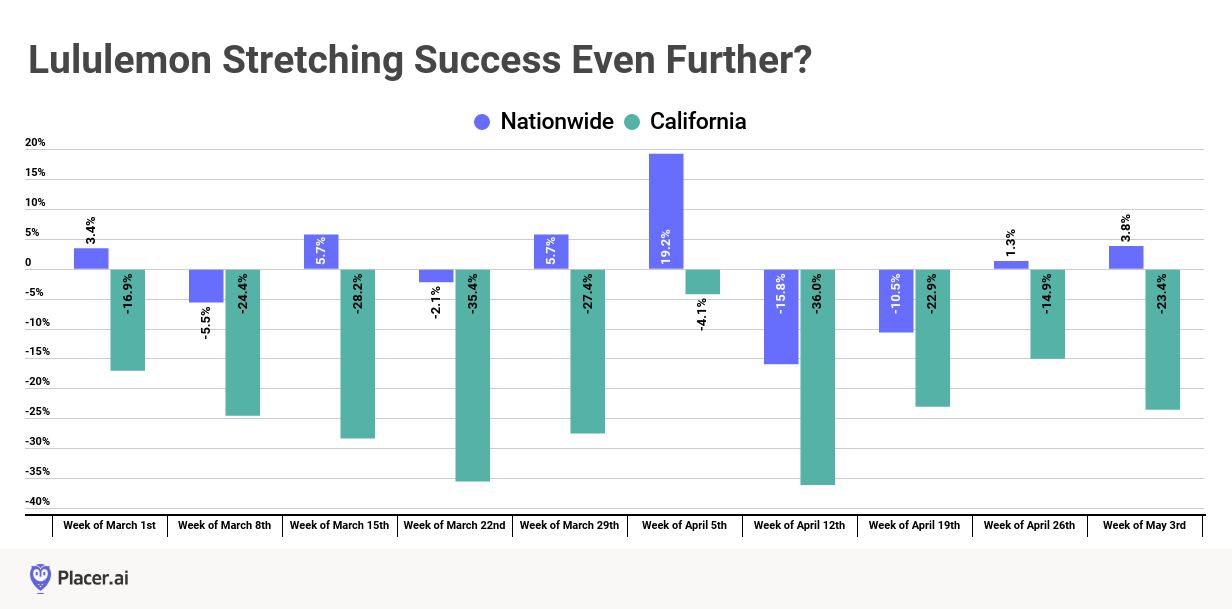

But the current success seems to be a precursor to even greater opportunities on the horizon. Lululemon, while seeing success, is still trailing far behind those nationwide numbers in key states like California. The continued reopening of the retail ecosystem in those states should only serve to add more fuel to the retail recovery fire.

Key Takeaways for the Sector

The result is a very clear expectation that the sector and its leading brands could be in for a very strong period offline in the near term. Why? A combination of several key factors.

First, the sector has momentum with strong surges pre and post closures turning into sustained strength in the most recent recovery period. The clear affinity that consumers have for these products is driving offline visits in a period where these same brands are actively working to expand their offline presence – a winning combination.

The second factor working in their favor is the wider phase of re-openings taking place across the country. While these brands have performed well even under the current circumstances, greater reopenings in key states like California and New York alongside growing traffic to malls and urban retail centers will only push the sector further.

The final factor likely to drive continued success is the key alignment these brands are enjoying with major trends. The push for owned retail, a greater shift to less formal apparel and even a growing appreciation for health and wellness should all give the sector an added boost in the coming months.

Will athleisure continue to outperform?

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.