Ad-supported streaming (AVOD) is a $11 billion business that doesn’t have a standard approach for ad purchasing.

Confusing processes lead to slow revenue growth. Meanwhile, Hulu’s gross revenue continues climbing.

Hulu is succeeding in the messy, crowded AVOD world and has much to teach. Which advertisers are buying from Hulu that could mean opportunity for you?

Hulu tests new ad tech to stay ahead of the curve

Hulu has been the leader of the pack in ad-supported TV-streaming for years. And even though their market has become increasingly crowded, Hulu’s years of experience gives it the advantage to build out better advertising experiences for ad buyers and consumers.

Part of Hulu’s approach to advertising takes advantage of “shoppable inventory,” enabling viewers to interact with QR codes, email and push notifications. This ‘Gateway Go’ platform increases audience engagement three fold compared to other interactive inventory, according to Hulu.

Hulu is experimenting with this type of advertising within its original content in addition to advertisement placements.

Hulu also lowers the barrier to entry for advertisers. Last year Hulu began testing Hulu Ad Manager. With this platform, small businesses can buy ads in a self-serve fashion and with only a $500 minimum spend.

For upfront purchases, minimum spend is in the thousand to tens of thousands range.

“One of the things we’ve heard is it’s really difficult to advertise on TV or too expensive. We thought this would be a great way to help change that,” said Faye Trapani, director of self-service platform sales at Hulu. Going after a Facebook and Google approach, Hulu is beginning to enable small advertising buys in local markets.

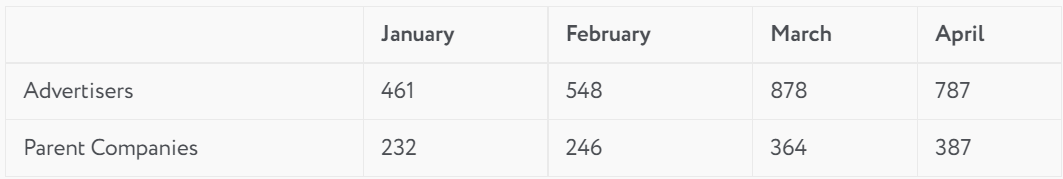

Even though the barrier to entry is lower compared to other streaming services, national brands still make up Hulu’s top spenders. We’ve been tracking Hulu advertising trends since January and have found that, in several ways, advertising buyers and categories remain stable on the platform.

MediaRadar Insights

Overall advertising on Hulu during April was slightly down from March, but well above the first two months of the year.

Hulu Top 10 Advertisers:

Nutrish is a premium dog food while Power for Tomorrow is a think tank for regulation in the energy market. Although it doesn’t say it explicitly, it seems like it’s a response to the Texas power outages in February.

* These brands were still present on Hulu in April but at much lower spending levels.

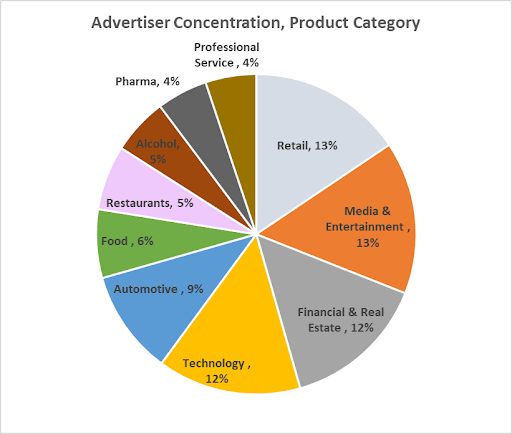

Key Advertising Product Categories

Methodology:

MediaRadar tracks Hulu’s subscription on-demand service. We look at ads through the day and night, seven days a week on Hulu’s Tier $5.99/month service. The company has said this represents ~70% of subscribers.

MediaRadar captures advertising using a panel of male and female users across different age groups. Ad tracking started on Jan 1, 2021.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.