In this Placer Bytes, we dive into the recovery of Disney World and convenience stores to see if dropping COVID rates and returning routines drove a needed boost.

Disney on the Rise

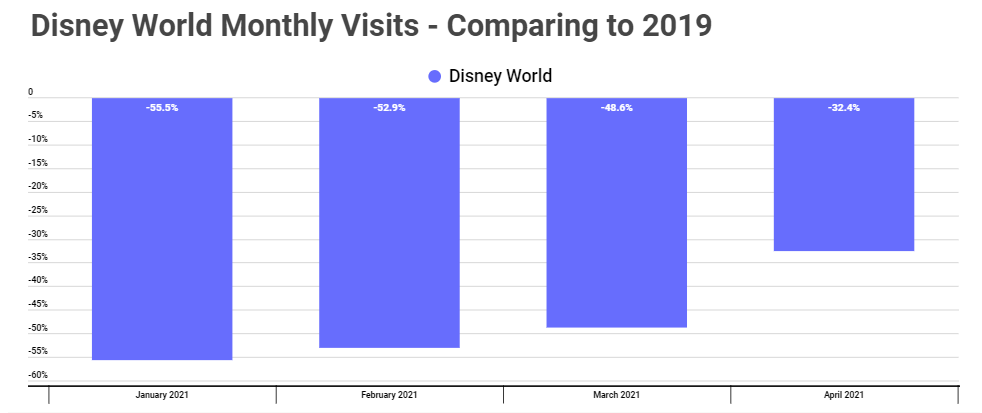

When we last looked at Disney World, a compelling recovery story was beginning to unfold. While the recovery had been happening, albeit slowly, since the reopening of the park last summer, the spring gave visits a needed boost. Visits were down just 48.6% in March when compared to the equivalent month in 2019, but in April that gap had dropped significantly to just 32.4%.

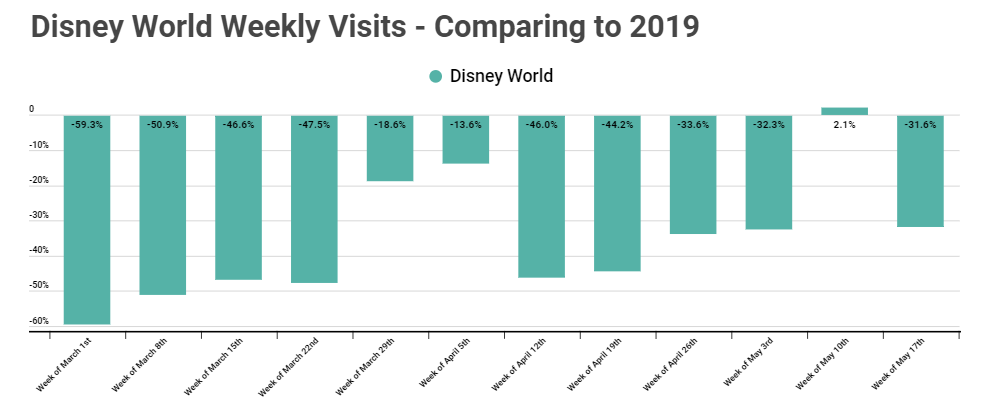

And the pace does not appear to be slacking. Weekly visits in May were largely in line with the new April standard, with the week of May 10th actually showing growth when compared to the equivalent week in 2019. The ability to drive surges, like those seen in April in May is very significant heading into a critical summer period that should help the park ‘normalize’ further. Should domestic travel increasingly open, the potential for a major surge at Disney parks is significant, especially considering the continuation of international travel limitations.

Returning Routines Buoy Convenience

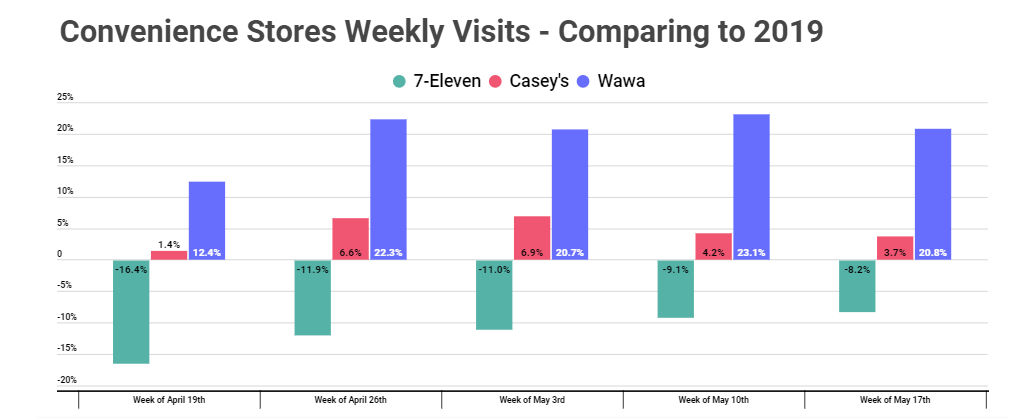

Few sectors are as dependent on normal work and school routines like convenience stores. The ability to stop into a 7-Eleven on the way to work, or a Wawa’s on the way back from school is a significant business driver for these brands. And it does appear that the return of routines is driving a recovery for these locations.

7-Eleven saw visits down just 8.2% the week of May 17th while Casey’s and Wawa saw visit growth of 3.7% and 20.8% when comparing weekly visits to the equivalent week in 2019. As commutes and routines increasingly return, there may be no sector better positioned to enjoy a surge than convenience store leaders.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.