Brazil has become increasingly reliant on the internet for banking, business, telecommunication and leisure during the COVID-19 pandemic. However, the country ranked 49th in the world for fixed broadband speed and 74th for mobile speed according to April 2021 data from the Speedtest Global Index™. In fact, Brazil’s fixed broadband speed has improved 69.2% year-over-year thanks to FTTH investments, moving the country up seven places from 56th in April 2020 to 49th in the Speedtest Global Index in April 2021. Brazil is on the brink of an internet revolution, with an upcoming 5G spectrum auction and future broadband investments becoming a priority. In this article, we examine fixed and mobile internet performance speeds, state-level performance, provider ratings and fastest providers, as well as city-level data on Brazil’s most populous cities to see which parts of the country are already enjoying faster speeds.

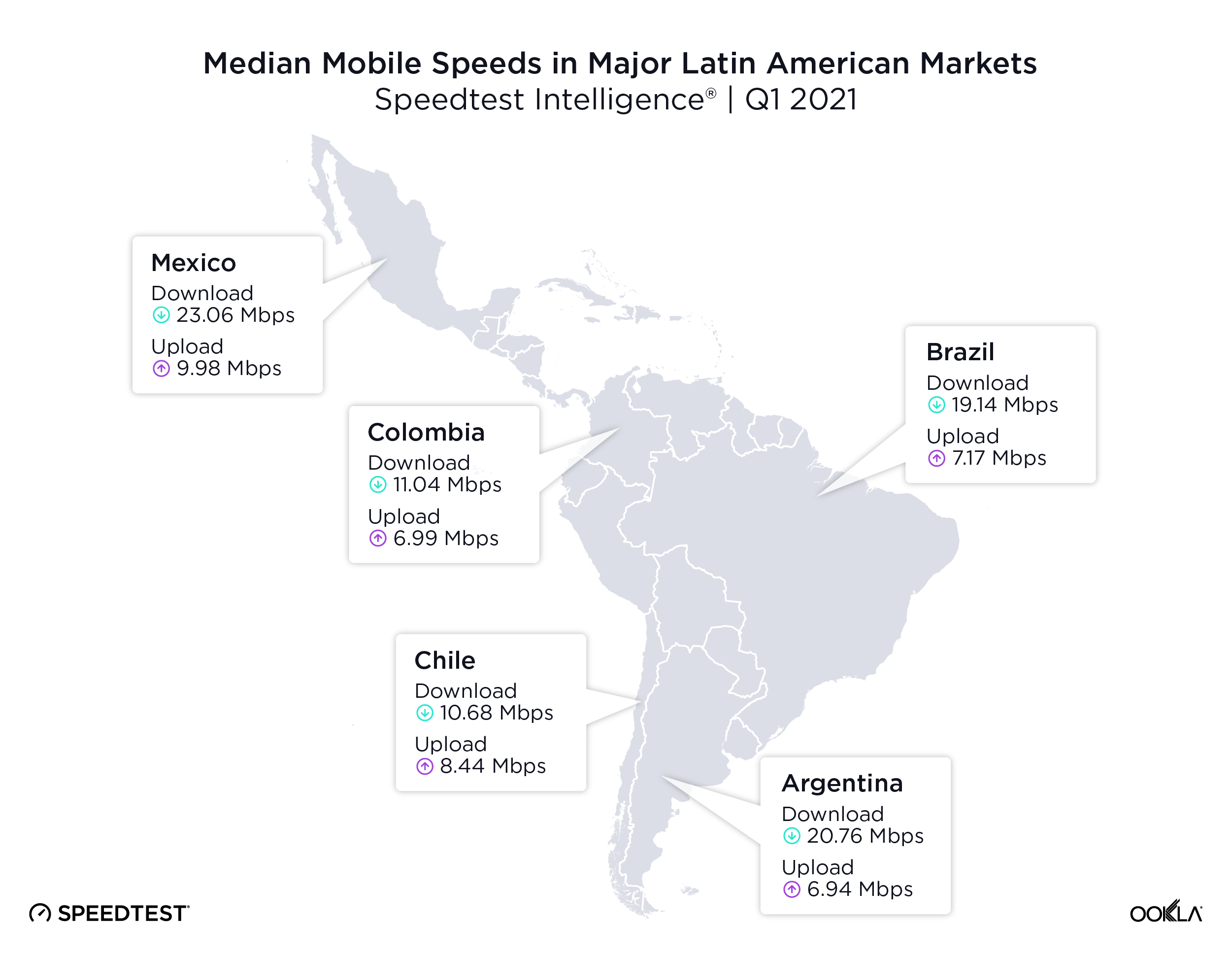

Brazil ranked third for mobile speeds among Latin America’s largest markets

Speedtest Intelligence® reveals Brazil ranked third for median mobile internet performance among major regional markets at 19.14 Mbps (download) and 7.17 Mbps (upload), Mexico was first on the list (23.08 Mbps download / 9.98 Mbps upload), Argentina second (20.76 Mbps download / 6.94 Mbps upload), Colombia fourth (11.04 Mbps download / 6.99 Mbps upload) and Chile fifth (10.60 Mbps download / 8.44 Mbps upload).

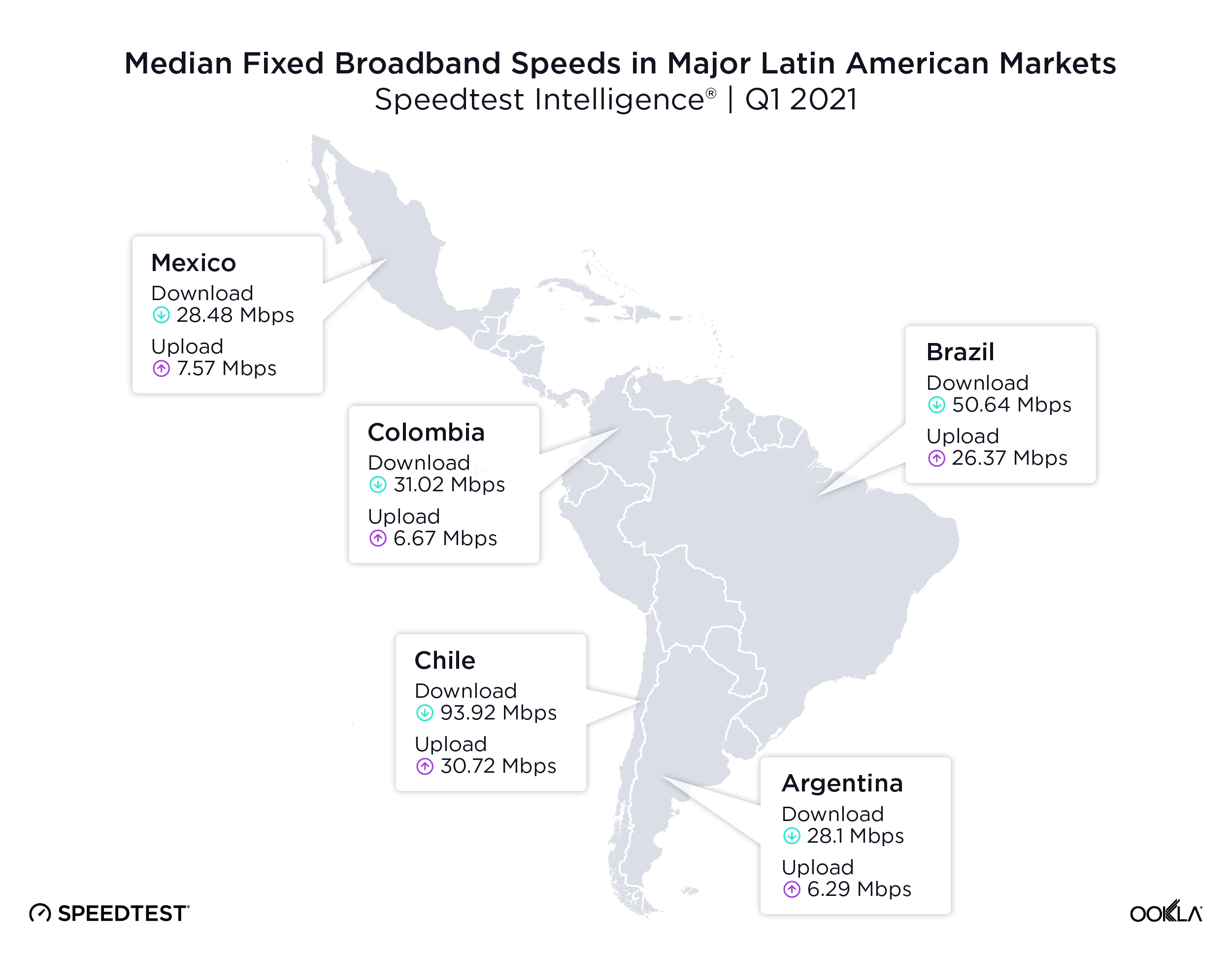

Brazil has the second fastest fixed broadband

Brazil was second only to Chile for median fixed broadband speeds among major Latin American markets during Q1 2021 according to Speedtest Intelligence. Chile showed speeds of 93.92 Mbps (download) and 30.72 Mbps (upload), and Brazil came in at 50.64 Mbps (download) and 26.37 Mbps (upload). Colombia was third (31.02 Mbps download / 6.67 Mbps upload), Mexico fourth (28.48 Mbps download / 7.57 Mbps upload) and Argentina fifth (28.10 Mbps download / 6.29 Mbps upload).

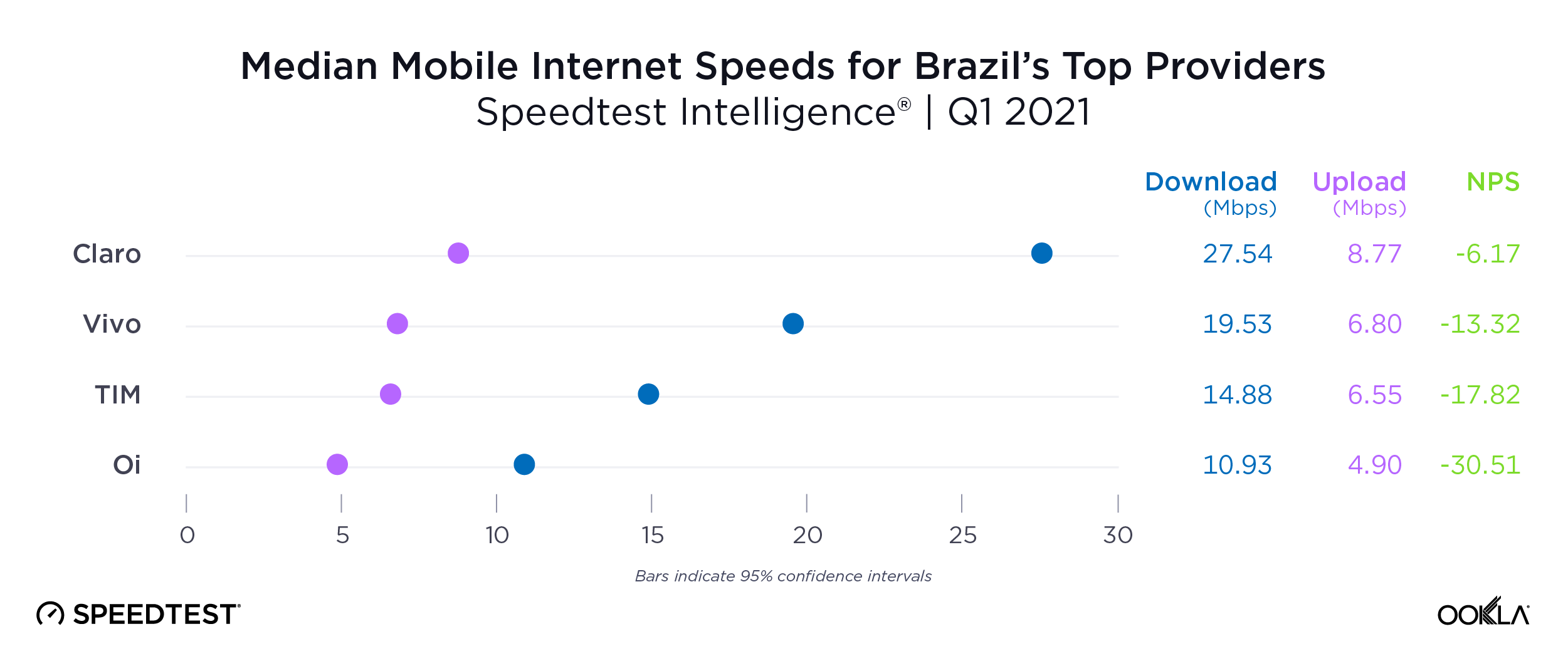

Brazil’s fastest mobile operator is far ahead of the competition

Claro had the fastest median mobile download and upload speeds

During Q1 2021, Claro had the fastest median mobile download and upload speeds in Brazil among top providers — an operator or ISP accounting for 3% or more of total test samples in the market for the entire period — at 27.54 Mbps (download) and 8.77 Mbps (upload). Vivo was second (19.53 Mbps download / 6.80 upload), TIM third (14.88 Mbps download / 6.55 Mbps upload) and Oi fourth (10.93 Mbps download / 4.90 Mbps upload).

We expect that Brazil’s mobile speeds will continue to accelerate as 5G technology becomes more accessible and network providers invest in more 5G deployments. An upcoming spectrum auction could improve 5G offerings for consumers and dramatically accelerate Brazilians’ mobile experience.

Network performance is often an important factor to a customer’s experience, but it’s not the only thing people take into consideration when evaluating their internet providers. We used Speedtest Consumer Sentiment™ data on five-star ratings and Net Promoter Score (NPS) to better understand how network performance impacts customer satisfaction in Brazil during Q1 2021.

According to Consumer Sentiment data, Brazil’s mobile network operators scored among consumers during Q1 2021: Claro had the best NPS score in Brazil at -6.17. Vivo was second (-13.32), TIM third (-17.82), and Oi fourth (-30.51). These scores happen to directly correspond to mobile performance among Brazil’s top providers, though there could be a host of other factors to account for in these scores.

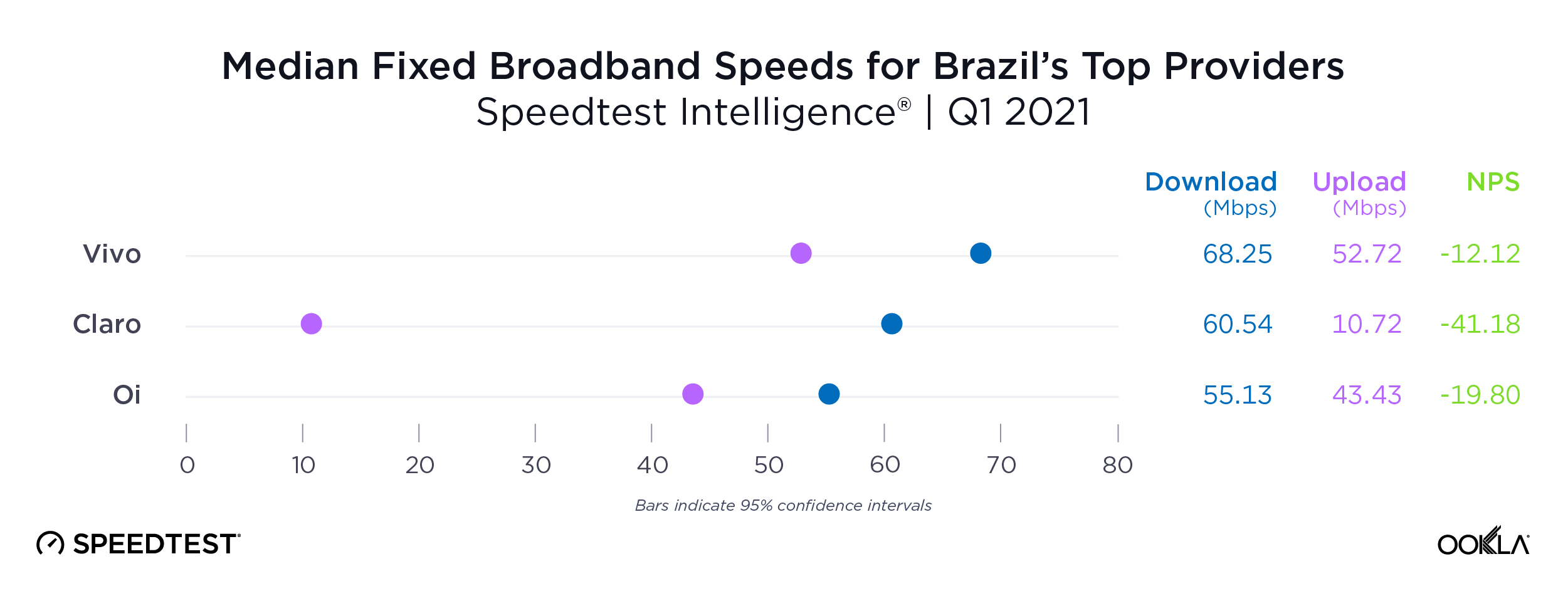

Vivo had the fastest fixed broadband performance

Brazil’s top fixed broadband providers had a competitive race for fastest provider in Brazil during Q1 2021. Vivo achieved the fastest median download and upload speeds in Brazil at 68.25 Mbps (download) and 52.72 Mbps (upload). Claro was second (60.54 Mbps download / 10.72 Mbps upload) and Oi was third (55.13 Mbps download / 43.43 Mbps upload).

Speedtest Consumer Sentiment data and NPS revealed that Vivo had the best score for fixed broadband among top providers during Q1 2021 at -12.12. Oi was second at -19.80 and Claro third (-41.18).

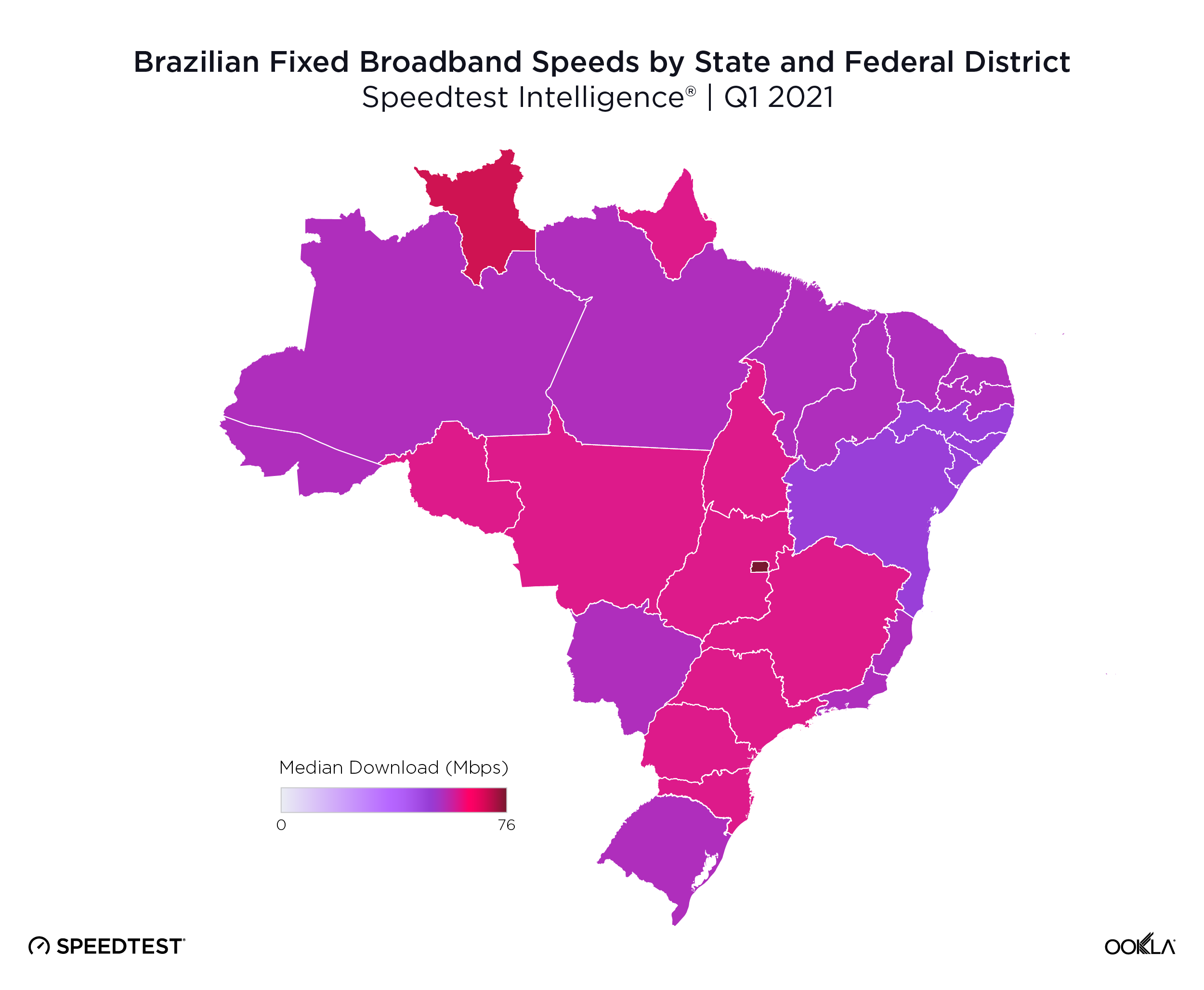

The Federal District had the fastest median fixed broadband download speed, Rio Grande do Sul the fastest mobile download speed

Most Brazilian states achieved median download speeds between 42.00 Mbps and 52.00 Mbps over fixed broadband

Brazil’s Federal District achieved the fastest median fixed broadband speed among Brazilian states at 75.71 Mbps during Q1 2021. Roraima was second (60.72 Mbps) and São Paulo third (57.48 Mbps). While there was no statistically slowest state in Brazil, Sergipe and Bahia recorded the slowest median speeds at 30.44 Mbps and 30.92 Mbps, respectively. Alagoas and Pernambuco ranked slightly faster at 32.90 Mbps and 36.50 Mbps, respectively.

During the same period, there was no clear statistical winner for fastest median upload speed over fixed broadband but Roraima achieved 43.43 Mbps, Amapá 42.34 Mbps, and Piauí 39.24 Mbps. The slowest median upload speeds among Brazilian states were in Sergipe (15.92 Mbps), Alagoas (19.87 Mbps) and Amazonas (20.26 Mbps).

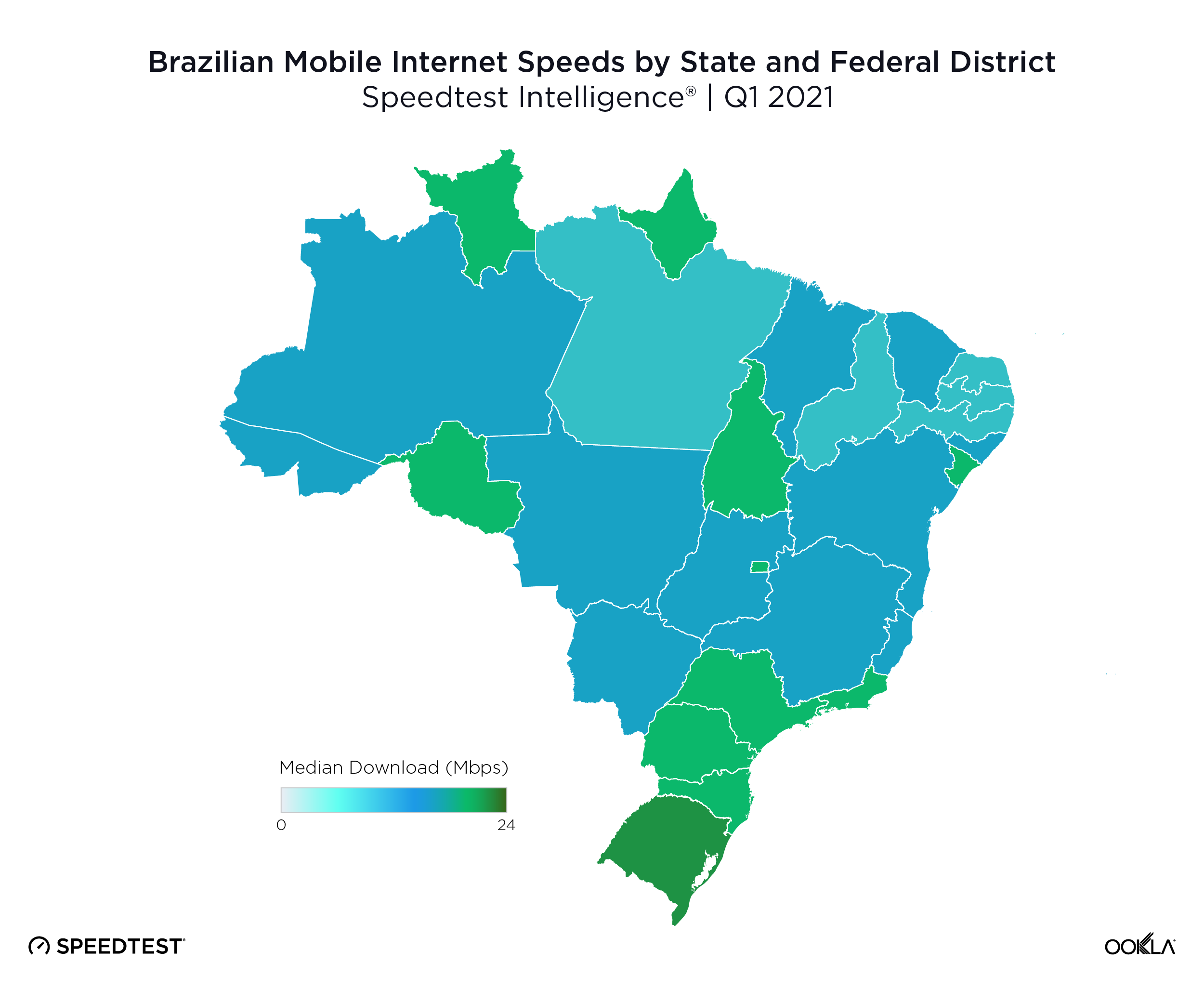

Rio Grande do Sul has the fastest median mobile download speeds

Rio Grande do Sul had the fastest median mobile download speed among Brazilian states during Q1 2021 at 23.31 Mbps. While there was no statistical runner-up, Rio de Janeiro recorded 21.10 Mbps, followed by Federal District (21.08 Mbps), São Paulo (21.00 Mbps), Paraná (20.64 Mbps), Roraima (20.51 Mbps) and Santa Catarina (20.42 Mbps). The state with the slowest median upload speed over mobile in Brazil was Paraiba at 13.74 Mbps.

There was no statistically significant winner for upload speed among Brazil’s states, though Roraima had a median upload of 9.38 Mbps, Federal District 8.90 Mbps and Rondonia 8.47 Mbps.

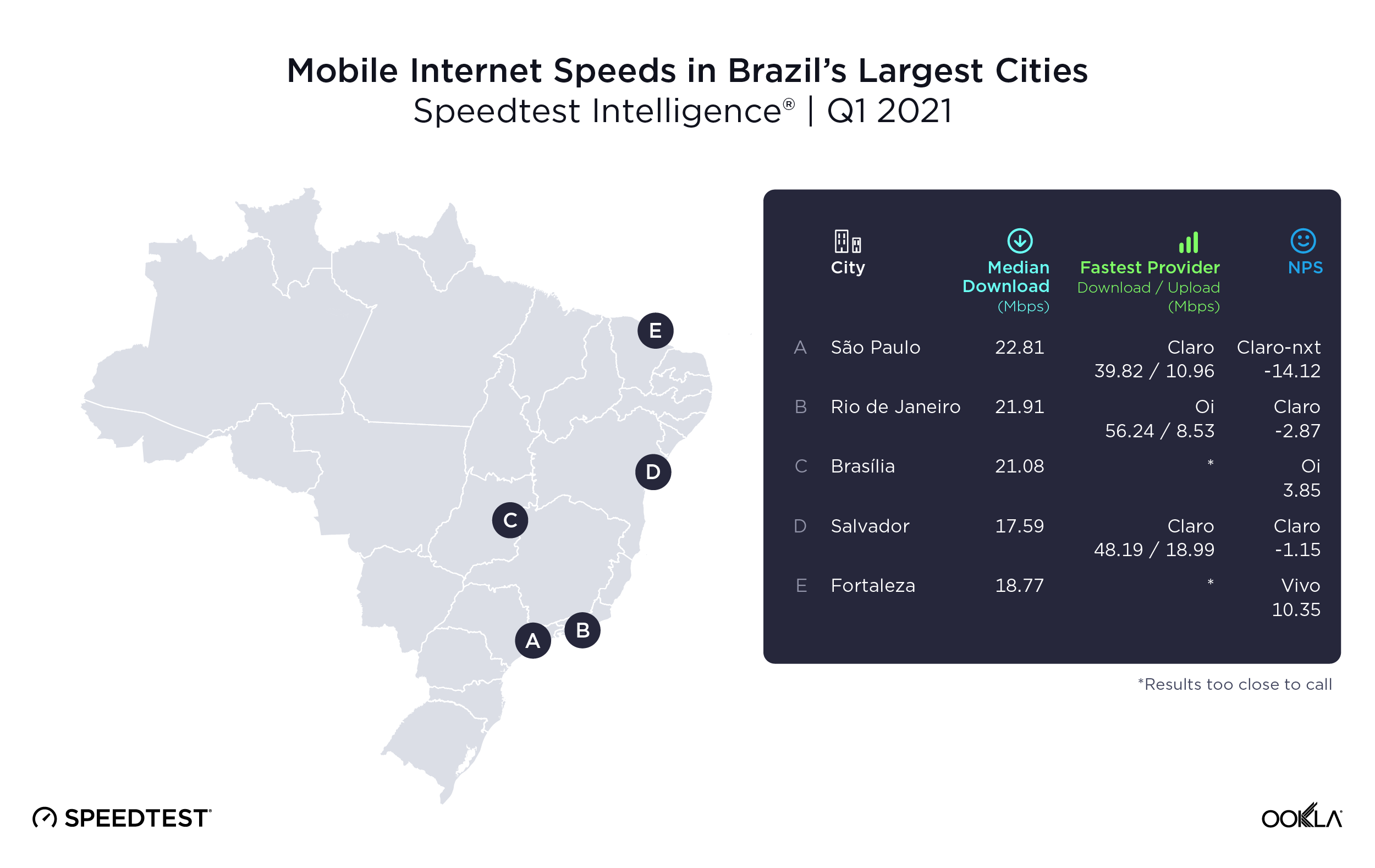

São Paulo had the fastest mobile speeds

São Paulo had the fastest median mobile download speeds of Brazil’s top five most populous cities at 22.81 Mbps during Q1 2021. Rio de Janeiro was second with 21.91 Mbps, Brasília third (21.08 Mbps), Fortaleza fourth (18.77 Mbps) and Salvador fifth (17.59 Mbps).

Competition for the fastest mobile provider was intense during Q1 2021. Oi had the fastest median download speed in Rio de Janeiro at 56.24 Mbps. Claro had the fastest median download and upload speeds during Q1 2021 in Salvador (48.19 Mbps download/18.99 Mbps upload) and in São Paulo (39.82 Mbps download/10.96 Mbps upload). In Brasília and Fortaleza there was no statistically significant winner for fastest mobile download speed among Brazil’s top providers. In Brasília, Claro achieved 32.57 Mbps to Vivo’s 31.16 Mbps and Oi’s 30.24 Mbps. Oi had the fastest median upload speed in Brasília with 14.23 Mbps. In Fortaleza, Vivo achieved a median download speed of 37.64 Mbps to Claro’s 34.77 Mbps.

Consumer sentiment varies across the country mobile consumers

Speedtest Consumer Sentiment data and NPS revealed a lot about consumer sentiment in Brazil’s major cities during Q1 2021. Claro was the top-rated provider in Rio de Janeiro (-2.87) and Salvador (-1.15). Vivo was the top-rated provider in Fortaleza (10.35). Claro-nxt (owned by Claro after the Nextel merger in Q2 2021) was top rated in São Paulo (-14.12). Oi was the top-rated provider in Brasília (3.85).

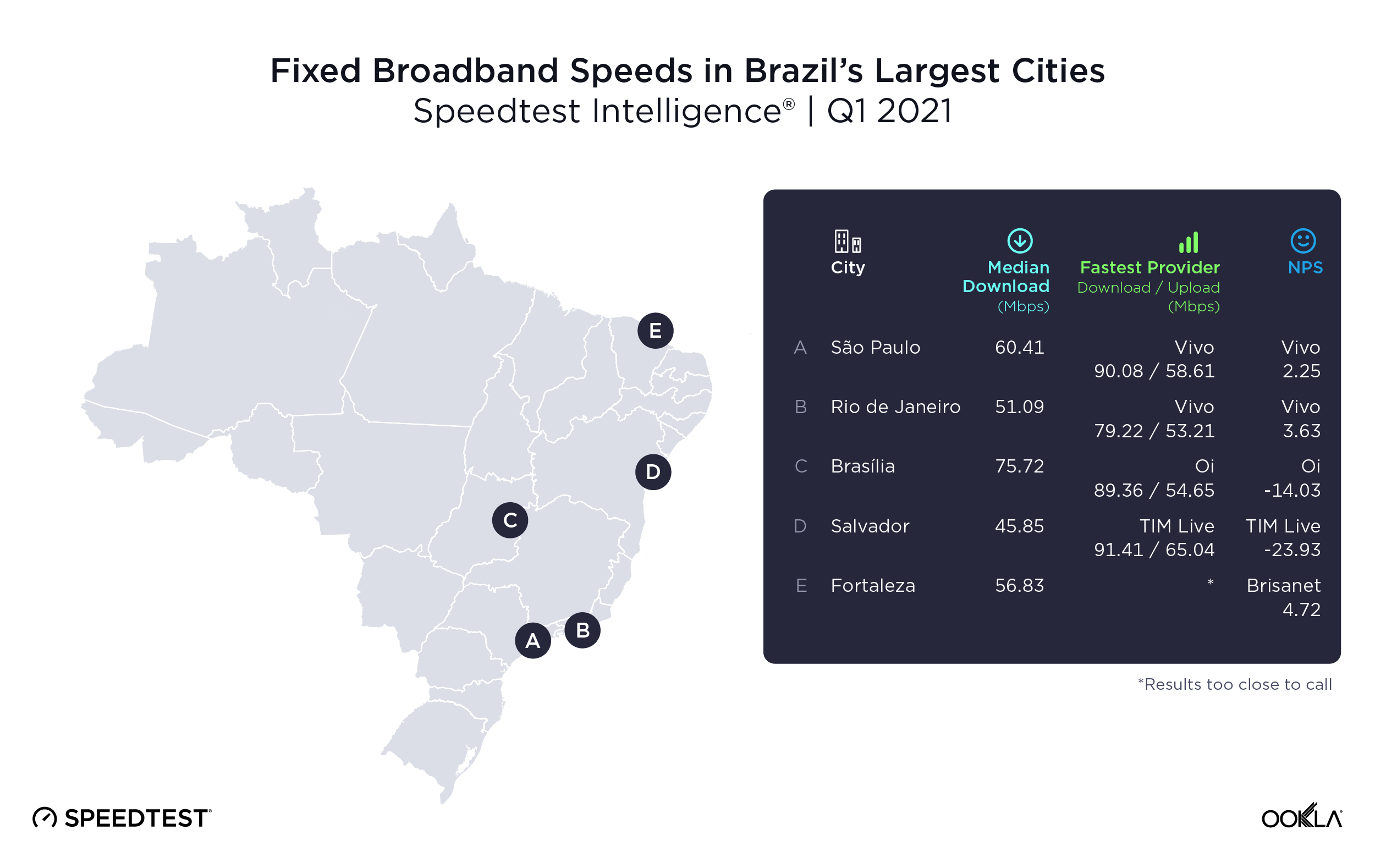

Brasília had the fastest median fixed broadband download speeds

Speedtest intelligence reveals Brasília had the fastest median fixed broadband download speeds among the five most populous cities in Brazil at 75.72 Mbps (21.06 Mbps upload) during Q1 2021. São Paulo was second at 60.41 Mbps, Fortaleza third (56.83 Mbps), Rio de Janeiro fourth (51.09 Mbps) and Salvador fifth (45.85 Mbps). Fortaleza had the fastest median upload speed at 34.03 Mbps.

Vivo was the fastest fixed broadband provider among top providers during Q1 2021 in Rio de Janeiro (79.22 Mbps) and São Paulo (90.08 Mbps). TIM Live was fastest in Salvador (91.41 Mbps). Oi provided the fastest fixed broadband speeds in Brasília at 89.36 Mbps. There was no statistically significant winner in Fortaleza, though Oi had a median download speed at 94.43 Mbps and Brisanet had a median download speed of 93.45 Mbps.

According to Speedtest Consumer Sentiment, these median download speeds almost mirrored consumer ratings. Vivo was the top-rated NPS provider in Rio de Janeiro and São Paulo at 3.63 and 2.25, respectively. Oi was top-rated in Brasília at -14.03. TIM Live edged out Oi in Salvador -23.93 to -24.65. And in Fortaleza, Brisanet was first at 4.72, followed by Oi at 2.28.

Faster mobile speeds are just around the corner for Brazil

Despite numerous political challenges, the Brazilian National Telecommunications Agency (Agency Nacional de Telecomunicacoes or Anatel) is inching closer to holding a massive 5G spectrum auction that is expected to take place around the end September or October. This auction aims to enable Brazilian operators to significantly boost their coverage footprint and capacity, and improve overall end user experience. Anatel will auction several ranges of spectrum:

Additionally, Anatel mandates that participating mobile operators deploy Standalone (SA) 5G networks by 2022 instead of relying on the Dynamic Spectrum Sharing (DSS) technology, which allows operators to use the existing 4G spectrum for both 4G and 5G operation. DSS technology is already in use by Brazilian operators, but the overall network capacity tends to be reduced due to the overhead associated with running both technologies on the same slice of spectrum. The injection of hundreds of megahertz of greenfield spectrum assets to the Brazilian mobile market promises an enhanced 5G coverage across wider geographies using the 700 MHz licenses, multi-gigabit speeds that come with 3.5 GHz and the millimeter wave, and endless opportunities for the enterprise segment of the industry.

To learn more about the data behind this article and what Ookla has to offer, visit https://www.ookla.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.