In this Placer Bytes, we dive into the shoe sector’s rapid recovery and look at the winners and losers in the crafting space.

Offline Shoes’ Rapid Recovery

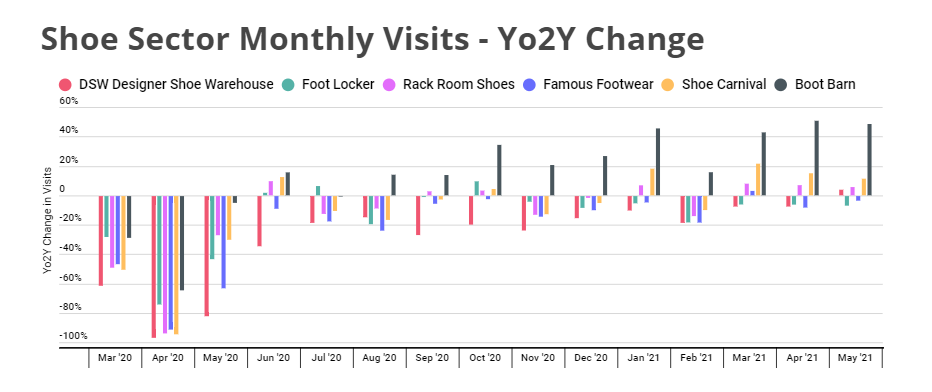

Like all retailers, the offline shoe market experienced a sharp downturn over the pandemic – but it looks like the sector is bouncing back. Boot Barn in particular has made a swift and impressive recovery, posting positive year-over-two-year growth in monthly visits every month since August – an especially impressive achievement considering the wider situation.

Shoe Carnival and Rack Room Shoes also look on track for a strong 2021. Monthly visits for both brands were up four out of five months of the year so far compared to the same months in 2019, with an average monthly increase of 11.3% and 2.7% for Shoe Carnival and Rack Room Shoes, respectively.

DSW and Famous Footwear are seeing a more staggered recovery, but they too are rapidly approaching 2019 levels. DSW increased its monthly visits in May by 3.8% compared to 2019, and Famous Footwear narrowed its May monthly visit gap to just 3.1%. Foot Locker, on the other hand, seems to still have some way to go, with its monthly visit gaps even increasingly slightly from March through May. While much of this centers around the boost in March as mall demand increased, the Back to School season could prove critical to understanding the brands’ true recovery.

Crafting Update

The pandemic created unexpected winners in the arts and crafts space, with others felt the impact of COVID shutdowns more.

Joann Fabric and Crafts’ Pandemic Boost

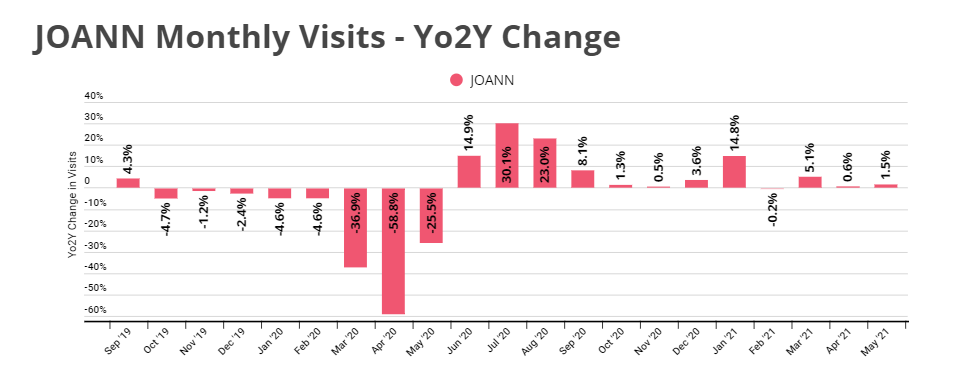

Visits at Joann Fabric and Crafts were down by an average of -2.2% in the six months preceding the pandemic, but following the initial wave of store closings, foot traffic climbed dramatically. June, July, and August of 2020 saw average visit increases of 22.6% compared to the same period two years prior.

While the visit gap has narrowed since then – with the exception of January 2021, where visits were up 14.8% compared to visits in January 2019 – Joann Fabric and Crafts has continued to attract more visitors to its stores almost every month compared to the same month two years prior.

Hobby Lobby and Michaels’s Strong Performances

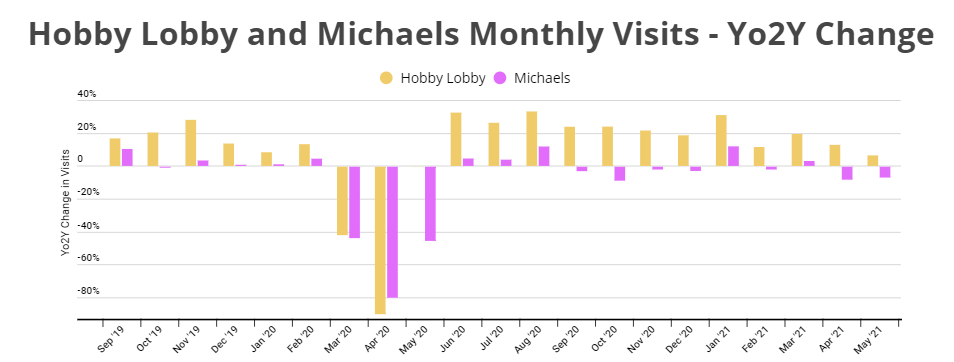

Hobby Lobby was another big winner in this space. Although visits in the six months pre-COVID were strong, with an average increase of 16.7% compared to the two years prior, monthly visits from June 2020 to May 2021 have swelled by an average of 21.7%.

And Michaels, which had posted relatively steady monthly visits in the months preceding the pandemic, has managed to maintain its relative stability with an average 0.3% change in monthly visits compared to two years ago over the last twelve months – a major achievement given the larger retail landscape and the brand’s wide distribution of locations.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.