Grocery stores and superstores carrying food and medicine were labeled “essential businesses” and allowed to stay open throughout the pandemic. Still, COVID affected in-store shopping patterns as shoppers limited their exposure to the virus by limiting their trips and spending more time in stores each visit as they filled bigger baskets – a key mission driven shopping trend.

Now, with COVID’s retail impact subsiding, Americans are returning to their pre-pandemic habits. We dove into our Q2 Quarterly Index to find out more.

Return to Grocery Stores

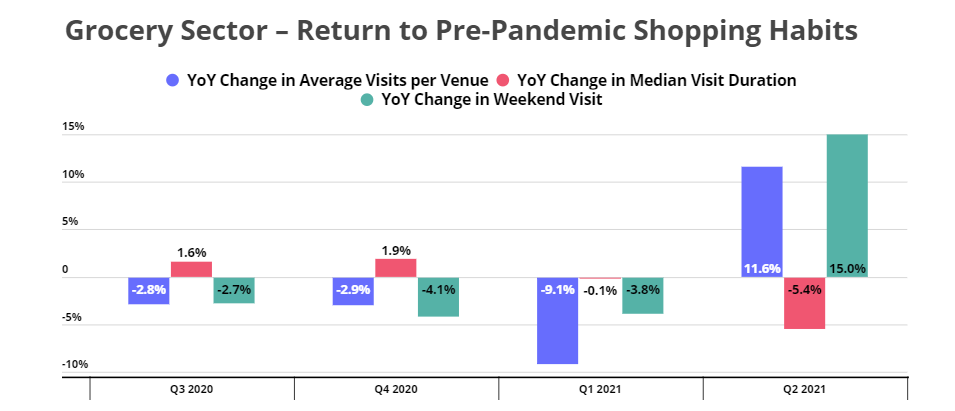

Visits per visitor and weekend visits were up significantly year over year for the grocery category in our Q2 Index, and visit duration was down 5.4% compared to Q2 2020. The increase in weekend and regular visits alongside the decline in visit durations indicates the return of normal shopping patterns.

The key takeaway here is the power of ‘normal’ routines to dictate shopping patterns, especially within the grocery sector. It may also signal that some Americans who were doing more grocery shopping online during the pandemic are returning to stores.

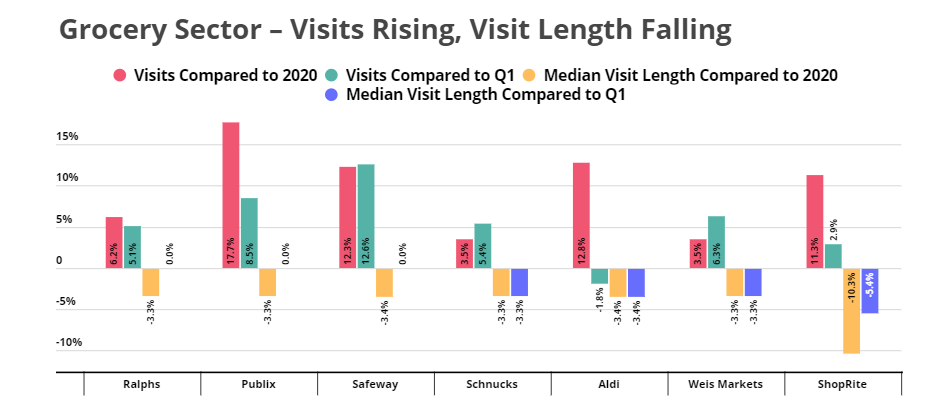

Grocery visits rising, visit length falling

When looking at these same metrics at the brand level, store visits were up almost across the board with Publix, Safeway, Aldi, and ShopRite seeing particularly impressive growth of 17.7%, 12.3%, 12.8%, and 11.3%, respectively, compared to Q2 2020. At the same time, median visit length was down compared to Q2 of last year, when mission-driven shopping was at its peak, with the metric down or flat when compared to Q1 as well.

The End of Mission-Driven Shopping?

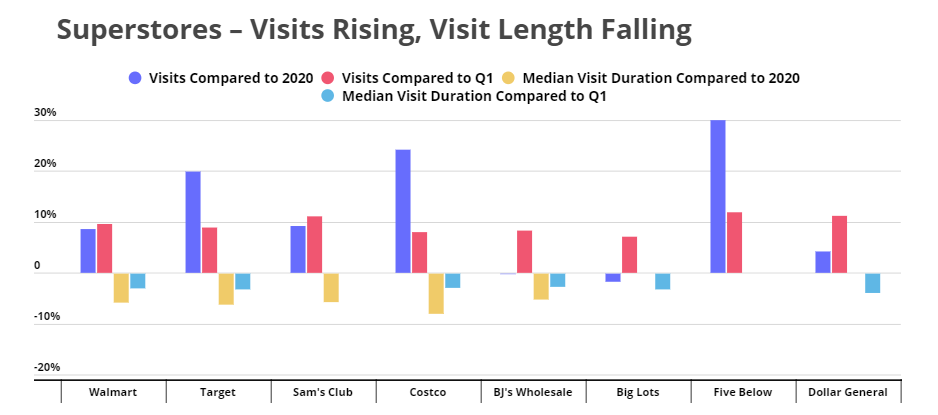

The mission-driven shopping trend also affected superstores. And here too, an increase in visits coupled with a decrease in median visit duration indicates that mission-driven shopping has come to an end. Most players in the sector saw significant visit increases when compared to both the quarter prior and the same quarter in 2020. At the same time, median visit duration fell, which shows the wider mission-driven shopping trend at superstores looks to have come to an end.

The increase in visits compared to last year may hint at shoppers preferring an in-store or omnichannel shopping experience rather than purchasing goods entirely online.

Routines Return

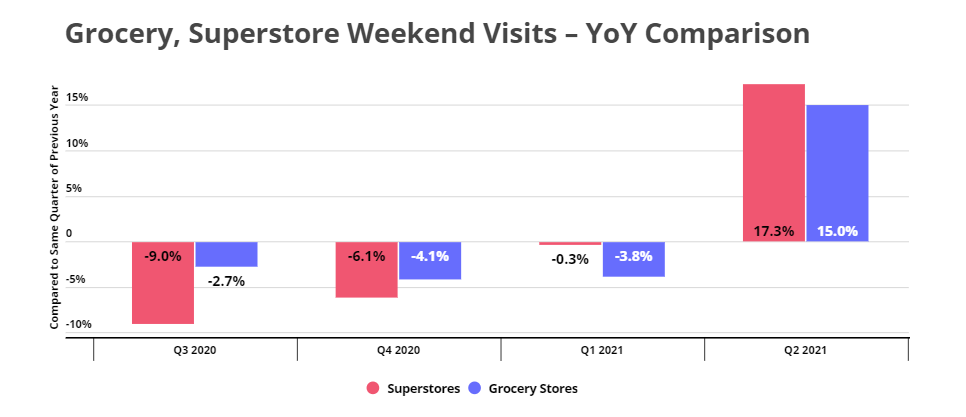

Weekend visit numbers are another key indicator of the return to routines. During the pandemic, as many Americans worked from home or became unemployed due to pandemic-related closures and economic disruptions, weekend visits took a hit. Customers with an abundance of time on their hands during the once-busy weekdays headed to stores at unusual times in the hopes of avoiding lines and crowds.

Now that schedules are filling up once more, shoppers are returning to their pre-pandemic habits of shopping on the weekends. In Q2, weekend visits to superstores and grocery stores rose 17.3% and 15.0%, respectively – indicating that the normalcy may have already returned to at least some retail sectors.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.