Significant time has passed since Amazon launched its Fresh grocery concept, and the channel is playing an increasingly important role in the grocery space. As the brand enters more and more states, we dove into Amazon’s grocery push by looking at both the Whole Foods recovery and the Amazon Fresh expansion.

Whole Foods Recovery Check

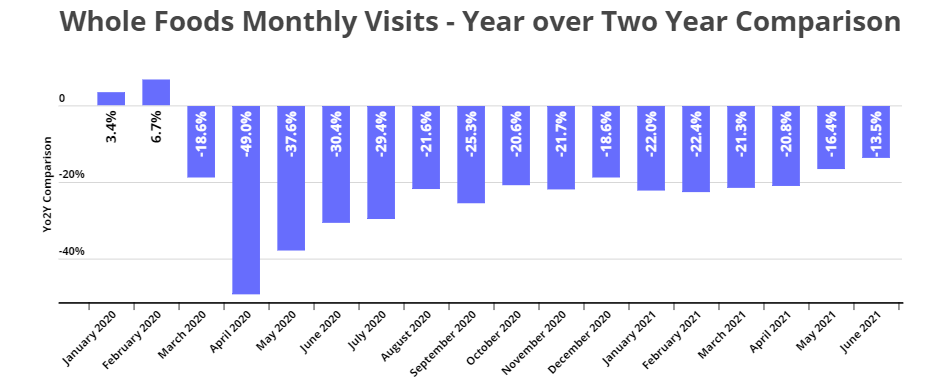

Though the brand was among the hardest-hit players in the grocery sector, Whole Foods is clearly enjoying a significant recovery. Comparing monthly visits to 2019 shows that the visit gap is consistently and steadily shrinking, with visits down just 16.4% and 13.5% respectively in May and June compared to the 2019 equivalents. This is a massive leap forward compared to 2020, when the year-over-two-year gap reached -49.0% and never shrunk below -20.6%.

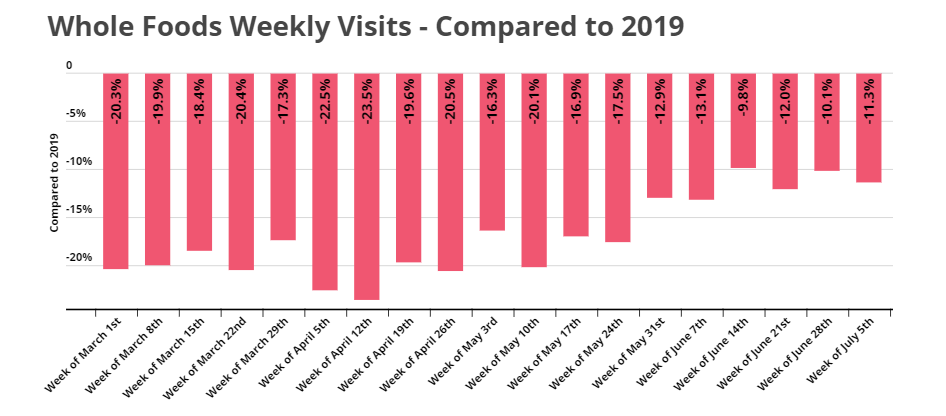

And the pace of recovery is also increasing. The weeks beginning June 28th and July 5th were down just 10.1% and 11.3% respectively compared to 2019. The last four weeks marked the four smallest visit gap weeks since the start of 2021.

The brand is clearly benefiting from visits returning to normal in key states and cities, a growing return of travel, a strong economic situation (especially for high-earning households), and a wider level of recovery in retail overall. Yet, there are still questions to address.

While many grocery brands have already returned to year-over-two-year growth, Whole Foods is still far off its 2019 pace. Whether this necessitates a shift in approach or only requires patience is a challenge for Whole Foods to solve. And the answer is likely a combination of the two. Although Whole Foods is a very strong brand, certain weaknesses were exposed during the pandemic. For example, the heavy orientation towards major cities hurt, as did its lower visits per visitor rates relative to other grocery stores. There is also a question of how a higher priced offering meshes with the convenience orientation of an Amazon operated entity.

Understanding the Role of Amazon Fresh

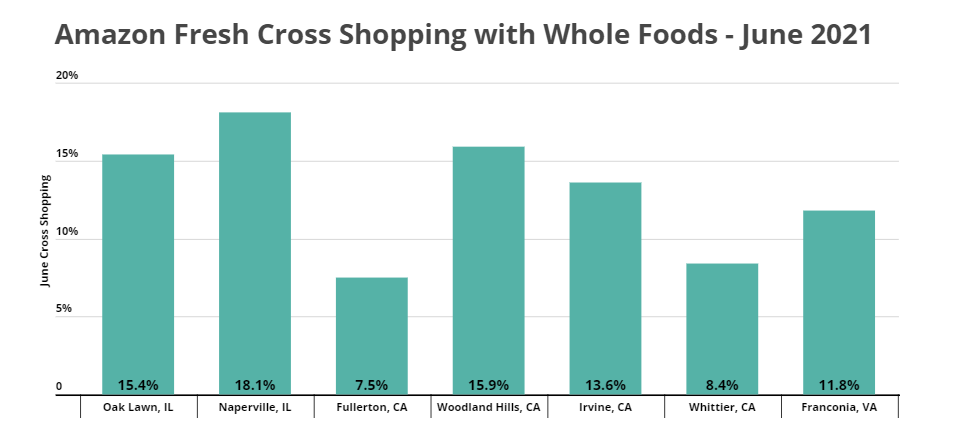

While determining the future role of Whole Foods may take time, it is becoming increasingly clear that Amazon has a very clear vision for Fresh locations. Whole Foods operates in the higher-end grocery category, and Amazon Fresh looks to be complementing, rather than competing with, Whole Foods. Looking at seven Amazon Fresh locations in June shows that, on average, just 13.6% of visitors also visited a Whole Foods location. For these same locations, Whole Foods was also on average the 7th most visited other grocery for Amazon Fresh shoppers.

This could be an incredibly positive sign for Amazon’s grocery push. While cross shopping is always a nice thing to have between owned brands and can be used to create a bigger overall pie, a division of audience may be even better. Amazon seems to be effectively leveraging grocery assets to target different segments of the market. While Whole foods clearly aims for a specific group, Amazon Fresh could create a complementary asset that is more aligned with cost and convenience benefits.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.