Source: https://www.placer.ai/blog/how-is-retail-in-americas-three-largest-cities-recovering-from-covid/

The events of the past year and a half have highlighted existing regional disparities – and created some new ones – as a result of the differences in virus spread, regulatory decisions, and calendars reopening. But because of how retail data is usually presented, the variance in the pace of economic recovery between different locales can sometimes be hard to spot.

Indeed, most stakeholders in the future of brick and mortar retail – retailers, CRE professionals, CPG executives, and financial analysis – stay up to date on their sectors of interest by tracking the performance of specific brands or categories. This can make it difficult to identify opportunities, forecast trends, and uncover local sub-market dynamics.

To give local government and business leaders a high-resolution image of how COVID impacted retail and tourism foot traffic in their area, we created the COVID Recovery Dashboard. The dashboard reveals the retail and tourism visit recovery for every state, county, and city in the United States, and includes data for over 300 key Business Improvement Districts (BIDs) so that decision-makers can obtain the exact information they need.

We used the dashboard to find out how the retail recovery was progressing in America’s three largest cities. Keep reading to find out how New York City, Los Angeles, and Chicago are rebounding from the pandemic’s impact.

Bird’s Eye View on NYC, LA, and Chicago’s Retail Recovery

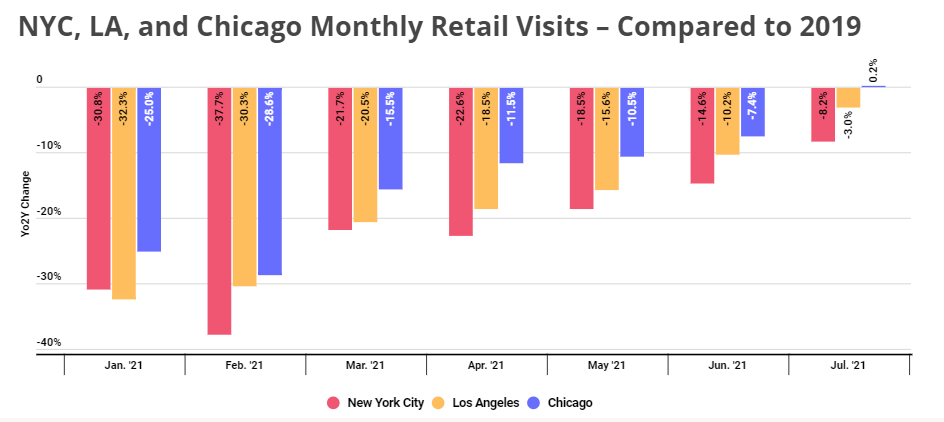

Chicago monthly retail visits have now fully recovered, with July retail visits up by 0.2% when compared to the same month in 2019. Meanwhile, July retail visits in New York City and Los Angeles were still down -8.2% and -3.0%, respectively, compared to 2019. But although these numbers don’t represent a full recovery, they are the smallest visit gaps either city has seen since the start of the year – indicating that retail in NYC and LA is definitely headed in the right direction. This is especially important considering the shifts both cities saw in migration patterns combined with tourism declines and shifts in work routines.

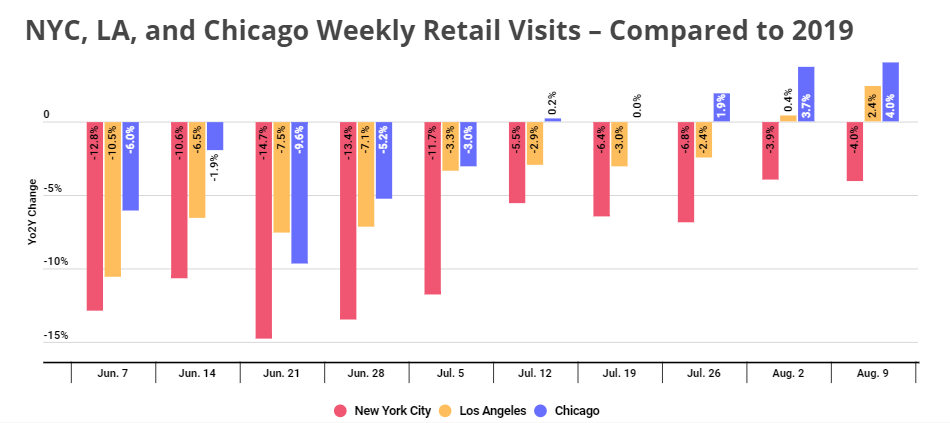

And data for the first half of August looks even better. For the first and second full week of August, retail visits in LA were up 0.4% and 2.4%, respectively, when compared to the equivalent week in 2019 – the first time weekly retail visits exceeded 2019 numbers since the start of the pandemic. Chicago also continued its growth streak, with visits up 3.7% and 4.0%, respectively, for the weeks of Aug. 2nd and Aug. 9th.

Even New York City, which is still lagging behind its 2019 retail visits, has managed to significantly reduce its visit gap. Visits to the city’s retailers were only -3.9% and -4.0% lower, respectively, for the weeks of Aug. 2nd and Aug. 9th when compared to the equivalent weeks in 2019.

NYC’s Retail Recovery

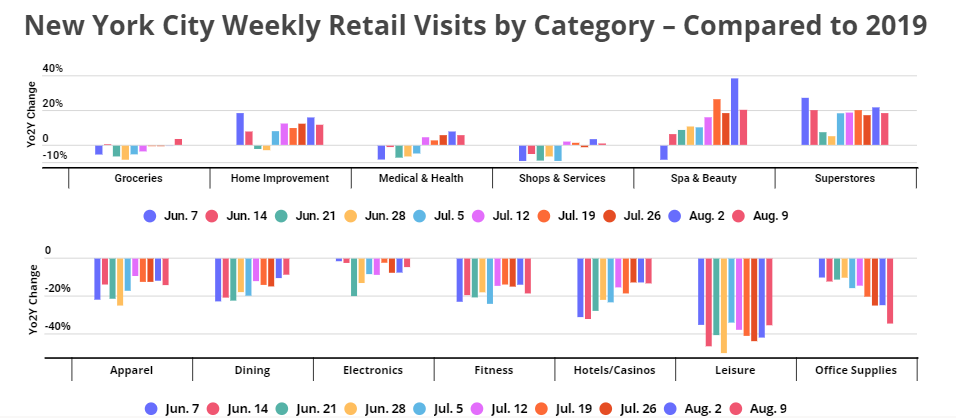

Overall retail visits in New York City may have yet to return to pre-pandemic levels, but focusing on the average masks major variance between the different retail categories. Weekly visits to superstores, spa & beauty venues, and home improvement outlets have been up significantly since June when compared to 2019. Grocery, medical & health (including drugstores), and shops & services (including auto shops and pet supplies stores) have also more or less recovered.

So while several categories are still exhibiting large visit gaps, many other retail categories are doing well. By identifying the specific retail categories that are over- and under-performing, stakeholders in New York City’s retail recovery can direct resources to where they are most needed and make data-driven investments in the city’s future.

Zooming into LA and Chicago

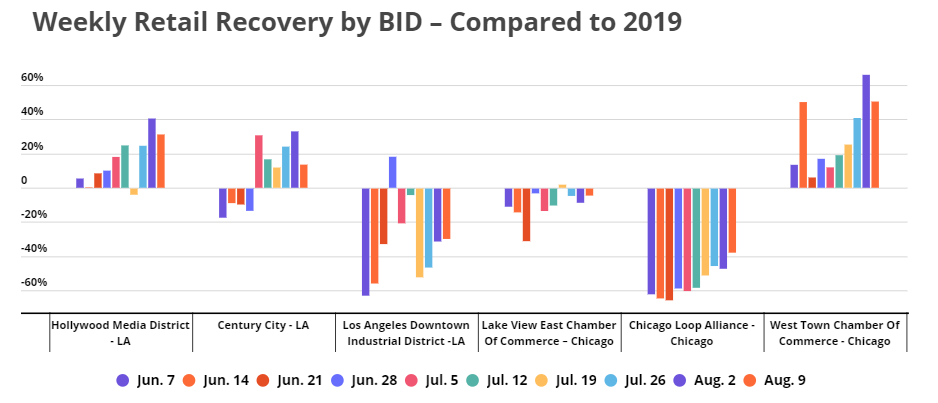

On a city-wide level, the retail recovery is going better in Chicago and Los Angeles than it is in New York City – but the foot-traffic rebound is very unevenly distributed. Zooming into the retail recovery for specific Business Improvement Districts (BIDs) highlights the hyper-local differences with both cities.

In Chicago, the West Town Chamber of Commerce BID appears to be thriving, with visits for the week of August 9th up by a whopping 50% compared to the equivalent week in 2019. The downtown Chicago Loop Alliance BID, on the other hand, is still reeling from the impact of the pandemic, with retail visits that same week down by -37.4% compared to 2019. And in Los Angeles, the Hollywood Media District is overperforming, with retail visits up 31.1% during the week August 9-15 – but the Los Angeles Downtown Industrial District is still struggling, with retail visits for that same week down -29.4% compared to 2019.

The differences between the retail recoveries of various BIDs in the same city underscores the need for accurate, up-to-date, and hyper-local foot traffic data. Having access to a high-resolution picture of the retail recovery in every category and for every locality empowers retailers, local officials, and real-estate professionals to make data-driven decisions that will best position their region to thrive in the years to come.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.