In this Placer Bytes, we dive into the recoveries of GameStop, Dave & Buster’s and AMC to gather insights on experiential retail and retail’s recovery overall.

GameStop’s Wave Continues

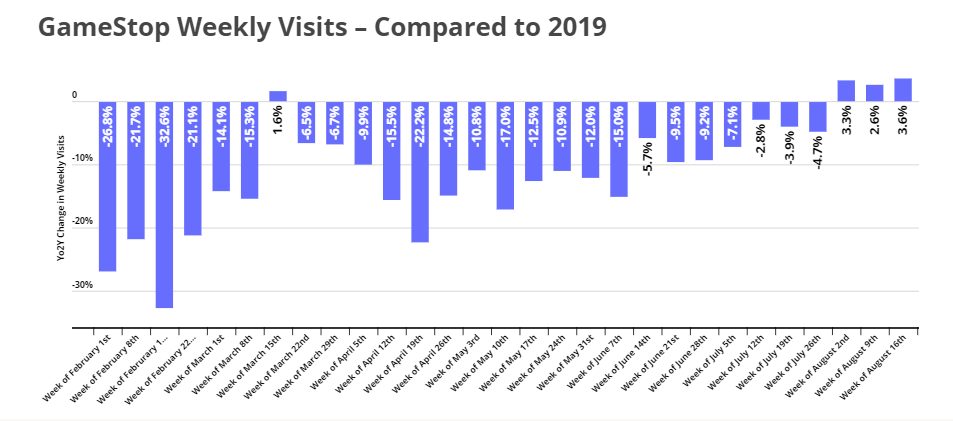

The wave of excitement surrounding GameStop’s stock had little to do with the retailer’s offline performance, but it does appear that the buzz is working in the brand’s favor. Comparing weekly visits to 2019 since the start of the year reveals a steady and consistent reduction in the visit gap. And while the initial rush of retail reopenings in March drove a short spurt of comparative growth, the real surge seems to have come during the summer.

Visits the weeks beginning August 2nd, 9th and 16th grew by 3.3%, 2.6%, and 3.6%, respectively, compared to their 2019 equivalents. Though strength in the Back-to-School season is clearly playing a significant role, there is also real reason for optimism for a wider turnaround for a brand that certainly needed it.

Experiential’s Restaurant Boost

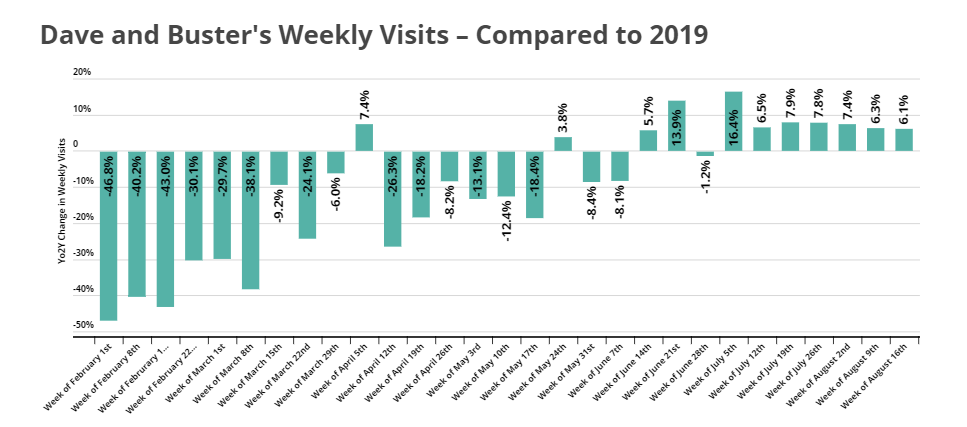

The power of ‘experience’ is also making a significant comeback and contributing to the impressive recovery for Dave & Buster’s – a chain that combines food and gaming. Since early June, the brand has seen strong weekly visit growth when compared to the equivalent weeks in 2019. In fact, since the week beginning July 12th, no week has seen a visit jump of less than 6%.

Dave & Buster’s had already been performing relatively well in previous years. But the summer surge could also be attributed to the brand’s unique offering, which is particularly well positioned to meet current customer demand. Food is clearly an important part of any dining experience, but the ‘experience’ element itself is what was fundamentally challenged by the pandemic environment. The chain’s focus on combining a casual dining experience with entertainment feels uniquely suited to the current recovery, and is likely playing a significant role in Dave & Buster’s impressive return.

Slow, But Steady Return

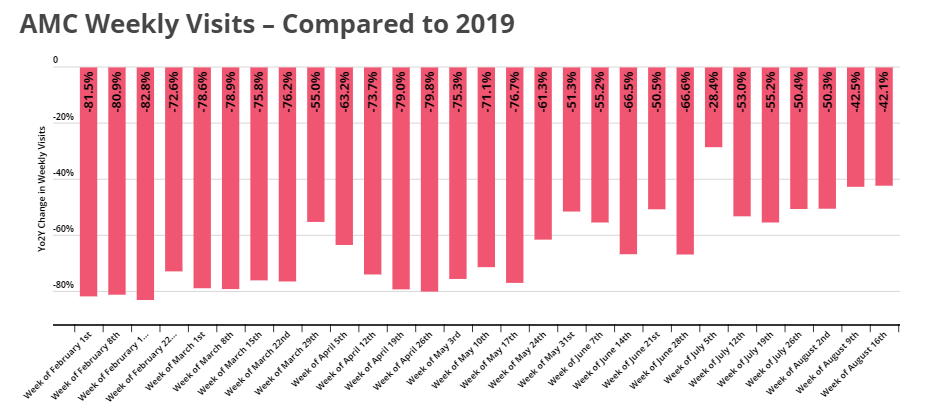

There was a fair amount of discussion during the pandemic about whether theatre chains would be able to ultimately recover. While there is clearly still a lingering challenge for the sector, there has been positive momentum in the recovery direction. Visits the weeks beginning August 2nd, 9th, and 16th were down 45.0% on average when compared to their 2019 equivalents. This is a strong step forward from the three weeks prior, when the average weekly visits gap was 52.8%.

Yet, there is still a question surrounding the sector’s ability to drive a full recovery. Should the pace continue, there is reason for optimism – but a full recovery will likely also require a degree of innovation in terms of the full experience being provided.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.