When we last looked at the Wholesale Club sector, the leading players were all showing strength ahead of the wider retail reopening. Yet, the strength in grocery alongside rising visits in restaurants created the potential for the sector’s top chains to see lower peaks in the summer.

We dove into the data to see how the summer treated these brands.

Costco’s Rise

Earlier in the year, we noted that Costco visit data was indicating that while the brand was seeing lower overall visits, the actual number of unique visitors was rising. The clear takeaway was that as shopping patterns did normalize, the wholesale club leader would see a massive jump in visits due to its larger overall membership base. And that idea is certainly playing out.

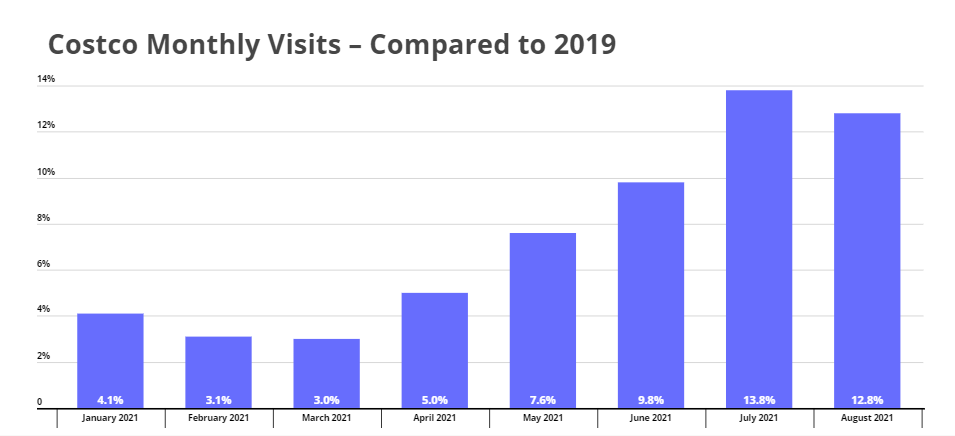

Costco visits have been growing consistently compared to 2019, with visits in June, July, and August up 9.8%, 13.8%, and 12.8% compared to the equivalent months two years prior. The incredible surge in visits is a strong sign that the brand not only succeeded in having relative strength during the pandemic, but turned that short term strength into a foundation for long term success. Considering the stickiness of its membership model and the sustained strength seen pre-pandemic, there is real reason to believe that Costco will be even stronger in the coming years.

The Tide Lifting All Boats

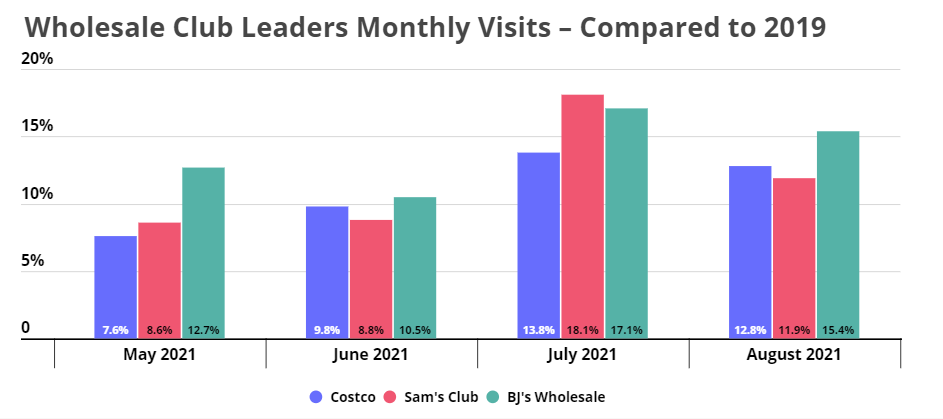

Yet, Costco’s strength does not appear to be coming at the expense of competitors Sam’s Club and BJ’s Wholesale Club. Instead, it looks as though the pandemic was a tide that lifted all wholesale club boats, with all three brands seeing significant traffic jumps in July and August when compared to the same months in 2019.

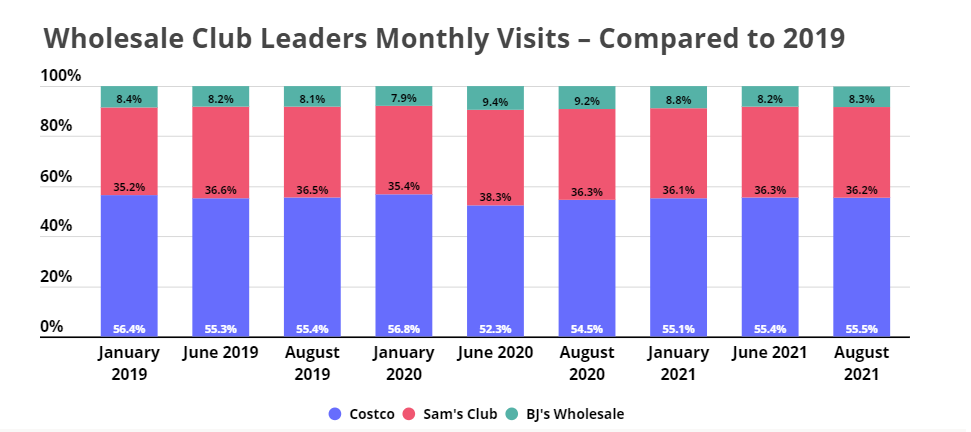

Diving deeper into the visit share breakdown only further confirms this perspective. While Costco did see a dip in relative visit share in June of 2020, balance had returned to the group by June and August of 2021. The growth in traffic alongside the steadiness in visit share shows just how powerful this sector could be in the coming years.

Whereas many sectors benefit from ‘lightning in a bottle’ moments that see tremendous short term growth from amazing alignment with trends, few have the same potential to turn short term gains into sustained growth. The continued pull of the membership model combined with the ability of these brands to adapt to shifting consumer behaviors shows the unique and powerful staying power of their success.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.