Is there a Pattern to Island Recovery?

For those of us in Europe it may feel like summer has come and gone and we haven’t managed to get away on holiday. Restrictions eased too late for many, and the Delta variant meant there was too much uncertainty about who would be permitted to travel, making it easier and less stressful to stay home. In a ‘normal’ year the next major holiday getaway period would be December for the Christmas and New Year break. For those seeking some sunshine in the northern hemisphere’s winter, the Caribbean can be a great destination - but what is in store for Caribbean destinations this winter from Europe, North America and elsewhere?

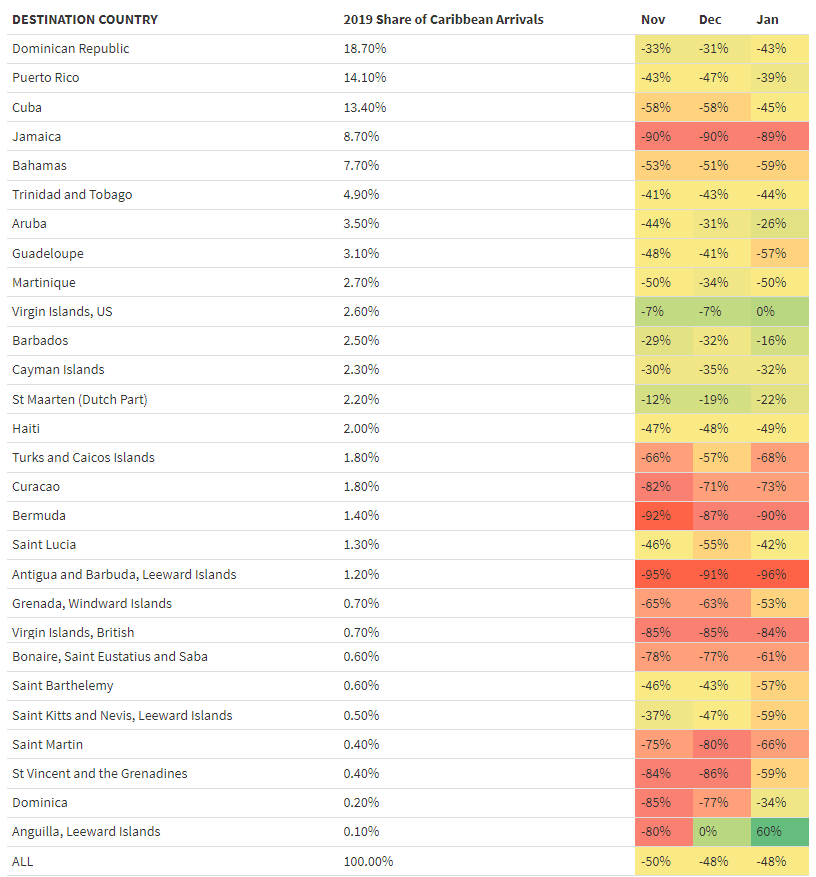

Flight bookings data from OAG shows how forward air travel bookings for November, December and January that are in the system now compare to this time two years ago for each Caribbean destination.

There are wide differences between the various countries in terms of forward bookings.

Forward Bookings for 2021/22 vs 2 years earlier

The largest destination in the Caribbean is the Dominican Republic which had 6.5 million arriving air passengers in 2019 of which 55% were from the US, and an economy in which travel and tourism accounted for 16% of GDP, according to World Travel and Tourism Council. Tourism appears to be a less important part of the economy for the Dominican Republic than for some of their smaller neighbours which are much more dependent on incoming visitors to drive their economy. At the moment forward bookings for November and December to the Dominican Republic are about a third down on the same time two years ago, while January bookings are lagging further still.

However, this compares favourably with the forward bookings across all Caribbean destinations which are 50% down compared to where they were two years ago for the following November, 48% down for December and 48% down for January. Before the pandemic over half of all air arrivals in the Caribbean were from airports in the USA and the scale of subdued bookings shows just how much this and other markets continue to be affected by the international travel consequences of the pandemic, despite the US domestic market being well on the way to recovery. In August 2021 US domestic capacity was just 12% below where it was in August 2019.

As an unincorporated US territory it isn’t surprising that Puerto Rico, the second largest Caribbean destination for air travel, is a much more US-orientated market with 80% of arrivals by air coming from the United States. Forward bookings are a bit worse than the Dominican Republic, at -43%, -47% and -39% for November, December and January respectively, but travel and tourism accounts for a smaller proportion of the economy, at just 5% pre-pandemic.

Forward bookings to Jamaica, the fourth largest destination in the Caribbean for air travel, are faring much worse with bookings for the end of the year still only 10% of where they were at this point two years ago even though tourism is a much more important element of the economy, accounting for 28% of GDP in 2019.

In contrast, some of the smaller destinations both in terms of population and arrivals by air such as Aruba, Barbados, St Maarten and the US Virgin Islands appear to be in a better position in terms of bookings for the end of the year. The US Virgin Islands is getting close to 2019 levels in November and December and forward bookings for January are now the same as they were in August 2019 for January 2020.

It isn’t easy to account for these differences. There is an element of vaccinated travellers gravitating to islands with strict rules on quarantine for unvaccinated travellers while the unvaccinated may head for islands which have a more relaxed approach. Maybe smaller island destinations are proving more attractive to holidaymakers than larger islands. The importance of tourism to the economy doesn’t necessarily point to better recovery; Barbados where travel and tourism accounted for less than 10% of GDP in 2019, has better forward bookings than Aruba where tourism accounted for 69% of the economy. Nor can it be explained by the importance of the US, a market which has seen high level of recovery in domestic air travel; air travel to and from Bermuda has traditionally been heavily skewed to the US with over 70% of passengers travelling to or from the US, and yet forward bookings are only around 10% of what they were two years ago. Antigua has had a strong element of UK travel but their forward bookings appear even more affected at only around 5% of where they should have been. There may be an element of non-leisure travel contributing to forward bookings such as students returning from other countries where they are studying, or diaspora communities generating VFR (Visiting Friends and Relatives) traffic.

Add the level of endemic virus to the mix, the proportion of the population in each island that has been vaccinated, the travel restrictions in place and the extent to which each destination marketing organisation has been able to adapt and promote the country and it’s no wonder there is so much variation in forward bookings across the Caribbean.

To learn more about the data behind this article and what OAG has to offer, visit https://www.oag.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.